Abstract

Targeting systemic risk, we propose a two-stage analysis of a large collection of stock markets by considering their interconnections. First, we characterize the joint dynamics of stock returns using a multivariate GARCH model in the presence of regime changes. The model detects three regimes of volatility rising from two unknown but common endogenous breaks. We compute filtered returns by normalizing them using the dynamic GARCH volatility. Second, we build a Gaussian signed weighted and undirected worldwide financial network from filtered stock returns, that evolves across regimes. The best network is built from the partial correlation matrix of filtered stock returns over each regime using regularisation and the minimum Extended Bayesian Information Criterion. To gain insights into the resilience of the financial network and its systemic risk over time, we then compute relevant nodal centrality measures—including the clustering coefficient—over each regime. Thus, we characterize the ever-changing network topology and structure by detecting group-like and community-like patterns (e.g., clustering and community detection, network cohesion). Under the resilience framework and depending on the studied regime, we analyse the propensity of a shock to propagate across the network thanks to positive weights, and the network’s ability to mitigate shocks thanks to negative weights. The balance between spreading and inhibiting node influences drives the network’s frailty and resilience to shocks. Hence, the network exhibits a high level of systemic risk when its connectivity is large and most edge weights are significantly positive (i.e., strong and multiple conditional dependencies of world stock markets). It is of high significance to policymakers because systemic risk/financial frailty is potentially costly (i.e., loss) while resilience is rewarding (i.e., gain).

Similar content being viewed by others

Change history

09 February 2024

A Correction to this paper has been published: https://doi.org/10.1007/s10479-024-05853-5

Notes

On a daily basis, regional stock markets exhibit a different number of structural breaks which happen at different dates. Gathering the stock markets worldwide provides a very large number of breaks with several short-lived regimes that build too small samples for a network analysis. Thus, we moved to weekly data to get significant market regimes with a convenient duration and sample size. Moreover, weekly data avoid to handle asynchronous daily closing prices by lagging relevant market prices but at the cost of dropping some insightful informational content.

The appendix provides results for daily data for extra information.

As an approximation, the quasi-correlation matrix Q needs to be scaled.

References

Adrian, T., & Brunnermeier, M. K. (2016). CoVaR. The American Economic Review, 106(7), 1705.

Baba, K., Shibata, R., & Sibuya, M. (2004). Partial correlation and conditional correlation as measures of conditional independence. Australian and New Zealand Journal of Statistics, 46(4), 657–664.

Barrat, A., Barthelemy, M., Pastor-Satorras, R., & Vespignani, A. (2004). The architecture of complex weighted networks. In Proc. Natl. Acad. Sci. USA 101 (pp. 3747–3752).

Bastidon, C., & Parent, A. (2022). Cliometrics of world stock markets evolving networks. Annals of Operations Research.

Bernanke, B S. “Chairman of the Board of Govenors Federal Reserve System, Ben Bernanke Written Testimony Before the FCIC” (2010). YPFS Documents. 4204.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics, 31, 307–327.

Braverman, A., & Minca, A. (2018). Networks of common asset holdings: Aggregation and measures of vulnerability. The Journal of Network Theory in Finance, 4(3), 53–78.

Cerqueti, R., Ciciretti, R., Dalò, A., & Nicolosi, M. (2021a). ESG investing: A chance to reduce systemic risk. Journal of Financial Stability, 54, 100887.

Cerqueti, R., Ciciretti, R., Dalò, A., & Nicolosi, M. (2022a). A new measure of the resilience for networks of funds with applications to socially responsible investments. Physica a: Statistical Mechanics and Its Applications, 593, 126976.

Cerqueti, R., Clemente, G. P., & Grassi, R. (2021b). Systemic risk assessment through high order clustering coefficient. Annals of Operations Research, 299, 1165–1187.

Cerqueti, R., Pampurini, F., Pezzola, A., & Quaranta, A. G. (2022b). Dangerous liaisons and hot customers for banks. Review of Quantitative Finance and Accounting, 59(1), 65–89.

Chen, H., & Hackbarth, D. (2020). Active sector funds and fund manager skill. Journal of Portfolio Management, 46(8), 64–85.

Chen, J., & Chen, Z. (2012). Extended BIC for small-n-large-p sparse GLM. Statistica Sinica, 22(2), 555–574.

Cho, H., & Fryzlewicz, P. (2015). Multiple-change-point detection for high dimensional time series via sparsified binary segmentation. Journal of the Royal Statistical Society B, 77(2), 475–507.

Cho, H., & Korkas, K. K. (2022). High-dimensional GARCH process segmentation with an application to value-at-risk. Econometrics and Statistics, 23, 187–203.

Connolly, R. A., Stivers, C., & Sun, L. (2007). Commonality in the time-variation of stock–stock and stock–bond return comovements. Journal of Financial Markets, 10(2), 192–218.

Cont, R., & Schaanning, E. (2019). Monitoring indirect contagion. Journal of Banking & Finance, 104, 85–102.

Costantini, G., & Perugini, M. (2014). Generalization of clustering coefficients to signed correlation networks. PLoS ONE, 9(2), e88669.

