Abstract

This paper examines the interdependence between imperfect competition and emissions trading. We particularly analyze the long run equilibrium in a two-sector (‘clean’ and ‘dirty’) model with Cournot competition among firms who face a fixed cost of production. The clean sector is defined as the sector with the highest long run cost margin on emissions. We compare the welfare implications of a cap-and-trade scheme with an emissions trading scheme based on relative intensity standards. It is shown that a firm’s long run equilibrium output in the clean or dirty sector does not depend on the emissions trading format, but only depends on the fixed cost of producing in the respective sector. Intensity standards can result in clean firms selling allowances to dirty firms, or dirty firms selling to clean firms. The former outcome yields higher welfare. It is demonstrated that cap-and-trade outperforms the intensity-based trading scheme in terms of long run welfare with free entry and exit. With intensity standards the size of the clean sector is too large.

Similar content being viewed by others

Notes

Note that Holland (2012) does not consider an absolute emissions trading scheme explicitly as we do but makes use of an emission tax instead, which is equivalent to an absolute cap on emissions.

See Millimet et al. (2009) for a survey on the interaction between environmental policy and market structure.

This is a standard assumption in the literature; Boom and Dijkstra (2009) is an exception.

Note that the slope of both inverse demand functions is normalized to \(-1\). In section “Normalization of the Slope of a Demand Function” in the Appendix it is demonstrated that this normalization procedure has no impact on the subsequent analysis.

Overbars represent the value of a variable in the unconstrained benchmark.

Since \(\gamma _{i}\) is measured in money per unit of output \(i\) and \( \epsilon _{i}\) is measured in emissions per unit of output \(i,\) the long run cost margin on emissions, \(\gamma _{i}/\epsilon _{i},\) is measured in money per unit of emission.

This follows formally from Eq. (36) given in section “Proofs” in the Appendix.

Note that the definition of a unit of production does not affect our definition of the clean and dirty sector as given by (12), because the latter definition is in terms of the long run cost margin on emissions (see also footnote 6).

The expressions for \(p_{c}^{r}(Q_{d})\) and \(p_{c}^{\rho }(Q_{d})\) are derived in section “Derivation of \(p_{c}^{r}(Q_{d})\) and \(p_{c}^{\rho }(Q_{d})\) Curves” in the Appendix.

Without the zero-profit result that \(q_{i}=f_{i}\) (or any other constraints on \(q_{i}\)), the welfare optimum would feature \(n_{c}\) and \(n_{d}\) arbitrarily small (ignoring the integer constraint) or \(n_{c}=n_{d}=1\) (taking the integer constraint into account) in order to minimize aggregate fixed costs.

See Holland et al. (2009) for a similar assessment of Low Carbon Fuel Standards.

The other solution \(Q_{d}^{\min }=\frac{\gamma _{d}-\sqrt{\gamma _{c}^{2}+\gamma _{d}^{2}}}{2}<0\) is irrelevant.

References

Barnett AH (1980) The Pigouvian tax rule under monopoly. Am Econ Rev 70:1037–1041

Boom JT, Dijkstra BR (2009) Permit trading and credit trading: a comparison of cap-based and rate-based emissions trading under perfect and imperfect competition. Environ Resour Econ 44:107–136

Buchanan JM (1969) External diseconomies, corrective taxes and market structure. Am Econ Rev 59:174–177

Dewees DN (2001) Emissions trading: ERCs or allowances? Land Econ 77:513–526

Dixit AK (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10:20–32

Ellerman DA, Buchner BK (2007) The European Union emissions trading scheme: origins, allocation, and early results. Rev Environ Econ Policy 1:66–87

Environment Canada (2007) Action on climate change and air pollution. Technical report, Environment Canada

Fischer C (2001) Rebating environmental policy revenues: output-based allocations and tradable performance standards. RFF Discussion Paper 01-22, Resources for the Future, Washington, DC

