Abstract

Extended producer responsibility (EPR) initiatives have shown success in enhancing the independent collection of plastic waste, but the existing recycling industry framework poses challenges to achieving optimal recyclability levels. For addressing this issue, various legislative strategies, including non-profit EPR, door-to-door collection systems, and deposit refund schemes (DRS), have been implemented in some countries such as the UK and Germany. As plastic waste management responsibility is shared between consumers and producers in Europe, with consumers generating 40% of plastic waste and producers being responsible for the remaining 60%, this review examines the impact of EPR and DRS programs on consumer and producer behaviors. The article also explores the potential for circularity and sustainability of recycling technologies, including their challenges and limitations. The significance of this study lies in its examination of the impact of EPR and DRS programs on consumer and producer behaviors, providing insight into sustainable practices that promote waste minimization and foster the adoption of recycling methods. Ultimately, the review recommends quick action in four crucial areas, including standardization, infrastructure investment, partnership models, and the production of higher-value recycled materials, all of which require supply chain collaboration.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The generation of solid waste, encompassing plastic, aluminum, and glass is becoming increasingly prevalent in modern society and is rapidly becoming a ubiquitous aspect of daily life (Deus et al. 2020). The proliferation of plastic waste, with its numerous applications and forms, constitutes a global crisis with far-reaching implications (Andeobu et al. 2022). Studies have shown that there are more than 5 trillion pieces of plastic waste in the world’s oceans, causing harm to marine wildlife and disrupting delicate ocean ecosystems. Moreover, it is estimated that by 2050, plastic in the ocean will outweigh fish (Brindha et al. 2021; Ramasubramanian et al. 2022c). In order to rapidly achieve a circular economy within the framework of the waste management hierarchy, extended producer responsibility (EPR) is regarded as an effective means of mitigating the negative environmental impacts associated with post-consumer waste by promoting reduced packaging usage and the development of more reusable packaging options (Lorang et al. 2022) (Pandey et al. 2022; Subbaiyan et al. 2022; Ragupathy et al. 2022). Approximately 400 EPR systems are operating worldwide, most of which are located in European union (EU) member states wherein trash regulation offers general rules for their use. Notwithstanding EU rules, the national EPR program and its effectiveness in attaining set reuse and recycling objectives fluctuate between countries but have similar agendas (Deus et al. 2020; Pandey et al. 2022).

At the UN Environmental Summit, the UK contributed to the start of discussions for an enforceable convention against plastic pollution, i.e., the deposit refund scheme (DRS) (Snowdon 2019). The UK has joined forces with international partners to advance discussions towards the creation of a new legally binding treaty aimed at addressing plastic pollution, as the fifth session of the United Nations Environment Assembly (UNEA-5) in Nairobi gathers global attention (Lorang et al. 2022). The enhancement of waste minimization, recovery, and recycling has been aided by the initiatives of EPR in Europe. The ~26 million tonnes of post-consumer plastic garbage produced in 2015 were recycled 30% of the time, and 40% were burned with electricity extraction (Oke et al. 2020; Ramasubramanian et al. 2022a). As an example, in other countries, Germany has already implemented the dual-role plastic management scheme. It has organized countrywide gathering, categorizing, and recycling of old packaging according to network cooperation and to record the achievement of the sustainable objectives in line with the legislation in favor of business and commerce (Snowdon 2019; Oke et al. 2020).

Thus, this review compares the existing and upcoming plans in Germany and the UK, promoting the awareness and visibility to follow similar traits in other countries ([CSL STYLE ERROR: reference with no printed form.]; Burgess et al. 2021). The current policies, the producer and consumer responsibilities, shortcomings of the schemes, the recycling process, and technologies with future improvement rubrics have been covered in this review (Fig. 1).

Rethinking Plastic: Case Studies on Waste Management in UK and Germany

Case Studies of Plastic Recycling in UK

Polymers and composites are highly customizable to meet specific application needs and can be cost-effectively produced (Burgess et al. 2021). As a result, in the UK alone, millions of tons of plastic were sold in 2017, with packaging being the largest contributor at 1.5 million tons (49%) in households and buildings ([CSL STYLE ERROR: reference with no printed form.]; Burgess et al. 2021). However, only 4% of plastic films are recovered, and the collection rate for solid plastics, such as drink and detergent bottles and grocery store trays, is only slightly better at 54%. This low collection rate can be attributed to factors such as on-the-go disposal and the lack of success in household collection programs, which are critical to increasing recycled tonnages as they represent a significant portion of uncollected waste (Snowdon 2019; Burgess et al. 2021).

In response to these challenges, the four constituent governments of the UK conducted joint consultations in 2019–2020 on waste management, including waste collection methods, consumer taxation, extended producer responsibility (EPR) policies, and the drink bottle deposit return scheme (DRS). Scotland has committed to implementing a DRS in 2022, while Wales has already implemented a charge for carrier bags and aims to become a circular economy with 100% recycling and zero waste by 2050. The Welsh Government established legally binding recycling targets for local authorities, resulting in a remarkable boost in household recycling from 5.2% (1998–99) to a world-leading 60.7% (2018–19), with the recycling rates of municipal waste also significantly rising from 4.8 to 62.8% over the same time frame (Burgess et al. 2021). Various corporate governance approaches make it challenging to create a single UK-wide waste management system that considers customer engagement, retail and garbage company strategies, and the widespread usage of identical plastics throughout the nation. To address this, starting in 2023, UK-based businesses handling packaging must report waste data, with EPR charges for producers taking effect in 2024 and recyclability-based packaging taxes in 2025. The packaging waste recycling note (PRN) is used to identify and classify different types of plastic resins, typically used in packaging materials. The PRN system uses a numbering system from 1 to 7 to designate different types of plastic resins based on their chemical composition and properties. This information helps with the proper disposal and recycling of plastic materials. This PRN system will continue to track recycling for both household and non-household packaging, and starting in April 2024, fees for household packaging waste and street bin packaging will be set, with fees adjusted based on recovery and recycling rates starting in 2025 (Campbell-Johnston et al. 2020) (Richter and Koppejan 2016). The UK government plans to establish a list of recyclable goods by 2023 to achieve uniformity in the collection, with hopes that Wales and Scotland will follow suit to prevent uncertainty across borders (Kalimo et al. 2015). The main obstacle to bin color standardization is cost, but the UK government proposes a £200/ton Plastic Packaging Tax starting in April 2022 for any packaging containing less than 30% recycled material (Kalimo et al. 2015) (Gupt and Sahay 2015). The government is also investigating DRS for both glass and plastic drink bottles, requiring a £0.20 refundable fee for each bottle sold, to be implemented in phases, starting with Scotland. However, issues such as shops setting up collection facilities and the possibility of deception need to be addressed (Gupt and Sahay 2015).

