Abstract

We propose a stochastic model allowing property and casualty insurers with multiple business lines to measure their liabilities for incurred claims risk and calculate associated capital requirements. Our model includes many desirable features which enable reproducing empirical properties of loss ratio dynamics. For instance, our model integrates a double generalized linear model relying on accident semester and development lag effects to represent both the mean and dispersion of loss ratio distributions, an autocorrelation structure between loss ratios of the various development lags, and a copula-based aggregation of risks model driving the dependence across the various business lines. Our work is the first in the literature to combine all such advantageous features within a loss triangle model. The model allows for a joint simulation of loss triangles and the quantification of the overall portfolio risk through risk measures. Consequently, a diversification benefit associated with the economic capital requirements can be measured, in accordance with IFRS 17 standards which allow for the recognition of such benefit. The allocation of capital across business lines based on the Euler allocation principle is then illustrated. The implementation of our model is performed by estimating its parameters based on a car insurance data obtained from the General Insurance Statistical Agency (GISA), and by conducting numerical simulations whose results are then presented.

Similar content being viewed by others

Notes

The IASB had originally proposed the implementation of IFRS 17 to be effective in 2021, but it has been delayed following public consultation.

We emphasize that the methodology developed in the current paper is not limited to the GISA dataset; it could also be applied to alternative insurance datasets, such as the Schedule P of the National Association of Insurance Commissioners (NAIC) for US companies.

Atlantic Canada is made up of four provinces: Prince Edward Island, New Brunswick, Nova Scotia and Newfoundland and Labrador.

The development lag is the number of semesters between the occurrence of an accident and the date at which the payment is made.

The approximation of the scaled observations \({\tilde{Y}}^{(k)}_{i,j}\) distributions by a normal one is deemed viable in the current study: estimated dispersion parameters \(\phi^{(k)}_{i,j}\) obtained through the estimation procedure described subsequently are sufficiently small to consider the asymptotic regime \(\phi \rightarrow 0\) as being a reasonable approximation. For the data considered in the current study, for all i, j, k, \(\phi ^{(k)}_{i,j}\) falls within the interval \((3.9\times 10^{-7}, 9.5\times 10^{-2})\).

Note that such definition of the weight matrix W disregards the presence of correlation between observations across development lags. The framework of Smyth and Jørgensen [35] was developed under the assumption of independent observations. We leave the consideration of the correlation in this step as a future refinement to our model.

The order of indices (i, j) put into the diagonal of the matrix are respectively (1, 1), \((1,2), \ldots , (1,J), (2,1), (2,2), \ldots \).

In Côté [9] it is pointed out that the empirical distribution functions of the marginals and the copula converge asymptotically to the true distributions. Thus, a larger sample size m provides a better sample more consistent with the hierarchical aggregation of risks dependence structure.

References

Abdallah A, Boucher JP, Cossette H (2015) Modeling dependence between loss triangles with hierarchical Archimedean copulas. ASTIN Bull 45(3):1–23

Acerbi C, Tasche D (2002) On the coherence of expected shortfall. J Bank Financ 26(7):1487–1503

Andersen DA, Bonat WH (2017) Double generalized linear compound Poisson models to insurance claims data. Electron J Appl Stat Anal 10(2):384–407

Arbenz P, Hummel C, Mainik G (2012) Copula based hierarchical risk aggregation through sample reordering. Insur Math Econ 51:122–133

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coherent measures of risk. Math Financ 9(3):203–228

Avanzi B, Taylor G, Vu PA, Wong B (2016) Stochastic loss reserving with dependence: a flexible multivariate tweedie approach. Insur Math Econ 71:63–78

Boucher JP, Davidov D (2011) On the importance of dispersion modeling for claims reserving: an application with the Tweedie distribution. Casual Actuarial Soc 5(2):158–172

Burgi R, Dacorogna M, Iles R (2008) Risk aggregation, dependence structure and diversification benefit. Stress testing for financial institutions. http://ssrn.com/abstract=1468526

Côté MP (2014) Copula-based risk aggregation modelling. Master’s thesis, McGill University, Quebec, Canada

Côté MP, Genest C, Abdallah A (2016) Rank-based methods for modeling dependence between loss triangles. Eur Actuar J 6(2):377–408

Cox D, Reid N (1987) Parameter orthogonality and approximate conditional inference. R Stat Soc 49(1):1–39

Denuit M, Trufin J (2017) Beyond the Tweedie reserving model: the collective approach to loss development. N Am Actuar J 21(4):611–619

Dunn PK, Smyth GK (2004) Series evaluation of Tweedie exponential dispersion model densities. Stat Comput 15(4):267–280

