Abstract

In addressing climate change, both abatement itself and the innovation of superior abatement technologies are exposed to free-riding. To examine this double free-riding problem, we develop a multi-country model with an international market for emission permits and licenses for abatement technologies. We show that the two problems are mutually reinforcing. To address the double free-riding problem we propose a rules treaty for innovation and abatement that consists of two rules, an allocation rule and a refunding rule. The allocation rule determines the share of issued emission permits that each country can directly allocate to its domestic firms, while the remainder is handed over to an international agency. The refunding rule determines how the agency’s revenues from selling these permits to firms are redistributed. A fraction is given to those countries that successfully develop superior abatement technologies provided they license the technology free of charge to all countries. The remaining revenues are redistributed to all countries. These rules can approximate globally optimal abatement and innovation levels.

Similar content being viewed by others

Notes

Barrett (2009) provides a comprehensive overview of the technology portfolio which he expects to play a significant role in future emission reductions. IPCC (2014a) provides a thorough and extensive overview of the mitigation options. Examples include wind and solar power or carbon capture and storage.

For an alternative and interesting formulation of low incentives to invest in new abatement technologies, see Goeschl and Perino (2017).

The connection between environmental and technological externalities is well-recognized in the literature on pollution regulation and technical progress. Early important papers in this area are Biglaiser and Howowitz (1995), Denicolo (1999) and Parry (1995). Our analysis adds novel insights on the mutual reinforcement between abatement and innovation in the context of climate change.

Our approach complements the existing literature on how treaties might address the market failures of technological change and abatement effort. See Jaffe et al. (2003), Jaffe et al. (2005), de Coninck et al. (2008), Popp et al. (2009), Aldy et al. (2009), Acemoglu et al. (2012), Harstad (2012), and Harstad (2016), for instance. See also de Coninck et al. (2008), who identify four types of treaties that promote new technologies: (1) knowledge sharing and coordination; (2) research, deployment, and demonstration (R&D); (3) technology transfer; and (4) technology deployment mandates, standards, and incentives.

See footnote 5.

The price remains unaffected due to the model set-up of constant marginal damages.

Other applications of refunding schemes may be found in the context of the European refugee crisis. A lax asylum law and welcoming refugees at the border in a particular country exerts externalities on other countries, since it may induce refugees to leave their countries of origin for economic reasons.

Note that, in principle, innovation costs are the sum of investments by the public and the firm. From the country’s perspective only total outlay for innovation matters. Whether and how much firms contribute to developing new technologies does not play a role as we focus on domestic welfare, and thus, transfers and cost sharing within a country do not matter.

See Chapter 7.7 for a discussion of stochastic innovation

The number of permits the firms receive depends on whether there is a treaty or not and on the parameters of the treaty. These specifications will be analyzed later in the paper.

Suppose, for instance, that Germany is the technology leader in building coal power plants that can capture and store carbon (CCS). Many countries, on the other hand, know how to make standard solar panels. Hence, countries would have to pay Germany for the blueprints to build a CCS coal power plant, but the technology to produce standard solar panels would be available at zero price for countries that do not yet posses this technology.

In order to guarantee \(E>0\), we assume for the rest of the paper \(\overline{E} > \frac{n^5 \beta ^3 }{4 \alpha \overline{\chi }^2}\).

Whether this occurs through free allocation or auctioning does not matter for our purpose; for this choice merely affects distribution of welfare within the country.

The envelope theorem implies \( \left( \chi _i (\bar{e}-e_i) + p \right) \dfrac{\partial e_i}{\partial \epsilon _i}=0 \) since the first term is zero.

If there is no international market for emission permits, the local planner chooses emissions (e.g. via taxes or national permits) such that marginal damages equal marginal costs, that is \(\beta = \chi (\overline{e}-e_i)\).

Erneuerbare–Energien–Gesetz (EEG).

A further scenario is ABA (Abatement) in which countries act non-cooperatively with respect to innovation but cooperatively with respect to abatement. Thus, in Stage 3 countries cooperate to minimize global costs. What can be achieved in this scenario depends on the precise commitment assumptions. If countries could make a binding international agreement on the socially optimal aggregate emission in anticipation of technological progress, there are mechanisms that would induce the optimal level of technology. An example is a central administrating agency that sets the price \(p^{GSO}\) at which further permits can be bought or sold, and the profit is shared equally across countries.

We exclude the case \(\mu =0\), as permit issuance in such cases is not determinate.

