Abstract

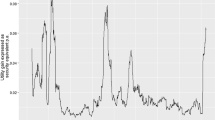

Multi-manager concepts are popular among institutional investors as they promise to deliver a better risk-adjusted performance than a single manager, thanks to diversification. A new measure of diversification, the diversification ratio, is introduced, which complements the usually used correlation coefficient. The diversification ratio provides information on the persistence of diversification and enables the investor to evaluate the potential diversification two managers with given skills may possibly provide.

Similar content being viewed by others

Notes

The hit ratio is defined as the percentage number of periods a manager yields a positive outperformance.

With bivariate normally distributed outperformances, the relationship between the diversification ratio and the central correlation coefficient is also easily obtained. Lee (2000) shows the relationship between the hit and information ratio for normally distributed returns; the relationship between the diversification ratio and the correlation coefficient is given in an analogous way.

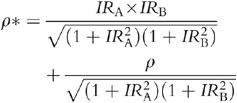

The noncentral correlation coefficient could be used instead. It is centred around zero outperformance and can be conveniently computed from the usual central correlation coefficient ρ and the information ratios IRA und IRB of the two involved managers:

The usefulness of noncentral moments has been demonstrated in another context by Ammann et al. (2006).

References

Ammann, M., Kessler, S. and Tobler, J. (2006) ‘Analyzing Active Investment Strategies’, Journal of Portfolio Management, 33, 56–67.

Constable, N. and Armitage, J. (2006) ‘Information Ratios and Batting Averages’, Financial Analysts Journal, 62 (3), 24–31.

Lee, W. (2000) Theory and Methodology of Tactical Asset Allocation, Frank J. Fabozzi Associates, New Hope.

Acknowledgements

The views expressed in this paper are those of the author and may not be shared by the City of Zurich Pension Fund. An earlier version of the paper was presented at the 10th Conference of the Swiss Society for Financial Market Research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tobler-Oswald, J. How well can multi-manager funds diversify?. J Asset Manag 9, 61–66 (2008). https://doi.org/10.1057/jam.2008.4

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2008.4