Abstract

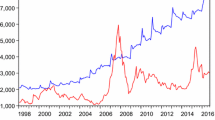

In this paper, we examine price dynamics, cycles and lead-lag relationships between private and public commercial real estate markets. We utilize wavelet technology to capture both the frequency and the time variations of a time series. We find that the long-run trend of prices in public commercial real estate markets is steeper than that of private commercial real estate markets. In addition, both short-term and long-term cycles are longer in the public market than the private market. We also find that the private market led the public market up until the recession of early 1990s and the public market has led the private market since then. Finally, we offer the first evidence of contagion between the two markets. We find that there is an increase in excess (high frequency) contagion between the two markets during periods of crisis, but not beyond the crises periods. An understanding of co-movements of real estate prices across these two markets is of crucial importance policy makers and for maximizing portfolio diversification benefits and managing risk.

Similar content being viewed by others

Notes

For example, in Structural Time Series Models, the long-term trend is usually treated as polynomial of time variable and is estimated with moving average method or exponential smoothing method. The cycle component is usually estimated with Fourier transform, requiring the cyclical pattern to be stable with a fixed period.

It should also be pointed out that commercial real estate market experienced a major crash in late 1980s and early 1990s. This crash followed a major episode of overbuilding of commercial space in 1980s. The overbuilding was partly encouraged by the Economics Recovery Tax Act of 1981 that lowered capital gains tax rate and accelerated cost recovery system that significantly shortened the period over which commercial real estate can be depreciated. The Tax Reform Act of 1986 eliminated the accelerated cost recovery provision of 1981 Act and made it impossible for taxpayers to offset ordinary income with tax losses from commercial real estate investments, and thus contributed to the market crash and slowdown in construction in late 1980s and early 1990s. Following the savings-and-loan crisis, banks essentially stopped making construction loans and commercial real estate mortgages. This offered an opportunity for the creation of conduit financing whereby investment banks, led by Bear Stearns and Lehman Brothers, started originating commercial mortgages and packaging them for sale to investors as mortgage-backed securities. This led to a recovery in commercial real estate market. Then on February 1994, the Fed unexpectedly started the most aggressive tightening in Fed history, as a result of which the real estate market suffered significantly.

By decomposing the original series into a time dependent sum of different frequency components, wavelet technology is also likely to improve the quality of forecasting. However, incorporating wavelets increases the model complexity due to more approximation steps, as well as more error sources. Schlüter and Deuschle (2010) discuss this trade-off by comparing the forecasting quality of wavelet-based method and other traditional methods (i.e., Census X-12, ARMA, ARIMA). They find that wavelet-based forecasting generally performs better than classical techniques, especially when a strong long-term pattern dominates short-term oscillations. However, for time series with a minor trend and a strong random component, wavelets generate only little improvements.

The formula takes into consideration any capital improvements and/or any partial sales that occurred during the quarter,

$$ \frac{\left( Ending\ Market\ Value- Beginning\ Market\ Value\right)+ Partial\ Sales- Capital\ Improvements}{Beginning\ Market\ Value+1/2\ Capital\ Improvements-1/2\ Partial\ Sales-1/3\ Net\ Operating\ Income} $$Since the original time series is not a normal distribution, Monte Carlo method is used here to establish significance levels and confidence intervals for the wavelet power spectrum.

The cone shaped curve in the figure is known as the Cone of Influence. Because one is dealing with finite-length time series, errors will occur at the beginning and end of the wavelet power spectrum. One solution to these edge effects is to pad the end of the time series with zeroes before doing the wavelet transform and then remove them afterward. The region in which the transform suffers from these edge effects is called the cone of influence. A more detailed explanation can be found in Aguiar-Conraria and Soares (2010).

The intervals are defined in terms of the results from Trend and Cycles Decomposition. We find that, the short and long cycle of public and private commercial market is ranging from 6.5 to 17.5 years, which is 26 to 70 quarters accordingly.

We focus on the direction, rather than the magnitude, of the lead-lag relationship. As a result, we do not differentiate among different values in the (0,90) or (−90,0) intervals.

We are grateful to David Ling and Andy Naranjo for sharing their data and calculations with us.

The WILSHIRE Real Estate Securities Index (WILSHIRE) is a market capitalization weighted index of publicly traded real estate securities including REITs, real estate operating companies (REOCs), and public partnerships.

