Summary

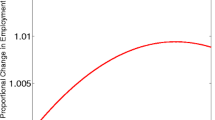

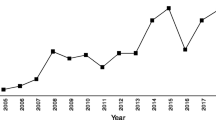

The self-employment rate depends on the distribution of full-time workers across ages, educational levels, and industries and on tax rates and business conditions. About 90 percent of the variation in self-employment across time and across age groups is explained by these factors. Swings in the self-employment rate over time result from the interplay of changes in these factors. The entry of the baby-boom generation into the labor-force beginning in the later 1960s has led to a decrease in the average age of the full-time nonagricultural workforce and has tended to decrease the self-employment rate. The secular decline of manufacturing, the secular rise of services, and secular increases in educational levels have tended to increase the self-employment rate. Fluctuations in business conditions and tax rates have also affected the self-employment rate. The evidence reported here suggests that self-employment is procyclical, although not strongly so. Increases in effective federal income during the late 1970s tended to increase self-employment rates while decreases during the Reagan years tended to decrease self-employment rates.

These findings are helpful for speculating about the answers to three important questions. First, are people more entrepreneurial than they used to be? The fact that the ebb and flow of self-employment over time can be explained almost entirely by structural changes in the economy suggests that people with given demographic characteristics and morking in particular industries have not become more likely to try entrepreneurship28.

Second, did the supply of entrepreneurs increase during the Reagan years? The answer is yes and no29. The number of people who operate full-time businesses has certainly increased: from 5.99 million in 1981 to 6.46 million in 1985. The absolute supply of entrepreneurs has risen. But the number of people who are full-time wage workers has also increased: from 65.2 million in 1981 to 71.6 million in 1985. The fraction of workers who operate businesses has fallen: it increased from 9.3 percent in 1981 to a peak of 10.0 percent in 1983 and then fell to 9.1 percent in 1985. The relative supply of entrepreneurs has thus fallen. Ironically, one of the many causes for the decline in the relative supply of entrepreneurs was the decrease in tax rates that were, according to supply-side advocates, supposed to have increased entrepreneurship30.

Third, will we see rising or falling self-employment in the coming decade? Predicting future rates of self-employment is treacherous because these rates depend upon many factors. The aging of the baby-boom generation will by itself lead to sharply increasing rates of self-employment as the baby-boomers, who started turning 40 in 1985, pass through the peak years of self-employment. This upward trend may be offset by a number of more fragile structural changes in the economy. The sharp decline of the dollar may reinvigorate manufacturing at the expense of services. If so, self-employment will decline. Further lowering of federal income tax rates may reduce the gains from tax-avoidance through self-employment and thereby impart a further downward trend in self-employment rates. Other changes that have helped increase self-employment may have run their course. Female labor-force participation rates and educational levels among both men and women may have reached a plateau. If so, these factors will cease to be a factor in changing self-employment rates.

This paper has analyzed the determinants of changes in the aggregate rate of self-employment across age cohorts. When examining aggregate rates of self-employment we have ignored more subtle questions concerning why particular individuals choose to try self-employment at particular times in their careers and what makes a successful entrepreneur. These questions await future research.

Similar content being viewed by others

References

Becker, 1984, ‘Self-Employed Workers: An Update to 1983’, Monthly Labor Review 107(7), 14–18.

BlauDavid, 1987, ‘A Time Series Analysis of Self-Employment’, Journal of Political Economy 95(2), 445–467.

EvansDavid S. and Linda S.Leighton, 1987, Self-Employment Selection and Earnings over the Life Cycle, Washington, D.C.: Office of Advocacy, U.S. Small Business Administration.

GillinghamRobert and John S.Greenlees, 1987, ‘The Impact of Direct Taxes on the Cost of Living’, Journal of Political Economy 95(4), 775–798.

JudgeGeorge G., W. E.Griffiths, R. CarterHill, HelmutLutkepohl, and Tsoung-ChaoLee, 1985, The Theory and Practice of Econometrics, New York: Wiley, 2nd ed.

LongJames E., 1982, ‘The Income Tax and Self-Employment’, National Tax Journal 35, 31–42.

HotzV. Joseph and RobertAvery, 1985, Hotz Tran User's Manual, Old Greenwich, Ct.: CERA Economic Consultants, Inc.

TheilHenri, 1971, Econometrics, New York: Wiley.

Author information

Authors and Affiliations

Additional information

We would like to thank Jules Lichtenstein and Edward Starr for helpful comments and suggestions.

Rights and permissions

About this article

Cite this article

Evans, D.S., Leighton, L.S. The determinants of changes in U.S. self-employment, 1968–1987. Small Bus Econ 1, 111–119 (1989). https://doi.org/10.1007/BF00398629

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF00398629