Abstract

A moderately risk averse person may turn down a 50/50 gamble that either results in her winning $200 or losing $100. Such behaviour seems rational if, for instance, the pain of losing $100 is felt more strongly than the joy of winning $200. The aim of this paper is to examine an influential argument that some have interpreted as showing that such moderate risk aversion is irrational. After presenting an axiomatic argument that I take to be the strongest case for the claim that moderate risk aversion is irrational, I show that it essentially depends on an assumption that those who think that risk aversion can be rational should be skeptical of. Hence, I conclude that risk aversion need not be irrational.

Similar content being viewed by others

Notes

In what follows, I will stick to the convention of calling a person who turns down a bet with a positive monetary expectation risk averse w.r.t. money (in the relevant interval). Such betting behaviour can be caused either by money having decreasing marginal utility for the person or by attitudes to risks and chances that are independent of attitudes to quantities of money (Stefánsson and Bradley 2018). Although some (e.g. Hansson 1988) would argue that the behaviour should only be called ‘risk averse’ when it is caused by the second type of attitude mentioned above, I will, for the sake of simplicity, call any person who turns down a bet with a positive monetary expectation risk averse w.r.t. money.

From now on, whenever I talk about packages of bets, I will assume that they consist of finite numbers of bets.

This assumption is reasonable if we assume thorough quality control, in which case a computer braking down could be treated as a random event.

As a referee correctly points out, it is not clear whether Samuelson (1963) was concerned with showing that turning down the single bet while accepting the package would be irrational. Rather, he seems to have been more concerned with showing that such behaviour would be inconsistent with expected utility maximisation. Nevertheless, for the sake of simplicity, and since Samuelson did endorse expected utility theory in some of his writings, I will occasionally refer to the claim in question as “Samuelson’s claim”.

It should be noted that this is not how Samuelson himself interpreted his result.

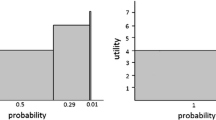

In what follows, a ‘coin-toss-bet’ is a bet that pays bettors $200 if their chosen side of a coin comes up on a particular toss but has them paying $100 otherwise.

Strictly speaking, the argument only requires the assumption that SC would turn down the single bet for any level of wealth in the range that the first 99 bets could result in. Hence, when this assumption is formalised, as Assumption 1 in the axiomatic argument presented in Sect. 3, the stated range is from a loss of $9900 to a gain of $19,800.

You can test this assumption on yourself, assuming that you share SC’s preference against the single bet but for the package, by considering whether your preference would change if you had, for instance, paid $10,000 less or $20,000 more off your mortgage, car loan or student loan.

That is, as a function of terminal wealth, in this case (or more generally as a function of terminal outcomes), rather than, say, as a function of changes in wealth.

It should be noted, however, that Thoma (forthcoming) argues that most alternatives to expected utility theory will also have great trouble accommodating SC’s preferences, for reasons that I shall briefly discuss in the concluding section.

Moreover, there are reasons for rejecting Dominance that have nothing to do with risk aversion, as a referee points out; in particular, as Dietrich and List (2005) show, the so-called Two Envelope Paradox calls the principle into question, as a general requirement of rationality.

Recall that by ‘bet’ I simply mean a risky prospect that will turn out favourably to the decision-maker in some event but unfavourably otherwise.

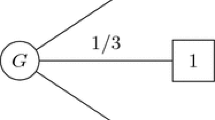

Here is a simple demonstration. First a formal statement of the Sure Thing Principle. Suppose we have four prospects, call them f, g, \(f'\) and \(g'\), let f(E) denote the outcome received when f is chosen in event E, and suppose: \(f(\lnot E)=g(\lnot E)\), \(f'(\lnot E)=g'(\lnot E)\), \(f(E)=f'(E)\), \(g(E)=g'(E)\). Then the STP says that: \(f\precsim g\Leftrightarrow f'\precsim g'\).

