Abstract.

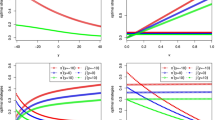

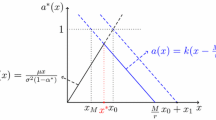

This paper represents a model for the financial valuation of a firm which has control on the dividend payment stream and its risk, as well as potential profit by choosing different business activities among those available to it. Furthermore the company invests its free reserve in an asset, which may or may not contain an element of risk. The company chooses a dividend payment policy and we associate the value of the company with the expected present value of the net dividend distributions (under the optimal policy). One of the examples could be a large corporation such as an insurance company, whose liquid assets in the absence of control and investments fluctuate as a Brownian motion with a constant positive drift and a constant diffusion coefficient. We interpret the diffusion coefficient as risk exposure, while drift is understood as potential profit. At each moment of time, there is an option to reduce risk exposure, simultaneously reducing the potential profit, like using proportional reinsurance with another carrier for an insurance company. The company invests its reserve in a financial asset, whose price evolve as a geometric Brownian motion, with mean rate \(r>0\) and diffusion constant \(\sigma_P\geq 0\). Thus \(\sigma_P=0\) corresponds to investments in a riskless bank account. The objective is to find a policy, consisting of risk control and dividend payment scheme, which maximizes the expected total discounted dividends paid out until the time of bankruptcy. We apply the theory of controlled diffusions to solve the problem. We show that if the discount rate c is less than r, the optimal return function is infinite. If \(r=c\) the return function is finite for all \(x < \infty\), but no optimal policy exists. If \(r < c\), then there is a finite level \(u_1>0\), such that the optimal action is to distribute all reserve exceeding \(u_1\) as dividends. Furthermore there exists a constant \(x_0\), with \(x_0 < u_1\) such that the risk exposure increases monotonically on \((0,x_0)\) from 0 to the maximum possible value.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Manuscript received: October 1999; final version received: January 2001

Rights and permissions

About this article

Cite this article

Højgaard, B., Taksar, M. Optimal risk control for a large corporation in the presence of returns on investments. Finance Stochast 5, 527–547 (2001). https://doi.org/10.1007/PL00000042

Issue Date:

DOI: https://doi.org/10.1007/PL00000042