Abstract

We analyse the economic interaction on the market for composed services. Typically, as providers of composed services, intermediaries interact on the sales side with users and on the procurement side with providers of single services. Thus, in how far a user request can be met often crucially depends on the prices and qualities of the different single services used in the composition. We study an intermediary who purchases two complementary single services and combines them. The prices paid to the service providers are determined by simultaneous multilateral Nash bargaining between the intermediary and the respective service provider. By using a function with constant elasticity of substitution (CES) to determine the quality of the composed service, we allow for complementary as well as substitutable degrees of the providers’ service qualities. We investigate quality investments of service providers and the corresponding evolution of the single service quality within a differential game framework.

This work was partially supported by the German Research Foundation (DFG) within the Collaborative Research Center “On-The-Fly Computing” (SFB 901). We thank Claus-Jochen Haake for constructive suggestions and comments.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Service composition in cloud computing or on-the-fly computing environments is not just technically challenging, but also offers interesting questions that arise from an economic perspective. Strategic decisions with respect to service quality and prices influence the interaction between users, providers of composed services (also referred to as intermediaries), and providers of single services. A composed service with complementary single services as inputs requires negotiations with different service providers interdependently about prices and qualities. However, the providers of single services strategically determine quality investments and thus the quality level to maximize their individual profits. Therefore, the intermediary selling the composed service has to pay the service providers accordingly to induce them to deliver the single services such that they fulfil the requirements to satisfy the users’ demand. We propose a model that allows us to analyse the negotiations between the intermediary and the service providers and to investigate the evolution of service quality and the investments therein in a dynamic context using a differential game.

2 Literature

Formally, we combine models from cooperative bargaining theory and from noncooperative differential game theory to describe the interaction on the market for composed services. More precisely, for the price negotiations we use the well established Nash [9] bargaining solution. The use of multilateral Nash bargaining is inspired by the analysis in [6]. They investigate negotiations in vertical supply relationships between one manufacturer and two retailers and make use of the Nash bargaining solution to describe simultaneous and sequential price negotiations. In our model we add a dynamic variable by considering the demand of the end user and thus the negotiations depending on the qualities of the single services. We assume that simultaneous multilateral price negotiations take place at every instant in time. Using a differential game we investigate the dynamic evolution of the service quality. A comprehensive introduction into differential games is [5]. In particular, the evolution of service quality is modelled using the techniques for capital accumulation games [5, Chapter 9]. A similar game is also used to describe the evolution of quality in health care markets [4].

A systematic overview of the literature on service composition in cloud computing environments can be found in [8]. Here, the intermediary is also referred to as a “cloud service broker”. They describe the analysis of “dynamically contracting service providers” as one of the “most remarkable challenges” for the cloud computing service composition problem [8, Sect. 4.2, p. 3813]. A comprehensive survey on the pricing of cloud services is [2]. Various pricing schemes and techniques are systematically presented and compared with respect to their advantages and disadvantages as well as fairness and implementation in practice. For cloud instance pricing, when jobs arrive sequentially following a specific stochastic process, two techniques such as fixed unit prices and spot markets have been explicitly investigated and compared in [1]. The authors provide evidence that a fixed unit price seems to dominate a combination of both pricing models in terms of expected revenue. Different approaches and protocols for bargaining-based negotiations of service level agreements in cloud computing are surveyed in [7, Sect. 4.2.1, p. 51:12f]. In particular, an application of cooperative bargaining theory to web services for bilateral negotiations between a user and a service provider is [10]. While the focus of these models is often primarily on the pricing or negotiation procedure, our model incorporates the interaction of different types of service providers that is required for trading composed services. A simple model describing the interaction between an intermediary and two service providers has already been analysed in [3]. However, the model was only able to capture two different quality levels of the composed and single services and the dynamic analysis was by means of a repeated game.

We extend this analysis here in the sense that the quality of a single service is a continuous state variable and the overall quality can range from complements to substitutes. This means that we include a parameter describing how the pure quality of a single service may or may not be compensated by the good quality of another single service. The investment decisions to change the quality level of the service providers are strategic. The differential game framework sets up a dynamic optimal control problem for each service provider and thus allows us to investigate the evolution of service quality over an infinite time horizon. Quality-dependent negotiations take place at every instant in time and are modelled by using cooperative bargaining theory.