Case Studies of Plastic Recycling in Germany

Over the past 2 decades, Germany’s population has experienced only a slight increase, but waste plastic production has more than doubled, resulting in a twofold increase in waste production per capita. The growing concern about the environmental impact of packaging and secure waste disposal led the European Commission to establish the Packaging and Packaging Waste Directive 94/62/EC in 1994 (Gharfalkar et al. 2015). In line with the polluter pays principle (PPP), many nations within the OECD (a global platform where leaders of 37 democracies with business economic systems collaborate to establish standards for public policy to promote long-term economic growth) are taking measures to promote energy (Ramasubramanian et al. 2021; Kowal et al. 2022) and resource conservation, reduce effluent discharge, and minimize waste intended for end-of-life (Gharfalkar et al. 2015). To achieve these goals, an extended producer responsibility (EPR) strategy aims to hold corporations accountable for actions that reduce ecological impacts from the use and disposal of their products while promoting the consumption of recovered resources and recycling (Gharfalkar et al. 2015) (Pani and Pathak 2021). However, managing solid waste in the supply chain segment of packaging presents specific challenges when implementing an EPR strategy because packaging waste is often discarded in large quantities from various sources shortly after manufacturing and is intrinsically contaminated. In 1991, Germany became the first country to establish legally binding requirements for the recovery and recycling of retail packaging under the packaging ordinance, which came into effect on June 12, 1991, as part of the German Waste Act (Peng et al. 2018). The primary objective of the ordinance is to ensure that manufacturers and sellers return a fixed percentage of packaging materials each year and recycle them in accordance with the guidelines outlined in the legislation. The German corporate industry has taken responsibility for waste prevention and reduction by agreeing to recycle and collect materials, including plastic packaging, glass, and metals, among others (Zhao et al. 2021). In Germany, the present state of waste management is divided into three categories: “return and collection,” “wastewater treatment,” and “stop wasting disposal.” Municipalities are required to separate their collection and recovery of hazardous electrical waste, end-of-life vehicles, and batteries (Kumar et al. 2019; Ramasubramanian et al. 2022b; Rajagopalan et al. 2022), while municipal garbage includes home waste and specific recyclable items such as sewage sludge, packaging, glassware, papers, and large items. In Germany, “urban waste” refers to household garbage generated by businesses, industries, and residences (Rubio et al. 2019; Ribeiro and Kruglianskas 2020; Cai and Choi 2021).

In Germany, waste management is regulated by a hierarchy of strategies that prioritize different methods of handling solid waste. The first step is to reduce waste by minimizing production through communication between the waste producer, manufacturer, and consumer. Reusing products is the next practical step, which typically requires less energy than recycling. Recycling is a crucial approach to dealing with solid waste, and it aims to keep products out of landfills by reusing waste resources (Gharfalkar et al. 2015). Various methods like separation, mechanical, and thermal treatments are employed in recycling. The next step is recovery, which includes microbial degradation, incineration, energy recovery, and other energy-producing techniques. The final step is disposal, which involves getting rid of something without trying to recover energy and is typically achieved through incineration or landfilling (Dornack 2018).

The implementation of pre-established disposal expenses and return-recycling rules can encourage manufacturers to use less plastic packaging in their products. The Producer Responsibility Organization (PRO) is crucial in raising awareness and promoting responsible management of discarded plastic among manufacturers and consumers (Gu et al. 2018). However, the goal of achieving 50% recycling of polyethylene waste in the European Union by 2025 is greatly hindered by the limited processing facilities of 6.0 metric tonnes. The transition to a circular plastic economy in the EU has been delayed because the recycling capacity of the European Union accounts for only about 23% of the total post-consumer plastic waste generated (Gu et al. 2018; Alev et al. 2019). To achieve the recycling objectives, recycling capacity must continue to grow rapidly, with an increase of 3 metric tonnes from 2018 to 2020 (Lorang et al. 2022). Germany has been utilizing Deposit Return Systems (DRS) since 2003, which was previously only used for PET and had a throughput of 98%. DRS programs have the potential to reduce pollution and increase recycling rates, but their implementation is fraught with challenges due to high operational costs and the need for a complex framework (Esenduran et al. 2019; Andreasi Bassi et al. 2020).

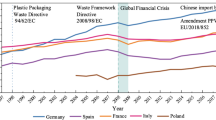

Yellow containers in Germany are used to collect municipal waste with plastic packaging, while pre-sorted plastic waste goes to material recovery facilities. Recyclable waste is incinerated to recover energy, and there is an effective producer responsibility (Peng et al. 2018). Germany has the highest rate of recycling based on the processed plastic waste in yellow containers. However, recycling is not always as effective as energy recovery treatment for plastic packaging waste, as it is intertwined with the latter. The German packaging regulation mandates extended producer accountability and the suggestion of product take-back, with suppliers allowing customers to return packaging, and vendors responsible for recycling and disposal costs (Kunz et al. 2018; Peng et al. 2018; Ribeiro and Kruglianskas 2020). This approach is effective in reducing waste and encouraging innovation in environmentally friendly packaging design, replenishing, and recycling. The main drawback is that plastic waste packaging is difficult to export due to a lack of a marketplace for recycled goods. The recycling potency of the ordinance’s energy recovery provision is lower in Germany when producers prefer to use biomass resources rather than recycled plastics as a source (Gharfalkar et al. 2015). In recent years, Germany has reduced the amount of plastic waste it exports. In 2021, only 766,200 tonnes of plastic litter were shipped from Germany, which represents a 25.2% decrease compared to the previous year when the Federal Statistical Office reported over a million tonnes being exported. This trend also indicates that plastic waste recycling rates have increased by almost 70% over a decade, as shown in Fig. 2 (Nakajima and Vanderburg 2016; Favot et al. 2022; di Foggia and Beccarello 2022; Compagnoni 2022).

On June 12th, 1991, the packaging regulations under the German Waste Act came into effect, and it was later revised in September 1994 as part of the “End up wasting Reduction, Recovery, and Management Act of 1986,” making Germany the first country to establish recycling and recovery standards for sales packaging (Dornack 2018; Chaudhary and Vrat 2018). By law, manufacturers are required to recycle a specified amount of packaging materials, with these quotas increasing annually. According to the OECD, several factors converged in 1998 to make the enactment of this regulation an inevitable outcome of Germany’s waste management policy and continued environmental discussions (Redlingshöfer et al. 2020).

The following are some of these forces:

The Waste Management, Recycling, and Disposal Act established the hierarchy of avoidance, reuse, and recycling. The polluter-paying principle was generally accepted by the public, who often found the manufacturer of the packaging material as the source of the problem as opposed to business consumers (Nakajima and Vanderburg 2016). Citizens were already in the habit of sorting waste for composting and recycling, and there were established systems for composting, glass recycling, and paper recycling. There were significant public concerns about the reduction of waste sent to landfills and municipal waste. Public opposition to incineration was growing, making the problems outlined above even more pressing. Packaging made up 50% of the total amount of municipal waste collected, which was considered a pressing issue to minimize the generation and, in turn, reduce its harmful effects (Nakajima and Vanderburg 2016).

Another efficient initiative of Europe is the green dot. The Green Dot system covers all types of packaging, including paper, cardboard, glass, plastic, and metal. In order to participate in the Green Dot system, producers must become members of a dual system organization (DSO), which is responsible for collecting and managing the funds generated by the Green Dot system (da Cruz et al. 2014). The system is run by a non-profit organization called Duales System Deutschland (DSD). There are currently over 60 DSOs operating in Germany, and they represent over 90% of all producers. The Green Dot system funds are used to finance the recycling of packaging waste and to support public authorities in their efforts to reduce and manage packaging waste (Hahladakis et al. 2018). The Green Dot system has been highly successful in promoting the recycling of packaging waste in Germany. In 2019, over 94% of all packaging placed on the German market was collected for recycling, and over 71% of this packaging was recycled. The Green Dot system has also been instrumental in reducing the amount of packaging waste generated in Germany. In 2019, the per capita generation of packaging waste in Germany was 47 kilograms (da Cruz et al. 2014), compared to an average of 63 kilograms in the EU as a whole, which has been embraced by more than 130,000 companies in 23 European nations, has been hailed as a leading strategy in Europe with impressive outcomes. Currently, the Green Dot label is found on over 460 billion packages (da Cruz et al. 2014; Hahladakis et al. 2018; Kish 2018).