To derive the STP from EWD, suppose first that \(f\precsim g\). Now by reflexivity of the indifference relation over outcomes, we have \(f(\lnot E)\sim g(\lnot E)\), \(f'(\lnot E)\sim g'(\lnot E)\), \(f(E)\sim f'(E)\), \(g(E)\sim g'(E)\). By completeness of the conditional preference relation, we have either \(f(E)\precsim g(E)\) or \(g(E)\precsim f(E)\) (or both). Now by EWD, at least the first of these must hold, because otherwise we would have \(g\prec f\). But then \(f'(E)\precsim g'(E)\), which by EWD entails \(f'\precsim g'\). Assuming \(f'\precsim g'\) would have allowed us to derive \(f\precsim g\) in a similar manner. Hence, EWD and completeness of the conditional preference relation entail the STP.

Critics of expected utility theory are faced with well-known dynamic arguments in favour of the theory theory, that can in fact be formulated as arguments in favour of Event-Wise Dominance. For a detailed discussion of ways in which those who are critical of expected utility theory can respond to these arguments, see McClennen (1990).

Another related way in which a person might be risk averse, is if she, in addition to caring about the expected values of prospects, also cares about the dispersion in the monetary values of the possible outcomes (McClennen 1990). Again, such a person might prefer B to A conditional on E (since the former has minimal dispersion but the latter has quite a lot), but would be indifferent between the two bets conditional on \(\lnot E\); but nevertheless prefer A to B unconditionally, since both bets have quite a lot of dispersion, but the former has a considerably higher monetary expectation.

References

Allais, M. (1953). Le comportement de l’homme rationnel devant le risque: Critique des postulats et axiomesde l’ecole Americaine. Econometrica, 21(4), 503–546.

Aloysius, J. A. (2007). Decision making in the short and long run: Repeated gambles and rationality. British Journal of Mathematical and Statistical Psychology, 60(1), 61–69.

Benartzi, S., & Thaler, R. H. (1999). Risk aversion or myopia? Choices in repeated gambles and retirement investments. Management Science, 45(3), 364–381.

Bradley, R., & Stefánsson, H. O. (2017). Counterfactual desirability. British Journal for the Philosophy of Science, 68(2), 485–533.

Buchak, L. (2013). Risk and rationality. Oxford: Oxford University Press.

Dietrich, F., & List, C. (2005). The two-envelope paradox: An axiomatic approach. Mind, 114(454), 239–248.

Hansson, B. (1988). Risk aversion as a problem of conjoint measurement. In P. Gärdenfors & N.-E. Sahlin (Eds.), Decision, probability and utility (pp. 136–158). Cambridge: Cambridge University Press.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Kahneman, D. (2012). Thinking, fast and slow. London: Penguin Books.

Lopes, L. A. (1996). When time is of the essence: Averaging, aspiration, and the short run. Organizational Behavior and Human Decision Processes, 65(3), 179–189.

McClennen, E. F. (1990). Rationality and dynamic choice: Foundational explorations. Cambridge: Cambridge University Press.

Rabin, M. (2000). Diminishing marginal utility of wealth cannot explain risk aversion. In D. Kahneman & A. Tversky (Eds.), Choices, values and frames (pp. 202–208). Cambridge: Cambridge University Press.

Samuelson, P. (1963). Risk and uncertainty: A fallacy of large numbers. Scientia, 98, 108–113.

Savage, L. (1954). The foundations of statistics. Hoboken: Wiley.

Stefánsson, H. O. (2016). Desirability of conditionals. Synthese, 193(6), 1967–1981.

Stefánsson, H. O., & Bradley, R. (2018). What is risk aversion? The British Journal for the Philosophy of Science. https://doi.org/10.1093/bjps/axx035.

Thoma, J. (forthcoming). Risk aversion and the long run. Ethics (in print).

Tversky, A., & Bar-Hillel, M. (1983). Risk: The long and the short. Journal of Experimental Psychology, 9(4), 713–717.

Acknowledgements

Versions of this paper were presented at the Final Conference of the Franco-Swedish Program for Philosophy and Economics, SCAS Uppsala (2015), and Self Prediction in Decision Theory and Artificial Intelligence, University of Cambridge (2015). I am grateful the the audience for their questions, comments and suggestions. In addition, I would like to thank Richard Bradley and Katie Steele for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Stefánsson, H.O. Is risk aversion irrational? Examining the “fallacy” of large numbers. Synthese 197, 4425–4437 (2020). https://doi.org/10.1007/s11229-018-01929-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11229-018-01929-5