Abstract

This study explores the relationship between the demand for federal corn insurance and premium subsidies at each coverage level using county-level data. The study shows that the elasticities of demand with respect to per U.S. dollar net premium vary across insurance plans, coverage levels, and regions. The results indicate that corn producers in riskier regions are more sensitive to premium changes for crop insurance. However, the heterogeneity of demand was overlooked in the majority of existing insurance demand studies, which could result in biased conclusions. In addition, this study estimates the changes in producers’ corn insurance purchases if premium subsidy rates were to be reduced by 10 percentage points. The expected change in corn revenue insurance demand at the 75% coverage level in the Southern Plains (− 12.182%) would be three times greater than it is at the 80% coverage level in the Corn Belt (− 4.167%) with a 10 percentage point reduction in premium subsidy rates, similar to the corn yield insurance demand.

Source USDA, Risk Management Agency, Summary of Business files, 1989–2014

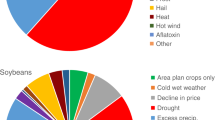

Source Glauber and Collins (2002)

Similar content being viewed by others

Notes

We do not distinguish between the different mechanisms of the subsidy effect and the adverse selection effect, since they are not the major objective of this study.

Although the information on unit structure is available in the new version of Summary of Business data, there is no unit structure in the data for the years prior to 2002.

Revenue Assurance (RA) was only underwritten by Iowa corn farmers in 1998, and the total premiums were about 4% of the CRC total premiums in that year.

For example, according to the 2011 Agricultural Resource Management Survey, the average net worth is USD 911,000 and USD 5,600,000 for all farms and large farms, respectively (see Table 7 in Hoppe 2014). The average gross farm income is USD 153,000 and USD 2,000,000, respectively. The ratio of net worth to gross income is about 6.0 for all farms, and 2.7 for large farms, implying that large farms are more leveraged on average.

The authors sincerely thank the anonymous reviewers for pointing out the problem and proposing potential solutions to the endogeneity problem.

References

Babcock, B.A., and C.E. Hart. 2005. Influence of the premium subsidy on farmers’ crop insurance coverage decisions. Card working papers 375.

Babcock, B.A., C.E. Hart, and D.J. Hayes. 2004. Actuarial fairness of crop insurance rates with constant rate relativities. American Journal of Agricultural Economics 86 (3): 563–575.

Bruin, J. 2006. Newtest: Command to compute new test. UCLA: Statistical Consulting Group.

Barnett, B.J., and J.R. Skees. 1995. Region and crop specific models of the demand for federal crop insurance. Journal of Insurance Issues 18 (2): 47–65.

Cannon, D., and B. Barnett. 1995. Modeling changes in participation in the federal multiple peril crop insurance program between 1982 and 1987. American Journal of Agricultural Economics 77: 1380.

Charness, G., and U. Gneezy. 2012. Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization 83 (1): 50–58.

Coble, K.H., and B.J. Barnett. 2012. Why do we subsidize crop insurance? American Journal of Agricultural Economics 95 (2): 498–504.

Eckel, C.C., and P.J. Grossman. 2002. Sex differences and statistical stereotyping in attitudes toward financial risk. Evolution and Human Behavior 23 (4): 281–295.

GAO. 2014. Crop insurance: Considerations in reducing federal premium subsidies. Washington: U.S. Government Accountability Office.

GAO. 2015. Crop insurance: In areas with higher crop production risks, costs are greater, and premiums may not cover expected losses. Washington: U.S. Government Accountability Office.

Gardner, B.L., and R.A. Kramer. 1986. Experience with crop insurance programs in the United States. In Crop insurance for agricultural development: Issues and experience, ed. P. Hazell, C. Pomareda, and A. Valdes. Baltimore: IFPRI/Johns Hopkins University Press.

Glauber, J.W. 2004. Crop insurance reconsidered. American Journal of Agricultural Economics 86 (5): 1179–1195.