Producer and Consumer Behavior and Economic Impact

The Environment Act 2021 (the “Act”) was approved on November 9, 2021, following the UK government’s promise to reach net carbon emissions by the year 2050 and the enthusiasm surrounding Glasgow’s hosting of COP 26 (Cai and Choi 2021). The person who packages and sells items using their brand name is the brand owner. The organization that handled the packaging or stuffing of the packaging would be responsible if a brand could not be identified. Anyone who imports packed packaging is an importer (Kish 2018). Providers of services who lend or rent out reusable packaging. Those who create or import empty packaging and resell it to anybody who is not a required manufacturer are known as distributors. Those who run an online store where non-UK vendors can offer full or empty packaging to shoppers in the UK (Sheldon and Norton 2020). Sellers are individuals that provide filled packaging for sale to final customers. Businesses that put certain items on the market will be expected to cover all expenses related to the product under the planned EPR rules, which will be phased starting in 2023. Previously, the local government covered all or part of these expenses. The following clauses are probably included in the eventual regulations:

Production companies of certain goods must pay a fee, enroll with a regulatory scheme, and receive a registration document as confirmation (Gupt and Sahay 2015). Producers must also keep records of the quantities of merchandize in relevant EPR categories they spot on the UK market and inform a government-appointed regulatory scheme (Burgess et al. 2021). Finally, waste handling, disposal, and recycling programs for a broader range of products are subject to increased regulation (Gupt and Sahay 2015). Measures for modifying the present EPR system are also included in the EPR recommendations outlined in the Act (Burgess et al. 2021).

Department of Agriculture, Rural Affairs, and Environment (UK) also set plans to declare the aim to include up to five current waste initiatives in the UK EPR model by the end of 2025, with the goal that at least one will be unveiled and subject to public consultation during 2022 (Snowdon 2019; Burgess et al. 2021).

The suggested plans were to focus waste management in:

-

Textiles, such as commercial and garment textiles

-

Bulky garbage, such as mattresses, furniture, and carpets, demolition

-

Construction debris

-

Automobile tires and fishing equipment

Under the EU’s waste framework directive, producers of certain products, including those exported from Germany, are required to take responsibility for the end-of-life management of their products and to contribute to the cost of waste management. The directive sets targets for the recovery and recycling of waste and requires producers to ensure that their products are disposed of in an environmentally responsible manner (Brady and Jackson 2010). In addition to the waste framework directive, the EU has also established a number of specific regulations for certain product categories, such as electronics, batteries, and packaging. These regulations require producers to comply with specific obligations, including the take-back of used products and the financing of waste management (Gerassimidou et al. 2022). When exporting products from the UK or Germany to other countries within Europe, producers must comply with the relevant EU regulations. This includes ensuring that their products are designed and manufactured in an environmentally responsible manner and that they are disposed of in accordance with the applicable regulations (Brady and Jackson 2010; Gerassimidou et al. 2022).

The application of extended producer responsibility (EPR) regulations to products exported from the UK or Germany to other countries may vary depending on the importing country’s regulations and international agreements. the importing country may have its own EPR regulations that apply to the products imported from the UK or Germany. In such cases, the producers may be required to comply with the importing country’s regulations, which may be different from the regulations in the UK or Germany (Brady and Jackson 2010). Furthermore, the packaging waste export recycling note (PERN) system is a mechanism used to track and verify the export of packaging waste for recycling from the UK to other countries. This system was implemented as a part of the UK’s compliance with the European Union’s (EU) waste shipment regulations, which aim to prevent the dumping of waste in developing countries. The PERN system requires that any company that exports packaging waste for recycling from the UK must obtain a PERN from a registered compliance scheme (Brady and Jackson 2010; Gerassimidou et al. 2022). A PERN is issued for each ton of material exported and serves as evidence that the waste has been exported for recycling purposes. The PERN must be kept on file for a period of 2 years and made available for inspection by the relevant authorities. The PERN system is designed to ensure that all packaging waste exported for recycling is traceable, transparent, and fully compliant with the relevant regulations. This helps to prevent the illegal export of waste and promotes responsible waste management practices, which are essential for protecting the environment and public health (Brady and Jackson 2010; Gerassimidou et al. 2022).

The consumer is one of the critical players in the e-waste issue, with consumer behavior, environmental consciousness, and demand increase for energy being essential variables (Burgess et al. 2021). According to the circular economy viewpoint, consumers can follow four possible paths: (1) upheld usage, including exchange and repair; (2) reuse and redistribution; (3) remanufacture/refurbishing; and (4) recycling. The Green Deal of Producers and Consumers becomes obvious that circular business practices and sustainable production and consumption choices are interlinked (Snowdon 2019; Burgess et al. 2021). Producers and consumers must adopt certain measures to speed up the economy’s transition (Oke et al. 2020). To advise consumers on the economic effect of their expenditures, product lifespans, and services offered, such as repair choices, the European Green Deal seeks to employ a sustainability label (Snowdon 2019). Similar to the Ecolabel, the label has a few drawbacks, including the fact that it is optional and does not always guard against going green (Lorang et al. 2022). Nevertheless, it may be viewed as a positive development as the available data lessens skepticism over the price-performance ratio (Snowdon 2019). While conducting their research, they focused on young customers, particularly students, and questioned their awareness, perspective, and trash disposal habits (Snowdon 2019; Burgess et al. 2021). The findings of this study indicate that even though consumers are aware of what electronic trash is, they need to become more familiar with its collection and recycling initiatives (Pandey et al. 2022). Additionally, these individuals demonstrate a willingness to discard electronic waste appropriately. Regarding these instances, the authors emphasize that family income should directly correlate with waste disposal practices (Pandey et al. 2022). Utilizing social media is one strategy that can be useful for examining customers’ behavior and society’s viewpoint (Lorang et al. 2022).

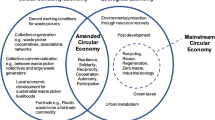

The Producer Responsibility Organisation (PRO) purview was widened in 2003 to encompass industrial, business, and transportation packaging waste and domestic packaging trash. The organization was founded in reaction to the Packaging and Packaging Waste Directive (PPWD), and the trademark “the Green Dot” is registered for packaging regulated by such schemes (Lorang et al. 2022). The PROs increase the segregated waste collection and make it fiscally feasible using the levies they get. The rates that producers must pay vary based on how easily the plastics can be recycled and the type of plastic, i.e., domestic, industrial, or commercial. An outline of the producer responsibility organization’s function in the plastics value chain, including take-back guidelines and upfront disposal costs, is given in Fig. 3 (Nakajima and Vanderburg 2016; Lorang et al. 2022).

The main objective of a circular economy is to reduce both the consumption of natural resources and the flow of trash produced through human activities that are returned to the environment. As a result, circular economy strategies concentrate on increasing the operational efficiencies of capitalist economies to ensure their long-term ecological and economic sustainability. A circular economy proposes maintaining resources and goods at their highest worth for the most extended time possible (Lorang et al. 2022). As a result, adopting EPR systems depends on producers and the government and widespread public involvement.

