Abstract

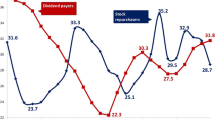

The effect of shareholder taxation on corporate dividend policy is a major controversy in financial economics. The Tax Reform Act of 1986 eliminated the statutory tax disadvantage of dividends versus long-term capital gains for individual shareholders. Using aggregate time series data I find evidence that corporate dividend payout has become more generous in the period after tax reform.

Similar content being viewed by others

References

Abrutyn, Stephanie, and Robert W. Turner, “Taxes and Firms' Dividend Policies: Survey Results,”National Tax Journal XLIII, December, 491–496 (1990).

Ang, James S., “Do Dividends Matter? A Review of Corporate Dividend Theories and Evidence,” Monograph Series in Finance and Economics, Graduate School of Business, New York University, (Solomon Brothers Center for the Study of Finanicial Institutions, New York) (1987).

Auerbach, Alan J., “Issues in the Measurement and Encouragement of Business Saving,” inSaving and Government Policy, Federal Reserve Bank of Boston, 79–101, (1982).

Bagwell, Laurie Simon, and John B. Shoven, “Cash Distributions to Shareholders,Journal of Economic Perspectives 3, Summer, 129–140 (1989).

Baker H. Kent, Gail Farrelly, and Richard Edelman, “A Survey of Management Views on Dividend Policy,”Financial Management 14, Autumn, 79–84 (1985).

Barclay, Michael J., “Dividends, Taxes, and Common Stock Prices,”Journal of Financial Economics 19, 31–44 (1987).

Ben-Horim, Moshe, Shalom Hochman, and Oded Palmon, “The Impact of the 1986 Tax Reform Act on Corporate Financial Policy,”Financial Management 16, 29–35 (1987).

Black, Fischer, “The Dividend Puzzle,”Journal of Portfolio Management 2, 5–8 (1976).

Bolster, Paul J., and Vahan Janjigian, “Dividend Policy and Valuation Effects of the Tax Reform Act of 1986,”National Tax Journal XLIV, 511–518 (1991).

Brittain, John A.,Corporate Dividend Policy, Washington, D.C., The Brookings Institution, 1966.

Crockett, Jean, and Irwin Friend, “Dividend Policy in Perspective: Can Theory Explain Behavior?”Review of Economics and Statistics 70, 603–613 (1988).

Economic Report of the President 1991, U.S. Government Printing Office.

Elton, Edwin J., and Martin J. Gruber, “Marginal Stockholders' Tax Rates and the Clientele Effect,”Review of Economics and Statistics 52, 68–74 (1970).

Fama, Eugene and Harvey Babiak, “Dividend Policy: An Empirical Analysis,”Journal of the American Statitical Association 63, 1132–1161 (1968).

Feldstein, Martin S., “Corporate Taxation and Dividend Behavior,”Review of Economic Studies 37, 57–72 (1970).

Feldstein, Martin S., “Corporate Taxation and Dividend Behavior: A Reply and Extension,”Review of Economic Studies 39, 235–240 (1972).

Gordon, Roger, and Jeffrey MacKie-Mason, “Effects of the Tax Reform Act of 1986 on Corporate Financial Policy and Organizational Form,” inDo Taxes Matter? The Impact of the Tax Reform Act of 1986, Joel Slemrod ed., Cambridge, MA, The MIT Press, 91–131, 1990.

Hamada, Robert S., and Myron S. Scholes, “Taxes and Corporate Financial Management,” inRecent Advances in Corporate Finance, Edward I. Altman, and Martin G. Subrahmanyam eds., Homewood, IL, Richard D. Irwin, 227–284, 1985.

King, Mervyn A., “Corporate Taxation and Dividend Behavior—A Comment,”Review of Economic Studies 38, 370–380 (1971).

King, Mervyn A., “Corporate Taxation and Dividend Behavior: A Further Comment,”Review of Economic Studies 39, 231–234 (1972).

Lee, Cheng F.,Financial Analysis and Planning, Reading, MA, Addison-Wesley, 1985.

Lee, Cheng F., and James B. Kau, “Dividend Payout Behavior and Dividend Policy of REITs,”Quarterly Review of Economics and Business 27, 6–21 (1987).

Lintner, John, “Distribution of Incomes of Corporations Among Dividends, Retained Earnings, and Taxes,”American Economic Review 46, 97–113 (1956).

Litzenberger, Robert H., and Krishna Ramaswamy, “The Effect of Personal Taxes and Dividends on Capital Asset Pricing,”Journal of Financial Economics 7, 163–195 (1979).

Maddala, G.S.,Introduction to Econometrics, 2nd ed., New York, Macmillan, 1992.

Miller, Merton H., “Behavioral Rationality in Finance: The Case of Dividends,”Journal of Business 59, S451-S469 (1986).

Miller, Merton, and Myron Scholes, “Dividends and Taxes: Some Empirical Evidence,”Journal of Political Economy 90, 1118–1142 (1982).

Nadeau, Serge, and Robert P. Strauss, “Tax Policies and the Real and Financial Decisions of the Firm: The Effects of the Tax Reform Act of 1986,”Public Finance Quarterly 19, 251–292 (1991).

Poterba, James M., “Tax Policy and Corporate Saving,”Brookings Papers on Economic Activity, 2, 455–515 (1987).

Poterba, James, and Lawrence Summers, “The Economic Effects of Dividend Taxation,” inRecent Advances in Corporate Finance, Edward I. Altman, and Martin Subrahmanyam eds., Homewood, IL, Richard D. Irwin, 227–284, 1985.

Scholes, Myron S. and Mark A. Wolfson, “Cost of Capital and Changes in Tax Regimes,” inUneasy Compromise: Problems of a Hybrid Income-Consumption Tax, Henry J. Aaron, Harvey Galper, and Joseph A. Pechman, eds. Washington, D.C., The Brookings Institution, 157–189, 1988.

Shoven, John B., “The Tax Consequences of Share Repurchases and Other Non-Dividend Cash Payments to Equity Owners,” inTax Policy and The Economy, vol. 1, Lawrence Summers, ed., Cambridge, MA, The MIT Press, pp. 29–54, 1987.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Lamdin, D.J. Shareholder taxation and aggregate dividend payout: Evidence from the tax reform act of 1986. Rev Quant Finan Acc 3, 459–468 (1993). https://doi.org/10.1007/BF02409623

Issue Date:

DOI: https://doi.org/10.1007/BF02409623