Dong, G., Fan, J., Shekhtman, L. M., Shai, S., Du, R., Tian, L., Chen, X., Stanley, H. E., & Havlin, S. (2018). Resilience of networks with community structure behaves as if under an external field. Proceedings of the National Academy of Sciences, 115(27), 6911–6915.

Elliott, M., Georg, C.-P., & Hazell, J. (2021). Systemic risk shifting in financial networks. Journal of Economic Theory, 191, 105157.

Engle, R. F. (2002a). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350.

Engle, R. F. (2002b). Anticipating correlations: A new paradigm for risk management. Princeton University Press.

Fioruci, J. A., Ehlers, R. S., & Andrade Filho, M. G. (2014). Bayesian multivariate GARCH models with dynamic correlations and asymmetric error distributions. Journal of Applied Statistics, 41(2), 320–331.

Foygel, R., & Drton, M. (2010). Extended Bayesian information criteria for Gaussian graphical models. In Advances in Neural Information Processing Systems (pp. 604–612).

Friedman, J., Hastie, T., & Tibshirani, R. (2008). Sparse inverse covariance estimation with the graphical lasso. Biostatistics, 9, 432–441.

Gatfaoui, H. (2013). Translating financial integration into correlation risk: A weekly reporting’s viewpoint for the volatility behavior of stock markets. Economic Modelling, 30, 776–791.

Gatfaoui, H., & de Peretti, P. (2019). Flickering in information spreading precedes critical transitions in financial markets. Scientific Reports, 9, 5671.

Geczy, C. (2014). The new diversification: Open your eyes to alternatives. Journal of Portfolio Management, 40(5), 146–155.

Ghanbari, M., Lasserre, J., & Vingron, M. (2019). The distance precision matrix: Computing networks from nonlinear relationships. Bioinformatics, 35(6), 1009–1017.

Ghanbari, R., Jalili, M., & Yu, X. (2018). Correlation of cascade failures and centrality measures in complex networks. Future Generation Computer Systems, 83, 390–400.

Guillemot, V., Bender, A., & Boulesteix, A.-L. (2013). Iterative reconstruction of high-dimensional Gaussian graphical models based on a new method to estimate partial correlations under constraints. PLoS ONE, 8(4), e60536.

Hafner, C. M., Herwartz, H., & Maxand, S. (2022). Identification of structural multivariate GARCH models. Journal of Econometrics, 227(1), 212–227.

Hasse, J.-B. (2022). Systemic risk: A network approach. Empirical Economics, 63, 313–344.

Hua, J., Peng, L., Schwartz, R. A., & Alan, N. S. (2020). Resiliency and stock returns. Review of Financial Studies, 33(2), 747–782.

Hübsch, A., & Walther, U. (2017). The impact of network inhomogeneities on contagion and system stability. Annals of Operations Research, 254, 61–87.

Jackson, M. O., & Pernoud, A. (2021). Systemic risk in financial networks: A survey. Annual Review of Economics, 13, 171–202.

Jankova, J., & van de Geer, S. (2018). Inference for high-dimensional graphical models. In: Handbook of graphical models (editors: Drton, M., Maathuis, M., Lauritzen, S., Wainwright, M.). CRC Press: Boca Raton, Florida, USA.

Junior, L. S., & Franca, I. D. P. (2012). Correlation of financial markets in times of crisis. Physica a: Statistical Mechanics and Its Applications, 391(1–2), 187–208.

Kenourgios, D., Samitas, A., & Paltalidis, N. (2011). Financial crises and stock market contagion in a multivariate time-varying asymmetric framework. Journal of International Financial Markets, Institutions and Money, 21(1), 92–106.

Kim, J., & Kim, Y. (2019). Transitory prices, resiliency, and the cross-section of stock returns. International Review of Financial Analysis, 63(C), 243–256.

Kritzman, M., Li, Y., Page, S., & Rigobon, R. (2011). Principal Components as a Measure of Systemic Risk 112–126.

Longstaff, F. A. (2010). The subprime credit crisis and contagion in financial markets. Journal of Financial Economics, 97(3), 436–450.

Malik, F., Ewing, B. T., & Payne, J. E. (2005). Measuring volatility persistence in the presence of sudden changes in the variance of Canadian stock returns. Canadian Journal of Economics, 38(3), 1037–1056.

Markose, S., Giansante, S., Eterovic, N. A., & Gatkowski, M. (2021). Early warning of systemic risk in global banking: Eigen-pair R number for financial contagion and market price-based methods. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04120-1

Mason, W., & Watts, D. J. (2012). Collaborative learning in networks. Proceedings of the National Academy of Sciences, 109(3), 764–769.

Mynhardt, R. H., Plastun, A., & Makarenko, I. (2014). Behavior of financial markets efficiency during the financial market crisis: 2007–2009. Corporate Ownership and Control, 11(2), 473–485.

Onnela, J. P., Chakraborti, A., Kaski, K., & Kertiész, J. (2002). Dynamic asset trees and portfolio analysis. The European Physical Journal B-Condensed Matter and Complex Systems, 30(3), 285–288.