In principle, several countries could be technology leaders, in which case the clean-tech refund would have to be shared equally. However, because countries could claim the complete refund by slightly increasing their innovation effort at little additional costs, there will be only one technology leader in equilibrium.

The envelope theorem implies that \( \left( \chi _1 ({\overline{e}}-e_1)+p \right) \frac{\partial e_1}{\partial \epsilon _1} = 0 \) since the first term is zero.

For very low values of \(\mu \), \(\epsilon _j^{RTIA}\) becomes negative. Negative permit issuance will be discussed in Sect. 5.7.

This holds as long as \( e < \frac{\overline{e}}{2} \). If \( e > \frac{\overline{e}}{2} \), the technology developer issues fewer permits than other countries. Still, Country 1 obtains a higher revenue from refunding than the other countries.

Our assumption of unanimous agreement is a special case, as it only allows single countries to deviate but not the deviation of a group of countries.

Note that the treaty is susceptible to deliberate changes of the number of issued permits to cause malfunctioning or even a break-down of the international permit market.

The detailed argument why buyer countries might not be willing to pay a positive price for frontier technologies is provided in “Appendix C”.

Switzerland is currently (fall 2017) in the process of linking its emission trading scheme to the EU’s. This is possible as Switzerland’s emission trading scheme was specifically designed for compatibility with the EU’s, by closely emulating the relevant standards.

Whether a technology is suitable for a country depends on this country’s geographical conditions and its level of development. For example, wind power replacing coal in electricity production is less useful in a country where there is little or erratic wind. A developing country will not benefit from a more efficient gas power plant design if it lacks the capacity to build such plants in the first place.

Full diffusion is first-best in our model, since diffusion can occur costlessly as technology represents ideas not embodied in machines or equipments.

As stated in the (IPCC 2014b), temperature increases linearly in emissions. Yet, damages are likely to be convex in the temperature increase.

In reference to the Kyoto Protocol, Hovi et al. (2015) list five different forms of free-riding: countries never ratify, ratify but withdraw, ratify non-bindingly, ratify without commitment, or do not comply. The announcement of President Trump in summer 2017 that the US will withdraw from the Paris Agreement is a striking example of the second form.

As climate change is subject to uncertainties, an ideal solution would be a complete contingent contract on future emission paths depending on future information.

More formally, one may argue that the RTIA succeeds under a weaker set of assumptions on the degree of global cooperation than treaties based on fixed targets. Countries have incentives to comply under a RTIA. However, as under any treaty, emissions must be monitored and must be covered by permits.

See Barrett (2005), Chapter 16, for example.

An alternative way to compute the autarky technology level is based on the solution of the RTIA. Setting \(\mu \rightarrow 1\) gives the desired result.

Note that parts of the permits are channeled through the refunding scheme. Due to symmetry, the price firms pay the agency to buy the permits exactly equals the refunds the country receives.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Aldy JE, Krupnick AJ, Newell RG, Parry IW, Pizer WA (2009) Designing climate mitigation policy. National Bureau of Economic Research Working Paper Series, No. 15022

Aldy JE, Stavins RN (2009) Post-Kyoto international climate policy: implementing architectures for agreement. Cambridge University Press, Cambridge

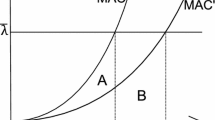

Amir R, Germain M, Van Steenberghe V (2008) On the impact of innovation on the marginal abatement cost curve. J Public Econ Theory 10(6):985–1010

Barrett S (1994) Self-enforcing international environmental agreements. Oxford Econ Pap 46:878–894

Barrett S (2005) The theory of international environmental agreements. Handb Environ Econ 3:1457–1516

Barrett S (2009) The coming global climate-technology revolution. J Econ Perspect 23(2):53–75

Biglaiser G, Howowitz JK (1995) Polluting regulation and incentives for polluting-control research. J Econ Manag Strategy 3:663–684

Bodansky D, Chou S, Jorge-Tresolini C (2004) International climate efforts beyond 2012: a survey of approaches. Pew Center on Global Climate Change, Arlington, VA

Bosetti V, Carraro C, Cian, ED, Duval R, Massetti E, Tavoni M (2009a) The incentive to participate in, and the stability of, international climate coalitions: a game theoretic analysis using the witch model. FEEM Working Paper Series, No. 64.2009

Bosetti V, Carraro C, Tavoni M (2009b) Climate policy after 2012. CESifo Econ Stud 55:235–254

Carraro C, Siniscalco D (1993) Strategies for the international protection of the environment. J Public Econ 52(3):309–328