Challenges in Current Initiatives

The existing state of affairs is complicated, ineffective, decentralized, impoverished, diversified, and subject to many, occasionally opposing, perspectives on how to move ahead. Although the proposed law implies an understanding that tighter targets necessitate national regulation, the UK government has, up until now, attempted to achieve national goals through disorganized local organizations (Critchell et al. 2019; Peng et al. 2019). All policy recommendations, however, focus on distinct aspects of the system with little regard for how the components work together or throughout a supply chain. Examples include a list of products that English Local Officials must collect for recycling by 2023 from the suggestion on collections consistency. It needs to be clarified what should be put in which bins or what colors the containers should be. Thus, there is a perpetuation of non-standardization and ensuing misunderstanding (Atasu 2019; Shan and Yang 2020). The principles connected to the acquisition of proof portray the increased expense of recycling various packaging substances because it is not intended to retrieve from manufacturers the entire cost of gathering and maintaining waste production but rather to encourage a rise in the packaging recycling rate (Banguera et al. 2018; Leclerc and Badami 2020). Only a tiny fraction of the money earned from selling PRNs has gone into supporting collecting; however, it has helped significantly enhance the capacity for sorting and other associated operations. Additionally, as previously mentioned, the cost of PRNs and, thus, the total amount of money collected through purchasing PRNs might vary significantly from season to year because the existing system is market-driven (Atasu and Subramanian 2012).

There are issues with the PRN system’s openness and the producers’ ability to see how their PRN payments have been used. Manufacturers will donate more money to the system under such an EPR system (Gu et al. 2018). Therefore, all participants must know how this money is obtained and dispersed and what results it produces. A future system will also require more reliable data and open reporting to meet higher recycling goals. Worry over unequal gameplay concerning the proof for waste disposal reused in the UK (PRNs) and that which is outsourced due to uncertainties surrounding the problem of recyclable material that is not packaging waste. Packaging that is of poor grade and cannot be refurbished, or on pollution from culinary leftovers, and that recovery that can be performed at a reduced cost elsewhere has been promoted (Ahlers et al. 2021).

EPR falls within the broader umbrella of the polluter-pay principle. Because the harmful repercussions of pollution result from various parties’ actions, it is difficult to isolate the polluter as a single actor. However, the EPR should be viewed as a strict responsibility rather than a liability principle to determine who can take the initiative productively and cost-effectively because they have the most influence and control over the critical transactions along the value chain (Andreasi Bassi et al. 2020). In Germany, it has been argued that downstream targets which involve segregated collection and recycling are emphasized more effectively by the collective responsibility over the upstream targets, including design for the environment (Critchell et al. 2019). Although individual accountability is more consistent with PPP and offers greater incentive appreciation for upstream targets, it also has a weaker certainty that the entire target will be met. Extensive studies have examined the effects of different payment plans on subjects required to pay and the characteristics of cost-sharing among EPR organizations and the public sector. The limited expansion of the recycling market space and the requirement for cooperation, particularly in the infant industry era, may be used to justify the development of collective compliance schemes with market strength. Additionally, a monopolistic PRO may balance off the raw material suppliers’ market dominance. Cooperative partnerships may result in monopolistic organizations (Atasu and Subramanian 2012; Ahlers et al. 2021; Lorang et al. 2022).

In terms of what the UK and Germany can learn from each other’s EPR policies, both countries have already made significant progress in implementing EPR and can learn from each other’s experiences and challenges. For example, the UK has established a comprehensive framework for the implementation of EPR, including the introduction of producer responsibility obligations for a range of product categories. This has resulted in a significant increase in household recycling, with household recycling rates rising from 5.2% (1998–99) to 60.7% (2018–19) (Hahladakis et al. 2018). In comparison, Germany has made significant progress in implementing EPR, including through the introduction of deposit systems for certain products and the promotion of recycling through the “Green Dot” scheme. These initiatives have helped to increase municipal waste recycling rates from 4.8 to 62.8% during the same period (da Cruz et al. 2014).

Possible solutions to enhance the implementation of extended producer responsibility (EPR) policies in the UK and Germany include harmonizing EPR policies across the EU and encouraging product design for the environment. Harmonizing EPR policies across the EU can ensure that producers are subject to consistent and effective EPR obligations, regardless of where they operate within the EU. This would create a level playing field for producers and minimize the environmental impact of their products. Encouraging producers to design products with the environment in mind can reduce waste and the environmental impact of products (da Cruz et al. 2014).

It is important to cover technological factors with policies for recycling plastics because technology plays a crucial role in the recycling process. Recycling plastics can help reduce waste and minimize the impact of plastics on the environment, but it requires an efficient and effective recycling infrastructure that can handle the volume and diversity of plastic waste.

Technologies for Processing PET, HDPE, Glass, and Aluminum

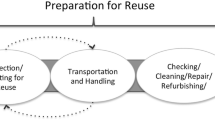

Figure 4 displays the various kinds of PET containers, the potential scale of recovery, and the worth of their DRS end product involved in the target, as part of all PET packaging available on the market (Khoo 2019). These categories are divided into primary, secondary, tertiary, and quad waste plastic recovery processes. Reserves refer to the scraps and by-products produced during the extrusion or final product production of the same plastic type. Secondary recovery involves actively processing recycled plastics to produce new plastic products, such as powders, flakes, or granules, which reduces their volume (Anuar Sharuddin et al. 2017). Tertiary recovery breaks down the elemental composition of plastic waste components through pyrolysis to generate oil and gas components in the presence of oxygen at high temperatures. Intermediate recycling frequently employs catalytic cracking, steam cracking, and liquid-gas gasification. To transform pre- or post-consumer polymers into a market-acceptable commercial fuel, tertiary recovery or task-engineered fuel production is required (Mwanza et al. 2018).

Statistics and classification of plastic waste collected in the UK (reproduced with permission from (Ahlers et al. 2021))

Thermochemical techniques like pyrolysis, liquefaction, and gasification offer possible solutions for managing plastic waste, as explained in the article (Khoo 2019) (Anuar Sharuddin et al. 2017). Pyrolysis is a process where plastic waste is converted into liquid hydrocarbon fuels like oil, char, and producer gas in an oxygen-free environment. Plastic waste can also be liquefied into energy-dense oil under high pressure and with the help of catalysts [49]. Using alkali catalysts during liquefaction can help increase the amount of oil produced while also reducing the formation of char (Khoo 2019). Another technique, gasification, involves converting organic molecules into synthesis gas through a thermochemical plastic-to-gas process (Anuar Sharuddin et al. 2017). These methods of plastic waste management align with the principles of extended producer responsibility (EPR), which places the responsibility of waste management on the producers of the products (Laubinger et al. 2021). By using these techniques, producers can take responsibility for the end-of-life management of their products and ensure that they are not causing harm to the environment. EPR encourages producers to design products that are recyclable or made from materials that can be converted into valuable products through the use of these thermochemical processing techniques (Mwanza et al. 2018).

Pyrolysis

EPR policies can play a crucial role in managing plastic waste by encouraging manufacturers to invest in recycling technologies such as pyrolysis. Pyrolysis is a process that can convert waste plastics into liquid hydrocarbon fuels like oil, char, and producer gas in an anaerobic environment (Davis et al. 2019). The distribution of the pyrolysis product depends on several factors like the combustion heat, growth temperature, timeframe, and steam boiler type. The elemental composition of different plastics and their particle size density also affect the amount of fuel, charcoal, and fumes that are created. Various types of reactors, including ablative, fixed bed, movable bed, vacuum-moving bed, fluidized bed, mechanical bed, and spinning cone (Kalargaris et al. 2017), can be used for combustion, but fluidized bed processors are the most commonly used due to their superior mass and temperature transfer, which results in better thermal degradation and higher oil yields (Kalargaris et al. 2017). Pyrolysis can be categorized as slow, fast-flash, or medium based on the reaction temperature and gas dwell duration (Miandad et al. 2016). After fast quenching, several degraded volatile compounds that could otherwise condense, cleave, or interact with other gases are isolated, resulting in the creation of non-condensable gases like hydrogen (H2), carbon monoxide (CO), carbon dioxide (CO2), and methane (CH4). Higher temperatures lead to more splitting processes, which reduce the amount of char generated (Brindha et al. 2020; Mohanraj et al. 2021; Zhen et al. 2022). Longer vapor dwell duration in the reactor, caused by the reduced velocities at which organic solvents condense, encourages side reactions during pyrolysis and creates heavy compounds like tars and chars. The crude produced by decomposition is a mixture of liquid organic and aqueous components (Qureshi et al. 2020).

