Abstract

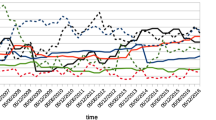

A computational approach combining machine learning (simulated annealing) and agent based simulation is shown to approximate financial time series. The agent based model allows to simulate the market conditions that produced the financial time series and simulated annealing optimize the parameters for the agent based model. The originality of our approach stays in the combination of financial market simulation with meta-learning of its parameters. The original contribution of the paper stays in discussing how the methodology can be applied under several meta-learning conditions and its experimentation on the real world SPDR Gold Trust (GLD) timeseries.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Arthur, W.B., Holland, J.H., LeBaron, B., Palmer, R., Taylorm, P.: Asset pricing under endogenous expectation in an artificial stock market. In: The Economy as an Evolving Complex System II, pp. 15–44. Santa Fe Institute Studies in the Sciences of Complexity Lecture Notes (1997)

Bonabeau, E.: Agent-based modeling: methods and techniques for simulating human systems. Proc. Nat. Acad. Sci. 99(3), 7280–7287 (2002)

Burke, E.K., Hyde, M., Kendall, G., Ochoa, G., Ozcan, E., Woodward, J.: A classification of hyper-heuristics approaches, handbook of metaheuristics. In: Gendreau, M., Potvin, J.Y. (eds.) Handbook of Metaheuristics. International Series in Operations Research and Management Science, pp. 449–468. Springer, Heidelberg (2009). https://doi.org/10.1007/978-1-4419-1665-5_15

Camilleri, M., Neri, F., Papoutsidakis, M.: An algorithmic approach to parameter selection in machine learning using meta-optimization techniques. WSEAS Transact. Syst. 13(1), 203–212 (2014)

Creamer, G., Freund, Y.: Automated trading with boosting and expert weighting. Quant. Financ. 4(10), 401–420 (2010)

Epstein, J.M., Axtell, R.: Growing Artificial Societies: Social Science from the Bottom Up. The Brookings Institution, Washington (1996)

Goldberg, D.: Genetic Algorithms in Search, Optimization, and Machine Learning. Addison-Wesley, Reading (1989)

Hoffmann, A.O.I., Delre, S.A., von Eije, J.H., Jager, W.: Artificial multi-agent stock markets: simple strategies, complex outcomes. In: Bruun, C. (ed.) Advances in Artificial Economics. Lecture Notes in Economics and Mathematical Systems, vol. 584, pp. 167–176. Springer, Heidelberg (2006). https://doi.org/10.1007/3-540-37249-0_12

Kendall, G., Su, Y.: A multi-agent based simulated stock market - testing on different types of stocks. In: Congress on Evolutionary Computation CEC 2003, pp. 2298–2305 (2003)

Kennedy, J., Eberhard, R.: Particle swarm optimization. In: International Conference on Neural Networks, pp. 1942–1948. IEEE press (1995)

Kirkpatrick, S., Gelatt, C.D., Vecchi, M.P.: Optimization by simulated annealing. Science 220, 671–680 (1983)

Kitov, I.: Predicting ConocoPhillips and Exxon Mobil stock price. J. Appl. Res. Financ. 2, 129–134 (2009)

Lebaron, B.: Agent based computational finance: suggested readings and early research. J. Econ. Dyn. Control 24, 679–702 (1998)

Majhi, R., Sahoo, G., Panda, A., Choubey, A.: Prediction of S&P 500 and DJIA stock indices using particle swarm optimization techniques. In: Congress on Evolutionary Computation 2008, pp. 1276–1282. IEEE press (2008)

Neri, F.: PIRR: A methodology for distributed network management in mobile networks. WSEAS Transact. Inf. Sci. Appl. 5(3), 306–311 (2008)

Neri, F.: Learning and predicting financial time series by combining natural computation and agent simulation. In: Chio, C., et al. (eds.) EvoApplications 2011. LNCS, vol. 6625, pp. 111–119. Springer, Heidelberg (2011). https://doi.org/10.1007/978-3-642-20520-0_12

Neri, F.: A comparative study of a financial agent based simulator across learning scenarios. In: Cao, L., Bazzan, A.L.C., Symeonidis, A.L., Gorodetsky, V.I., Weiss, G., Yu, P.S. (eds.) ADMI 2011. LNCS (LNAI), vol. 7103, pp. 86–97. Springer, Heidelberg (2012). https://doi.org/10.1007/978-3-642-27609-5_7

Neri, F.: Can agent based models capture the complexity of financial market behavior. In: 42nd Annual Meeting of the AMASES Association for Mathematics Applied to Social and Economic Sciences. University of Naples and Parthenope University Press, Napoli (2018, in press)

Neri, F.: Case study on modeling the silver and nasdaq financial time series with simulated annealing. In: Rocha, Á., Adeli, H., Reis, L.P., Costanzo, S. (eds.) WorldCIST’18 2018. AISC, vol. 746, pp. 755–763. Springer, Cham (2018). https://doi.org/10.1007/978-3-319-77712-2_71

Neri, F.: Combining machine learning and agent based modeling for gold price prediction. In: Cagnoni, S. (ed.) WIVACE 2018, Workshop on Artificial Life and Evolutionary Computation. Springer, Heidelberg (2018, in press)

Neri, F.: Agent-based modeling under partial and full knowledge learning settings to simulate financial markets. AI Commun. 25(4), 295–304 (2012)

Papoutsidakis, M., Piromalis, D., Neri, F., Camilleri, M.: Intelligent algorithms based on data processing for modular robotic vehicles control. WSEAS Trans. Syst. 13(1), 242–251 (2014)

Quinlan, J.R.: C4.5: Programs for Machine Learning. Morgan Kaufmann, Burlington (1993)

Rumelhart, D.E., Hinton, G.E., Williams, R.J.: Learning internal representations by error propagation. In: Parallel Distributed Processing: Explorations in the Microstructure of Cognition, Volume 1: foundations, pp. 318–362. MIT Press, Cambridge (1986)

Schulenburg, S., Ross, P.: An adaptive agent based economic model. In: Lanzi, P.L., Stolzmann, W., Wilson, S.W. (eds.) IWLCS 1999. LNCS (LNAI), vol. 1813, pp. 263–282. Springer, Heidelberg (2000). https://doi.org/10.1007/3-540-45027-0_14

Staines, A., Neri, F.: A matrix transition oriented net for modeling distributed complex computer and communication systems. WSEAS Trans. Syst. 13(1), 12–22 (2014)

Takahashi, H., Terano, T.: Analyzing the influence of overconfident investors on financial markets through agent-based model. In: Yin, H., Tino, P., Corchado, E., Byrne, W., Yao, X. (eds.) IDEAL 2007. LNCS, vol. 4881, pp. 1042–1052. Springer, Heidelberg (2007). https://doi.org/10.1007/978-3-540-77226-2_104

Tesfatsion, L.: Agent-based computational economics: growing economies from the bottom up. Artif. Life 8(1), 55–82 (2002)

Zirilli, J.: Financial Prediction Using Neural Networks. International Thompson Computer Press, London (1997)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Neri, F. (2019). Combining Machine Learning and Agent Based Modeling for Gold Price Prediction. In: Cagnoni, S., Mordonini, M., Pecori, R., Roli, A., Villani, M. (eds) Artificial Life and Evolutionary Computation. WIVACE 2018. Communications in Computer and Information Science, vol 900. Springer, Cham. https://doi.org/10.1007/978-3-030-21733-4_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-21733-4_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-21732-7

Online ISBN: 978-3-030-21733-4

eBook Packages: Computer ScienceComputer Science (R0)