3 Model

We study a market consisting of three types of market participants: users, intermediaries and service providers. An intermediary purchases single services and combines them, where the quality of the composed service depends on the qualities of the single services delivered by the service providers. Finally, the composed service is sold to the users. Here, we focus on the interaction between one intermediary as the seller of a composed service to the users and two service providers as the sellers of single services to the intermediary. Each of the service providers is assumed to produce one single service. These services are supposed to have complementary properties, i.e., the intermediary needs to bargain with both service providers and the overall quality depends on both single services. The economic interaction on the market for composed services is illustrated in Fig. 1. Time is indexed by \(t \in \mathbb {R}_+ := [0, \infty )\). However, for ease of notation the time index is generally omitted.

4 Demand and Bargaining

The quality of the composed service is a function of the single services’ qualities

where \(\theta _i\in \mathbb {R}_+\) denotes the quality of the single service produced by provider \(i=1,2\) and \(\rho \in (-\infty ,1)\) is a measure of substitutability between the two single services. Technically, the quality of the composed service as in (1) is determined by a function with constant elasticity of substitution (CES) between the two single services. For the limit cases we get some special functions, namely

For a given overall quality of the composed service Fig. 2(a) illustrates the special cases. That is, for \(\rho < 0\) the service qualities are complementary while for \(\rho > 0\) they are substitutes.Footnote 1

The users’ demand for the composed services is modelled by a demand function

that describes the quantity the users are willing to purchase for a given price \(P \in \mathbb {R}_+\) and overall quality level \(\Theta (\cdot )\) of the composed service. In addition, the users’ demand for a single service is supposed to be zero. These assumptions on the user’s demand imply the following for the composition of services: Single services themselves are assumed to be complementary, i.e., both single services are needed to produce the composed service; while the qualities of the single services may be substitutable or complementary, i.e., quality differences between both single services may cancel out to a given extent in the composed service. The demand function is strictly decreasing in price and strictly increasing in quality. This means that at a given quality level, higher prices lead to a lower demand of composed services; and at a given price level, higher quality of the composed service increases the quantity demanded. The demand function is illustrated in Fig. 2(b) and is similar to the demand function analysed in the analytical example of [3, Appendix A].

In order to trade the single services the intermediary has to agree with each service provider on a price. We refer to this price as a transfer \(T_i\) in the following. To model the negotiations between the intermediary and the service providers we make use of cooperative bargaining theory (see [9]). We look at the individual profits from trading the single services. The intermediary is not only concerned with costs \(T_i\), but must take into account the users’ demand as well. The service provider on the other hand has revenues of \(T_i\), but in addition production costs for supplying the single service. The overall cost function for each service provider i captures production as well as investment costs

with \(\alpha _i, \beta _i, \gamma _i > 0\) and for \(i=1,2\). Here \(I_i\) denotes the investment to improve the quality of service \(\theta _i\), i.e., one unit of investment comes with quadratic costs. In addition, production costs are linear increasing to cover a given demand and quadratic in the supplied quality level. The intermediary must pay some transfer \(T_i\) to each service provider to incentivise production. The profits of the three parties can now be stated as

where \(\Pi (\cdot )\) is the profit of the intermediary, i.e., revenues from selling the composed service to the users minus transfers to the input suppliers. And \(\pi _i(\cdot )\), for \(i=1,2\), denotes the profit of the service providers, i.e. transfers from providing the single service minus total costs. The individual transfer schedule is the result of a simultaneous negotiation between the intermediary and the two service providers.

To ensure that negotiations actually take place we must assume that revenues of the intermediary exceed the production costs, i.e., there exists some surplus to be divided among the three parties

If this condition did not hold, the analysis of the economic interaction was trivial in the sense that there is no allocation of the surplus that induces non-negative profits simultaneously for all negotiating parties and thus no trade would take place. Moreover, the profits of the negotiating parties shall be non-negative, i.e.,

Equation (8) is known to be the individual rationality or participation constraints. In case of a disagreement the payoff is assumed to be zero. Hereby, we implicitly suppose that the disagreement with one service provider means that the composed service cannot be produced, since the single services are assumed to be complementary. This also implies that the profit of the intermediary cannot become positive when agreeing only with the other service provider as users do not demand single services.