Polyethylene (PET) produces waxes rather than oil but can increase oil yield by using polystyrene and polypropylene. Because polystyrene breaks down into free radicals, each of which has unique synergistic effects. Various plastics are pyrolyzed in a fixed-bed reactor and produce H2, CH4, C2H4, C2H6, C3H6, C2H8, C4H8, and C4H10 (Qureshi et al. 2020). Most of the pyrolysis liquid from HDPE, LDPE, and PP comprised aliphatics, alkanes, alkenes, and alkadienes, whereas aromatic hydrocarbons were formed from polystyrene, PVC, and PET. When plastics are co-pyrolyzed, the resulting oils contain fewer aromatic hydrocarbons and polycyclic aromatic hydrocarbons than separately. The pyrolytic oil seemed like a great place to get to some valuable molecules like benzene, toluene, styrene, and condensable aromatic hydrocarbons, all of which have practical use in industry (Miandad et al. 2016). By implementing EPR policies, manufacturers can be incentivized to produce more recyclable products and invest in recycling technologies like pyrolysis, thereby reducing plastic waste and its environmental impact.

Liquefaction

The process of converting plastic waste into a high-energy-density liquid using extreme pressure and catalyst supports is a promising technique. When alkali catalysts are used during liquefaction, they can increase oil yields and reduce char generation. Conversely, acidified catalysts can decrease the liquefaction heat and reaction speed. The use of liquefaction can produce commercially relevant products, including epoxies, sealants, and urethane sponges, as well as oil (Qureshi et al. 2020). Through condensation, the resulting monomers re-polymerize to produce oils and a small amount of charcoal. However, certain solvents can prevent the formation of harmful condensing reactions and solid-state reactions that typically result in char creation. Supercritical methanol is a suitable solvent for liquefying polymers (Miandad et al. 2016). Supercritical alcohols are advantageous for enhancing the solubility and cracking of organic components, which can result in improved hydrogen-donating characteristics, increased oil output, and enhanced phase separation due to the alcohol’s low boiling point. Hydrothermal liquefaction uses water as the aqueous reaction media due to its superior solvation qualities, low cost, non-toxicity, and abundance (Qureshi et al. 2020). Supercritical alcohols are favorable for improving the solubility and cracking of organic components, which may lead to better hydrogen-donating properties, greater oil production, and improved phase separation because of their low boiling points. Water is used as the aqueous reaction medium in hydrothermal liquefaction because of its outstanding solvation properties, low cost, lack of toxicity, and availability (Davis et al. 2019). The liquid polymer products contain branched paraffin elements that resemble gasoline. The liquefied plastics produce oil with reduced water content, and the lower oxygen level of the oils produced contributes to their fuel properties and utility as a heater. Catalytic fuel improvement methods, including hydro refining, hydro treatment, and hydrodeoxygenation, are frequently much less effective due to the low moisture content of plastic-derived oils (Qureshi et al. 2020) (Al-Salem et al. 2017). Overall, the use of high-performance liquefaction processes can help alleviate the environmental impact caused by plastic waste by reducing the quantity of plastic waste that is disposed of in landfills or the environment.

Gasification

Implementing EPR policies could encourage the use of the thermochemical plastic-to-gas process called gasification, which converts organic molecules into synthesis gas. The resulting H2 and CO-based synthetic gas contains small amounts of CO2, CH4, C2H2, C4H8, and C2H6. Gasification is a more modern process that can function at lower temperatures with higher reactivity compared to coal gasification, a well-established technique for making syngas at high temperatures (Mojaver et al. 2022). Gasification is preferred over other thermochemical processes since it produces H2, which could help reduce energy loss during power plant combustion. Gasification can be carried out using air, steam, or liquids, and subcritical or supercritical water is used as the reaction media (Ciuffi et al. 2020). Traditional gasification involves a series of thermochemical processes, such as partial oxidation, pyrolysis, and steam gasification. Pyrolysis produces oil, gas, and charcoal by thermally cracking plastics in the absence of oxygen. In contrast, partial oxidation uses less oxygen than molar ratio combustion. Additionally, steam reforming involves reforming organic compounds in water to CO, CO2, and H2 (Ciuffi et al. 2020). Hydrothermal gasification has features such as the rapid conversion of plastic polymers to monomers, improved monomer solubility, greater carbon conversion efficiency, increased syngas yields, reduced formation of char and tar, and a lower possibility of intermediate polymerization (Ciuffi et al. 2020).

Although the conventional regenerative method has been extensively industrialized, novel techniques such as altered regenerative method, cracking regeneration technology, etc. are critical for recycling and reusing HDPE (Hasanzadeh et al. 2022). The mechanical properties of recycled products are significantly reduced due to the aging of waste HDPE during use and regeneration processes, rendering them unsuitable for high-grade manufacturing (Zhao and You 2021a). Filling alteration technology, plastic alloying technology, and cross-linking modification technology are the three emerging methods for processing plastic bags. By proportionately mixing plastics with varying densities and contents, plastic alloying technology can produce mixed alloy materials with unique properties. The plastic bags are broken, cleaned, and dried, then treated with cross-linking modification technology to create a 3D recycled material with improved mechanical properties for new applications (Zhao and You 2021b; Liew et al. 2021; Hasanzadeh et al. 2022). By adopting an EPR approach, manufacturers can be incentivized to produce more recyclable products and invest in these recycling technologies.

Aluminum and Glass Recycling

The extended producer responsibility recycle rate for aluminum packaging is displayed in Fig. 5a. Juice pouches make up the majority of aluminum packaging; they are included by the Scottish deposit return scheme and are anticipated to be included in the English, Welsh, and Ireland deposit return schemes as well (Mojaver et al. 2022). The impact evaluation assumes that 229 kt of aluminum containers will be sold in 2023; 98kt is non-can and falls within EPR. This is by market projections for the tonnage of beverage cans in 2019 (Burke et al. 2019; McNicholas and Cotton 2019). Once the containers have been eliminated, the research estimates that the remaining weight includes packages with a low recycling rate, such as sprays and foils, mainly as these are not accepted for recycling by all regional officials. This causes a poor recycling rate. Suppose all local councils are obliged to gather such items from homes, especially aerosol cans, foil, and lids, the recycling process will rise, and a greater goal for aluminum might be established. The researchers should keep working with industry while the government does further study (Kosior and Mitchell 2020; Watermeyer et al. 2021).

a EPR packaging materials and expected growth in 2030 and 2040 in the UK b DRS and EPR % increase in 2020 and 2030 in the UK (data obtained from https://www.gov.uk/government/statistics/uk-waste-data)

Glass packaging is primarily used for packaged foods like toppings, gravies, and preserves. A considerable percentage of glass bottles in beverage bins are covered by the Scottish DRS and suggested to be covered by Britain, England, and Northern Irish DRS. Since this packaging is easily recycled, a high standard for non-bottle manufacturing products may be set. For a few decades previously, there has been a “re-melt” objective for glassware to encourage more glasses to be used in re-melt uses (such as putting bottle glass back into the container), which promotes good quality and more critical ecological quality than other uses like aggregates. The objective for re-melt in the UK in 2021 and 2022 is 72% (Kosior and Mitchell 2020; Watermeyer et al. 2021). The DRS and EPR % increase in 2020 and 2030 in the UK, a timeline of EPR and DRS activities is shown in Fig. 5b.