Onnela, J. P., Saramaki, J., Kertesz, J., & Kaski, K. (2005). Intensity and coherence of motifs in weighted complex networks. Physical Review E, 71(6), 065103.

Opgen-Rhein, R., & Strimmer, K. (2007). Accurate ranking of differentially expressed genes by a distribution-free shrinkage approach. Statistical Applied Genetics Molecular Biology, 6, 1.

Pourahmadi, M. (2011). Covariance estimation: The GLM and regularization perspectives. Statistical Science, 26(3), 369–387.

Renn, O., Laubichler, M., Lucas, K., Kröger, W., Schanze, J., Scholz, R. W., & Schweizer, P. J. (2022). Systemic risks from different perspectives. Risk Analysis, 42(9), 1902–1920.

Schäfer, J., & Strimmer, K. (2005). A shrinkage approach to large-scale covariance estimation and implications for functional genomics. Statistical Applied Genetics Molecular Biology, 4, 32.

Simaan, M., Gupta, A., & Kar, K. (2020). Filtering for risk assessment of interbank network. European Journal of Operational Research, 280(1), 279–294.

So, M. K. P., Mak, A. S. W., & Chu, A. M. Y. (2022). Assessing systemic risk in financial markets using dynamic topic networks. Scientific Reports, 12, 2668.

Strohsal, T., & Weber, E. (2015). Time-varying international stock market interaction and the identification of volatility signals. Journal of Banking & Finance, 56, 28–36.

Tibshirani, R. (1996). Regression Shrinkage and selection via the Lasso. Journal of the Royal Statistical Society Series B, 58(1), 267–288.

van Borkulo, C. D., Borsboom, D., Epskamp, S., Blanken, T. F., Boschloo, L., Schoevers, R. A., & Waldorp, L. J. (2014). A new method for constructing networks from binary data. Scientific Reports, 4(1), 1–10.

Ward, M. D., Stovel, K., & Sacks, A. (2011). Network analysis and political science. Annual Review of Political Science, 14(1), 245–264.

Watts, D. J., & Strogatz, S. H. (1998). Collective dynamics of “small-world” networks. Nature, 393(6684), 440–442.

Whittaker, J. (1990). Graphical models in applied multivariate statistics. John Wiley.

Zhang, B., & Horvath, S. (2005). A general framework for weighted gene co-expression network analysis. Statistical Applications in Genetics and Molecular Biology, 4(1), 17.

Zhu, Y., Yang, F., & Ye, W. (2018). Financial contagion behavior analysis based on complex network approach. Annals of Operations Research, 268, 93–111.

Acknowledgements

We thank two anonymous referees for their questions and comments.

Funding

R. Cerqueti and G. Rotundo have no financial interests. Hayette Gatfaoui received a supporting grant from the “Sapienza Visiting Professor Programme 2020” of Sapienza University of Rome, Italy.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

G. Rotundo is an unpaid member of GNFM-INdAM and COST Action CA18232 and she thanks these organizations for fruitful discussions.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Daily GARCH estimates

Appendix: Daily GARCH estimates

From the 3rd January 2000 to the 8th July 2022, the daily sample size is T = 5875 (observations per series). The region-specific daily results are displayed in the forthcoming tables as follows. Table

9 displays the estimated changepoints (i.e., break dates) for each region, while Tables

10,

11 and

12 present the estimated GARCH(1,1) parameters across regimes and for each region on a daily basis. We find different regimes for stock returns across regional marketplaces.

In America, stock market indices exhibit (strong) persistence in volatility over time except for IPC index during period 3. Correlations persist over all periods except period 3. In Europe, individual volatilities of indices are strongly persisting across periods except for the following cases. CACALL index exhibits weak volatility persistence over period 2, while DAX, SMI, AEX, IBEX35, and OMXS indices exhibit small volatility persistence over period 3. Periods 1 and 2 exhibit almost no correlation persistence, while a low correlation persistence arises over period 3, giving then rise to strongly persisting correlations from period 4 to period 6. In Asia, stock market indices globally exhibit small persistence in volatility over periods 1, 2 and 5, while volatilities exhibit strong persistence over remaining periods 3, 4, 6, 7 and 8. Periods 1, 2 and 5 exhibit a small persistence in correlations, while the remaining periods 3, 4, 6, 7 and 8 strong exhibit persistence in correlations.

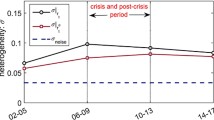

1.1 Clustering coefficient for signed networks

We apply the extension proposed by Costantini and Perugini (2014). The corresponding clustering coefficients per regime are displayed in the table below.

See Table

Obviously, considering weights' signs yields narrower standardized clustering coefficients because of the interplay between negative and positive node influences. Indeed, positive edges illustrate amplifying connections (e.g., risk frailty) within the network, and interact with negative edges that reflect inhibiting connections (e.g., risk resistance). Such interplay balances the network (shock spreading versus shock mitigation).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cerqueti, R., Gatfaoui, H. & Rotundo, G. Resilience for financial networks under a multivariate GARCH model of stock index returns with multiple regimes. Ann Oper Res (2024). https://doi.org/10.1007/s10479-023-05756-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05756-x