We use the well-known Nash bargaining solution to explicitly determine these transfers [9]. The Nash bargaining solution has the advantage that it is characterized by some specific axiomsFootnote 2 and leads to strictly positive profits of the intermediary as well as the service providers. Consider the negotiations between the intermediary and service provider i. The Nash bargaining solution then satisfies

Note that the Nash product for the negotiations with service provider i in (9) as well as the participation constraint in (8) depend on the outcome of the negotiations between the intermediary and the other service provider \(3-i\). The complementarity of the single services is reflected by taking a zero disagreement payoff in case one of the negotiations fails.

The resulting transfer is then readily given by

For \(i=1,2\) we have two equations in two unknowns \(T^N_i(\cdot )\). Hence, we may explicitly solve for the transfer and obtain

This means that the surplus that exists on the market for selling the composed service taking the service providers’ costs into account is evenly split among the two service providers and the intermediary. Finally, the intermediary determines the sales price of the composed service. In every period the intermediary solves the following (static) program

Note that \(P^*\) is a datum determined by exogenous parameters, i.e., profits are given by

Since every party earns the same profit, we may stick to one symbol \(\pi \). After substituting (3), (4) and (12) into (13) one arrives at

where \(\theta = (\theta _1,\theta _2)\) and \(I = (I_1, I_2)\). Note that costs of service composition may be easily introduced into the model. As the surplus resulting from the composed service is always evenly distributed among the negotiating parties we may include costs of service composition directly into Eqs. (5) and (7).

For the dynamic analysis it is crucial to note that the bargaining process takes place in every period. Therefore, (14) holds at every point in time \(t\in \mathbb {R}_+\). This reduces the entire profit path \(\{\pi (\theta (t),I(t)) : t\in \mathbb {R}_+\}\) into an expression which solely depends on the respective quality and investment level in each period where \(\theta _i(t) : \mathbb {R}_+ \rightarrow \mathbb {R}_+\) and \(I_i(t) : \mathbb {R}_+ \rightarrow \mathbb {R}\), respectively, are time-dependent functions. Next, we set up a differential game to investigate the dynamic interaction of both service providers and show how to determine the optimal investment decision and the associated path of the overall quality level.

5 Dynamics of Service Quality and Investments

In this section we analyse the service providers’ incentives to invest into the quality of their single services. Each service provider i can govern the quality level over time by investing \(I_i\) (control variable). This means the next periods’ quality is given by the current investment minus a loss in quality that appears over time (depreciation). The law of motion for the state variable can be modelled by a differential equation

where \(\delta \in (0, 1]\) denotes depreciation of quality and we used the abbreviation \(\dot{\theta }_i(t) := \frac{d\theta _i}{dt}(t)\). By introducing a depreciation of quality we assume that maintaining the service quality requires continuous investments. That is, \(I_i\) denotes gross investment. Here, the depreciation rate of quality captures that a service provider has to continuously take care of the quality of his service. For software services this is by continuously adapting the software to technological changes in the runtime environments, dependencies with other services or security requirements, for example. In our theoretical analysis, the depreciation rate remains a parameter of the model and may range from almost no reduction of quality over time to a complete reduction, making the software without investments in the extreme case useless. Equation (15) links the current quality and the investments into quality of a service provider. Thus, the optimization problem of service provider i boils down to choose a stream of investment levels \(\{I_i(t) : t\in \mathbb {R}_+\}\) as to maximize his discounted profits with respect to the flow constraints and some given initial quality level

where \(r > 0\) denotes the time preference rate. Future profits are discounted since we presume that economic agents are impatient, i.e., they rather prefer to earn profits today than tomorrow.Footnote 3

Next, the best response of a service provider is determined. The dynamic optimization problem is solved by applying the maximum principle [5, Theorem 4.2]. We set up the current value Hamiltonians for each service provider i by

where \(\mu _i\) is the costate variable. The current value Hamiltonian measures current profits as well as future profits which arise by investing into the service quality. Note that each service provider faces an intertemporal trade-off when making an investment decision. Current investment instantly lowers profits due to investment costs, but also raises expectations of future gains from the investment due to an increase in the service quality. The costate variable is thus considered as a shadow price which translates gains of investment into current profits. Inserting the service provider’s profit from (14), the 1. first order condition for optimal investment reads

