Abstract

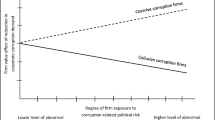

Political corruption imposes substantial costs on shareholders in the U.S. Yet, we understand little about the basic factors that exacerbate or mitigate the value consequences of political corruption. Using federal corruption convictions data, we find that firm-level economic rents and monitoring mechanisms moderate the negative relation between corruption and firm value. The value consequences of political corruption are exacerbated for firms operating in low-rent product markets and mitigated for firms subject to external monitoring by state governments or monitoring induced by disclosure transparency. Our results should inform managers and policymakers of the tradeoffs imposed on firms operating in politically corrupt districts.

Similar content being viewed by others

Notes

The definition of corruption varies greatly in the academic literature (Warren and Laufer 2009). Our definition narrowly focuses on political corruption in terms of specific transactions as well as general relationships between public officials and private agents. We also note that political corruption is distinct from bureaucratic inefficiency and weak institutional quality, and captures broader costs and benefits than those associated with political lobbying and political connectedness, which are legal ways to gain political influence (Campos and Giovannoni 2007).

The DOJ’s convictions data do not provide granular information on the types of corrupt acts committed within each district. While the lack of detailed data is a limitation of our study, we note that the DOJ’s convictions data are the most direct measure of political corruption within and across American states. Highlights of cases from the DOJ’s annual reports to Congress indicate that typical offenses include firms making bribes, unofficial payments, or campaign contributions in exchange for direct political actions as well as extortion and criminal conflicts of interest by public officials. The convictions also capture corrupt and unethical practices that indirectly affect firms such as election crimes and other crimes of a strictly political nature.

Firm value is the inflation-adjusted stock market capitalization in 2013 dollars. The economic magnitude of our corruption-value effect is similar to that reported in Dass et al. (2016). Using state-level aggregates of the convictions data, Dass et al. find a 5% decline in firm value when moving from the fifth least corrupt state (Minnesota) to the first most corrupt state (Mississippi).

Our corporate governance measure is based on the Entrenchment Index developed by Bebchuk et al. (2009). The entrenchment index is a count of six anti-takeover and entrenching provisions that exist in a given firm’s corporate charter: staggered boards, limits on amending by-laws, limits on amending charters, supermajority requirements, poison pills, and golden parachutes. As argued in Bebchuk et al. (2009), these provisions promote managerial entrenchment by (1) limiting the extent to which shareholders can impose their will on management and (2) insulating managers from hostile takeovers (see Bates et al. 2008 for evidence consistent with staggered boards as a strong entrenchment device). Consistent with this argument, we use the term “strong corporate governance” to refer to a low number of anti-takeover and entrenching provisions within the firm’s corporate charter (i.e., the inverse of the Entrenchment Index).

Consistent with our earlier arguments, firms in more corrupt districts could also disclose less to hide collusion with public officials or to preserve business secrecy.

Our sample is free of survivorship bias since we do not restrict our sample to surviving firms.

Corruption occurs when a transfer of wealth is beneficial to public officials (and, in some cases, firms), and these opportunities generally arise in situations where a firm applies or competes for a tax credit, contract, permit, license, or other action (such as a takeover) that requires government approval. A firm is more likely to engage in such activity in the district in which it focuses its operations, generally that of its headquarters. Thus, we believe it is more appropriate to focus on the district location of firms’ headquarters as opposed to the state of incorporation. In untabulated analyses, we use data from García and Norli (2012) to control for the geographic dispersion in the operations of a subset of our sample firms over the 1994 to 2008 period. The García–Norli (2012) data are based on disclosure text extracted from 10-K filings and counts how many times each state name appears in discussing the firm’s operations. We merge the data with our sample and measure geographic concentration in the headquarter state as the ratio of headquarter-state name counts scaled by the counts of all U.S. states. We then restrict the sample to those firm-years in which the headquarter-state concentration ratio is at least 0.25. We replicate our tests using this reduced sample and find evidence consistent with our main results.