A simpler version of the derivations here can be found in Appendix C that uses Haar Wavelet, considered to be the simplest possible wavelet.

In orthogonal wavelet analysis, the number of convolutions at each scale is proportional to the width of the wavelet basis at that scale. It is gives the most compact representation of the signal as it produces a wavelet spectrum that contains discrete “blocks” of wavelet power.

Smoothing is needed because without it coherency would be identically one at all times and scales. Smoothing can be achieved by a convolution (see Cazelles et al. 2007)

Cycle 1 exhibits the reconstructed signal excluding low-pass component (LFA7) and high-pass component in layer 1 (LFD1) and layer 2 (LFD2). Cycle 2 exhibits the reconstructed signal excluding low-pass component (LFA5), high-pass component in layer 1 (LFD1) and high-pass component in layer 2 (LFD2). Cycle 3 exhibits the reconstructed signal excluding low-pass component (LFA5), high-pass component in layer 1 (LFD1), high-pass component in layer 2 (LFD2) and high-pass component in layer 3 (LFD3). Cycle 4 exhibits the reconstructed signal excluding low-pass component (LFA5), high-pass component in layer 1 (LFD1), high-pass component in layer 2 (LFD2), high-pass component in layer 3 (LFD3) and high-pass component in layer 4 (LFD4).

References

Abdi, A., Barger, J. A., & Kaveh, M. (2002). A parametric model for the distribution of the angle of arrival and the associated correlation function and power Spectrum at the Mobile Station. IEEE Transactions on Vehicular Technology, 51(3), 425–434.

Abraham, J. M., & Hendershott, P. H. (1994). Bubbles in metropolitan housing markets. Journal of Housing Research, 7(2), 191–207.

Aguiar-Conraria, L., & Soares, M. J. (2010). The continuous wavelet transform: A primer. In NIPE working papers 23/2010. Minho: NIPE - Universidade do.

Aguiar-Conraria, L., Azevedo, N., & Soares, M. J. (2008). Using wavelets to decompose the time–frequency effects of monetary policy. Physica A: Statistical Mechanics and its Applications, 387(12), 2863–2878.

Barkham, R., & Geltner, D. G. (1995). Price discovery in American and British property markets. Real Estate Economics, 23, 21–44.

Bekaert, G., & Harvey, C. R. (1995). Time varying world market integration. The Journal of Finance, 50(2), 403–444.

Benveniste, L., Capozza, D., & Seguin, P. (2001). The value of liquidity. Real Estate Economics, 29(4), 633–660. https://doi.org/10.1111/1080-8620.00026.

Bilen, C., & Huzurbazar, S. (2002). Wavelet-based detection of outliers in time series. Journal of Computational and Graphical Statistics, 11(2), 311–327.

Bourassa, S. C., Hendershott, P. H., & Murphy, J. (2001). Further evidence on the existence of housing market bubbles. Journal of Property Research, 18(1), 1–19.

Bowden, R., & Zhu, J. (2008). The agribusiness cycle and its wavelets. Empirical Economics, 34(3), 603–622.

Breitung, J., & Candelon, B. (2006). Testing for short-and long-run causality: A frequency-domain approach. Journal of Econometrics, 132(2), 363–378.

Cazelles, B., Chavez, M., de Magny, G. C., Guégan, J. F., & Hales, S. (2007). Time-dependent spectral analysis of epidemiological time-series with wavelets. Journal of the Royal Society Interface, 4(15), 625–636.

Chiang, K. C. H. (2009). Discovering REIT price discovery: A new data setting. Journal of Real Estate Finance and Economics, 39(1), 74–91.

Clapp, J. M., & Tirtiroglu, D. (1994). Positive feedback trading and diffusion of asset Price changes: Evidence from housing transactions. Journal of Economic Behavior & Organization, 24(3), 337–355.

Cohen, J. and Zabel, J. (2017). Local house Price diffusion, Working paper.

Crowley, P. M., & Hudgins, D. (2017). Evaluating south African fiscal and monetary policy using a wavelet-based model. School of Economics, University of Cape Town working paper (no. 2017-08).

DeFusco, A. A., Ding, W., Ferreira, F. V., & Gyourko, J. (2015). The role of contagion in the American housing boom. Working Paper, The Role of Contagion in the American Housing Boom.