The interpretation of (18) is straightforward: the larger the investment cost parameter given by \(\beta _i\), the smaller the investment and the larger future gains of an increase in quality measured by the shadow price \(\mu _i\), the higher the investment. That is, current marginal costs of investment must be outweighed by future gains of current investment. The 2. first order condition gives the evolution of the costate over time

Since we are rather interested in evaluating the dynamics in the \((I_i, \theta _i)\) space, we may differentiate (18) over time yielding

and then combine it with (19) using (18) which gives us

Considering both service providers, we now have a four-dimensional system of differential equations which is denoted by \(\mathcal {D}(\dot{\theta }, \dot{I})\). The dynamic equilibrium or fixed point can be found by solving \(\mathcal {D}(0, 0)\) for I and \(\theta \) and is given byFootnote 4

with \(\xi _i := \delta \beta _i(\delta + r) + \alpha _i\) and \(\xi _{3-i} :=\delta \beta _{3-i}(\delta + r) + \alpha _{3-i}\) for \(i=1,2\). Note that for particular values of \(\rho \) we haveFootnote 5

If the qualities of the single services are complementary, then service provider i also takes into account the cost parameters of \(3-i\) and both providers will supply their single service in the same quality. This feature essentially captures the Leontief characteristics of the quality for the composed service. No service provider has an incentive to invest into quality of the single service if the overall quality is solely determined by the other provider. The dynamic equilibrium is in fact identical for both service providers for \(\rho \rightarrow -\infty \). While if qualities are perfect substitutes, a service provider is concerned only about his firm-specific quality and investment costs. In addition, we see that the long-run quality level is unambiguously increasing in all exogenous parameters. The economic interpretation is as follows: Since \(\alpha _i, \beta _i\) and \(\gamma _i\) are cost parameters for producing \(\theta _i\), we will observe a low long-run quality level for high production costs. If \(\delta \) is high, then we will observe a low \(\tilde{\theta }_i\), because quality depreciates rather rapidly over time. To maintain some specific quality level the service provider must make large gross investments \(\tilde{I}_i\), which are costly. Finally, \(\tilde{\theta }_i\) is decreasing in r. That is, if the service provider is impatient and does not value future profits that much, he invests little and the long-run equilibrium is low as well.

The stability of the fixed point can be checked by evaluating the eigenvalues of the Jacobian matrix. It turns out that the eigenvalues are real and opposite in sign. That is, there are two positive and two negative eigenvalues, indicating that the system is saddle point stable.Footnote 6 There also exists a unique saddle path converging to the dynamic equilibrium.

6 Simulation

Since the problem is open loopFootnote 7 in nature, we are dealing with an initial value problem. That is, given \(\theta _i(0)\) we are concerned only with determining optimal initial investment decisions \(I_i(0)\), for \(i=1,2\). The system dynamics are then fully characterized by the four differential equations \(\mathcal {D}(\dot{\theta }, \dot{I})\). However, there are infinitely many possibilities to pick initial investment \(I_i(0) \in \mathbb {R}\). To pin down the unique saddle path we make use of the 3. first order condition, namely the transversality condition

The transversality condition ensures that the system moves along the saddle path, because it rules out exploding paths which diverge from the dynamic equilibrium. Hence the transversality condition gives rise to a terminal condition. If investment is in steady state at some time instance \(t = t_f\), then it has to be stuck there forever, i.e., \(\lim _{t_f \rightarrow \infty } I_i(t_f) = \tilde{I}_i\) for \(i=1,2\).

Now we are dealing with a 4D system of differential equations with two initial and two terminal conditions. We then use a numerical boundary value problem solver to simulate the system. To simulate the model we have to parametrize it. We used the following parameters throughout \(\theta _1(0) = \theta _2(0) = 3\), \(\delta = 1\), \(r = 0.05\), \(\alpha _1,\beta _1,\gamma _1 = 0.1\) and \(\alpha _2,\beta _2,\gamma _2 = 0.2\). We vary \(\rho \in \{-5,0.9\}\) to emphasize the main feature of the model. That is, what the optimal quality level of a single service is if the overall quality of the composed service is either complementary or substitutable. The respective steady states are given by (23) and read

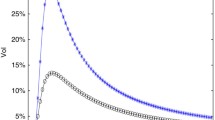

If the services are substitutable (\(\rho =0.9\)), then cost parameters drive the long-run equilibrium. Here the cost advantage of service provider 1 yields a higher investment and thus also a higher quality in the dynamic equilibrium. On the other hand, if services are complementary (\(\rho =-5\)), the cost advantage nearly vanishes and both service providers adjust quality towards some similar level. Figure 3 displays the respective time paths \(\theta _i(t)\) and \(I_i(t)\) over a time horizon of five periods \(t \in [0,5]\).

