Abstract

This study examines how regional diversification affects firm performance. The results indicate that regional diversification has linear and curvilinear effects on firm performance. Regional diversification enhances firm performance linearly up to a certain threshold, and then its impact becomes negative. The results also show that firms of developed countries maximize their performance when they operate across a moderate number of developed regions and a strictly limited number of developing regions. This explains why internationalization by most international firms is regional rather than global.

Similar content being viewed by others

Notes

For a firm to be included in the sample, the requisite data for the entire 5-year period were required for the firm. Because there were some missing data on many of the firms during this period, we were left with a sample of 189 firms.

There are 13 industry groups based on their Standard Industrial Classification (SIC). Firms are placed in the group that represents the greatest volume of their sales. The industries are: Beverages; Chemicals; Food; Paper and Wood Products; Electrical; Industrial and Farm; Office Equipment (with computers); Metal Products; Measurement, Scientific and Photographic Equipment; Motor Vehicles; Non-Electrical Machinery; Pharmaceuticals; and Textiles.

Firm performance (e.g., ROA and ROS) has, for example, self-accumulation characteristics that tend to be dynamic, as its past level is related to its current level (Bond, Klemm, Newton-Smith, Syed, & Vlieghe, 2002).

Accordingly, two hypotheses are proposed. Hypothesis 1: Both the slope and the intercept are the same at different cross-sectional units and periods. Hypothesis 2: The slope is the same but the intercept is different at different cross-sectional units and periods. Apparently, if we accept Hypothesis 1, then it is unnecessary to conduct further tests. If we do not, then we have to test Hypothesis 2 to ensure that the slope is equal. If Hypothesis 2 is rejected, then we can be sure that our panel data fall into Situation 3, in which both the intercept and the slope are different. We used the F-statistic (both F 1 and F 2) to test Hypothesis 1 and Hypothesis 2 for model 4 of all sample firms. The observed F 1 value of 1.256 exceeds the critical F value that is obtained from the F table [F(375, 556)=1.127], while the F 2 value of 0.886 does not exceed the critical value F [F(181,556)=1.162] at the 10% level. Hypothesis 2 is therefore accepted, which implies that the panel data fit nicely into Situation 2, whereas Hypothesis 1 is rejected. Hence the model specified should be a dynamic variable intercept model.

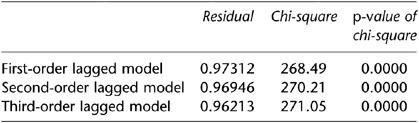

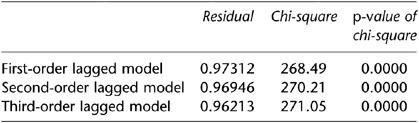

The results (both chi-square and p-value of chi-square) indicate that the three models are statistically significant, and the level of significance for the first-order lagged model is almost the same as for both the second-order and third-order lagged dependent models. illustration

The Hausman test is a multi-purpose test designed to compare two estimators that present the following contrast. Hypothesis 0: Both estimators are consistent, but the first estimator is efficient. Hypothesis 1: Only the second estimator is consistent. This test is widely used to compare between fixed effects and random effects in the analysis of panel data. If H0 is to hold, then there should be no systematic difference between the coefficients of the efficient estimator. If the two models display a systematic difference in the estimated coefficients, then we have reason to doubt the assumptions on which the efficient estimator is based. The formal representation of the test statistic is

which is asymptotically distributed as a chi-square with degrees of freedom equal to the rows of each coefficient vector. If its p-value is smaller than the 0.05 significant level, we have to reject the null hypothesis, which means the acceptance of the fixed effect model and the invalidity of the random effect model. In our study, the test statistic [chi-square (12)] equals 32.60. The Hausman specification test indicates that the p-value is 0.001, which is clearly smaller than the 0.05 level, thus favoring the fixed effect model.

This classification is based on the medium of the entropy measure of RD (cf. Qian, Wang, Li, & Yang, 2000).

Moreover, we conducted an additional regression diagnosis using the variance-inflating factor (VIF) to determine whether there was any multicollinearity among the variables. The results (the highest value of VIF=1.04) further confirm that multicollinearity is not a major concern in this study.

We test whether the orthogonal conditions hold using both the Sargan test of over-identifying restrictions and the p-values of the first-order serial correlation test. The Sargan test is a test of the validity of instrumental variables (or a test of the overidentifying restrictions). In the first test, the null hypothesis is that the instrumental variables are uncorrelated to a specified set of residuals. If the hypothesis is accepted, the instrument variables are valid. In the second test, the null hypothesis is that the error term is not first-order serially correlated. If the p-value is larger than the 0.05 level, the hypothesis is accepted, and thus the estimation is reliable.

