Abstract

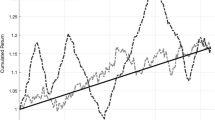

We examine a decision-theoretic Bayesian framework for the estimation of Sharpe Style portfolio weights of the MSCI sector returns. Following [van Dijk and Kloek (1980)] an appropriately defined prior density of style weights can incorporate non-negativity and other constraints. We use factor-mimicking portfolios as proxies to global style factors such as Value, Growth, Debt and Size. Our computational approach is based on Monte Carlo Integration (MCI) of [Kloek and van Dijk (1978)] for the estimation of the posterior moments and distribution of portfolio weights. MCI provides a number of advantages, such as a flexible choice of prior distributions, improved numerical accuracy of the estimated parameters, the use of inequality restrictions in prior distributions and exact inference procedures. Our empirical findings suggest that, contrary to existing evidence, style factors do explain the MSCI sector portfolio returns for the particular sample period. Further, non-negativity constraints on portfolio weights were found to be binding in all cases.

Similar content being viewed by others

References

Andrews, D.W.K. (1999). Estimation when the Parameter in on the Boundary. Econometrica vol. 67, 1341–1383.

Christodoulakis, G.A. and Satchell, S.E. (2002). On the Evolution of Global Style Factors in the MSCI Universe of Assets. International Transactions in Operational Research, Forthcoming.

Connor, G. and Linton, O. (2000). Semiparametric Estimation of a Characteristic- based Factor Model of Stock Returns. Working Paper, Department of Accounting and Finance, LSE, University of London, UK.

Davis, W.W. (1978). Bayesian Analysis of the Linear Model subject to Linear Inequality Constraints. Journal of the American Statistical Association vol. 78, 573–579.

Geweke, J, (1986). Exact Inference in the Inequality Constrained Normal Linear Regression Model. Journal of Applied Econometrics vol. 1, 127–141.

Geweke, J, (1989). Exact Predictive Densities in Linear Models with ARCH Distarbances. Journal of Econometrics vol. 40, 63–86.

Hall, A.D., Hwang, S. and Satchell, S.E. (2002). Using Bayesian Variable Selection Methods to choose Style Factors in Global Stock Return Models. Journal of Banking and Finance, Forthcoming.

Huberman, G., Shmuel, A. and Stambaugh, R.F. (1987). Mimicking Portfolios and Exact Arbitrage Pricing. Journal of Finance vol. 42, 1–10.

Judge, G.G. and Takayama, T. (1966). Inequality Restrictions in Regression Analysis. Journal of the American Statistical Association vol. 61, 166–181.

Judge, G.G. and Yancey, T.A. (1986). Improved Methods of Inference in Econometrics. Amsterdam, North Holland.

Judge, G.G., Griffiths, W.E., Hill, R.C., Lutkepohl, H. and Lee, T.C. (1985). The Theory and the Practice of Econometrics. Wiley, New York.

Kim, T-H., Stone, D. and White, H. (2000). Asymptotic and Bayesian Confidence Intervals for Sharpe Style Weights. University of California, San Diego, Department of Economics Working Paper 2000–27.

Kloek, T. and Van Dijk, H.K. (1978). Bayesian Estimates of Equation System Parameters: an Application of Integration by Monte Carlo. Econometrica vol. 46(1), 1–19.

Koop, G. (1994). Bayesian Semi-nonparametric ARCH Models. Review of Economics and Statistics vol. 76(1), 176–181.

Lehman, B.N. and Modest, D.M. (1988). The Empirical Foundations of the Arbitrage Pricing Theory. Journal of Financial Economics vol. 21(2), 213–54.

Lobosco, A. and DiBartolomeo, D. (1997). Approximating the Confidence Intervals for Sharpe Style Weights. Financial Analysts Journal. July–August, 80–85.

Sharpe, W.F. (1988). Determining the Fund’s Effective Asset Mix. Investment Management Review. November-December, 59–69.

Sharpe, W.F. (1992). Asset Allocation: Management Style and Performance Measurement. Journal of Portfolio Management vol. 18, 7–19.

Van Dijk, H.K. and Kloek, T. (1980). Further Experience in Bayesian Analysis Using Monte Carlo Integration. Journal of Econometrics vol. 14, 307–328.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the author and should in no part be attributed to the Bank of Greece.

Rights and permissions

About this article

Cite this article

Christodoulakis, G.A. Sharpe style analysis in the msci sector portfolios: a monte carlo integration approach. Oper Res Int J 2, 123–137 (2002). https://doi.org/10.1007/BF02936324

Issue Date:

DOI: https://doi.org/10.1007/BF02936324