Devaney, S., & Xiao, Q. (2017). Cyclical co-movements of private real estate, public real estate and equity markets: A cross-continental spectrum. Journal of Multinational Financial Management, 42, 132–151.

Dewandaru, G., Masih, R., & Masih, A. M. M. (2015). Why is no financial crisis a dress rehearsal for the next? Exploring contagious heterogeneities across major Asian Stock markets. Physica A: Statistical Mechanics and its Applications, 419, 241–259.

Dewandaru, G., Masih, R., & Masih, A. M. M. (2016). What can wavelets unveil about the vulnerabilities of monetary integration? A tale of Eurozone Stock markets. Economic Modelling, 52, 981–996.

Dolde, W., & Tirtiroglu, D. (1997). Temporal and spatial information diffusion in real estate price changes and variances. Real Estate Economics, 25(4), 539–565.

Fan, Y., Yang, Z., & Yavas, A. (2019). Understanding real estate Price dynamics: The case of housing prices in five major cities of China. Journal of Housing Economics, 43, 37–55.

Florance, A., Miller, N., Peng, R., & Spivey, J. (2010). Slicing, dicing, and scoping the size of the U.S. commercial real estate market. Journal of Real Estate, Portfolio Management., 16(2), 101–118.

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: Measuring Stock market Comovements. The Journal of Finance, 57(5), 2223–2261.

Geltner, D. (1993). Estimating market values from appraised values without assuming an efficient market. Journal of Real Estate Research, 8(3), 325–345.

Gençay, R., Selçuk, F., and Whitcher, B. J. (2001). An Introduction to Wavelets and Other Filtering Methods in Finance and Economics: Academic press.

Grinsted, A., Moore, J. C., & Jevrejeva, S. (2004). Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Processes in Geophysics, 11(5/6), 561–566.

Gyourko, J., & Keim, D. B. (1992). What does the Stock market tell us about real estate returns? Real Estate Economics, 20, 457–485.

Hoesli, M., Oikarinen, E. (2012). Are REITs real estate? Evidence from international sector level data. Journal of International Money and Finance, 31(7), 1823-1850.

Hoesli, M., Oikarinen, E., & Serrano, C. (2015). Do public real estate returns really Lead private returns? The Journal of Portfolio Management, 6, 105–117.

Ikramov, N., & Yavas, A. (2012). Asset characteristics and boom and bust periods: An experimental study. Real Estate Economics, 40(3), 603-636.

Jammazi, R., & Aloui, C. (2010). Wavelet decomposition and regime shifts: Assessing the effects of crude oil shocks on Stock market returns. Energy Policy, 38(3), 1415–1435.

Jinliang, L., Mooradian, R. M., & Yang, S. X. (2009). The information content of the NCREIF index. Journal of Real Estate Research, 31, 93–116.

Lee, M.-L., & Chiang, K. (2010). Long-run Price behaviour of equity REITs: Become more like common stocks after the early 1990s? Journal of Property Investment & Finance, 28, 454–465.

Ling, D. C., & Naranjo, A. (2015). Returns and information transmission dynamics in public and private real estate markets. Real Estate Economics, 43, 163–208.

Ling, D. C., Naranjo, A., & Nimalendran, M. (2000). Estimating returns on commercial real estate: A new methodology using latent-variable models. Real Estate Economics, 28(2), 205–231.

Mallat, S. (2008). A wavelet tour of signal processing: The sparse way. Academic Press.

Ng, E. K., & Chan, J. C. (2012). Geophysical applications of partial wavelet coherence and multiple wavelet coherence. Journal of Atmospheric and Oceanic Technology, 29(12), 1845–1853.

Nneji, O., Brooks, C., & Ward, C. W. (2015). Speculative bubble spillovers across regional housing markets. Land Economics, 91(3), 516–535.

Pagliari Jr., J. L., Scherer, K. A., & Monopoli, R. T. (2005). Public versus private real estate equities: A more refined, long-term comparison. Real Estate Economics, 33, 147–187.

Percival, D., and Walden, A. (2000). Wavelets Analysis for Time Series Analysis. Cambridge University Press, UK Ramsey, J., D. Usikov and G. Zaslavsky (1995)“An analysis of US stock price behavior using wavelets.” Fractals, 3(2), 377–389.

Ramsey, J. B. (2002). Wavelets in economics and finance: Past and future. Studies in Nonlinear Dynamics & Econometrics, 6(3), 1–27.