Glauber, J.W., and K.J. Collins. 2002. Risk management and the role of the federal government. In A comprehensive assessment of the role of risk in U.S. agriculture, ed. R.E. Just and R.D. Popepp, 469–488. Boston: Springer.

Goodwin, B.K. 1993. An empirical analysis of the demand for multiple peril crop insurance. American Journal of Agricultural Economics 75 (2): 425–434.

Goodwin, B.K. 2001. Problems with market insurance in agriculture. American Journal of Agricultural Economics 83 (3): 643–649.

Goodwin, B.K., and A.P. Ker. 1998. Nonparametric estimation of crop yield distributions: Implications for rating group-risk crop insurance contracts. American Journal of Agricultural Economics 80 (1): 139–153.

Goodwin, B.K., M.L. Vandeveer, and J.L. Deal. 2004. An empirical analysis of acreage effects of participation in the federal crop insurance program. American Journal of Agricultural Economics 86 (4): 1058–1077.

Hoppe, R.A. 2014. Structure and finances of U.S. farms: Family farm report. No. 1476-2017-3884. United States Department of Agriculture.

Jose, H.D. 2001. The impact of the Agricultural Risk Protection Act of 2000 on crop insurance programs. Lincoln: University of Nebraska-Lincoln.

Just, R.E., L. Calvin, and J. Quiggin. 1999. Adverse selection in crop insurance: Actuarial and asymmetric information incentives. American Journal of Agricultural Economics 81 (4): 834–849.

Kelley, C.R. 2001. The Agricultural Risk Protection Act of 2000: Federal Crop Insurance, the Non-Insured Crop Disaster Assistance Program, and the Domestic Commodity and Other Farm Programs. Drake Journal of Agricultural Law 6: 141.

Knox, L., and T.J. Richards. 1999. A two-stage model of the demand for specialty crop insurance. Nashville, Tennesee: American Agricultural Economics Association Annual Meeting.

O’Donoghue, E. 2014. The effects of premium subsidies on demand for crop insurance. USDA-ERS economic research report, vol. 169. Washington, DC: USDA-ERS.

Richards, T.J. 2000. A two-stage model of the demand for specialty crop insurance. Journal of Agricultural and Resource Economics 25 (1): 177–194.

Serra, T., B.K. Goodwin, and A.M. Featherstone. 2003. Modeling changes in the U.S. demand for crop insurance during the 1990s. Agricultural Finance Review 63 (2): 109–125.

Shields, D.A. 2015. Federal crop insurance: Background. Washington, DC: Congressional Research Service.

Smith, V.H., and A.E. Baquet. 1996. The demand for multiple peril crop insurance: Evidence from Montana wheat farms. American Journal of Agricultural Economics 78 (1): 189–201.

Wang, H.H., S.D. Hanson, R.J. Myers, and J.R. Black. 1998. The effects of crop yield insurance designs on farmer participation and welfare. American Journal of Agricultural Economics 80 (4): 806–820.

Woodard, J.D. 2015. Estimating demand for government subsidized insurance: Evidence from the U.S. Agricultural Insurance Market, SSRN Working Paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2826036.

Woodard, J.D., and J. Yi. 2018. Estimation of insurance deductible demand under endogenous premium rates. Journal of Risk and Insurance. https://doi.org/10.1111/jori.12260.

Acknowledgements

This material is based upon work that is supported by the Office of the Chief Economist, U.S. Department of Agriculture, Cooperative Agreement no. 58-0111-15-017.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 6, 7, 8, 9, 10, 11, 12, and 13.

Rights and permissions

About this article

Cite this article

Yi, J., Bryant, H.L. & Richardson, J.W. How do premium subsidies affect crop insurance demand at different coverage levels: the case of corn. Geneva Pap Risk Insur Issues Pract 45, 5–28 (2020). https://doi.org/10.1057/s41288-019-00144-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-019-00144-8