Chander P, Tulkens H (1995) A core-theoretic solution for the design of cooperative agreements on transfrontier pollution. Int Tax Public Finance 2(2):279–293

Chwe MS (1994) Farsighted coalitional stability. J Econ Theory 63(2):299–325

de Coninck H, Fischer C, Newell RG, Ueno T (2008) International technology-oriented agreements to address climate change. Energy Policy 36(1):335–356

De Zeeuw A (2008) Dynamic effects on the stability of international environmental agreements. J Environ Econ Manag 55(2):163–174

Denicolo V (1999) Pollution-reducing innovations under taxes and permits. Oxford Econ Pap 51:184–199

Gerber A, Wichardt P (2009) Providing public goods in the absence of strong institutions. J Public Econ 93:429–439

Gerber A, Wichardt P (2013) On the private provision of intertemporal public goods with stock effect. Environ Resour Econ 55:245–255

Gersbach H, Winkler R (2007) On the design of global refunding and climate change. CER-ETH—Center of Economic Research at ETH Zurich Working Paper No. 07/69

Gersbach H, Winkler R (2011) International emission permit markets with refunding. Eur Econ Rev 55(6):759–773

Gersbach H, Winkler R (2012) Global refunding and climate change. J Econ Dyn Control 36:1775–1795

Goeschl T, Perino G (2017) The climate policy hold-up: green technologies, intellectual property rights, and the abatement incentives of international agreements. Scand J Econ 119(3):709–732

Golombek R, Hoel M (2005) Climate policy under technology spillovers. Environ Resour Econ 31(2):201–227

Harstad B (2012) Climate contracts: a game of emissions, investments, negotiations, and renegotiations. Rev Econ Stud 79(4):1527–1557

Harstad B (2016) The dynamics of climate agreements. J Eur Econ Assoc 14(3):719–752

Hoel M (1992) International environment conventions: the case of uniform reductions of emissions. Environ Resour Econ 2(2):141–159

Hovi J, Skovodin T, Aakre S (2013) Can climate change negotiations succeed? Politics Gov 1:138–150

Hovi J, Ward H, Grundig F (2015) Hope or despair? Formal models of climate cooperation. Environ Resour Econ 62(4):665–688

IPCC (2014a) Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge and New York, NY

IPCC (2014b) Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge and New York, NY

Jaffe AB, Newell RG, Stavins RN (2003) Technological change and the environment. Handb Environ Econ 1:461–516

Jaffe AB, Newell RG, Stavins RN (2005) A tale of two market failures: technology and environmental policy. Ecol Econ 54:164–174

Kremer M (1998) Patent buyouts: a mechanism for encouraging innovation. Q J Econ 113:1137–1167

Kuik O, Aerts J, Berkhout F, Biermann F, Bruggink J, Gupta J, Tol RS (2008) Post-2012 climate policy dilemmas: a review of proposals. Clim Policy 8(3):317–336

Parry IWH (1995) Optimal pollution taxes and endogenoustechnological progress. Resour Energy Econ 17:69–85

Perino G, Requate T (2012) Does more stringent environmental regulation induce or reduce technology adoption? When the rate of technology adoption is inverted U-shaped. J Environ Econ Manag 64(3):456–467

Popp D, Newell RG, Jaffe AB (2009) Energy, the environment, and technological change. National Bureau of Economic Research Working Paper Series No 14832

Ray D, Vohra R (2001) Coalitional power and public goods. J Polit Econ 109(6):1355–1385

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: Will the true ranking please stand up? Eur Econ Rev 47(1):125–146

Sferra F, Tavoni M (2013) Endogenous participation in a partial climate agreement with open entry: a numerical assessment. Nota di Lavoro. No. 60.2013. Fondazione Eni Enrico Mattei

World Bank (2016) Partnership for market readiness: International carbon action partnership (2016) emissions trading in practice: A handbook on design and implementation. Technical report, World Bank, Washington, D.C

World Bank and Ecofys (2017) Carbon pricing watch 2017. Technical report, World Bank and Ecofys, Washington, D.C

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Clive Bell, Hans Haller, Antoine Bommier, Noemi Hummel, Marie-Catherine Riekhof participants at EAERA 2012 in Prague, at the workshop Uncertainty, Risk and Climate in Zurich and the Astute Modeling seminar for valuable comments. Financial support from the Swiss National Science Foundation, Project No. 100014-124440, is gratefully acknowledged.