Richter, C. (2008). On the Transmission Mechanism of Monetary Policy. In On the transmission mechanism of monetary policy. In Quantitative Economic Policy. Berlin Heidelberg: Springer.

Reboredo, J. C., & Rivera-Castro, M. A. (2014). Wavelet-based evidence of the impact of oil prices on Stock returns. International Review of Economics & Finance, 29, 145–176.

Schlüter, S., & Deuschle, C. (2010). Using wavelets for time series forecasting: Does it pay off?. IWQW discussion papers (no. 04/2010).

Stock, J. H., and Watson, M. W. (1993). A procedure for predicting recessions with leading indicators: Econometric issues and recent experience. Business Cycles, Indicators and Forecasting. University of Chicago Press.

Toluca, W., Myer, F. C. N., & Webb, J. R. (2000). Dynamics of private and public real estate markets. Journal of Real Estate Finance and Economics, 21, 279–296.

Yavas, A., & Yildirim, Y. (2011). Price discovery in real estate markets: A dynamic analysis. Journal of Real Estate Finance and Economics, 42, 1–19.

Yousefi, S., Weinreich, I., & Reinarz, D. (2005). Wavelet-based prediction of oil prices. Chaos, Solitons & Fractals, 25(2), 265–275.

Yunus, N., Hansz, J. A., & Kennedy, P. J. (2012). Dynamic interactions between private and public real estate markets: Some international evidence. Journal of Real Estate Finance and Economics, 45, 1021–1040.

Zhang, Q., & Benveniste, A. (1992). Wavelet networks. IEEE Transactions on Neural Networks, 3(6), 889–898.

Acknowledgments

We would like to thank Kelly Pace, David Ling and participants at the 2018 FSU-UF-UCF Critical Issues in Real Estate Symposium and 2017 UNC Real Estate Research Conference for their helpful comments.

Availability of Data and Material

Upon request.

Code Availability

Upon request.

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest/Competing Interests

No conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Wavelet Decomposition Footnote 13

We begin with identifying the primary variable of interest, time series of commercial real estate prices, expressed as x(t). We believe that this original time series will include long-term trends that will reflect the effects of economic fundamentals such as income and interest rates. We also know that the time series will be disturbed along the way by other intervening effects, such as cycles and temporary exogenous and endogenous shocks that will push prices above or below the trend line. The time line will also be disturbed by random noise. The primary purpose here is to use wavelet analysis to segregate these various effects. The technology we use to achieve that end is called wavelet decomposition.

We define the wavelet basis, ψ(t), which is a square integrable function, and whose Fourier transform \( \hat{\psi}\left(\omega \right) \) must satisfy the following admissible condition (Daubechies, 1992):

In order to bring ψ(t) function into a harmonic relationship with x(t), it can be dilated to a time interval a and translated (shifted) along the time line by b, thus defining a new wavelet function (van der Burgt, 2009):

where the time interval a is defined as a scale factor denoting the cycle length of the wavelet, and b is defined as shift factor, which represents a transition in the time domain.

The modified wavelet function can now be drawn up into the envelope of the original function using a Continuous Wavelet Transform (CWT) that defines the overlap between x(t) and ψa, b(t) as follows:

where Wx(a, b) is the wavelet coefficient. ψ∗(·) is the complex conjugate of ψ(·) in (A.2). There will be a different CWT for each wavelet. |Wx(a, b)| could be regarded as an indicator of amplitude. Accordingly, the wavelet power spectrum is defined as |Wx(a, b)|2, which can be interpreted as the local variance of specific time series at each time and frequency.

Since price signal is a discrete series, we need to further discretize CWT through sampling specific wavelet coefficients. We define a = 2−j and b = k2−j, where integers j and k denote the set of discrete translation and discrete dilations, and produce an orthogonal basis with a dyadic dilation.Footnote 14 This method is also called multi-resolution analysis (MRA), which is an approach of fast wavelet transformation (Mallat 2008). In Mallat’s algorithm, the decomposition of a signal is accomplished by repeating a linear transformation involving a scaling function H (a low pass filter) and a wavelet function G (a high pass filter). Thus, in the jth scale decomposition, we obtain cj + 1 = Hcj and dj + 1 = Gcj, where c and d are the approximation (low-frequency) and detail (high-frequency) coefficients, respectively, whose lengths decrease dyadically at higher scales or coarser resolutions.

