Abstract

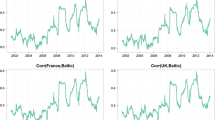

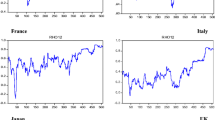

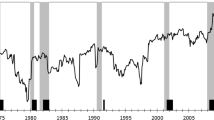

This paper examines the diversification benefits available to U.S. and Japanese investors over the period 1974-94 in seven of the smaller European stock markets (SESMs): Austria, Belgium, Greece, Holland, Ireland, Italy, and Spain. With reference to a simplified International CAPM that accommodates both contemporaneous and delayed information flows, we employ correlation, principal components, and cointegration analysis in studying monthly observations from national basket indices. The empirical evidence is conclusive in showing that the SESMs have behaved differently, at least since the October 1987 crash, with stronger contemporaneous interdependencies and integration between them and with the U.S. market. Cointegration analysis found no significant common trend shared between the SESMs and the U.S. and Japanese markets. We conclude that despite the increasing international integration there still exist opportunities for diversification investment in the smaller and less studied European stock markets.

Similar content being viewed by others

References

Arshanapalli, B.; Doukas J. "International Stock Market Linkages: Evidence from the Pre- and Post- October 1987 Period,"Journal of Banking and Finance, 17, 1993, pp. 193–208.

Blackman, S. K.; Holden, W. T. "Long-Term Relationships Between International Share Prices,"Applied Financial Economics, 4, 1994, pp. 297–304.

Byers, J.; Peel, D. "Some Evidence of the Interdependence of National Stock Markets and the Gains from International Portfolio Diversification,"Applied Financial Economics, 3, 1993, pp. 239–43.

Chelley-Steeley, P. L.; Pentecost, E. J.; Steeley, J. M. "Exchange Controls and the Behaviour of European Stock Market Indexes," Working Paper, Department of Economics, Loughborough University, Loughborough, United Kingdom, 95/1, 1995.

Dechert, W. D.; Gencay, R. "Lyapunov Exponents as a Nonparametric Diagnostic for Stability Analysis,"Journal of Applied Econometrics, 7, 1992, pp. 41–60.

Grubel, H. "Internationally Diversified Portfolios: Welfare Gains and Capital Flows,"American Economic Review, 58, 1968, pp. 1299–314.

Jolliffe, I. T.Principal Components Analysis, New York, NY: Springer-Verlag, 1986.

Levy, H.; Sarnat, M. "International Diversification of Investment Portfolios,"American Economic Review, 60, 1970, pp. 668–75.

Marmol, F. "Nonsense Regressions Between Integrated Processes of Different Orders,"Oxford Bulletin of Economics and Statistics, 58, 1996, pp. 525–35.

Mills, T. C. "The Econometrics of the ‘Market Model’: Cointegration, Error Correction and Exogeneity,"International Journal of Finance and Economics, 1996.

__.The economic Modeling of Financial Time Series, Cambridge, United Kingdom: Cambridge University Press, 1993.

Nellis, J. G. "A Principal Components Analysis of International Financial Integration Under Fixed and Floating Exchange Rate Regimes,"Applied Economics, 14, 1982, pp. 339–54.

Richards, A. J. "Comovements in National Stock Market Returns: Evidence of Predictability, but not Cointegration,"Journal of Monetary Economics, 36, 1995, pp. 631–54.

Solnik, B. H. "The International Pricing of Risk: An Empirical Investigation of the World Capital Market Structure,"Journal of Finance, 29, 1974, pp. 365–78.

Author information

Authors and Affiliations

Additional information

The present study is an extensively revised version of a paper presented at the 42nd Atlantic Economic Society Conference in Washington, DC, October 1996. We are indebted to the attendants and discussants of our session, especially Nicholas Apergis, Erotokritos Varelas, and George Zestos for their constructive comments and arguments. We also thank Terence Mills and two anonymous referees for their comments on this paper. Finally, we wish to thank Jay Smith, Leading Market Technologies, Cambridge, MA for providing us theEXPO/NeuralNet™ andEXPO/Econometrics™ software used in this study. For any remaining errors, the authors are fully responsible. Raphael Markellos is grateful for financial support received from the Department of Economics and the School of Humanities and Social Sciences, Loughborough University, United Kingdom.

Rights and permissions

About this article

Cite this article

Markellos, R.N., Siriopoulos, C. Diversification benefits in the smaller European stock markets. International Advances in Economic Research 3, 142–153 (1997). https://doi.org/10.1007/BF02294935

Issue Date:

DOI: https://doi.org/10.1007/BF02294935