Conversely, COVID-19 has significantly impacted how producers apply regulations like DRS and EPR. The economics report’s investigation indicates that COVID-19 is to blame for the most extensive global economic catastrophe since World War II and maybe even the Great Depression. Additionally, COVID-19 has stopped production, putting manufacturers under much stress concerning rent, equipment depreciation, and loan interest, as well as creating a danger of capital chain disruption (Winternitz et al. 2019; Tian et al. 2020; Watermeyer et al. 2021). The timeline and expected EPR initiatives were shown in Fig. 6.

Future Trends and Circular Economy Prospects

The essence of circularity is to optimize resource usage while minimizing waste generation by establishing priorities through the “6Rs.” These include cutting back on raw material use, remodeling products to facilitate reuse or recycling, preventing the use of plastics, recycling through closed-loop processes, and extracting energy via combustion or the separation of chemicals and fuels. Adhering to these principles is crucial for achieving a circular economy and reducing waste production (Peng et al. 2019).

In order to implement the circular economy, it is important to redesign products to promote circularity from the outset. This involves removing qualities that hinder recycling and incorporating those that facilitate it throughout the product design process. By doing this, the transition from a linear to a circular economy for waste management can be simplified. All stakeholders, from manufacturers to end-of-life deployment, must work together towards a shared objective of creating a waste-free circular economy that benefits everyone and imposes no externalized costs on society. This requires a fundamental shift in the way we produce, consume, and dispose of goods, and a commitment to sustainable and responsible practices. By embracing circularity, we can create a more efficient, equitable, and environmentally conscious society (Bonsu 2020).

Conclusion

The circular plastics economy can be achieved through the promotion of mechanic, pharmacological, and reusable recycling channels. By categorizing UK plastic waste based on relative value instead of polymers, higher plastic recycling quantities can be generated. To achieve this, quick action is needed in four critical areas, including standardization, infrastructure investment, partnership models, and the production of higher-value recycled materials, all of which require supply chain collaboration. Although many organizations have made efforts to recycle plastics, it is necessary to adopt a team effort approach that includes cooperative producer, consumer, and government objectives to create a more aspirational, system-wide framework for success. To achieve success in the circular plastics economy, it is important to develop material recovery data using available open standards and achieve cross-supply channel uniformity. This involves implementing unified bin collection, reducing plastic usage, decreasing pollutants, implementing uniform labeling, and defining policies to create a more consistent and effective system. The implementation of a collaborative approach involving all stakeholders is crucial to achieving this goal, as well as investing in infrastructure and research to create new, higher-value recycled materials. With these efforts, a circular plastics economy can be realized, reducing the environmental impact of plastic waste and creating a more sustainable future.

References

Ahlers J, Hemkhaus M, Hibler S, Hannak J (2021) Analysis of extended producer responsibility schemes assessing the performance of selected schemes in European and EU countries with a focus on WEEE, waste packaging and waste batteries

Alev I, Agrawal VV, Atasu A (2019) Extended producer responsibility for durable products. Manuf Serv Oper 22:364–382. https://doi.org/10.1287/MSOM.2018.0742

Al-Salem SM, Antelava A, Constantinou A et al (2017) A review on thermal and catalytic pyrolysis of plastic solid waste (PSW). J Environ Manage 197:177–198. https://doi.org/10.1016/J.JENVMAN.2017.03.084

Andeobu L, Wibowo S, Grandhi S (2022) Artificial intelligence applications for sustainable solid waste management practices in Australia: a systematic review. Sci Total Environ 834:155389. https://doi.org/10.1016/J.SCITOTENV.2022.155389

Andreasi Bassi S, Boldrin A, Faraca G, Astrup TF (2020) Extended producer responsibility: how to unlock the environmental and economic potential of plastic packaging waste? Resour Conserv Recycl 162:105030. https://doi.org/10.1016/J.RESCONREC.2020.105030

Anuar Sharuddin SD, Abnisa F, Wan Daud WMA, Aroua MK (2017) Energy recovery from pyrolysis of plastic waste: study on non-recycled plastics (NRP) data as the real measure of plastic waste. Energy Convers Manag 148:925–934. https://doi.org/10.1016/J.ENCONMAN.2017.06.046

Atasu A (2019) Operational perspectives on extended producer responsibility. J Ind Ecol 23:744–750. https://doi.org/10.1111/JIEC.12816

Atasu A, Subramanian R (2012) Extended producer responsibility for E-waste: individual or collective producer responsibility? Prod Oper Manag 21:1042–1059. https://doi.org/10.1111/J.1937-5956.2012.01327.X

Banguera LA, Sepúlveda JM, Ternero R et al (2018) Reverse logistics network design under extended producer responsibility: the case of out-of-use tires in the Gran Santiago city of Chile. Int J Prod Econ 205:193–200. https://doi.org/10.1016/J.IJPE.2018.09.006

Bonsu NO (2020) Towards a circular and low-carbon economy: insights from the transitioning to electric vehicles and net zero economy. J Clean Prod 256:120659. https://doi.org/10.1016/J.JCLEPRO.2020.120659

Brady S, Jackson T (2010) Waste recovery using packaging waste recovery notes: a cost-effective way of meeting targets? J Environ Plan Manag 46:605–619. https://doi.org/10.1080/0964056032000133189

Brindha R, Mohanraj R, Manojkumar P et al (2020) Hybrid electrochemical behaviour of La1-xCaxMnO3 nano perovskites and recycled polar interspersed graphene for metal-air battery system. J Electrochem Soc 167:120539. https://doi.org/10.1149/1945-7111/ABB34F

Brindha R, Kandeeban R, Kamal KS et al (2021) Andrographis paniculata absorbed ZnO nanofibers as a potential antimicrobial agent for biomedical applications. Adv Nat Sci: Nanosci Nanotechnol 12:045002. https://doi.org/10.1088/2043-6262/AC389E

Burgess M, Holmes H, Sharmina M, Shaver MP (2021) The future of UK plastics recycling: one bin to rule them all. Resour Conserv Recycl 164:105191. https://doi.org/10.1016/J.RESCONREC.2020.105191

Burke J, Byrnes R, Fankhauser S et al (2019) How to price carbon to reach net-zero emissions in the UK

Cai YJ, Choi TM (2021) Extended producer responsibility: a systematic review and innovative proposals for improving sustainability. IEEE Trans Eng Manag 68:272–288. https://doi.org/10.1109/TEM.2019.2914341

Campbell-Johnston K, Calisto Friant M, Thapa K et al (2020) How circular is your tyre: experiences with extended producer responsibility from a circular economy perspective. J Clean Prod 270:122042. https://doi.org/10.1016/J.JCLEPRO.2020.122042

Chaudhary K, Vrat P (2018) Case study analysis of e-waste management systems in Germany, Switzerland, Japan and India: A RADAR chart approach. Benchmarking 25:3519–3540. https://doi.org/10.1108/BIJ-07-2017-0168/FULL/XML

Ciuffi B, Chiaramonti D, Rizzo AM, et al (2020) A critical review of SCWG in the context of available gasification technologies for plastic waste. Applied Sciences 10:6307. https://doi.org/10.3390/APP10186307

Compagnoni M (2022) Is extended producer responsibility living up to expectations? A systematic literature review focusing on electronic waste. J Clean Prod 367:133101. https://doi.org/10.1016/J.JCLEPRO.2022.133101