Note that the wavelet transforms a one-dimensional signal into a two-dimensional plane (a, b) in the coordinate position b and scale a (the time and frequency domains, respectively), creating a new version of the original signal S.

When all of the wavelet functions have been included in the reconstruction of the original signal S, we are ready to deconstruct S into its component parts using a multi-resolution process. For the case of real estate, we identify four fundamental movements: long-term trend (T), cyclical change (C), seasonal variation (SV) and random error (R).

The purpose of multi-resolution analysis is to separate the true trend in response to economic fundamentals from the noise of random error. Where we observe high frequencies in the frequency domain as we move across the time line, we are more likely to be observing the influence of random errors. This tradeoff problem is managed by smoothing the frequencies in a series of iterations called layers. In each iteration, we divide the signal over the full length of time into two parts: high frequency (high-pass component, HPC), and low frequency (low-pass component, LPC). At the end of each iteration, we take the low-frequency part (LPC) to be the new expression of the frequency domain, and then we repeat the process, using a new designation for the threshold that will separate the two parts. At some point, we conclude that we have reached the optimal compromise between de-noising and loss of fidelity. Fortunately, MATLAB is very helpful in identifying the optimal number or layers (iterations), and the most appropriate threshold. This process itself is called wave decomposition. We take the frequency expression of the low frequency (LPC) part at the end of the last layer to be an expression of the price trend (T), while the high frequency (HPC) part in the first layer is considered to be the random error (R). We can then identify other decomposed elements using the proof by contradiction method of analysis.

Wavelet Coherence

In our second estimation, we introduce the wavelet coherence index to measure the co-movement of commercial real estate prices in response to changes in economic fundamentals across markets (Grinsted et al. 2004).

With the individual wavelet transform determined, we can assume a pair of time series representing a pairing of two markets included in the study, x(t) and y(t). The wavelet coherence Rx, y(a, b) of two time series x and y is defined as

where Wx(a, b) and Wy(a, b) denote continuous wavelet transforms of x and y at scales a and positions b, respectively, \( \left|{W}_{xy}\left(a,b\right)\right|=\left|{W}_x\left(a,b\right)\cdotp {W}_y^{\ast}\left(a,b\right)\right| \) is the cross-wavelet power, superscript * is the complex conjugate for the time series y(t), and Ω(·) is a smoothing operator in time and scale.Footnote 15Rx, y(a, b), as modulo operation, must lie between 0 and 1. A high value indicates a strong co-movement in the time series.

Since coherency follows modulo identification, which cannot distinguish positive or negative co-movement, we then introduce phase-difference (the angle) to investigate the lead-lag relationships of two series. The phase-difference is defined as

where I{·} and R{·} represent imaginary and real parts of the cross-wavelet power spectrum Wxy(a, b). Intuitively, if θx, y = 0, then time series x(t) and y(t) move together at the specified time-frequency. θx, y(a, b)ϵ(0, 90) means x(t) leading y(t) while θx, y(a, b)ϵ(−90, 0) means y(t) leading x(t).

Wavelet Cross-Correlation Test

The purpose of this test is to discover if there is excess contagion between the two markets and how it may be changing through time. To obtain volatility in different timescales, wavelet variance analysis is applied to decompose the variance of a time series associated with different time scales. This will show which timescales are important contributors to the overall volatility of a series (Percival and Walden 2000). Let x1, x2, …, xn be a time series with variance \( {\sigma}_x^2 \). If \( {\nu}_x^2\left({\tau}_j\right) \) is defined as the wavelet variance for scale τj = 2j – 1, then the following relationship holds:

The above relationship is similar to that between the variance of a stationary process and its spectral density function (SDF):

where Sx(f) denotes the SDF at the frequency f [−1/2,1/2]. An unbiased estimator of the wavelet variance will be as follows:

where \( {n}_j^{\prime } \)=(n/2j) is the number of wavelet coefficients at level j; n is the sample size; \( {L}_j^{\prime } \)= (L - 2) (1–1/2j) is the number of discrete wavelet transfer boundary coefficients at level j; L is the width of the wavelet filter. The wavelet correlation coefficient ρxy (λj)provides a standardized measure of the relationship between the two time series in multi-timescales. Therefore, the unbiased estimator of the wavelet correlation for scale j, \( {\overset{\sim }{\rho}}_{xy}\ \left({\lambda}_j\right) \), can be defined by