We use the header information from firms’ 10-K filings to capture the location of their headquarters. This provides more precise information compared to the location information in Compustat and, thus, allows us to capture changes (though rare) in firm headquarter locations and state of incorporation over our sample period.

Prior studies use the DOJ convictions data to demonstrate that state-level corruption affects state education and income levels (Glaeser and Saks 2006) and the sale and underwriting of municipal bonds (Butler et al. 2009). Relatedly, Dass et al. (2016) use the convictions data at both the state and district levels to show that corruption dampens U.S. firm value.

These district-level data preclude any analysis of the variation in corruption within a district. For example, we are unable to detect or exploit differences in the level of political corruption between neighborhoods in the same city. Future researchers with better access to granular location data should view this as a potential area for further research.

Across our sample, the correlation between current and lagged corruption varies between 0.70 and 0.85 (depending on the measure of corruption; see Footnote 16 for alternative constructions of the corruption measure), which suggests that within a district, corruption from year to year is similar, but not unchanging.

The annual number of convictions is missing for some district-years. For these years, we use the average of the number of convictions for the year before and after. Our results are not affected when these years are excluded.

Our inferences are unchanged when we remove the District of Columbia from our sample.

To draw any inferences from our regressions with these data, we assume the ratio of convictions to underlying corruption is relatively homogeneous or proportional across districts. If per capita convictions do not accurately reflect the corrupt nature of a district, or if certain districts are more thorough in rooting out corruption than others, then our proxy may be inappropriate. Using conviction statistics based on the U.S. District Court system alleviates much of the concern about heterogeneity in the vigilance of the prosecution. Prosecutorial vigilance is mandated at the federal level; thus, federal prosecutors are likely to prosecute cases with equal vigor regardless of the district. Indeed, Meier and Holbrook (1992) find that the number of corruption convictions at the state level is largely unaffected by the number of federal prosecutors and judges within each state. Occasionally, an unusually complicated or expensive corruption case will be moved from a state court to a U.S. District Court. While such moves could introduce a bias, these cases are quite rare.

A more pressing concern is whether corruption convictions represent a reasonable proxy for the underlying corruption within a district. This concern is alleviated to a great extent by Glaeser and Saks (2006), who observe a positive correlation between the conviction data (at the state level) and the perception of state-level corruption by state house reporters (Boylan and Long 2003). Campante and Do (2014) also document a positive correlation between the conviction data and an online search volume measure of corruption at the state level. These correlations suggest that the conviction data represent underlying corruption reasonably well.

Our results are robust to using the untransformed Corruption values and to measuring Corruption based on the raw number of corruption convictions in each district-year. We report results based on the standardized Corruption measure for brevity.

These covariates are based on prior studies that rely on Tobin’s Q to measure firm value. We omit a few of the variables used in Dass et al. (2016) for reasons of data availability. However, we observe similar results in smaller samples with non-missing data for the full battery of firm-level covariates from Dass et al. (2016). Also, the treatment of missing R&D data does not affect our inferences. Our results are unchanged when we include an indicator variable to identify those firm-years with missing R&D data.

Prior research uses Tobin’s Q to capture not only firm value, but also the firm’s growth opportunities. Our inclusion of the ratio of R&D expenditures to sales—a widely used measure of growth opportunities—in our regressions should rule out this alternative interpretation of Tobin’s Q. In untabulated tests, we interact corruption with multiple permutations of the R&D-to-sales ratio and do not find significant interaction effects. This result suggests that corruption does not differentially impact the value of high- versus low-growth firms. Lastly, our regressions include industry and year fixed effects, which should subsume any between-industry and across-time differences in growth opportunities.