A strict procedure is followed to ensure that the strict analytical assumption of the homogeneity of variability is met: that is, that the error variance of the dependent variable is equal across the groups (Maxwell & Delaney, 1990). If the error variance is different within each group, then there is an increased probability of the occurrence of a Type I error, which would thus affect the power of the statistical test (Wilcox, 1987). Accordingly, we conducted the univariate homogeneity of variance test to see whether our data meet the assumption of the homogeneity of variability. The results are significant: ROA[Cochran C(4, 9)=0.412, p=0.014; Bartlett–Box F(8, 1166)=2.49, p=0.011] and ROS[Cochran C(4, 9)=0.426, p=0.013; Bartlett–Box F(8, 1166)=3.303, p=0.002]. All of the statistics indicate that the assumption is fully met.

References

Alvarez, S. A., & Busenitz, L. W. 2001. The entrepreneurship of resource-based theory. Journal of Management, 27 (6): 755–775.

Arellano, M., & Bond, S. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58 (2): 277–297.

Barkema, H. G., & Vermeulen, F. 1998. International expansion through start-up or acquisition: A learning perspective. Academy of Management Journal, 41 (1): 7–26.

Barney, J. B. 1986. Strategic factor markets: Expectations, luck and business strategy. Management Science, 32 (10): 1231–1241.

Barney, J. B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17 (1): 99–120.

Berry, H. 2004. The influence of location, multinationality and knowledge on MNE performance. Working paper, University of Pennsylvania.

Berry, H. 2006. Shareholder valuation of foreign investment and expansion. Strategic Management Journal, 27 (12): 1123–1140.

Bond, S. R., Klemm, A., Newton-Smith, R., Syed, M. H., & Vlieghe, G. 2002. The roles of expected profitability, Tobin's q and cash flow in econometric models of company investment, Mimeo, Institute for Fiscal Studies, London.

Brewer, H. L. 1981. Investor benefits from corporate international diversification. Journal of Financial and Quantitative Analysis, 16 (1): 113–126.

Buckley, P. J., Dunning, J. H., & Pearce, R. B. 1978. The influence of firm size, industry, nationality, and degree of multinationality on the growth and profitability of the world's largest firms, 1962–1972. Weltwirtschaftliches Archiv, 114 (2): 243–257.

Buckley, P. J., Dunning, J. H., & Pearce, R. B. 1984. An analysis of the growth and profitability of the world's largest firms 1972 to 1977. Kyklos, 37 (1): 3–26.

Bühner, R. 1987. Assessing international diversification of West German corporations. Strategic Management Journal, 8 (1): 25–37.

Campa, J. M., & Kedia, S. 2002. Explaining the diversification discount. Journal of Finance, 57 (4): 1731–1762.

Cho, K. R. 1988. Determinants of intra-firm trade: A search for a theoretical framework. The International Trade Journal, 3 (2): 167–186.

Contractor, F. J., Kundu, S. K., & Hsu, C. C. 2003. A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies, 34 (1): 5–18.

Daniels, J. D., & Bracker, J. 1989. Profit performance: Do foreign operations make a difference? Management International Review, 29 (1): 46–56.

Delios, A., & Beamish, P. W. 1999. Geographic scope, product diversification and the corporate performance of Japanese firms. Strategic Management Journal, 20 (8): 711–727.

Denis, D. J., Denis, D. K., & Yost, K. 2002. Global diversification, industrial diversification, and firm value. Journal of Finance, 57 (5): 1951–1979.

Eisenhardt, K., & Martin, J. A. 2000. Dynamic capabilities: What are they? Strategic Management Journal, 21 (Special Issue): 1105–1121.

Errunza, V. R., & Senbet, L. W. 1981. The effects of international operations on the market value of the firm: Theory and evidence. Journal of Finance, 36 (2): 401–417.

Errunza, V. R., & Senbet, L. W. 1984. International corporate diversification, market valuation, and size-adjusted evidence. Journal of Finance, 39 (3): 727–745.

Ettlie, J. E. 1998. R&D and global manufacturing performance. Management Science, 44 (1): 1–11.

Evans, M., Hastings, N., & Peacock, B. 2000. Statistical distributions. New York: Wiley.

Fatemi, A. M. 1984. Shareholder benefits from corporate international diversification. Journal of Finance, 39 (5): 1325–1344.

Geringer, J. M., Beamish, P. W., & daCosta, R. C. 1989. Diversification strategy and internationalization: Implications for MNE performance. Strategic Management Journal, 10 (2): 109–119.

Geringer, J. M., Tallman, S., & Olsen, D. M. 2000. Product and international diversification among Japanese multinational firms. Strategic Management Journal, 21 (1): 51–80.