where \( {\overset{\sim }{\sigma}}_x^2\left({\lambda}_j\right) \)and \( {\overset{\sim }{\sigma}}_y^2\left({\lambda}_j\right) \) are the unbiased estimators of the wavelet variances, and \( {\overset{\sim }{\gamma}}_x\left({\lambda}_j\right) \) is the unbiased estimators of the wavelet covariance. We follow Gençay et al. (2001) for a wavelet-based approach to test for significant difference. Our study tests whether wavelet correlation coefficients on a scale-by-scale basis between crisis and non-crisis periods, as well as pre-crisis and post-crisis periods, are significantly different. The significant change is identified by observing approximate confidence intervals between pre-crisis and crisis periods. The null hypothesis of no statistically significant difference can be rejected if 95% approximate confidence intervals are non-overlapping

where \( {{\overset{\sim }{\rho}}_{xy}}^A\ \left({\lambda}_j\right) \) and \( {{\overset{\sim }{\rho}}_{xy}}^B\ \left({\lambda}_j\right) \) denote wavelet correlation coefficients estimated for the non-crisis and crisis periods, respectively. The null can be rejected when 95% approximate confidence intervals of the correlation coefficients of crisis and non-crisis periods are not overlapping. We also apply the similar test on difference between the pre-crisis and post-crisis periods.

Appendix B

The fundamental principle of multi-layer wavelet decomposition is shown in Fig. 19. We use a seven-layer decomposition as example. Original signal (S) is the raw time-series to be decomposed. The high-pass component (HPC) denotes the signals with a frequency higher than a certain cutoff frequency, while the low-pass component (LPC) denotes the signals with frequencies lower than the cutoff frequency. Through the first layer filtering process, the original signal is decomposed into a high-pass component (HPC1) and a low-pass component (LPC1) respectively. The low-pass filtered signal (LPC1) is then used as the input for the next iteration step and is decomposed into a high-pass component (HPC2) and a low-pass component (LPC2), and so on

Using MATLAB, we get the step-by-step output of the wavelet decomposition procedure, as shown in Fig. 20. LPC7 denotes the low-pass component remaining after the last decomposition process, while HPC1 to HPC7 denote the high-pass component in layer 1 to layer 7 respectively. According to the decomposition results, the component LPC7 is directly regarded as the long-term trend.

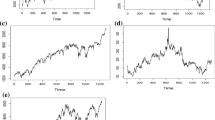

Figure (a) shows the trend and cyclical components of public commercial real estate price index (NAREIT). Figure (b) shows the trend and cyclical components of private commercial real estate price index (NCREIF). LPC7 denotes the low-pass component remaining after the last decomposition process, while HPC1 to HPC7 denote the high-pass component in layer 1 to layer 7 respectively.

We diagnose the corresponding component combining eq. (A.4) and the wavelet decomposition output in Fig. 19. Obviously, LPC7 component can be regarded as the long-term trend of commercial real estate index. After the ADF (Augmented Dickey-Fuller) test, we find the time series of high-pass component HPC1 and HPC2 to be stable, which implies that these two high frequency fluctuations can be regarded as random parts. However, components HPC3, HPC4, HPC5, HPC6 and HPC7 do not represent either trend characteristics or white noise characteristics, which are tentatively included into the cycle component. Comparing the results of different components of Cycle 1 to Cycle 4,Footnote 16 we find that only Cycle 3 demonstrates a relatively smooth fluctuation with a cycle exceeding one year. Thus, we choose Cycle 3 to denote short-term cyclical fluctuation in our empirical analysis. In contrast, Cycle 4 exhibits the long-term cyclical fluctuations.

Trend and cycle of commercial real estate index extracted by wavelet decomposition are shown in Fig. 21.

Figure (a) shows the trend and cyclical components of the public and private commercial real estate price index. NAREIT denotes the public commercial real estate price index while NCREIF denotes the private commercial real estate index. Both of these indexes are standardized into 100 in January 1987.

Appendix C

This appendix offers a brief technical introduction to Haar Wavelet to illustrate wavelet basics. Haar wavelet is considered to be the simplest wavelet. As in Appendix A.1, we use factor a = 2−j and b = k2−j (j and k denote the set of discrete translations and discrete dilations,), and have

The Haar Wavelet’s function is defined as

For demonstration purposes, the Haar Wavelet function is illustrated in Fig. 22.

