Abstract

We examine whether third-party endorsement and institutional trust can mitigate the potential negative effects of higher levels of executive compensation on the likelihood of future donations to a nonprofit organization. Using an experimental design, we find support for prior expectations that paying higher executive compensation reduces the likelihood of future individual donations. We also find that this negative effect is only significant in the absence of a third-party endorsement so that individual donations significantly decrease when the nonprofit pay is high relative to moderate executive compensation levels. Finally, the likelihood of future individual donations is higher when institutional trust is high. However, high institutional trust does not validate the payment of higher levels of executive compensation. Our results have theoretical and practical implications by showing that nonprofits are better off paying moderate executive compensation levels but not paying too much if they have not attracted respectable third-party endorsers.

Similar content being viewed by others

Notes

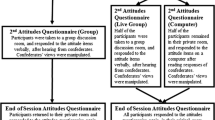

We informed the participants that they would receive an endowment of $10 (Brazilian currency) in cash for their participation in the study. Further, we informed them that over the course of the experiment, they could choose one of three alternatives: (1) keep the total amount received, (2) donate the total amount to the nonprofit organization described in the study, or (3) donate a partial amount to the nonprofit organization and keep the difference. The participants decided to donate a total amount of $1,259.90 in Brazilian currency, which we deposited in the nonprofit’s bank account. The participants could have access to the deposit receipt to confirm that the total amount collected during the experimental sessions had been donated to the organization.

We also asked the participants to indicate the percentage of their last-year income donated to nonprofits, according to their tax-return file. We use this information to capture the participants’ prior experience with donations.

Only one participant (0.7%) reported that he/she knew the organization (AFECE). Our main results remained the same after we excluded this participant. We then opted to keep the participant.

A total of 122 (87.1%) participants donated the total amount; six (4.3%) donated half of the amount; 11 (7.9%) participants kept the total amount; and one participant donated $0.1 (in Brazilian currency) of his/her endowment. Given the low level of variation in this variable, we decided not include it in our main analyses and will not refer to this variable again in the sequence of our discussion. We speculate that most of the participants donated the total amount of their endowment following the rule of reciprocity (Alpizar et al. 2005); that is, they reciprocated with the researchers for the endowment they were not actually expecting to receive by donating a high amount to the nonprofit organization.

Three participants indicated that neither did they remember the executive compensation nor did they pay attention to this information. Two participants were in the high level of executive compensation/absence of information about third-party endorsement, while the third one was in the low level of executive compensation/absence of information about third-party endorsement. The results did not substantially differ when we excluded the three participants who failed in the manipulation check of level of compensation. We report all the results, including the totality of our participants.

References

Agrawal, J., & Kamakura, W. A. (1995). The economic worth of celebrity endorsers: An event study analysis. The Journal of Marketing, 59(3), 56–62.

Alpizar, F., Carlsson, F., & Johansson-Stenman, O. (2005). How much do we care about absolute versus relative income and consumption? Journal of Economic Behavior e Organization, 56(3), 405–421.

Andreasen, A. R., & Kotler, P. (2013). Strategic marketing for nonprofit organizations. Upper Saddle River: Pearson Education Limited.

Balsam, S., & Harris, E. E. (2014). The impact of CEO compensation on nonprofit donations. The Accounting Review, 89(2), 425–450.

Becker, A. (2018). An experimental study of voluntary nonprofit accountability and effects on public trust, reputation, perceived quality, and donation behavior. Nonprofit and Voluntary Sector Quarterly, 47(3), 562–582.

Bekkers, R. (2003). Trust, accreditation, and philanthropy in the Netherlands. Nonprofit and Voluntary Sector Quarterly, 32(4), 596–615.

Bekkers, R., & Wiepking, P. (2011). A literature review of empirical studies of philanthropy: Eight mechanisms that drive charitable giving. Nonprofit and Voluntary Sector Quarterly, 40(5), 924–973.

Brower, H. H., Lester, S. W., Korsgaard, M. A., & Dineen, B. R. (2009). A closer look at trust between managers and subordinates: Understanding the effects of both trusting and being trusted on subordinate outcomes. Journal of Management, 35(2), 327–347.

Das, T. K., & Teng, B. S. (1998). Between trust and control: Developing confidence in partner cooperation in alliances. Academy of Management Review, 23(3), 491–512.

Dean, D. H., & Biswas, A. (2001). Third-party organization endorsement of products: an advertising cue affecting consumer prepurchase evaluation of goods and services. Journal of Advertising, 30(4), 41–57.

Dirks, K. T., & Ferrin, D. L. (2001). The role of trust in organizational settings. Organization Science, 12(4), 450–467.

Dolnicar, S., & Lazarevski, K. (2009). Marketing in non-profit organizations: an international perspective. International Marketing Review, 26(3), 275–291.

Doney, P. M., & Cannon, J. P. (1997). An examination of the nature of trust in buyer–seller relationships. The Journal of Marketing, 61(2), 35–51.