Fischer C (2003) Combining rate-based and cap-and-trade emissions policies. Clim Policy 3S2:S89–S103

Hahn RW, Hester GL (1989) Marketable permits: lessons for theory and practice. Ecol Law Q 16:361–406

Helfand GE (1991) Standards versus standards: the effects of different pollution restrictions. Am Econ Rev 81:622–634

Holland SP (2012) Emissions taxes versus intensity standards: second-best environmental policies with incomplete regulation. J Environ Econ Manag 63:375–387

Holland SP, Hughes JE, Knittel CR (2009) Greenhouse gas reductions under low carbon fuel standards? Am Econ J Econ Policy 1:106–146

Jotzo F, Pezzey JCV (2007) Optimal intensity targets for greenhouse gas emissions trading under uncertainty. Environ Resour Econ 38:259–284

Kerr S, Newell RG (2003) Policy-induced technology adoption: evidence from the U.S. lead phasedown. J Ind Econ 51:317–343

Michaelowa A, Tangen K, Hasselknippe H (2005) Issues and options for the post-2012 climate architecture—an overview. Int Environ Agreem 5:5–24

Millimet DL, Roy S, Sengupta A (2009) Environmental regulations and economic activity: influence on market structure. Annu Rev Resour Econ 1:99–118

Philibert C, Pershing J (2001) Considering the options: climate targets for all countries. Clim Policy 1:211–227

Tietenberg T (1999) Lessons from using transferable permits to control air pollution in the United States. In: van den Bergh JCJM (ed) Handbook of environmental and resource economics. Edward Elgar, Cheltenham, pp 275–292

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank two anonymous reviewers for valuable comments.

Appendix A

Appendix A

1.1 Proofs

1.1.1 Proposition 2

Proposition 2.1 There are two solutions to Eq. (29) for each sector \(i=c,d,\) (13) and (30) which we shall denote by \(r\) and \(\rho \). Solution \(r\) is:

with \(\bar{E}>L\) being the unconstrained emissions given by (11) and \(\gamma _{i}\) by (9). We see that \(h_{d}^{r}\) in (32b) is negative, i.e., dirty firms are buying allowances so that \(n_{d}^{r}<\bar{n}_{d}\) by (10) and (29). Market clearing with \( n_{c}^{r},n_{d}^{r}>0\) then requires by (30) that \( h_{c}^{r}>0\): clean firms are selling allowances, and \(n_{c}^{r}>\bar{n}_{c}\) by (10) and (29).

Solution \(\rho \) is:

We see that \(h_{c}^{\rho }\) in (33a) is negative, i.e., clean firms are buying allowances so that \(n_{c}^{\rho }<\bar{n}_{c}\) by (10) and (29). Market clearing with \(n_{c},n_{d}>0\) then requires by (30) that \( h_{d}^{\rho }>0\): dirty firms are selling allowances so that \(n_{d}^{\rho }> \bar{n}_{d}\) by (10) and (29).\(\square \)

Proposition 2.2 Substituting (29) and (30) into (31) gives welfare \(W^{R}\) under intensity standards:

Substituting (32c) and (32d) into (34) yields:

Substituting (33c) and (33d) into (34) yields:

By definition (12), \(W^{r}>W^{\rho }\). \(\square \)

Proposition 2.3 Since \(n_{d}^{r}< \bar{n}_{d}\) and \(n_{c}^{r}>\bar{n}_{c},\) we have to ensure that \( n_{d}^{r}>0 \) and \(P_{c}(Q_{c}^{r})>0\). From (32d), \(n_{d}^{r}>0\) if and only if (14) holds. Maximizing \(n_{c}^{r}\) in (32c) with respect to \(L\) yields:

Substituting (35) into (32c) yields, using Proposition 1:

Then \(P_{c}(Q_{c}^{\max })>0\) if and only if (15) holds. \(\square \)

1.1.2 Proposition 3

Maximizing welfare (31) with respect to \(n_{i}\ (i=c,d)\) yields:

This is the same condition as the first-order condition under the cap-and-trade regime, substituting (7) and (16) into (4). The shadow price \(\lambda \) of emissions in (36) therefore equals the allowance price \(v\) in (17), and \( n_{i}\) in (36) equals \(n_{i}^{A}\) in (18). This means that a cap-and-trade scheme implements the welfare optimum for a given level of total emissions with \(q_{i}=f_{i}\). Combining (19) and Proposition 2.1, we find \(n_{c}^{A}< \bar{n}_{c}<n_{c}^{r}=n_{c}^{R}\). Combining \(n_{c}^{A}<n_{c}^{R}\) with (13) yields \(n_{d}^{A}>n_{d}^{R}\). \(\square \)

1.2 Normalization of the Slope of a Demand Function

The slope of the demand function for a good, when using conventional units for measuring the good as well as for money, is usually different from \(-1\). In this appendix we show how to normalize the slopes of the demand functions for two goods (gasoline and coal) to \(-1\) by changing the unit of measurement of the respective goods. We leave the money measurement intact, so that consumer surplus from the two goods can still be added together after normalization.

Suppose the inverse demand function for gasoline \((gas)\) is:

with the quantity of gasoline \(Y_{gas}\) measured in gallons and its price \( P_{gas}\) in dollars per gallon. Thus the units on \(A\) and \(B\) are “$/gallon” and “$/(gallon)\(^{2}\)”, respectively. Total revenue is \( P_{gas}Y_{gas}\) and units for total revenue are dollars. To normalize the demand function, we first divide both sides by \(b\equiv \sqrt{B}\) “\(1/b\)-gallons” per gallon (or equivalently, we multiply by \(1/b\) gallons per “\(1/b\) -gallon”). The demand function then becomes:

with \(p_{gas}\equiv P_{gas}/b\) and \(\alpha _{gas}\equiv A/b\). Now \(p_{gas}\) and \(\alpha _{gas}\) are measured in “$ per \(1/b\) -gallon” and \(b=B/b\) in “\(\$/\)(gallon \( \times 1/b\)-gallon)”. Finally, we introduce the quantity measure \(Q_{gas}\) which is expressed in “\(1/b\) -gallon” so that \(Q_{gas}=bY_{gas}.\ \)This turns the demand function into:

with \(\beta _{gas}=\$1/(1/b\)-gallon)\(^{2}\). The slope of the demand function is now \(-1\).

As a specific example, let us set \(A=\$500/\)gallon and \(B=\$100/\)(gallon)\( ^{2}\) in \(P_{gas}=A-BY_{gas}\). This means the vertical intercept is $500 per gallon and the horizontal intercept is 5 gallons. Writing the unit of measurement below each parameter and variable, we have:

Multiplying the left-hand side and the right-hand side by 0.1 gallon/decigallon yields:

Simplifying and noting that \(Y_{gas}=0.1Q_{gas}\) yields:

Simplifying this gives:

After normalization, the vertical intercept is $50 per decigallon and the horizontal intercept is 50 decigallons.

In the same way, let the inverse demand function for coal be \( P_{coal}=C-DY_{coal}\) with the quantity of coal measured in tons and its price in dollars per ton. We normalize this demand function to \( p_{coal}=\alpha _{coal}-Q_{coal}\) with \(p_{coal}\equiv P_{coal}/d,\ \alpha _{coal}\equiv C/d\) and\(\ Q_{coal}\equiv dY_{k}\) where \(d\equiv \sqrt{D}\). Now the quantity of coal is measured in “\(1/d\) -tons” and its price in dollars per \(1/d\)-ton. As a specific example, let us set \(C=\$100\) per ton and \(D=\$4/\)(ton)\(^{2}\). This means the vertical intercept is $100 per ton and the horizontal intercept is 25 tons. We normalize this demand function by expressing the quantity of coal \(Q_{coal}\) in “half tons,” with its price \(p_{coal}\) expressed in dollar per half ton. After normalization the demand curve is \(p_{coal}=50-Q_{coal}\). The vertical intercept is $50 per half ton and the horizontal intercept is 50 half tons.

