Abstract

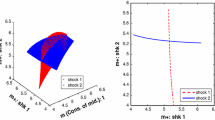

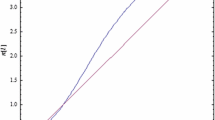

We study fixed price temporary equilibria (with rationing) and sequences of temporary equilibria in a three commodities (goods, labor, bonds) overlapping generations model with endogenous investment. Young consumers, living two periods, work, consume, and buy bonds for financing next period's consumption. New firms, existing for two periods, make a production plan for the next period, taking into account expected rationing, assumed similar to present rationing. The plan determines the amount of goods to buy as capital, financed by bonds. Old firms produce, using labor and the previously bought capital. Different regimes exist and expectations can be self-fulfilling and self-destroying.

Similar content being viewed by others

References

d'Autume, A., and Michel, P. (1986): “Déséquilibre général et investissement.”Annales d'Économie et de Statistique 4: 23–51.

Barro, R. J., and Grossman, H. I. (1976):Money, Employment and Inflation. Cambridge: Cambridge University Press.

Böhm, V. (1989):Disequilibrium and Macroeconomics. Oxford: Basil Blackwell.

Böhm, V., and Puhakka, M. (1988): “Rationing and Optimality in Overlapping Generations Models.”Scandinavian Journal of Economics 90: 225–232.

Day, R. H., and Pianigiani, G. (1991): “Statistical Dynamics and Economics.”Journal of Economic Behaviour and Organization 16: 37–83.

Diamond, P. (1965): “National Debt in a Neoclassical Growth Model.”American Economic Review 55: 1126–1150.

Gale, D. (1983):Money: In Disequilibrium. Cambridge: Cambridge University Press.

Ginsburgh, V., Hénin, P. Y., and Michel, P. (1985): “A Dual Decision Approach to Disequilibrium Growth.”Oxford Economic Papers 37: 353–361.

Hénin, P. Y., and Michel, P. (1982): “Théorie de la croissance avec rigidités salariales et contraintes de demande effective: une reformulation.” InCroissance et Accumulation en Déséquilibre, edited by P. Y. Hénin and P. Michel. Paris: economica.

Honkapohja, S. (1979): “On the Dynamics of Disequilibrium in a Macro Model with Flexible Wages and Prices.” InNew Trends in Dynamic System Theory and Economics, edited by M. Aoki and A. Marzollo. San Diego, CA: Academic Press.

Ito, T. (1978): “A Note on Disequilibrium Growth Theory.”Economics Letters 1: 45–49.

— (1980): “Disequilibrium Growth Theory.”Journal of Economic Theory 23: 380–409.

Malinvaud, E. (1977):The Theory of Unemployment Reconsidered. Oxford: Basil Blackwell.

— (1980):Profitability and Unemployment. Cambridge: Cambridge University Press.

Michel, P. (1985): “Application of Optimal Control Theory to Disequilibrium Analysis.” InOptimal Control Theory and Economic Analysis, Vol. 2, edited by G. Feichtinger. Amsterdam: North-Holland.

Muellbauer, J., and Portes, R. (1978): “Macroeconomic Models with Quantity Rationing.”Economic Journal 88: 788–821.

Neary, J. P., and Stiglitz, J. E. (1983): “Toward a Reconstruction of Keynesian Economics: Expectations and Constrained Equilibria.”Quarterly Journal of Economics 98: 199–228.

Picard, P. (1983): “Inflation and Growth in a Disequilibrium Macroeconomic Model.”Journal of Economic Theory 30: 266–295.

Saari, D. G. (1985): “Iterative Price Mechanisms.”Econometrica 53: 1117–1131.

Weddepohl, C. (1987): “An Overlapping Generations Model with a Stock Market.” A. E. Report 5/87, University of Amsterdam.

Author information

Authors and Affiliations

Additional information

We are grateful to the referees for helpful comments.

Rights and permissions

About this article

Cite this article

Weddepohl, C., Yildirim, M. Fixed price equilibria in an overlapping generations model with investment. Zeitschr. f. Nationalökonomie 57, 37–68 (1993). https://doi.org/10.1007/BF01237436

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01237436