Abstract

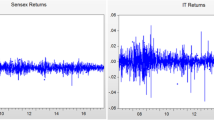

Traditionally, many stock traders have utilized the measure (LMMA-SMA) \{((Long-Medium term moving average (such as 26 weeks moving average)) – (Short term moving average (such as 13 weeks moving average))\} in order to detect up and down tendency of the stock market. In this paper, we shall demonstrate by the several computer simulations that the DSS whose dealings are done by the measure (LMMA – SMA) is further improved by the use of the AI techniques. We shall also suggest that GAs would be useful for improving the proposed DSS.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Refenes, A.P. (ed.): Neural Networks in the Capital Markets. Wiley, Chichester (1995)

Weigend, A.S., et al. (eds.): Decision Technologies for Financial Engineering. World Scientific, Singapore (1997)

Baba, N., Kozaki, M.: An intelligent forecasting system of stock price using neural network. In: Proceedings of IJCNN, vol. 1, pp. 371–377 (1992)

Baba, N., et al.: A hybrid algorithm for finding the global minimum of error function of neural networks and its applications. Neural Networks 7, 1253–1265 (1994)

Baba, N., et al.: Utilization of neural networks and GAs for constructing an intelligent decision support system to deal stocks. In: Proceedings of the SPIE conference, Orland, U.S.A, vol. 2760, pp. 164–174 (1996)

Baba, N., Suto, H.: Utilization of artificial neural networks and TD-learning method for constructing intelligent decision support systems. European Journal of Operational Research 122, 501–508 (2000)

Baba, N., et al.: Utilization of soft computing techniques for constructing reliable decision support systems for dealing stocks. In: Proceedings of IJCNN 2002, Hawaii, U.S.A. (2002)

Baba, N.: Utilization of soft computing techniques for dealing in the TOPIX and the Nikkei-225. In: Proceedings of KES 2002, Milano, Italy, pp. 374–380 (2002)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2003 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Baba, N., Wang, Y., Kawachi, T., Xu, L., Deng, Z. (2003). Utilization of AI & GAs to Improve the Traditional Technical Analysis in the Financial Markets. In: Palade, V., Howlett, R.J., Jain, L. (eds) Knowledge-Based Intelligent Information and Engineering Systems. KES 2003. Lecture Notes in Computer Science(), vol 2773. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-540-45224-9_147

Download citation

DOI: https://doi.org/10.1007/978-3-540-45224-9_147

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-40803-1

Online ISBN: 978-3-540-45224-9

eBook Packages: Springer Book Archive