Genest C, Rémillard B (2008) Validity of the parametric bootstrap for goodness-of-fit testing in semiparametric models. Ann Inst Henri Poincaré 44(6):1096–1127

Genest C, Werker BJ (2002) Conditions for the asymptotic semiparametric efficiency of an omnibus estimator of dependence parameters in copula models. Distributions with given marginals and statistical modelling. Springer, Berlin, pp 103–112

Hardin JW, Hilbe JM (2013) Generalized estimating equations. Chapman and Hall, New York

Hudecová S, Pešta M (2013) Modeling dependencies in claims reserving with gee. Insur Math Econ 53:786–794

IAA (2018) Risk adjustments for insurance contracts under IFRS 17. Canada

IASB (2017) IFRS 17 insurance contracts. IFRS Foundation. https://bit.ly/2X1XFGo

Iman RL, Conover WJ (1982) A distribution-free approach to inducing rank correlation among input variables. Commun Stat Simul Comput 11(3):311–334

Joe H (2005) Asymptotic efficiency of the two-stage estimation method for copula-based models. J Multivar Anal 94:401–419

Jørgensen B (1997) The theory of dispersion models. CRC Press, Boca Raton

Lee Y, Nelder J (1998) Generalized linear models for the analysis of quality-improvement experiments. Can J Stat 26(1):95–105

Liang KY, Zeger SL (1986) Longitudinal data analysis using generalized linear models. Biometrika 73(1):13–22

McNeil AJ, Frey R, Embrechts P (2005) Quantitative risk management: concepts, techniques and tools. Princeton University Press, New Jersey

OSFI (2019) Minimum capital test for federally regulated property and casualty insurance companies. Canada. http://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/mct2019.aspx

Quijano Xacur OA (2011) Property and casualty premiums based on tweedie families of generalized linear models. Master’s thesis, Concordia University, Quebec, Canada

Rémillard B (2013) Statistical methods for financial engineering. CRC Press, Boca Raton

Rémillard B, Scaillet O (2009) Testing for equality between two copulas. J Multivar Anal 100:377–386

Shi P (2016) Insurance ratemaking using a copula-based multivariate Tweedie model. Scand Actuar J 3:198–215

Shi P, Frees EW (2011) Dependent loss reserving using copulas. ASTIN Bull 41(2):449–486

Shi P, Feng X, Boucher JP (2016) Multilevel modeling of insurance claims using copulas. Ann Appl Stat 10(2):834–863

Smolárová T (2017) Tweedie models for pricing and reserving. Master’s thesis, Charles University, Prague, Czech Republic

Smyth GK (1989) Generalized linear models with varying dispersion. J R Stat Soc 51(1):47–60

Smyth GK, Jørgensen B (2002) Fitting Tweedie’s compound Poisson model to insurance claims data: dispersion modelling. ASTIN Bull 32(1):143–157

Tasche D (1999) Risk contributions and performance measurement

Acknowledgements

The authors gratefully acknowledge the financial support from NSERC (Godin: RGPIN-2017-06837, Mailhot: RGPIN-2015-05447) and MITACS (Araiza Iturria, Godin and Mailhot: IT12099). We also thank the three anonymous referees and the editor who allowed us to significantly improve the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

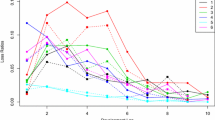

Appendix 1: Parameter estimates for marginal business lines

Estimated parameters for the accident semester and development lag effects which are denoted AS and DL, respectively. Furthermore, the lines of business are Personal Auto (PA) and Commercial Auto (CA) for the three regions of Ontario (ON), Alberta (AB) and Atlantic Canada (ATL) (Tables 5, 6, 7, 8, 9).

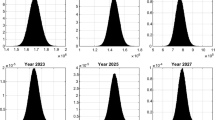

Appendix 2: Selection of the Tweedie index

Estimating the Tweedie index \(p_k\) is not a trivial endeavour, and therefore a procedure inspired from Dunn and Smyth [13] is considered in the current work. A set of fixed values of \(p_k\), namely \(p_k=\{1.105,1.110,1.115,\ldots ,1.900\}\), is considered. For each of these values, DGLM parameters \(\Theta ^{(\mu )}_k\) and \(\Theta ^{(\phi )}_k\) are estimated through maximum likelihood while assuming a null development lag correlation i.e. \(\rho _k=0\), the latter assumption considerably simplifying the estimation. The value of \(p_k\) for which the loglikelihood is maximized is the value selected as the parameter estimate.