Hoberg and Phillips (2016) dispense with the typical industry-wide definition of product market competition (where industry concentration serves as a proxy) and develop a new firm-year specific HHI by reviewing over 50,000 product descriptions filed by firms with the U.S. Securities and Exchange Commission (SEC). This new classification gauges the competitive environment of a firm based on the similarity of its product descriptions to those of other firms (referred to as the Text-based Network Industry Classification (TNIC). The new measure allows for more cross-sectional variation than measures based on SIC or NAICS industry codes, and has the benefit of being firm-specific and more applicable to firms in unique industries. The TNIC HHI data are available at http://hobergphillips.usc.edu/industryclass.htm.

The index is a count of six anti-takeover and entrenching provisions, where higher values represent weaker corporate governance through increased managerial entrenchment and less minority shareholder protection. The index is recalculated every 2 or 3 years, and unreported firm-years are matched to the previous measure, following Bebchuk et al. (2009). We gather the Entrenchment Index data from the Institutional Shareholder Services (ISS) database.

The SEC expanded and renumbered the list of events that would trigger a Form 8-K filing, effective August 23, 2004. The voluntary items considered in our study remained intact and largely unchanged after the SEC expansion. Prior to the expansion, the item numbers for the voluntary disclosure items are 12 (Results of Operations and Financial Conditions), 9 (Regulation Fair Disclosure), and 5 (Other Important Events). These item numbers were subsequently revised to 2.01 (Results of Operations and Financial Conditions), 7.01 (Regulation Fair Disclosure), and 8.01 (Other Important Events).

Our results (not reported) are robust to Fama–MacBeth regressions with Newey–West errors.

We caution readers to consider that Big N auditors tend to audit large firms, and that differentiating the Big N effect from a size effect is difficult. Untabulated results suggest that the Corruption × Big N Auditor term remains negative and significant in these models after including a Corruption × Size interaction term, but a dedicated analysis by future researchers may be of value.

References

Ades, A., & Di Tella, R. (1999). Rents, competition, and corruption. The American Economic Review, 89(4), 982–993.

Bao, D., Kim, Y., Mian, G., & Su, L. (2018). Do managers disclose or withhold bad news? Evidence from short interest. The Accounting Review. https://ssrn.com/abstract=3212921.

Bates, T., Becher, D., & Lemmon, M. (2008). Board classification and managerial entrenchment: Evidence from the market for corporate control. Journal of Financial Economics, 87(3), 656–677.

Bebchuk, L., Cohen, A., & Ferrell, A. (2009). What matters in corporate governance? Review of Financial Studies, 22(2), 783–827.

Beck, T., Demirgüҫ-Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm size matter? Journal of Finance, 60(1), 137–177.

Borisov, A., Goldman, E., & Gupta, N. (2016). The corporate value of (corrupt) lobbying. Review of Financial Studies, 29(4), 1039–1071.

Bourveau, T., Lou, Y., & Wang, R. (2018). Shareholder litigation and corporate disclosure: Evidence from derivative lawsuits. Journal of Accounting Research, 56(3), 797–842.

Boylan, R., & Long, C. (2003). Measuring public corruption in the American States: A survey of State House reporters. State Politics and Policy Quarterly, 3(4), 420–438.

Buchanan, J., & Tullock, G. (1962). The calculus of consent. Ann Arbor, MI: University of Michigan Press.

Butler, A., Fauver, L., & Mortal, S. (2009). Corruption, political connections, and municipal finance. Review of Financial Studies, 22(7), 2873–2905.

Campante, F., & Do, Q.-A. (2014). Isolated capital cities, accountability, and corruption: Evidence from US States. American Economic Review, 104(8), 2456–2481.

Campos, N., & Giovannoni, F. (2007). Lobbying, corruption and political influence. Public Choice, 131(1), 1–21.

Choi, J.-H., & Wong, T. J. (2007). Auditors’ governance functions and legal environments: An international investigation. Contemporary Accounting Research, 24(1), 13–46.

Clarke, G., & Xu, L. (2004). Privatization, competition, and corruption: How characteristics of bribe takers and payers affect bribes to utilities. Journal of Public Economics, 88(9–10), 2067–2097.