Critchell K, Bauer-Civiello A, Benham C et al (2019) Plastic pollution in the coastal environment: current challenges and future solutions. Coasts Estuaries: Future: 595–609. https://doi.org/10.1016/B978-0-12-814003-1.00034-4

da Cruz NF, Ferreira S, Cabral M et al (2014) Packaging waste recycling in Europe: is the industry paying for it? Waste Manage 34:298–308. https://doi.org/10.1016/J.WASMAN.2013.10.035

Davis B, Williams M, Talbot P (2019) iQOS: evidence of pyrolysis and release of a toxicant from plastic. Tob Control 28:34–41. https://doi.org/10.1136/TOBACCOCONTROL-2017-054104

de Miranda Ribeiro F, Kruglianskas I (2020) Critical factors for environmental regulation change management: evidences from an extended producer responsibility case study. J Clean Prod 246:119013. https://doi.org/10.1016/J.JCLEPRO.2019.119013

Deus RM, Mele FD, Bezerra BS, Battistelle RAG (2020) A municipal solid waste indicator for environmental impact: assessment and identification of best management practices. J Clean Prod 242:118433. https://doi.org/10.1016/J.JCLEPRO.2019.118433

di Foggia G, Beccarello M (2022) An overview of packaging waste models in some european countries. Recycling 2022, Vol 7, Page 38 7:38. https://doi.org/10.3390/RECYCLING7030038

Dornack C (2018) Waste policy for source separation in Germany. Handb Environ Chem 63:3–10. https://doi.org/10.1007/698_2017_114/COVER

Esenduran G, Atasu A, van Wassenhove LN (2019) Valuable e-waste: implications for extended producer responsibility. IISE Trans 51:382–396. https://doi.org/10.1080/24725854.2018.1515515

Favot M, Grassetti L, Massarutto A, Veit R (2022) Regulation and competition in the extended producer responsibility models: results in the WEEE sector in Europe. Waste Management 145:60–71. https://doi.org/10.1016/J.WASMAN.2022.04.027

Gerassimidou S, Lovat E, Ebner N et al (2022) Unpacking the complexity of the UK plastic packaging value chain: a stakeholder perspective. Sustain Prod Consum 30:657–673. https://doi.org/10.1016/J.SPC.2021.11.005

Gharfalkar M, Court R, Campbell C et al (2015) Analysis of waste hierarchy in the European waste directive 2008/98/EC. Waste Manag 39:305–313. https://doi.org/10.1016/J.WASMAN.2015.02.007

Gu F, Guo J, Hall P, Gu X (2018) An integrated architecture for implementing extended producer responsibility in the context of Industry 4.0. Int J Prod Res 57:1458–1477. https://doi.org/10.1080/00207543.2018.1489161

Gupt Y, Sahay S (2015) Review of extended producer responsibility: a case study approach. Waste Manag Res 33:595–611. https://doi.org/10.1177/0734242X15592275

Hahladakis JN, Purnell P, Iacovidou E et al (2018) Post-consumer plastic packaging waste in England: assessing the yield of multiple collection-recycling schemes. Waste Manage 75:149–159. https://doi.org/10.1016/J.WASMAN.2018.02.009

Hasanzadeh R, Mojaver P, Khalilarya S, Azdast T (2022) Air co-gasification process of LDPE/HDPE waste based on thermodynamic modeling: hybrid multi-criteria decision-making techniques with sensitivity analysis. Int J Hydrog Energy 48(6):2145–2160. https://doi.org/10.1016/J.IJHYDENE.2022.10.101

Kalargaris I, Tian G, Gu S (2017) Combustion, performance and emission analysis of a DI diesel engine using plastic pyrolysis oil. Fuel Process Technol 157:108–115. https://doi.org/10.1016/J.FUPROC.2016.11.016

Kalimo H, Lifset R, Atasu A et al (2015) What roles for which stakeholders under extended producer responsibility? Rev Eur Comp Int Environ Law 24:40–57. https://doi.org/10.1111/REEL.12087

Khoo HH (2019) LCA of plastic waste recovery into recycled materials, energy and fuels in Singapore. Resour Conserv Recycl 145:67–77. https://doi.org/10.1016/J.RESCONREC.2019.02.010

Kish RJ (2018) Using legislation to reduce one-time plastic bag usage. Econ Affairs 38:224–239. https://doi.org/10.1111/ECAF.12287

Kosior E, Mitchell J (2020) Current industry position on plastic production and recycling. Plastic Waste Recycling:133–162. https://doi.org/10.1016/B978-0-12-817880-5.00006-2

Kowal J, Ramasubramanian B, Rao RP et al (2022) Towards sustainable fuel cells and batteries with an AI perspective. Sustainability 14(14):16001. https://doi.org/10.3390/SU142316001

Kumar KK, Brindha R, Nandhini M et al (2019) Water-suspended graphene as electrolyte additive in zinc-air alkaline battery system. Ionics (Kiel) 25:1699–1706. https://doi.org/10.1007/S11581-019-02924-7/METRICS

Kunz N, Mayers K, van Wassenhove LN (2018) Stakeholder views on extended producer responsibility and the circular economy. Calif Manage Rev 60:45–70. https://doi.org/10.1177/0008125617752694

Laubinger F et al (2021) Modulated fees for Extended Producer Responsibility schemes (EPR). OECD Environment Working Papers, No. 184. OECD Publishing, Paris. https://doi.org/10.1787/2a42f54b-en

Leclerc SH, Badami MG (2020) Extended producer responsibility for E-waste management: policy drivers and challenges. J Clean Prod 251:119657. https://doi.org/10.1016/J.JCLEPRO.2019.119657

Liew JX, Loy ACM, Chin BLF et al (2021) Synergistic effects of catalytic co-pyrolysis of corn cob and HDPE waste mixtures using weight average global process model. Renew Energ 170:948–963. https://doi.org/10.1016/J.RENENE.2021.02.053

Lorang S, Yang Z, Zhang H et al (2022) Achievements and policy trends of extended producer responsibility for plastic packaging waste in Europe. Waste Dispos Sustain Energ 4(2):91–103. https://doi.org/10.1007/S42768-022-00098-Z

McNicholas G, Cotton M (2019) Stakeholder perceptions of marine plastic waste management in the United Kingdom. Ecol Econ 163:77–87. https://doi.org/10.1016/J.ECOLECON.2019.04.022

Miandad R, Barakat MA, Aburiazaiza AS et al (2016) Catalytic pyrolysis of plastic waste: a review. Process Saf Environ Prot 102:822–838. https://doi.org/10.1016/J.PSEP.2016.06.022

Mohanraj R, Brindha R, Kandeeban R et al (2021) Electrochemical detection of 5-hydroxytryptamine using sustainable SnO2-Graphite nanocomposite modified electrode. Mater Lett 305:130796. https://doi.org/10.1016/J.MATLET.2021.130796

Mojaver M, Hasanzadeh R, Azdast T, Park CB (2022) Comparative study on air gasification of plastic waste and conventional biomass based on coupling of AHP/TOPSIS multi-criteria decision analysis. Chemosphere 286:131867. https://doi.org/10.1016/J.CHEMOSPHERE.2021.131867

Mwanza BG, Mbohwa C, Telukdarie A (2018) Strategies for the recovery and recycling of plastic solid waste (PSW): a focus on plastic manufacturing companies. Procedia Manuf 21:686–693. https://doi.org/10.1016/J.PROMFG.2018.02.172

Nakajima N, Vanderburg WH (2016) A description and analysis of the German packaging take-back system. Bull Sci Technol Soc 26:510–517. https://doi.org/10.1177/0270467606295193

Oke A, Osobajo O, Obi L, Omotayo T (2020) Rethinking and optimising post-consumer packaging waste: a sentiment analysis of consumers’ perceptions towards the introduction of a deposit refund scheme in Scotland. Waste Manage 118:463–470. https://doi.org/10.1016/J.WASMAN.2020.09.008