Appendices

A Appendix: Table of Variables

Symbol | Meaning |

|---|---|

n | Number of countries |

i, j | Country indices |

\(\overline{e}\) | Business-as-usual emissions |

\(e_i\) | GHG emissions of Country i |

\(\overline{E}\) | Global business-as-usual emissions |

E | Global GHG emissions |

\(\epsilon _i\) | Emission permits issued by local planner to domestic firm |

\(\mathcal {E}\) | Global emission permits issued |

\(\alpha \) | Innovation cost parameter |

\(\beta \) | (Environmental) damage parameter |

\(\overline{\chi }\) | Business-as-usual abatement technology |

\(\chi _i^\prime \) | Pre-trade abatement technology of Country i |

\(\chi _i\) | Post-trade abatement technology of Country i |

p | Price of emission permit |

\(\pi \) | Price of abatement technology |

\(K_i\) | Local costs of Country i |

\(\mu \) | Allocation parameter |

\(\rho \) | General refunding parameter |

\(\rho ^{CT}\) | Clean-tech refunding parameter |

GSO | Global social optimum |

NTO | No-treaty outcome |

RTIA | Rules treaty for innovation and abatement |

RTA | Refunding treaty for abatement only |

INN | NTO with cooperation in innovation only |

ABA | NTO with cooperation in abatement only |

AUT | Autarky |

B Appendix: Proofs

1.1 B.1 Proof of Proposition 1

Let \(\lambda \) denote the Lagrange multiplier associated with the constraint. The Karush–Kuhn–Tucker conditions read

Summing up over all countries and rearranging terms yields

Suppose the constraint is non-binding. In this case, the complementarity slackness condition yields \(\lambda = 0\), and since \(\overline{e}-e = \frac{n \beta }{\chi }\), we get \(\chi = \frac{4 \alpha \overline{\chi }^2}{n^3 \beta ^2}\). This a solution to the optimization problem if and only if it satisfies the constraint \(\chi - \overline{\chi } \le 0\), which is true as long as \(4 \alpha \overline{\chi } \le n^3 \beta ^2\). Otherwise, the globally optimal technology level is \(\chi = \overline{\chi }\). \(\square \)

1.2 B.2 Proof of Equations (12a) and (12b)

Let \(\lambda _1\) denote the Lagrange multiplier associated with the constraint. The Karush–Kuhn–Tucker conditions are given by

Suppose the constraint is non-binding. Then, \(\lambda _1 = 0\). Solving for \(\chi _1\) yields

This is a solution as long as \(\chi _1 \le \overline{\chi }\), which is true if \(4 \alpha \overline{\chi } \le (3n-2) \beta ^2\). Otherwise, \(\chi _1 = \overline{\chi }\). Hence, \(\chi _1 = \min \left\{ \frac{4 \alpha \overline{\chi }}{(3n-2) \beta ^2}, 1 \right\} ~ \overline{\chi }\).

Let \(\lambda _2\) denote the Lagrange multiplier associated with the constraint. The Karush–Kuhn–Tucker conditions read

Suppose the constraint is non-binding. Then, \(\lambda _2 =0\). Solving for \(\chi _2^\prime \) yields

which is a solution as long as \(\chi _2^\prime \le \overline{\chi }\) or, equivalently, \(4 \alpha \overline{\chi } \le \beta ^2\). Otherwise, \(\chi _2^\prime = \overline{\chi }\). Hence, \(\chi _2^\prime = \left\{ \frac{4 \alpha \overline{\chi }}{\beta ^2}, 1 \right\} ~ \overline{\chi }\). \(\square \)

1.3 B.3 Proof of Corollary 1

The cost functions are

For convenience, define \(\gamma = \frac{4 \alpha \overline{\chi }}{(3 n - 2) \beta ^2}\). There are three possible cases to consider:

- Case 1 :

-

Suppose \(4 \alpha \overline{\chi } \ge (3n-2) \beta ^2\). This implies \(\chi _1 = \chi _2^{\prime } = \chi _j^{\prime } = \overline{\chi }, ~ \forall j = 3,\ldots ,n\). Because there are no innovation effort, this directly leads to \( K_j^{NTO} = K_2^{NTO} = K_1^{NTO} = K^{NoR \& D}, ~ \forall j = 3,\ldots ,n\).