Erdogan, B. Z. (1999). Celebrity endorsement: A literature review. Journal of Marketing Management, 15(4), 291–314.

Frumkin, P., & Keating, E. K. (2010). The price of doing good: Executive compensation in nonprofit organizations. Policy and Society, 29(3), 269–282.

Frumkin, P., & Kim, M. T. (2001). Strategic positioning and the financing of nonprofit organizations: Is efficiency rewarded in the contributions marketplace? Public Administration Review, 61(3), 266–275.

Galler, B., & Walker, D. I. (2016). Donor reaction to salient disclosures of nonprofit executive pay: A regression-discontinuity approach. Nonprofit and Voluntary Sector Quarterly, 45(4), 787–805.

Handy, F. (2000). How we beg: The analysis of direct mail appeals. Nonprofit and Voluntary Sector Quarterly, 29(3), 439–454.

Hansmann, H. B. (1980). The role of nonprofit enterprise. The Yale Law Journal, 89(5), 835–901.

Hansmann, H. B. (1987). The effect of tax exemption and other factors on the market share of nonprofit versus for-profit firms. National Tax Journal, 40(1), 71–82.

Harris, E. E., & Ruth, J. A. (2015). Analysis of the value of celebrity affiliation to nonprofit contributions. Nonprofit and Voluntary Sector Quarterly, 44(5), 945–967.

King, C., & Lewis, G. B. (2017). Nonprofit pay in a competitive market: Wage penalty or premium? Nonprofit and Voluntary Sector Quarterly, 46(5), 1073–1091.

Lee, S. P., & Babiak, K. (2017). Measured societal value and its impact on donations and perception of corporate social responsibility: An experimental approach. Nonprofit and Voluntary Sector Quarterly, 46(5), 1030–1051.

Li, W., McDowell, E., & Hu, M. (2012). Effects of financial efficiency and choice to restrict contributions on individual donations. Accounting Horizons, 26(1), 111–123.

Oster, S. M. (1998). Executive compensation in the nonprofit sector. Nonprofit Management e Leadership, 8(3), 207–221.

Rose-Ackerman, S. (1996). Altruism, nonprofits, and economic theory. Journal of Economic Literature, 34(2), 701–728.

Sargeant, A., Ford, J. B., & West, D. C. (2006). Perceptual determinants of nonprofit giving behavior. Journal of Business Research, 59(2), 155–165.

Sargeant, A., & Lee, S. (2002). Improving public trust in the voluntary sector: An empirical analysis. International Journal of Nonprofit and Voluntary Sector Marketing, 7(1), 68–83.

Sargeant, A., & Lee, S. (2004). Donor trust and relationship commitment in the UK charity sector: The impact on behavior. Nonprofit and Voluntary Sector Quarterly, 33(2), 185–202.

Saxton, G. D., & Guo, C. (2011). Accountability online: Understanding the web-based accountability practices of nonprofit organizations. Nonprofit and Voluntary Sector Quarterly, 40(2), 270–295.

Saxton, G. D., Kuo, J. S., & Ho, Y. C. (2012). The determinants of voluntary financial disclosure by nonprofit organizations. Nonprofit and Voluntary Sector Quarterly, 41(6), 1051–1071.

Schouten, A. P., Janssen, L., & Verspaget, M. (2019). Celebrity versus influencer endorsements in advertising: The role of identification, credibility, and product-endorser fit. International Journal of Advertising, 39(2), 1–24.

Spry, A., Pappu, R., & Bettina Cornwell, T. (2011). Celebrity endorsement, brand credibility and brand equity. European Journal of Marketing, 45(6), 882–909.

Taniguchi, H., & Marshall, G. A. (2014). The effects of social trust and institutional trust on formal volunteering and charitable giving in Japan. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 25(1), 150–175.

Thornton, J. (2006). Nonprofit fund-raising in competitive donor markets. Nonprofit and Voluntary Sector Quarterly, 35(2), 204–224.

Trussel, J. M., & Parsons, L. M. (2007). Financial reporting factors affecting donations to charitable organizations. Advances in Accounting, 23, 263–285.

Valentinov, V. (2008). The economics of the non-distribution constraint: A critical reappraisal. Annals of Public and Cooperative Economics, 79(1), 35–52.

Wheeler, R. T. (2009). Nonprofit advertising: Impact of celebrity connection, involvement and gender on source credibility and intention to volunteer time or donate money. Journal of Nonprofit e Public Sector Marketing, 21(1), 80–107.

Yan, W., & Sloan, M. F. (2016). The impact of employee compensation and financial performance on nonprofit organization donations. The American Review of Public Administration, 46(2), 243–258.

Funding

Funding was provided by Coordenação de Aperfeiçoamento de Pessoal de Nível Superior.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

de Azevedo, S.U., Braga de Aguiar, A. Paying Enough but not Paying too Much When There is no Third-Party Endorsement: Executive Compensation and Individual Donations for Nonprofit Organizations. Voluntas 32, 477–487 (2021). https://doi.org/10.1007/s11266-020-00225-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11266-020-00225-6