Abstract

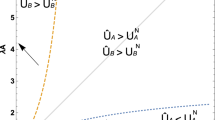

This paper establishes a parallelism between indirect tax harmonization when taxes are levied according to the destination principle and its counterpart when taxes are imposed on an origin basis. Using a simple two-country model of international trade it is argued that, under “normal” circumstances, indirect tax harmonization under the origin principle, considered as a movement of domestic taxes toward an appropriately designed average tax structure, is potentially Pareto improving. It is also shown that if the initial position is a Nash equilibrium, there are “exceptional” situations under which the above-mentioned reform may generate an actual Pareto improvement, so that both countries improve their welfare without any need for a compensating international transfer.

Similar content being viewed by others

References

CnossenS., and C.S.Shoup. (1987). “Coordination of Value-Added Taxes.” In S.Cnossen (ed.), Tax Coordination in the European Community (pp. 59–84). Deventer: Kluwer Law and Taxation.

deCrombruggheA., and H.Tulkens. (1990). “On Pareto Improving Commodity Tax Changes under Fiscal Competition.” Journal of Public Economics 41, 335–350.

DelipallaS. (1994). “Commodity Tax Harmonisation with Public Goods.” Department of Economics Discussion Paper 94-17, University of Wales, Swansea.

DixitA.K., and V.Norman. (1980) Theory of International Trade. Cambridge: Cambridge University Press.

KanburR., and M.Keen. (1993). “Jeux Sans Frontières: Tax Competition and Tax Coordination When Countries Differ in Size.” American Economic Review 83, 877–892.

KeenM. (1987). “Welfare Effects of Commodity Tax Harmonisation.” Journal of Public Economics 33, 107–114.

KeenM. (1989a). “Pareto-Improving Indirect Tax Harmonisation.” European Economic Review 33, 1–12.

KeenM. (1989b). “Multilateral Tax and Tariff Reform.” Economic Studies Quarterly 40, 195–202.

KeenM. (1990). “Aspects of Tax Coordination in the European Community.” In D.Purvis (ed.), Europe 1992 and the Implications for Canada (pp. 28–43). John Deutsch Institute Policy Forum Series No. 21, Queens University, Kingston.

KeenM. (1993). “The Welfare Economics of Tax Co-ordination in the European Community: A Survey.” Fiscal Studies 14, 15–36.

KeenM., and S.Lahiri. (1993). “Domestic Tax Reform and International Oligopoly.” Journal of Public Economics 51, 55–74.

Lahiri, S., and P. Raimondos. (1995). “Public Good Provision and the Welfare Effects of Indirect Tax Harmonization.” Paper presented at the 51st Congress of the IIPF, Lisbon.

LockwoodB. (1993). “Commodity Tax Competition Under Destination and Origin Principles.” Journal of Public Economics 52, 141–162.

Lockwood, B. (1995). “Commodity Tax Harmonisation with Public Goods: An Alternative Perspective.” EPRU Discussion Paper 1995-10, Copenhagen Business School.

MintzJ., and H.Tulkens. (1986). “Commodity Tax Competition Between Member States of a Federation: Equilibrium and Efficiency.” Journal of Public Economics 29, 133–172.

SinnH.W. (1990). “Tax Harmonization and Tax Competition in Europe.” European Economic Review 34, 489–504.

Turunen-RedA.H., and A.D.Woodland. (1990). “Multilateral Reform of Domestic Taxes.” Oxford Economic Papers 42, 160–186.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Lopez-Garcia, MA. The origin principle and the welfare gains from indirect tax harmonization. International Tax and Public Finance 3, 83–93 (1996). https://doi.org/10.1007/BF00400149

Issue Date:

DOI: https://doi.org/10.1007/BF00400149