- Case 2 :

-

Suppose \(\beta ^2 \le 4 \alpha \overline{\chi } < (3n-2) \beta ^2\). This implies \(\chi _1 < \chi _2^{\prime } = \chi _j^{\prime } = \overline{\chi }, ~ \forall j = 3,\ldots ,n\). Because Country 2 exerts no innovation effort, \(K_j^{NTO} = K_2^{NTO}, ~ \forall j = 3,\ldots ,n\). First, the cost difference between Country 2 and Country 1 is given by

$$\begin{aligned} K_2^{NTO} - K_1^{NTO}&= \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi _{2}^\prime }\bigg )^2 - \bigg (\frac{\overline{\chi }}{\chi _{1}}\bigg )^2 \bigg ) + n ~ \pi (\chi _1, \chi _2^\prime )\\&= \frac{\beta ^2}{4 \gamma \overline{\chi }} (1-\gamma ) (2 n - (1+\gamma ) (3n-2)). \end{aligned}$$Since \(\gamma \in (0,1]\), the first two factors are unambiguously positive. The third factor attains its maximum as \(\gamma \rightarrow 0\) and amounts to \(2-n\), which is non-positive as long as \(n \ge 2\). This establishes \(K_2^{NTO} < K_1^{NTO}\). Second, the cost difference between Country 1 and the benchmark without innovation reads

$$ \begin{aligned} K_1^{NTO} - K^{NoR \& D}&= \left( \frac{\beta ^2}{2} - n \beta ^2 \right) \bigg ( \frac{1}{\chi _1} - \frac{1}{\overline{\chi }} \bigg ) + \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi _{1}}\bigg )^2-1\bigg ) \\&\quad - (n-1) ~ \pi (\chi _1, \chi _2^\prime ) \\&= -\frac{(\gamma -1)^2 (3n-2) \beta ^2}{4 \gamma \overline{\chi }} < 0, \end{aligned}$$which establishes \( K_1^{NTO} < K^{NoR \& D}\).

- Case 3 :

-

Suppose \(\beta ^2 > 4 \alpha \overline{\chi }\). This implies \(\chi _1< \chi _2^{\prime } < \chi _j^{\prime } = \overline{\chi }, ~ \forall j = 3,\ldots ,n\). First, for an arbitrary Country \(j = 3,\ldots ,n\), the cost difference to Country 2 is given by

$$\begin{aligned} K_j^{NTO} - K_2^{NTO} = - \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi _{2}^\prime }\bigg )^2-1\bigg ) < 0, \end{aligned}$$which establishes \(K_j^{NTO} < K_2^{NTO}, ~ \forall j = 3,\ldots ,n\). Second, the cost difference between Country 2 and Country 1 is given by

$$\begin{aligned} K_2^{NTO} - K_1^{NTO}&= \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi _{2}^\prime }\bigg )^2 - \bigg (\frac{\overline{\chi }}{\chi _{1}}\bigg )^2 \bigg ) + n ~ \pi (\chi _1, \chi _2^\prime )\\&= - \frac{3 (n-1)^2 \beta ^2}{4 \gamma (3n-2) \overline{\chi }} < 0, \end{aligned}$$which establishes \(K_2^{NTO} < K_1^{NTO}\). Third, the cost difference between Country 1 and the benchmark without innovation reads

$$ \begin{aligned} K_1^{NTO} - K^{NoR \& D}&= \left( \frac{\beta ^2}{2} - n \beta ^2 \right) \bigg ( \frac{1}{\chi _1} - \frac{1}{\overline{\chi }} \bigg ) + \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi _{1}}\bigg )^2-1\bigg ) \\&\quad - (n-1) ~ \pi (\chi _1, \chi _2^\prime ) \\&= \frac{\beta ^2}{4 \gamma \overline{\chi }} \left( -(3n-2) \gamma ^2 - 2 (1-2 n) \gamma - n -6 \frac{(n-1)^2}{3n-2}\right) . \end{aligned}$$The term in brackets is a quadratic equation in \(\gamma \) that attains its maximum at \(\gamma = \frac{2n-1}{3n-2} > 0\). At its maximum the value of the large parenthesis is negative. Hence, \( K_1^{NTO} < K^{NoR \& D}\).