Cooper, M. J., He, J., & Plumlee M. P. (2018). Measuring disclosure using 8K filings. Working paper, University of Utah and University of Delaware.

Collins, J., Uhlenbruck, K., & Rodriguez, P. (2009). Why firms engage in corruption: A top management perspective. Journal of Business Ethics, 87, 89–108.

Cumming, D., Hou, W., & Lee, E. (2016). Business ethics and finance in Greater China: Synthesis and future directions in sustainability, CSR, and fraud. Journal of Business Ethics, 138(4), 601–626.

Dass, N., Nanda, V., & Xiao, S. (2016). Public corruption in the United States: Implications for local firms. Review of Corporate Finance Studies, 5(1), 102–138.

Desai, M., Gompers, P., & Lerner, J. (2003). Institutions, capital constraints and entrepreneurial firm dynamics: Evidence from Europe. Working Paper No. 10165. Cambridge, MA: National Bureau of Economic Research.

Durnev, A., & Fauver, L. (2011). Stealing from thieves: Expropriation risk, firm governance, and performance. Unpublished Working Paper. Knoxville, TN: University of Tennessee.

Dyck, A., Volchkova, N., & Zingales, L. (2008). The corporate governance role of the media: Evidence from Russia. Journal of Finance, 63(3), 1093–1135.

Emerson, P. (2006). Corruption, competition and democracy. Journal of Development Economics, 81(1), 193–212.

Fackler, T., & Lin, T. (1995). Political corruption and presidential elections, 1929–1992. The Journal of Politics, 57(4), 971–993.

Francis, J. (2004). What do we know about audit quality? The British Accounting Review, 36(4), 345–368.

García, D., & Norli, Ø. (2012). Geographic dispersion and stock returns. Journal of Financial Economics, 106(3), 547–565.

Gardberg, N., Sampath, V., & Rahman, N. (2012). Corruption and corporate reputation: The paradox of buffering and suffering. In Academy of Management proceedings.

Glaeser, E., & Saks, R. (2006). Corruption in America. Journal of Public Economics, 90(6–7), 1053–1072.

Gompers, P., Ishii, J., & Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 118(1), 107–156.

Guedhami, O., Pittman, J., & Saffar, W. (2009). Auditor choice in privatized firms: Empirical evidence on the role of state and foreign owners. Journal of Accounting and Economics, 48(2–3), 151–171.

He, J., & Plumlee, M. (2019). Measuring disclosures using 8-K filings. Unpublished Working Paper. Newark, DE: University of Delaware.

Healy, P., & Palepu, K. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1), 405–440.

Hoberg, G., & Phillips, G. (2016). Text-based network industries and endogenous product differentiation. Journal of Political Economy, 124(5), 1423–1465.

Hope, O.-K., Kang, T., Thomas, W., & Yoo, Y. K. (2008). Culture and auditor choice: A test of the secrecy hypothesis. Journal of Accounting and Public Policy, 27(5), 357–373.

Johan, S., & Najar, D. (2010). The role of corruption, culture, and law in investment fund manager fees. Journal of Business Ethics, 95(Supplement 2), 147–172.

John, K., & Kadyrzhanova, D. (2008). Relative governance. Unpublished Working Paper. Atlanta, GA: Georgia State University.

Khanna, V., & Zyla, R. (2012). Survey says…corporate governance matters to investors in emerging market companies. Washington, DC: International Finance Corporation.

Klapper, L., & Love, I. (2004). Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance, 10(5), 703–728.

Kolstad, I., & Wiig, R. (2009). Is transparency the key to reducing corruption in resource-rich countries? World Development, 37(3), 521–532.

Kwon, S., Lim, C., & Tan, P. (2007). Legal systems and earnings quality: The role of auditor industry specialization. Auditing: A Journal of Practice and Theory, 26(2), 25–55.

Lang, M. H., & Lundholm, R. J. (1996). Corporate disclosure policy and analyst behavior. The Accounting Review, 71(4), 467–492.