Consider the case \(\rho = 0.9\) (cf. Fig. 3(a)). Firm 1 invests slightly more than the long-run equilibrium level and thus increases quality over time \(\dot{\theta }_1 > 0\). Service provider 2 on the other hand invests less and thus the quality decreases. Note that the time paths of quality steadily diverge from the common origin \(\theta _1(0) = \theta _2(0)\). Consider the case \(\rho = -5\) (cf. Fig. 3(b)). Even though the cost parameters did not change, the dynamics fundamentally differ with respect to the first case. Here the shape of the time path is congruent for both service providers. Service provider 1 now adjusts the quality towards the less efficient provider 2, i.e., both service providers decrease quality over time and reach some “close” equilibria due to the complementarity of the services. Now service provider 1 has no incentive to produce a high quality service, since the overall quality is strongly determined by the lower quality.

7 Conclusion

We introduced a model with an intermediary producing a composed service using two single services to investigate the dynamic interaction on the market for composed services. While considering in principal a composed service with two complementary single services as inputs, our analysis is valid for different assumptions on how the quality of the composed service is actually determined from the single services’ qualities. Price negotiations have been modelled cooperatively by simultaneously applying the Nash bargaining solution in negotiations between the intermediary and each single service provider. We have shown that the surplus that is generated from producing and selling the composed service to a user is evenly divided among the intermediary and the two service providers. The dynamic evolution of quality and the investments therein have been analysed using a differential game with an open loop strategy profile. We find that there exists a unique saddle point for the quality and respective investment level. That is, the equilibrium is generally unstable, but reachable on the unique saddle path. We pin down the saddle path by applying a boundary value problem solver. Depending on the quality substitutability the dynamics fundamentally differ for fixed, but asymmetric cost parameters. That is, cost advantages are of minor interest if the overall quality heavily depends on both services. This means we observe that there is a crucial impact of how quality differences between single services may or may not be compensated when the quality of the composed service is determined.

Beyond our analysis here, several extensions of the model are possible. First of all, we did not explicitly fix a negotiation protocol. In fact, existing approaches and protocols implementing the Nash bargaining solution may be easily incorporated into the model without changing our observations. Surely the impact of competition between several intermediaries producing composed services and the use of more complex models of service composition are worth further investigation in future work. For instance, typically different alternative single services may be available for a composed service. Thus, besides complementary also substitutable single services may be considered. Competition between service providers may as well have an effect on the bargaining power of the intermediary. In addition, the comparison of different pricing models in an additional direction for further research.

Notes

- 1.

Note that the elasticity of substitution can be denoted by \( \sigma = \frac{1}{1 - \rho }\). We may observe \(\sigma \rightarrow \{0,1,\infty \}\) for \(\rho \rightarrow \{-\infty , 0,1\}\).

- 2.

See [9] for further details.

- 3.

From a technical point of view we must assume that \(r > 0\), because otherwise the payoff integral may not converge.

- 4.

Further details on the derivation are presented in Appendix A.1.

- 5.

At the discontinuity point \(\rho = 0\), where the quality of the composed good switches from complementary to substitutable, one can show that the left- and right-hand side limits differ with \(\lim _{\rho \rightarrow 0^-}\tilde{\theta }_i = 0\) and \(\lim _{\rho \rightarrow 0^+} \tilde{\theta }_i = \infty \).

- 6.

The derivation can be found in Appendix A.2.

- 7.

Actually, here the cooperative as well as the open and closed loop solution coincide. Since profits are split evenly among the market participants they try to maximize the overall profit, which is basically the definition of a cooperative mood of play. In addition, the game is somehow linear-quadratic (LQ). That is, the law of motions are linear and the payoffs are quadratic with respect to the control and state variable. LQ games are known to have the same solution for open and closed loop strategies [5, Sect. 7.1].