Summing up, \( K_j^{NTO} \le K_2^{NTO} \le K_1^{NTO} \le K^{NoR \& D}, ~ \forall j = 3,\ldots ,n\). \(\square \)

1.4 B.4 Proof of Table 1

In general the local costs function for Country 1 is:

- Case AUT :

-

For autarky, \(p = \beta \), \(E = \overline{E}- \frac{p}{\chi _1}\) and \(\pi = 0\). The cost minimization problem with respect to the abatement technology reads

$$\begin{aligned}&\min _{\chi _1} \bigg \{ \beta \left( \overline{E}- \frac{\beta }{\chi _1}\right) + \frac{\beta ^2}{2 \chi _1} + \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi _1}\bigg )^2-1\bigg ) \bigg \}. \end{aligned}$$Solving the first order condition

$$\begin{aligned}&\frac{\beta ^2}{\chi _1^2} - \frac{\beta ^2}{2 \chi _1^2} - 2 \alpha \frac{\overline{\chi }^2}{\chi _1^3}=0 \end{aligned}$$for \(\chi _1\) yields the autarky technology level given in the table.Footnote 39

- Case INN :

-

For cooperation with respect to innovation only, \(p = \beta \), \(E = \overline{E}- n \frac{p}{\chi _1}\) and \(\pi = 0\). Furthermore we take into account that Country 1 considers global damages and global abatement costs. The cost minimization problem with respect to the abatement technology reads

$$\begin{aligned} \min _{\chi } \bigg \{ n\Big (\beta \left( \overline{E}- n\frac{\beta }{\chi }\right) + \frac{\beta ^2}{2 \chi }\Big )+ \alpha \bigg (\bigg (\frac{\overline{\chi }}{\chi }\bigg )^2-1\bigg ) \bigg \}. \end{aligned}$$Solving the first order condition

$$\begin{aligned}&n^2\frac{ \beta ^2}{\chi ^2} - n\frac{\beta ^2}{2 \chi ^2} - 2 \alpha \frac{\overline{\chi }^2}{\chi ^3}= 0 \end{aligned}$$for \(\chi _1\) yields the cooperation with respect to innovation-only technology level given in the table.

For both cases, the global emissions can be calculated using \(E=\overline{E}-n\frac{p}{\chi }\). \(\square \)

1.5 B.5 Proof of Equation (22)

The respective cost minimization problem reads

subject to

Let \(\lambda \) denote the Lagrange multiplier associated with the constraint. The Karush–Kuhn–Tucker conditions read

Suppose the constraint is non-binding. In this case, the complementarity slackness condition yields \(\lambda = 0\) and we get

This is a solution to the optimization problem if and only if it satisfies the constraint \(\chi - \overline{\chi } \le 0\), which is true as long as \(4 \alpha \overline{\chi } \le n^3 \beta ^2 (1+\frac{(n-1)\mu }{(n-1)\mu +1})\). Otherwise, the globally optimal technology level is \(\chi ^*= \overline{\chi }\). \(\square \)

1.6 B.6 Proof of Proposition 3

First, we determine the first-order condition of local costs of Country 1 (13a) with respect to the technology level under a RTIA \(\{\mu ,\rho ,\rho ^{CT},F\}\). Using Eqs. (1), \(E = \overline{E}- \frac{n p}{\chi _1}\) and (21a) together with \(\frac{\partial E}{\partial \chi _1}= \frac{n p}{\chi _1^2}\), \(\frac{\partial e}{\partial \chi _1}= \frac{ p}{\chi _1^2}\), and \(\frac{\partial \epsilon _1}{\partial \chi _1} = \frac{p}{\chi _1^2} - 2(n-1) \frac{1-\mu }{\mu } \rho ^{CT} \frac{p}{\chi _1^2}\), the first-order condition reads

Substituting for the permit price (27) and using the fact that \( \rho ^{CT} = 1-n \rho \) yields

Suppose there is an interior solution of (22). Setting \(\chi _1= \chi ^*(\mu )= \frac{4 \alpha \overline{\chi }^2}{n p (2 n \beta - p)}\) yields the clean-tech parameter that ensures that \(\chi ^*(\mu )\) is the minimum of Country 1’s local costs

Plugging \({\rho ^{CT}}^*\) and \(\chi _1= \chi ^*(\mu )= \frac{4 \alpha \overline{\chi }^2}{n p (2 n \beta - p)} \) into the local costs functions (13a) and (13b) and using the constrained optimal amount of emission permits (21a) and (21b) yields

Next, given \(\mu \), we define \(\overline{F}(\mu )\) as the lump-sum parameter that equalizes local costs in countries 1 and 2: \(K_1^{RTIA}(\chi _1 = \chi ^*(\mu )) = K_2^{RTIA}(\chi _1 = \chi ^*(\mu ))\).