Geyikdagi, Y. M., & Geyikdagi, N. V. 1989. International diversification in Latin America and the industrialized countries. Management International Review, 29 (3): 62–71.

Goerzen, A., & Beamish, P. W. 2003. Geographic scope and multinational enterprise performance. Strategic Management Journal, 24 (13): 1289–1306.

Gomes, L., & Ramaswamy, K. 1999. An empirical examination of the form of the relationship between multinationality and performance. Journal of International Business Studies, 30 (1): 173–188.

Grant, R. M. 1987. Multinationality and performance among British manufacturing companies 1972–84. Journal of International Business Studies, 18 (3): 79–89.

Grant, R. M., Jammine, A. P., & Thomas, H. 1988. Diversity, diversification, and profitability among British manufacturing companies 1972–84. Academy of Management Journal, 31 (4): 771–801.

Haar, J. 1989. A comparative analysis of the profitability performance of the largest US, European and Japanese multinational enterprises. Management International Review, 29 (3): 5–18.

Hausman, J. A. 1978. Specification tests in econometrics. Econometrica, 46 (6): 1251–1271.

Hill, C. W. L., & Jones, G. R. 1998. Strategic management: An integrated approach. Boston: Houghton Mifflin Company.

Hitt, M. A., Hoskisson, R. E., & Ireland, R. D. 1994. A mid-range theory of the interactive effects of international and product diversification on innovation and performance. Journal of Management, 20 (2): 297–326.

Hitt, M. A., Hoskisson, R. E., & Kim, H. 1997. International diversification: effects on innovation and firm performance in product-diversified firms. Academy of Management Journal, 40 (4): 767–798.

Hsiao, C. 2003. Analysis of panel data. Cambridge: Cambridge University Press.

Hu, L. 2002. Estimation of a censored dynamic panel data model. Econometrica, 70 (6): 2499–2517.

Hyndman, R. J., & Fan, Y. 1996. Sample quantiles in statistical packages. American Statistics, 50 (4): 361–365.

Ietto-Gillies, G. 1998. Different conceptual framework for the assessment of the degree of internationalization: An empirical analysis of various indices for the top 100 transnational corporations. Transnational Corporations, 7 (1): 17–39.

Jung, Y. 1991. Multinationality and profitability. Journal of Business Research, 23 (2): 179–187.

Kim, W. S., & Lyn, E. O. 1987. Foreign direct investment theories, entry barriers, and reverse investments in US manufacturing industries. Journal of International Business Studies, 18 (2): 53–67.

Kim, W. C., Hwang, P., & Burgers, W. P. 1989. Global diversification strategy and corporate profit performance. Strategic Management Journal, 10 (1): 45–57.

Kim, W. C., Hwang, P., & Burgers, W. P. 1993. Multinationals’ diversification and the risk-return tradeoff. Strategic Management Journal, 14 (4): 275–286.

Kimberly, J. R. 1976. Issues in the design of longitudinal organizational research. Sociological Methods and Research, 4 (3): 321–347.

Kogut, B., & Zander, U. 1993. Knowledge of the firm and the evolution theory of the multinational enterprise. Journal of International Business Studies, 24 (4): 625–646.

Kohers, T. 1975. The effect of multinational corporations on the cost of equity capital of US corporations. Management International Review, 15 (2–3): 121–124.

Kumar, M. S. 1984. Growth, acquisition and investment: An analysis of the growth of industrial firms and their overseas activities. Cambridge: Cambridge University Press.

Lu, J. W., & Beamish, P. 2004. International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal, 47 (4): 598–609.

Markides, C. C. 1995. Diversification, restructuring and economic performance. Strategic Management Journal, 16 (2): 101–118.

Markides, C. C., & Williamson, P. J. 1994. Related diversification, core competencies, and corporate performance. Strategic Management Journal, 15 (Special issue): 149–165.

Maxwell, S. E., & Delaney, H. D. 1990. Designing experiments and analyzing data. Belmont, CA: Wadsworth.

Michel, A., & Shaked, I. 1986. Multinational corporations vs domestic corporations: Financial performance and characteristics. Journal of International Business Studies, 17 (3): 89–101.

Miller, D., & Chen, M. -J. 1994. Sources and consequences of competitive inertia: A study of the US airline industry. Administrative Science Quarterly, 39 (1): 1–23.

Miller, J. C., & Pras, B. 1980. The effects of multinational and export diversification on the profit stability of US corporations. Southern Economic Journal, 46 (3): 792–805.

Mitchell, W., Roehl, T., & Slattery, R. J. 1995. Influences on R&D growth among Japanese pharmaceutical firms, 1975–1990. Journal of High Technology Management Research, 6 (1): 17–32.