Pandey J, Kaushal RK, Shukla SP (2022) Behavioural and structural analysis of stakeholders in E-waste management. Mater Today Proc 51:416–421. https://doi.org/10.1016/J.MATPR.2021.05.566

Pani SK, Pathak AA (2021) Managing plastic packaging waste in emerging economies: the case of EPR in India. J Environ Manage 288:112405. https://doi.org/10.1016/J.JENVMAN.2021.112405

Peng B, Tu Y, Elahi E, Wei G (2018) Extended producer responsibility and corporate performance: effects of environmental regulation and environmental strategy. J Environ Manage 218:181–189. https://doi.org/10.1016/J.JENVMAN.2018.04.068

Peng B, Wang Y, Elahi E, Wei G (2019) Behavioral game and simulation analysis of extended producer responsibility system’s implementation under environmental regulations. Environ Sci Pollut Res 26:17644–17654. https://doi.org/10.1007/S11356-019-05215-W

Qureshi MS, Oasmaa A, Pihkola H et al (2020) Pyrolysis of plastic waste: opportunities and challenges. J Anal Appl Pyrolysis 152:104804. https://doi.org/10.1016/J.JAAP.2020.104804

Ragupathy M, Ramasubramanian B, Rajagopalan K, Ganesan A (2022) Electrocatalytic response of the modified ZnO-G electrodes towards the oxidation of serotonin with multi metallic corrosion protection. J Indian Chem Soc 99:100768. https://doi.org/10.1016/J.JICS.2022.100768

Rajagopalan K, Ramasubramanian B, Manojkumar K et al (2022) Organo-metallic electrolyte additive for regulating hydrogen evolution and self-discharge in Mg–air aqueous battery. New J Chem 46:19950–19962. https://doi.org/10.1039/D2NJ04488A

Ramasubramanian B, Reddy MV, Zaghib K, Armand M, Ramakrishna S (2021) Growth mechanism of micro/nano metal dendrites and cumulative strategies for countering its impacts in metal ion batteries: a review. Nanomaterials 11(10):2476. https://doi.org/10.3390/NANO11102476

Ramasubramanian B, Chinglenthoiba C, Huiqing X et al (2022a) Sustainable Fe-MOF@carbon nanocomposite electrode for supercapacitor. Surf Interfaces 34:102397. https://doi.org/10.1016/J.SURFIN.2022.102397

Ramasubramanian B, Sundarrajan S, Chellappan V et al (2022b) Recent development in carbon-LiFePO4 cathodes for lithium-ion batteries: a mini review. Batteries 8(10):133. https://doi.org/10.3390/BATTERIES8100133

Ramasubramanian B, Subramanian S, Prasada Rayavarapu PR et al (2022c) Novel low-carbon energy solutions for powering emerging wearables, smart textiles, and medical devices. Energy Environ Sci. https://doi.org/10.1039/D2EE02695C

Redlingshöfer B, Barles S, Weisz H (2020) Are waste hierarchies effective in reducing environmental impacts from food waste? A systematic review for OECD countries. Resour Conserv Recycl 156:104723. https://doi.org/10.1016/J.RESCONREC.2020.104723

Richter JL, Koppejan R (2016) Extended producer responsibility for lamps in Nordic countries: best practices and challenges in closing material loops. J Clean Prod 123:167–179. https://doi.org/10.1016/J.JCLEPRO.2015.06.131

Rubio S, Ramos TRP, Leitão MMR, Barbosa-Povoa AP (2019) Effectiveness of extended producer responsibility policies implementation: the case of Portuguese and Spanish packaging waste systems. J Clean Prod 210:217–230. https://doi.org/10.1016/J.JCLEPRO.2018.10.299

Shan H, Yang J (2020) Promoting the implementation of extended producer responsibility systems in China: a behavioral game perspective. J Clean Prod 250:119446. https://doi.org/10.1016/J.JCLEPRO.2019.119446

Sheldon RA, Norton M (2020) Green chemistry and the plastic pollution challenge: towards a circular economy. Green Chem 22:6310–6322. https://doi.org/10.1039/D0GC02630A

Snowdon C (2019) A load of rubbish? Introducing a deposit return scheme to the UK. SSRN Electronic Journal. https://doi.org/10.2139/SSRN.3852674

Subbaiyan R, Ganesan A, Ramasubramanian B (2022) Self-potent anti-microbial and anti-fouling action of silver nanoparticles derived from lichen-associated bacteria. Appl Nanosci 12(8):2397–2408. https://doi.org/10.1007/S13204-022-02501-X

Tian F, Sošić G, Debo L (2020) Stable recycling networks under the extended producer responsibility. Eur J Oper Res 287:989–1002. https://doi.org/10.1016/J.EJOR.2020.05.002

Watermeyer R, Shankar K, Crick T et al (2021) Pandemia: a reckoning of UK universities’ corporate response to COVID-19 and its academic fallout. Br J Sociol 42:651–666. https://doi.org/10.1080/01425692.2021.1937058

Winternitz K, Heggie M, Baird J (2019) Extended producer responsibility for waste tyres in the EU: lessons learnt from three case studies – Belgium, Italy and the Netherlands. Waste Manag 89:386–396. https://doi.org/10.1016/J.WASMAN.2019.04.023

Zhao X, You F (2021a) Consequential life cycle assessment and optimization of high-density polyethylene plastic waste chemical recycling. ACS Sustain Chem Eng 9:12167–12184. https://doi.org/10.1021/ACSSUSCHEMENG.1C03587/SUPPL_FILE/SC1C03587_SI_001.PDF

Zhao X, You F (2021b) Waste high-density polyethylene recycling process systems for mitigating plastic pollution through a sustainable design and synthesis paradigm. AIChE J 67:e17127. https://doi.org/10.1002/AIC.17127

Zhao Y, Peng B, Elahi E, Wan A (2021) Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J Clean Prod 319:128631. https://doi.org/10.1016/J.JCLEPRO.2021.128631

Zhen Y, Reddy VS, Ramasubramanian B, Ramakrishna S (2022) Three-dimensional AgNps@Mxene@PEDOT:PSS composite hybrid foam as a piezoresistive pressure sensor with ultra-broad working range. J Mater Sci 57:21960–21979. https://doi.org/10.1007/S10853-022-08012-Y/FIGURES/6

Acknowledgements

Authors acknowledge Lloyd’s Register Foundation, UK (Grant No: R265000553597) and NUS Hybrid-Integrated Flexible (Stretchable) Electronic Systems (HiFES) Program Seed Fund (Grant No. R265000628133).

Availability of Data and Materials

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Funding

The obtaining of data sets was supported and funded by both Lloyd’s Register Foundation, UK (Grant No: R265000553597) and NUS Hybrid-Integrated Flexible (Stretchable) Electronic Systems (HiFES) Program Seed Fund (Grant No. R265000628133).

Author information

Authors and Affiliations

Contributions

BR conceptualized, collect data, and wrote the first draft; JT reviewed and edited the manuscript; VC provided technical suggestions; SR conceptualized and did data curation, supervision

Corresponding authors

Ethics declarations

Conflict of Interest

Prof Seeram Ramakrishna is the Editor-in-chief of Materials Circular Economy. There is no conflict of interest between authors to disclose.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ramasubramanian, B., Tan, J., Chellappan, V. et al. Recent Advances in Extended Producer Responsibility Initiatives for Plastic Waste Management in Germany and UK. Mater Circ Econ 5, 6 (2023). https://doi.org/10.1007/s42824-023-00076-8

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42824-023-00076-8