Abstract

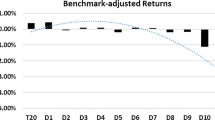

Recent studies of mutual funds have concluded that there is some evidence of superior performance. We test for the existence of superior performance and its persistence with mutual funds and mutual fund investment advisers on a data set of monthly returns from 1979 to 1989 for 1,387 mutual funds grouped by 243 advisers. We find no evidence of superior performance or its persistence but we do find significant evidence of persistence of inferior performance. Consistent with previous studies our findings depend on the benchmark chosen, with multiple benchmarks producing a larger degree of inferior performance.

Similar content being viewed by others

References

Brown, Stephen, William Goetzmann, Roger Ibbotson, and Stephen Ross, “Survivorship Bias in Performance Studies.”Review of Financial Studies 5, 553–580 (1992).

Elton, Edwin, Martin Gruber, Sanjiv Das, and Matthew Hlavka, “Efficiency with Costly Information: A Reinter-pretation of Evidence from Managed Portfolios.”Review of Financial Studies 6, 1–22 (1993).

Grinblatt, Mark and Sheridan Titman, “Performance Measurement without Benchmarks: An Examination of Mutual Fund Returns,”Journal of Business, January (1993).

Grinblatt, Mark and Sheridan Titman, “The Evaluation of Mutual Fund Performance: An Analysis of Quarterly Portfolio Holdings.”Journal of Business 62, 393–416 (1989a).

Grinblatt, Mark and Sheridan Titman, “Portfolio Performance Evaluation: Old Issues and New Insights.”Review of Financial Studies 2, 393–421 (1989b).

Hendricks, Darryll, Jayendu Patel, and Richard Zeckhauser, “Hot Hands in Mutual Funds: The Persistence of Performance.” 1974–1987,Journal of Finance 48, 93–130 (1993).

Ibbotson Associates,Stocks, Bonds, Bills, and Inflation, 1990 Yearbook, 1990.

Ippolito, Richard, “Efficiency with Costly Information: A Study of Mutual Fund Performance, 1965–1984.”Quarterly Journal of Economics 104, 1–23 (1989).

Ippolito, Richard, “Consumer Reaction to Measures of Poor Quality: Evidence from the Mutual Fund Industry,”Quarterly Journal of Economics (1992).

Jensen, Michael, “Risk, the Pricing of Capital Assets, and the Evaluation of Investment Portfolios,”Journal of Business 42, 167–247 (1969).

Lehmann, Bruce and David Modest, “Measuring Mutual Fund Performance: A Comparison of Benchmarks and Benchmark Comparisons.”Journal of Finance 42, 233–265 (1987).

Patel, Jayendu, Richard Zeckhauser, and Darryll Hendricks, “Investment Flows and Performance: Evidence from Mutual Funds, Cross-Border Investments, and New Issues.” Center of Japan-US Business and Economic Studies, (1990).

Shukla, Ravi and Charles Trzcinka, “Sequential Tests of the Arbitrage Pricing Theory: A Comparison of Principal Components and Maximum Likelihood Factors.”Journal of Finance 45, 1541–1564 (1990).

Shukla, Ravi and Charles Trzcinka, “Performance Evaluation of Managed Portfolios.”Financial Markets, Institutions & Instruments, Cambridge, MA: Blackwell Publishers, 1992.

Treynor, Jack and Kay Mazuy, “Can Mutual Funds Outguess the Market.”Harvard Business Review 44, 131–136 (1966).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Shukla, R., Trzcinka, C. Persistent performance in the mutual fund market: Tests with funds and investment advisers. Rev Quant Finan Acc 4, 115–135 (1994). https://doi.org/10.1007/BF01074960

Issue Date:

DOI: https://doi.org/10.1007/BF01074960