Like all wavelet transforms, the Haar transform decomposes a discrete signal into two sub-signals (a trend signal and a fluctuation signal) of half its length. Assume there is a one-dimensional signal (x(t) = (x1, x2, …xN)) with the length N = 2j. Thus, the first layer (j = 1) Haar-Transform follows,

where \( {c}^1=\left(\frac{x_1+{x}_2}{\sqrt{2}},\frac{x_3+{x}_4}{\sqrt{2}},\dots, \frac{x_{N-1}+{x}_N}{\sqrt{2}}\right) \) and \( {d}^1=\left(\frac{x_1-{x}_2}{\sqrt{2}},\frac{x_3-{x}_4}{\sqrt{2}},\dots, \frac{x_{N-1}-{x}_N}{\sqrt{2}}\right) \). c1 is regarded as “the first trend” (low-frequency) component and d1 is regarded as “the first fluctuation” (high-frequency) component. We also know that inverse transforms are given by \( {x}_{2N/2-1}=\frac{c^1-{d}^1}{2} \) and \( {x}_{2N/2}=\frac{c^1+{d}^1}{2} \). The first layer Haar-Transform can also be reversible, which means f can be reconstructed via (c1, d1) and that, \( x(t)=\left(\frac{c_1+{d}_1}{\sqrt{2}},\frac{c_1-{d}_1}{\sqrt{2}},\dots, \frac{c_{N/2}+{d}_{N/2}}{\sqrt{2}},\frac{c_{N/2}-{d}_{N/2}}{\sqrt{2}}\right) \). The energy of the signal f can be defined as

The second layer Haar-Transform can be denoted by

where \( x(t)\overset{H_1}{\to}\left({c}^1,{d}^1\right) \) and \( {c}^1\overset{H_1}{\to}\left({c}^2,{d}^2\right) \). The remaining layers could be derived in a similar manner.

Appendix D

This appendix offers a comparison of some of the test results of this paper with those of the traditional methods. Since both traditional methods and the wavelet method can test for coherency and lead-lag relationships, we use these two relationships in our comparisons.

First, we use the traditional method to calculate the cross-correlations of housing price in five cities. The cross-correlation function is as follows (Abdi et al. 2002)

where Cx, y(b) denotes the traditional cross-correlations of two time series x and y with a given position b. The superscript * is the complex conjugate and fx (or fy) is complex-valued Fourier transform functions. A high (low) value indicates a strong (weak) co-movement of time series. Thus, we can use the cross-correlation to find how much fy must be shifted along the x-axis to make it identical to fx.

The results are exhibited in pairs in Fig. D1. Without considering the frequency variation of price indices, we still find a significantly high co-movement (higher than 0.8) between public and private commercial real estate markets.

Note: This figure shows the normalized co-movement degree of the price indices. The coefficient \( {\hat{C}}_{x,y, coeff}(m)={\hat{C}}_{x,y}(m)/\sqrt{{\hat{C}}_{x,x}(0){\hat{C}}_{y,y}(0)} \) , which normalizes the sequences so that the autocorrelations at zero lag equal 1. Axis x represents the value of position b, which reflects the distance (in quarters) between the two time series being compared. Axis y represents the cross-correlation value. As defined before, NCREIF2 is the constructed commercial index based on Appraiser Confidence Factor method. NCREIF3 denotes the constructed private commercial index based on Latent-Variable Statistical method.

Second, we provide Granger causality test on the lead-lag relationship between public and private markets. As NAREIT and NCREIF price series contain unit root and are thus non-stationary, we take the first difference of these two variables accordingly. The empirical model is,

As displayed in Table D1, we find the public market leading the private market during the study period at 5% significance level. We then conduct additional tests based the structural change we have detected with wavelet technology around the year 1994. When we focus on the pre-1994 period, we observe a significant leading role of the private market over the public market. During the post-1994 period, however, public real estate market takes over the leading role. These results are consistent with our main findings with wavelet technology. However, unlike the wavelet method, tradition Granger causality test fails to detect such a structural change.

Rights and permissions

About this article

Cite this article

Fan, Y., Yavas, A. Price Dynamics in Public and Private Commercial Real Estate Markets. J Real Estate Finan Econ 67, 150–190 (2023). https://doi.org/10.1007/s11146-020-09773-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09773-6