Recall that values of \(p_k\) must lie in the (1, 2) interval. However, for stability considerations, values below 1.1 are not considered since values very close to 1 tend to make the distribution multimodal; this complicates the estimation procedure and creates convergence issues. Moreover, values close to 2 were also disregarded for numerical considerations; when \(p_k\) is close to 2, the infinite sum approximation embedded in the Tweedie distribution includes a large number of terms that are materially different from zero, which makes computations more cumbersome.

Appendix 3: Goodness-of-fit for parametric copulas

To select appropriate bivariate copula families within the global dependence structure, a Crámer–Von Mises test applicable to copula families is used. Its test statistic is defined as

where \(C_n\) is the empirical copula, \(\bf{u}=(u_1,u_2) \,{\text{for}}\,\text{all}\, \bf{u} \in [0,1]^2\) \(C_{\theta _n}\) is the parametric copula and \(\theta _n\) is its rank-based estimated parameter. The null hypothesis of the test is \(H_0: C \in C_{\theta }\), i.e., the copula C is a member of the parametric family \(C_{\theta }\). p values from the Cramér–Von Mises test are obtained by parametric bootstrapping according to the methodology proposed in Genest and Rémillard [14].

Table 10 presents the test statistic \(S_n\), the estimated dependence parameter \(\theta _n\) and the p value for the various combinations of business lines subgroups which exhibit statistical evidence of dependence. The Cramér–Von Mises test is applied to six different copula families: Clayton, Gumbel, Frank, Plackett, Gaussian and student-t. The first three are Archimedean copulas, the Plackett copula only exists in a bivariate setting and the Gaussian and t-copula are elliptical copulas. The t-copula family is retained due to its higher associated test statistics \(S_n\) for all aggregation steps, except for the aggregation of Alberta and Atlantic Canada where it is the second best. It is nevertheless relevant to note that except for the Clayton family, other copulas are never rejected by the test at a \(90\%\) confidence level. Other copula families could therefore also have been adequate choices.

Appendix 4: The Iman–Conover procedure

Figure 2 provides an illustration of the modeled dependence structure of the GISA dataset lines of business, which is based on a hierarchical aggregation of risks model. The Iman–Conover reordering algorithm used to simulate from the dependence structure goes as follows:

-

1.

Simulate k independent samples of size \(m>>N\)Footnote 8 composed of independent standard normal random variables:

$$\begin{aligned} {\mathbf {U}}^{(k)} \sim N(0,1), \quad k=\{1,2,3,4,5,6\}. \end{aligned}$$ -

2.

Simulate independent copula samples of size m from each bivariate copula \(C_1,\ldots ,C_5\).

-

3.

Reorder the samples of each bivariate vector by merging the observed marginal ranks with the joint ranks in the copula sample (Table 11). A brief example follows for the first node of the dependence structure.

Then, the reordered data is a sample from the copula \(\left( {\mathbf {U}}^{(1)},{\mathbf {U}}^{(2)}\right) \sim C_1\).

-

4.

Repeat step 3 for the first level copulas \(C_2\) and \(C_3\).

-

5.

Aggregate the reordered data following the dependence structure to obtain samples from \({\mathbf {U}}^{(1)}+{\mathbf {U}}^{(2)}\) and respectively for \({\mathbf {U}}^{(3)}+{\mathbf {U}}^{(4)}\) and \({\mathbf {U}}^{(5)}+{\mathbf {U}}^{(6)}\).

-

6.

Repeat step 3 to obtain sample from \(\left( {\mathbf {U}}^{(3)}+{\mathbf {U}}^{(4)},{\mathbf {U}}^{(5)}+{\mathbf {U}}^{(6)}\right) \sim C_4\).

-

7.

Aggregate the reordered sample from \(C_4\) to obtain a sample from \({{\sum}_{k=3}^{6}{\mathbf{U}}^{(k)}}\), and repeat step 3 for \({\left({\mathbf{U}}^{(1)}+{\mathbf{U}}^{(2)},{\sum}_{k=3}^{6}{\mathbf{U}}^{(k)}\right)\sim C_5}\).

-

8.

To obtain a joint sample of \(\left( {\mathbf {U}}^{(1)}, {\mathbf {U}}^{(2)}, {\mathbf {U}}^{(3)}, {\mathbf {U}}^{(4)}, {\mathbf {U}}^{(5)}, {\mathbf {U}}^{(6)}\right) \), perform the permutations applied to \({\mathbf {U}}^{(1)}+{\mathbf {U}}^{(2)}\) back to \({\mathbf {U}}^{(1)}\) and \({\mathbf {U}}^{(2)}\), the permutations applied to \({\mathbf {U}}^{(3)}+{\mathbf {U}}^{(4)}\) back to \({\mathbf {U}}^{(3)}\) and \({\mathbf {U}}^{(4)}\), and finally, the permutations applied to \({\mathbf {U}}^{(5)}+{\mathbf {U}}^{(6)}\) back to \({\mathbf {U}}^{(5)}\) and \({\mathbf {U}}^{(6)}\).