Morck, R., & Yeung, B. 1991. Why investors value multinationality. Journal of Business, 64 (2): 165–187.

Palich, L. E., Cardinal, L. B., & Miller, C. C. 2000. Curvilinearity in the diversification–performance linkage: An examination of over three decades of research. Strategic Management Journal, 21 (2): 155–174.

Porter, M. E. 1990. The competitive advantage of nations. New York: Free Press.

Prahalad, C. K., & Hamel, G. 1990. The core competence of the corporation. Harvard Business Review, 68 (3): 79–91.

Qian, G. 1997. Assessing product–market diversification of US firms. Management International Review, 37 (2): 127–149.

Qian, G. 2000. Performance of US FDI in different world regions. Asia Pacific Journal of Management, 17 (1): 67–83.

Qian, G. 2002. Multinationality, product diversification, and profitability of emerging US small- and medium-sized enterprises. Journal of Business Venturing, 17 (6): 611–633.

Qian, G., & Li, J. 2002. Multinationality, global market diversification and profitability among the largest US firms. Journal of Business Research, 55 (4): 325–335.

Qian, G., Wang, D., Li, J., & Yang, L. 2000. US diversification in global markets: Strategic combinations and performance. Global Focus, 12 (3): 1–12.

Ramaswamy, K. 1995. Multinationality, configuration, and performance: A study of MNEs in the US drug and pharmaceutical sector. Journal of International Management, 1 (2): 231–253.

Riahi-Belkaoui, A. R. 1996. Internationalization, diversification strategy and ownership structure: Implications for French MNE performance. International Business Review, 5 (4): 367–376.

Riahi-Belkaoui, A. R. 1998. The effects of the degree of internationalization on firm performance. International Business Review, 7 (3): 315–321.

Rindfleisch, A., & Heide, J. 1997. Transaction cost analysis: Past, present and future applications. Journal of Marketing, 61 (4): 30–54.

Rugman, A. 2003. Regional strategy and the demise of globalization. Journal of International Management, 9 (4): 409–417.

Rugman, A. 2005. The regional multinationals. Cambridge: Cambridge University Press.

Rugman, A., & Verbeke, A. 2004. A perspective on regional and global strategies of multinational enterprises. Journal of International Business Studies, 35 (1): 3–18.

Ruigrok, W., & Wagner, H. 2003. Internationalization and performance: An organizational learning perspective. Management International Review, 43 (1): 63–83.

Sambharya, R. B. 1995. The combined effect of international diversification and product diversification strategies on the performance of US-based multinational corporations. Management International Review, 35 (3): 197–218.

Shaked, I. 1986. Are multinational corporations safer? Journal of International Business Studies, 17 (1): 75–80.

Siddharthan, N. S., & Lall, S. 1982. Recent growth of the largest US multinationals. Oxford Bulletin of Economics and Statistics, 44 (1): 1–13.

Solberg, C. A. 2000. Standardization or adaptation of the international marketing mix: The role of the local subsidiary/representative. Journal of International Marketing, 8 (1): 78–98.

Stopford, J., & Wells, L. 1972. Managing the multinational enterprise. New York: Basic Books.

Sullivan, D. 1994. Measuring the degree of internationalization of a firm. Journal of International Business Studies, 24 (2): 325–342.

Tallman, S. B., & Li, J. 1996. Effects of international diversity and product diversity on the performance of multinational firms. Academy of Management Journal, 39 (1): 179–196.

Thomas, D. E., & Eden, L. 2004. What is the shape of the multinationality–performance relationship? Multinational Business Review, 12 (1): 89–110.

UNCTAD 1995. World investment report 1995: Transnational corporations and competitiveness. New York and Geneva: United Nations.

Vernon, R. 1971. Sovereignty at bay: The multinational spread of US enterprises. New York: Basic Books.

Wilcox, R. R. 1987. New designs in analysis of variance. Annual Review of Psychology, 38: 29–60.

World Bank 1995. World development report: Workers in a dynamic world: transforming institutions, growth, and quality of life. New York: Oxford University Press.

World Bank 2002. World development report: Building incentives for markets. New York: Oxford University Press.

Zaheer, S. 1995. Overcoming the liability of foreignness. Academy of Management Journal, 38 (2): 341–363.

Author information

Authors and Affiliations

Corresponding author

Additional information

Accepted by Nicolai Juul Foss, Departmental Editor, and Arie Y Lewin, Editor-in-Chief, 23 August 2007. This paper has been with the authors for two revisions.

Rights and permissions

About this article

Cite this article

Qian, G., Li, L., Li, J. et al. Regional diversification and firm performance. J Int Bus Stud 39, 197–214 (2008). https://doi.org/10.1057/palgrave.jibs.8400346

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jibs.8400346