Consider a RTIA \(\{\mu , \rho , \rho ^{CT} ,F\}\). If \(F < \overline{F}(\mu )\) an equilibrium that implements \(\chi ^*(\mu )\) does not exist. The proof is as follows: Suppose there are two countries A and B, and Country A is the technology leader with \(\chi _A=\chi ^*(\mu )\). Since \(F < \overline{F}(\mu )\), local costs in Country B are higher than local costs in Country A. By exerting slightly more innovation effort than Country A, Country B would steal the complete clean-tech refund and lower its local costs. Clearly, country A responds to increase its innovation effort as well. This process continues until costs are equalized between Country A and B. As a consequence, one country, say A, would exert innovation effort while the other, say B, would not innovate. However, this cannot be an equilibrium because given that Country B does not exert innovation effort, Country A chooses \(\chi _A = \chi ^*(\mu )\). Thus, for an equilibrium to exist, \(F \ge \overline{F}(\mu )\).

Furthermore, if F is sufficiently large, the costs for Country 1 can exceed the costs for either leaving the treaty or the costs for selling the technology in Stage 2. Thus, in our treaty proposal, we restrict to \(F = \overline{F}(\mu )\) since this always guarantees the existence of a constrained optimal subgame perfect equilibrium by construction. \(\square \)

1.7 B.7 Proof of Proposition 5

Because \( K_i^{NTO} \le K_2^{NTO} \le K_1^{NTO} \le K^{NoR \& D}, ~ \forall i = 3,\ldots ,n\) (see Corollary 1) and \(K_j^{RTIA} = K^{RTIA}, ~ \forall j = 1,\ldots ,n\) (see Proposition 3), it suffices to show that \(K_i^{NTO} \ge K^{RTIA}\).

First, suppose \(\chi ^{NTO} = \overline{\chi }\) and \(\chi ^{RTIA} = \overline{\chi }\). This directly yields \(K_i^{NTO} \ge K^{RTIA}\). Next, suppose \(\chi ^{NTO} = \overline{\chi }\) and \(\chi ^{RTIA} < \overline{\chi }\). Due to optimization, we immediately know that \(K^{RTIA}(\chi ^{RTIA}) < K^{RTIA}(\overline{\chi }) = K_i^{NTO}\). Hence, it remains to show that for interior solutions of the technology level in the NTO and the RTIA, \(K_i^{NTO} \ge K^{RTIA}\).

The cost under RTIA is given by

where the second line follows from the equilibrium conditions on the emission market, zero-profits for the agency controlling the refunding scheme, and the optimal amount of emission permits issued by Countries \(j = 2,\ldots ,n\). The last line additionally uses the optimal technology level and the optimal clean-tech refund for a given \(\mu \). Since \(p^{RTIA}\) is decreasing in \(\mu \), the cost function \(K^{RTIA}\) is increasing in \(\mu \). Hence, it suffices to show that \(K^{RTIA}|_{\mu = 1} \le K_i^{NTO}\). Evaluating the cost at \(\mu = 1\) yields

The cost function under NTO is given by

where the second line follows from the equilibrium conditions on the emission market, the optimal amount of emission permits issued by countries \(i = 3,\ldots ,n\) and the equilibrium price for the frontier technology. The last line additionally uses the optimal technology level.

- Case 1 :

-

Suppose \(4 \alpha \overline{\chi } < \beta ^2\). Then, \(\chi _2^{NTO} = 4 \alpha \overline{\chi }^2/\beta ^2\) and

$$\begin{aligned} K_3^{NTO} - K^{RTIA}|_{\mu = 1} = \frac{\alpha }{n} - \frac{\beta ^4}{16 ~ \alpha ~ \overline{\chi }^2} ~ [10 - 21 ~ n + 16 ~ n^2 - 4 ~ n^3]. \end{aligned}$$The term in square brackets is decreasing in n and equals to zero for \(n = 2\). Hence, the cost difference is strictly positive.

- Case 2 :

-

Suppose \(4 \alpha \overline{\chi } \ge \beta ^2\). Then, \(\chi _2^{NTO} = \overline{\chi }\) and

$$\begin{aligned} K_3^{NTO} - K^{RTIA}|_{\mu = 1} = \frac{\alpha }{n} - \frac{\beta ^4}{16 ~ \alpha ~ \overline{\chi }^2} ~ [8 - 21 ~ n + 16 ~ n^2 - 4 ~ n^3] - \frac{\beta ^2}{2 ~ \overline{\chi }}. \end{aligned}$$The term in square brackets is unambiguously negative and since \(4 \alpha \overline{\chi } \ge \beta ^2\), we get