1.3 Derivation of \(p_{c}^{r}(Q_{d})\) and \(p_{c}^{\rho }(Q_{d})\) Curves

Solving (29) and (30) for \(Q_{c}\) yields two solutions:

The highest possible value of \(Q_{d}\) in (37) and (38) is where the term under the square root is zero:Footnote 13

The \(Q_{c}^{+}\) solution (37) includes the unconstrained benchmark, since \(Q_{c}^{+}(\gamma _{d})=\gamma _{c}\). Substituting (37) into (13), we find that total emissions are:

The first and second derivatives are:

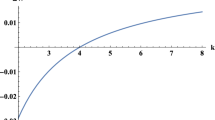

The inequality follows from (12). Equation (42) together with \(L^{+\prime \prime }(Q_{d})<0\) from (41) implies that \(L^{+}(Q_{d})\) has a unique stationary point, which is a maximum, between \(\gamma _{d}\) and \(Q_{d}^{\max }\). Thus \(L^{+\prime }(Q_{d})>0\) for \( Q_{d}\in [0,\gamma _{d}]\). From (37) it follows that \( Q_{c}^{+}(Q_{d})\ge \gamma _{c}=\bar{n}_{c}f_{c}\) for \(Q_{d}<\gamma _{d}= \bar{n}_{d}f_{d}\). Thus, \(Q_{c}^{+}(Q_{d})\) implements solution \(r\) for \( Q_{d}<\gamma _{d}\). Substituting (37) into (2), the expression for \(p_{c}^{r}(Q_{d})\) is then:

In our numerical example (21), this becomes:

By (42), \(L^{+}(Q_{d})>L^{+}(\gamma _{d})=\bar{E}\) for \(Q_{d}\) just above \(\gamma _{d}\). The other solution to \(L^{+}(Q_{d})=\bar{E}\) is:

Since \(L^{+}(Q_{d})\) has a unique stationary point, which is a maximum, between \(\gamma _{d}\) and \(Q_{d}^{\max }, L^{+\prime }(Q_{d})<0\) for \( Q_{d}\in [\tilde{Q}_{d},Q_{d}^{\max }]\) and \(L^{+}(Q_{d})<\bar{E}\) for \(Q_{d}\in (\tilde{Q}_{d},Q_{d}^{\max }]\). With \(Q_{d}\in (\tilde{Q}_{d},Q_{d}^{\max }], Q_{d}\) exceeds \(\gamma _{d}\) and \(L^{+}(Q_{d})<\bar{E} ,\) so that \(Q_{c}\) must be below \(\gamma _{c},\) which means this is part of solution \(\rho \).

The other part of solution \(\rho \) is found on \(Q_{c}^{-}(Q_{d})\) in (38) with \(Q_{c}^{-}(Q_{d}^{\max })=\gamma _{c}/2\) by (39)\( , \) and \(Q_{d}=0\) and \(Q_{d}=\gamma _{d}\) the only solutions to \( Q_{c}^{-}(Q_{d})=0\). Thus \(Q_{d}\in [\gamma _{d},Q_{d}^{\max }]\). Substituting (38) into (13), total emissions are:

with

The inequality follows from \(Q_{d}\ge \gamma _{d}\). The correspondence \( p_{c}^{\rho }(Q_{d})\) is therefore given by:

In our numerical example (21), this becomes:

Rights and permissions

About this article

Cite this article

de Vries, F.P., Dijkstra, B.R. & McGinty, M. On Emissions Trading and Market Structure: Cap-and-Trade versus Intensity Standards. Environ Resource Econ 58, 665–682 (2014). https://doi.org/10.1007/s10640-013-9715-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9715-2