-

9.

Get a subsample of size N from the reordered sample of size m.

Appendix 5: The conditional distribution of simulated scaled observations

The assumption made in the current paper’s model based on (3) is that for a given accident semester i and business line k, the scaled observations vector \(\tilde{{\mathbf {Y}}}^{(k)}_i\) are approximately multivariate normal with a null mean vector and covariance matrix \(R_{k,J}\) as defined in (4).

A classic result on multivariate normal distributions is first recalled. Consider a multivariate normal random column vector \(\mathbf{X }\) which is decomposed into two blocks (i.e. two stacked random vectors): \(\mathbf{X } = [(\mathbf{X }^{(1)})^\top \,\, (\mathbf{X }^{(2)})^\top ]^\top \). Denote respectively the mean vector and covariance matrix of the entire vector \(\mathbf{X }\) and of each of the two blocks \(\mathbf{X }^{(1)}\) and \(\mathbf{X }^{(2)}\) by

Then, the conditional distribution of \(\mathbf{X }^{(2)}\) given \(\mathbf{X }^{(1)}\) is multivariate normal with mean \(\pmb {\mu }^{(2)} + \Sigma ^{(2,1)} \left[ \Sigma ^{(1,1)}\right] ^{-1} \left( \mathbf{X }^{(1)}-\pmb {\mu }^{(1)}\right) \) and variance \(\Sigma ^{(2,2)} - \Sigma ^{(2,1)} \left[ \Sigma ^{(1,1)}\right] ^{-1} \Sigma ^{(1,2)}\).

We can decompose the scaled innovation vector \(\tilde{{\mathbf {Y}}}^{(k)}_i\) into two blocks: the unobserved one \(\mathbf{X }^{(1)} = \tilde{{\mathbf {Y}}}^{(k)}_{i,J+2-i:J} \equiv [Y^{(k)}_{i,J+2-i} , \ldots , Y^{(k)}_{i,J}]^\top \) and the observed one \(\mathbf{X }^{(2)} = \tilde{{\mathbf {Y}}}^{(k)}_{i,1:J+1-i} \equiv [Y^{(k)}_{i,1} , \ldots , Y^{(k)}_{i,J+1-i}]^\top \). In other words,

Since, the covariance matrix of \(\tilde{{\mathbf {Y}}}^{(k)}_i\) can be decomposed as

with

Setting \(\pmb {\mu } = \pmb {0}\) in the previous result along with \(\Sigma ^{(1,1)} = R_{k,J+1-i}\), \(\Sigma ^{(2,2)} = R_{k,i-1}\) and \(\Sigma ^{(1,2)} = R^{(1,2)}_{k,i}\) leads to approximate the conditional distribution of unobserved scaled observations \(\tilde{{\mathbf {Y}}}^{(k)}_{i,J+2-i:J}\) given observed ones \(\tilde{{\mathbf {Y}}}^{(k)}_{i,1:J+1-i}\) by a multivariate normal with mean vector and covariance matrix being respectively:

Appendix 6: Capital requirements based on alternative copulas

Tables 12 and 13 present values for the economic capital and the risk adjustment for non-financial risks under various choices of parametric copulas in the global dependence structure depicted by Fig. 3. The first row (t) provides the results using the t-copula structure exactly as obtained in Sect. 5.1.2. The second row (Gaussian) and third row (Independence) respectively present the results obtained when replacing the t-copulas with either Gaussian copulas or the independence copula.

As expected, the risk adjustment is lower when using the independence copula rather than the elliptical copulas. Furthermore, the t-copula structure is slightly more conservative due to its heavy dependence in the tails. The difference between results stemming from the three choices of copula families is nevertheless small. This is mainly due to two reasons. First, the exposure is heavily skewed towards the Ontario personal auto branch in the GISA dataset of the current study, which limits the impact of the dependence model. Second, in our framework, the data contains industry aggregates rather than company-specific losses, which lead to small variability due to the law of large numbers.

Rights and permissions

About this article

Cite this article

Araiza Iturria, C.A., Godin, F. & Mailhot, M. Tweedie double GLM loss triangles with dependence within and across business lines. Eur. Actuar. J. 11, 619–653 (2021). https://doi.org/10.1007/s13385-021-00267-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-021-00267-0