$$\begin{aligned} K_3^{NTO} - K^{RTIA}|_{\mu = 1}&\ge \frac{\alpha }{n} - \alpha ~ [8 - 21 ~ n + 16 ~ n^2 - 4 ~ n^3] - \frac{\beta ^2}{2 ~ \overline{\chi }}\\&\ge \frac{\alpha }{n} - \alpha ~ [8 - 21 ~ n + 16 ~ n^2 - 4 ~ n^3] - 2 ~ \alpha \\&\ge \frac{\alpha }{n} - \alpha ~ [10 - 21 ~ n + 16 ~ n^2 - 4 ~ n^3]. \end{aligned}$$The expression in square brackets is decreasing in n and equals to zero for \(n = 2\). Hence, the cost difference is strictly positive.

Combining case 1 and case 2 completes our proof. \(\square \)

1.8 B.8 Proof of Equation (23)

To derive Eq. (23), we consider the case in which only one country innovates, i.e. \(\chi _2'=\overline{\chi }\). Countries are symmetric and \(\rho ^{CT} = 0\). Thus \(\rho =\frac{1}{n}\) and \(e^{RTA}= \epsilon ^{RTA}\). For this reason the local costs of trading, \(p^{RTA} (e^{RTA} - \mu \epsilon ^{RTA})\) and the refund revenue, \(\rho (1-\mu )p^{RTA} E^{RTA}\), add up to zero irrespective of whether a country buys the technology or not. As a consequence, we can directly apply Eq. (10) to calculate the technology price \(p = p^{RTA}\). \(\square \)

C Appendix: Negative Willingness to Pay in the RTA

We discuss the rather surprising result that in the RTA as \(\mu \) decreases, the buyer country’s willingness to pay for the superior technology decreases and finally even turns negative.

Consider Eq. (23). The first term in the first bracket is positive and linear in the permit price, as it stems from the local damages reduction. The second term in the brackets is negative and quadratic in the permit price, as it stems from the cost increase in the abatement costs. Surprisingly, although the superior technology decreases abatement cost for a given amount of abatement, the total abatement costs increase. The reason is that better technology induces higher abatement levels, which overcompensates the cost decrease for a certain level. As a consequence, for \(p^{RTA}\) sufficiently high, the quadratic term dominates and buying the technology makes the country worse off. This result clearly depends on how the damage and abatement costs are modeled and, in our case, is driven by the assumption of linear damages on the one side and quadratic abatement costs on the other side.

To get further intuition, consider a setting where a firm faces the decision of either buying (or not selling) permits or reducing emissions. Suppose that permit prices are fixed and the value of the permits the firm is being grandfathered is sunk. Hence, a firm minimizes \(pe +\frac{\chi }{2} (\overline{e}-e)^2\), and with \(e=\overline{e}-\frac{p}{\chi }\) we get \(p\overline{e}-\frac{p^2}{2\chi }\). The firms’ costs unambiguously decrease in the technology level. The firm level, however, is not the case we are considering. Instead, our focus is on the national level where the local damages, \(\beta E\), are also accounted for. In addition, in our setting there are no costs associated with buying emission permits as the local planner creates exactly the amount needed by the firm. Hence, the term pe is dropped and other terms related to permit trading or refunding do not enter either.Footnote 40 Knowing that he can create the amount of permits needed, the local planner only cares about the balance between abatement costs on the one side and environmental damages on the other side.

The result hinges on the assumption that the firms always use the best available technology. To see this, consider the case where the willingness to pay is negative (\(p^{RTA}>2 \beta \)). If the local planner could influence the firms’ decision, he would promt the firm to use \(\overline{\chi }\) instead of \(\chi ^{RTA}\), even though the technology leader does not charge anything for it. This influence could be direct via a command and control approach. A more indirect way would be to promise the firms that, for whatever they emit, they receive both the fraction of permits the local planner is allowed to keep and, in addition, the revenues of the refunding. Thus, the only costs the firm would be left with are the abatement costs and would thus voluntarily use \(\overline{\chi }\). The RTA has to be set up in a way that prevents such a counterproductive behavior of countries.

Rights and permissions

About this article

Cite this article

Gersbach, H., Oberpriller, Q. & Scheffel, M. Double Free-Riding in Innovation and Abatement: A Rules Treaty Solution. Environ Resource Econ 73, 449–483 (2019). https://doi.org/10.1007/s10640-018-0270-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-018-0270-8

Keywords

- Rules treaty

- Climate change

- Global refunding scheme

- International permit markets

- Technological innovation

- Patent

- Licensing