References

Abhishek, V., Kash, I.A., Key, P.: Fixed and market pricing for cloud services. In: 2012 IEEE Conference on Computer Communications Workshops (INFOCOM WKSHPS), pp. 157–162, March 2012

Al-Roomi, M., Al-Ebrahim, S., Buqrais, S., Ahmad, I.: Cloud computing pricing models: a survey. Int. J. Grid Distrib. Comput. 6(5), 93–106 (2013)

Brangewitz, S., Haake, C.-J., Manegold, J.: Contract design for composed services in a cloud computing environment. In: Ortiz, G., Tran, C. (eds.) ESOCC 2014. CCIS, vol. 508, pp. 160–174. Springer, Heidelberg (2015)

Brekke, K.R., Cellini, R., Siciliani, L., Straume, O.R.: Competition and quality in health care markets: a differential-game approach. J. Health Econ. 29(4), 508–523 (2010)

Dockner, E., Jørgesen, S., Long, N.V., Sorger, G.: Differential Games in Economics and Management Science. Cambridge University Press, Cambridge (2000)

Guo, L., Iyer, G.: Multilateral bargaining and downstream competition. Mark. Sci. 32(3), 411–430 (2013)

Hani, A.F.M., Paputungan, I.V., Hassan, M.F.: Renegotiation in service level agreement management for a cloud-based system. ACM Comput. Surv. (CSUR) 47(3), 51:1–51:21 (2015)

Jula, A., Sundararajan, E., Othman, Z.: Cloud computing service composition: a systematic literature review. Expert Syst. Appl. 41(8), 3809–3824 (2014)

Nash, J.F.: The bargaining problem. Econometrica 18(2), 155–162 (1950)

Zheng, X., Martin, P., Powley, W., Brohman, K.: Applying bargaining game theory to web services negotiation. In: 2010 IEEE International Conference on Services Computing (SCC), pp. 218–225, July 2010

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

A Technical Appendix

A Technical Appendix

1.1 A.1 Fixed Point

In this section we derive the unique fixed point of \(\mathcal {D}(\dot{\theta }, \dot{I})\) denoted by \((\tilde{\theta },\tilde{I})\). Instead of solving \(\dot{I}_1 = \dot{I}_2 = \dot{\theta }_1 = \dot{\theta }_2 = 0\) simultaneously, we express the equilibrium investment level by means of the quality. Setting (15) equal to zero yields

We now solve the remaining equations for \(\tilde{\theta }_1\) and \(\tilde{\theta }_2\). Inserting (28) into (21) yields

Rearranging gives us

Note that the right-hand side of (30) is identical for both providers, i.e., symmetric in the variables \(\gamma _1\) and \(\gamma _2\) as well as in \(\tilde{\theta }_1\) and \(\tilde{\theta }_2\). Thus, we know that

where we defined \(\xi _i := \delta \beta _i(\delta + r) + \alpha _i\) for \(i=1,2\). This yields a relationship between the two quality levels

Now, we plug (32) into (30) and obtain

Solving according to \(\tilde{\theta }_i\) yields

1.2 A.2 Stability

The stability of the fixed point can be checked by evaluating the eigenvalues \(\{\omega _n : n = 1,2,3,4\}\) of the Jacobian matrix. We obtain

with

The eigenvalues are

Since \(\varepsilon _{13} > 0\) and \(\varepsilon _{24}>0\) we must have \(|r| < |\sqrt{(r+2\delta )^2 + 4\varepsilon _{13}}|\) and \(|r| < |\sqrt{(r+2\delta )^2 + 4\varepsilon _{24}}|\). Hence two eigenvalues are positive and the remaining two are negative \(\omega _{1,3}> 0 > \omega _{2,4}\) respectively. The system is thus said to be saddle point stable.

Rights and permissions

Copyright information

© 2016 IFIP International Federation for Information Processing

About this paper

Cite this paper

Brangewitz, S., Hoof, S. (2016). Economic Aspects of Service Composition: Price Negotiations and Quality Investments. In: Aiello, M., Johnsen, E., Dustdar, S., Georgievski, I. (eds) Service-Oriented and Cloud Computing. ESOCC 2016. Lecture Notes in Computer Science(), vol 9846. Springer, Cham. https://doi.org/10.1007/978-3-319-44482-6_13

Download citation

DOI: https://doi.org/10.1007/978-3-319-44482-6_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-44481-9

Online ISBN: 978-3-319-44482-6

eBook Packages: Computer ScienceComputer Science (R0)