Leff, N. (1964). Economic development through bureaucratic corruption. American Behavioral Scientist, 8(3), 8–14.

Lindgreen, A. (2004). Corruption and unethical behavior: Report on a set of Danish guidelines. Journal of Business Ethics, 51(1), 31–39.

Massart, D. L., Kaufman, L., Rousseeuw, P. J., & Leroy, A. (1986). Least median of squares: A robust method for outlier and model error detection in regression and calibration. Analytica Chimica Acta, 187, 171–179.

Meier, K., & Holbrook, T. (1992). “I seen my opportunities and I took ‘em:” Political corruption in the American states. The Journal of Politics, 54(1), 135–155.

Miller, G. (2006). The press as a watchdog for accounting fraud. Journal of Accounting Research, 44(5), 1001–1033.

Nice, D. (1983). Political corruption in the American states. American Politics Quarterly, 11(4), 507–517.

Rose-Ackerman, S. (1975). The economics of corruption. Journal of Public Economics, 4(2), 187–203.

Rose-Ackerman, S. (1999). Corruption and government, causes, consequences and reform. Cambridge: Cambridge University Press.

Rousseeuw, P. J. (1984). Least median of squares regression. Journal of the American Statistical Association, 79(388), 871–880.

Sampath, V., Gardberg, N., & Rahman, N. (2016). Corporate reputation’s invisible hand: Bribery, rational choice, and market penalties. Journal of Business Ethics, 151, 1–18.

Shleifer, A., & Vishny, R. (1993). Corruption. Quarterly Journal of Economics, 108(3), 599–617.

Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737–783.

Shleifer, A., & Vishny, R. (1998). The grabbing hand, government pathologies and their cures. Cambridge, MA: Harvard University Press.

Stulz, R. (2005). The limits of financial globalization. Journal of Finance, 60(4), 1595–1638.

Svensson, J. (2003). Who must pay bribes and how much? Evidence from a cross section of firms. Quarterly Journal of Economics, 118(1), 207–230.

United Nations. (2009). Corporate governance: The foundation for corporate citizenship and sustainable businesses. New York: United Nations.

Wang, Q., Wong, T. J., & Xia, L. (2008). State ownership, the institutional environment, and auditor choice: Evidence from China. Journal of Accounting and Economics, 46(1), 112–134.

Warren, D., & Laufer, W. (2009). Are corruption indices a self-fulfilling prophecy? A social-labeling perspective of corruption. Journal of Business Ethics, 88(Supplement 4), 841–849.

Watts, R., & Zimmerman, J. (1978). Towards a positive theory of the determination of accounting standards. The Accounting Review, 54(1), 112–134.

Wu, X. (2005). Corporate governance and corruption: A cross-country analysis. Governance, 18(2), 151–170.

Zeume, S. (2017). Bribes and firm value. Review of Financial Studies, 30(5), 1457–1498.

Acknowledgements

We thank Greg Shailer (Editor), three anonymous reviewers, Helen Brown-Liburd, David Denis, Diane Denis, Jing He, Andy Koch, Ahmet Kurt, Tianshu Qu (Discussant), Tom Shohfi, Scott Smart, Bryan Stikeleather, Shawn Thomas, Jack White, and seminar participants at Georgia State University, North Carolina State University, University of Florida, University of Pittsburgh, and the American Accounting Association Annual Meeting for insightful comments and suggestions. We also thank Diego García and Øyvind Norli for sharing data on firm operations and Gerald Hoberg and Gordon Phillips for sharing data on industry competition.

Funding

All authors did not receive funding from any sources.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical Approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed Consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Brown, N.C., Smith, J.D., White, R.M. et al. Political Corruption and Firm Value in the U.S.: Do Rents and Monitoring Matter?. J Bus Ethics 168, 335–351 (2021). https://doi.org/10.1007/s10551-019-04181-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-019-04181-0