Abstract

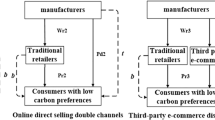

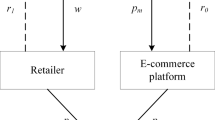

This study considers a manufacturer that invests in decarbonization and sells a product to consumers through a direct channel and an online retail platform. The platform decides to operate in either an agency selling or a reselling mode, and apply blockchain technology to improve its performance. The selected selling mode determines the market power wielded by the platform and the manufacturer. A five-stage game is constructed to examine the interplay between the manufacturer’s decarbonized investment decision and the platform’s decisions on blockchain application and selling mode selection. Results imply that the retail platform benefits from the manufacturer’s investment while the latter gains from the former’s blockchain application hinge on its selling mode selection. Specifically, the manufacturer benefits from blockchain application in an agency mode but is disadvantaged under a reselling mode. Besides, the blockchain application and the manufacturer’s investment have diametrically opposing influences on the platform’s selling mode selection. As the efficiency of the manufacturer’s investment increases, blockchain application becomes more favorable to the platform, particularly in a reselling mode. Furthermore, applying blockchain is not always conducive to social welfare, but the platform can increase the utility of blockchain application to consumers or reduce the commission rate to improve social welfare. Finally, switching the order of decarbonization investment and blockchain application does not affect their optimal operational decisions.

Similar content being viewed by others

Notes

For convenience, we use “she” to denote the manufacturer and “he” to denote the platform in this paper.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2016). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Adams, R., Kewell, B., & Parry, G. (2018). Blockchain for good? Digital ledger technology and sustainable development goals. Handbook of Sustainability and Social Science Research, 127–140.

Babich, V., & Hilary, G. (2020). OM Forum-distributed ledgers and operations: What operations management researchers should know about blockchain technology. Manufacturing & Service Operations Management, 22(2), 223–240.

Bian, J., & Guo, X. (2022). Policy analysis for emission-reduction with green technology investment in manufacturing. Annals of Operations Research, 316(1), 5–32.

Cai, Y., Choi, T. M., & Zhang, J. (2021). Platform supported supply chain operations in the blockchain era: Supply contracting and moral hazards. Decision Sciences, 52(4), 866–892.

Chen, X., Li, B., Chen, W., & Wu, S. (2023). Influences of information sharing and online recommendations in a supply chain: reselling versus agency selling. Annals of Operations Research, 329(1–2), 717–756.

Chitra, K. (2007). In search of the green consumers: A perceptual study. Journal of Services Research, 7(1), 173–191.

Choi, T. M. (2019). Blockchain-technology-supported platforms for diamond authentication and certification in luxury supply chains. Transportation Research Part E: Logistics and Transportation Review, 128, 17–29.

Choi, T. M. (2022). Achieving economic sustainability: Operations research for risk analysis and optimization problems in the blockchain era. Annals of Operations Research, 1–26.

Choi, T. M., Feng, L., & Li, R. (2020b). Information disclosure structure in supply chains with rental service platforms in the blockchain technology era. International Journal of Production Economics, 221, 107473.

Choi, T. M., Guo, S., Liu, N., & Shi, X. (2020a). Optimal pricing in on-demand-service-platform-operations with hired agents and risk-sensitive customers in the blockchain eras. European Journal of Operational Research, 284(3), 1031–1042.

de Sousa, J., Ana, B. L., Jabbour, C. J., Foropon, C., & Godinho Filho, M. (2018). When titans meet–Can industry 4.0 revolutionize the environmentally-sustainable manufacturing wave? The role of critical success factors. Technological Forecasting and Social Change, 132, 18–25.

Dou, Y., Hu, Y. J., & Wu, D. J. (2017). Selling or leasing? Pricing information goods with depreciation of consumer valuation. Information Systems Research, 28(3), 585–602.

Fan, X., Chen, K., & Chen, Y. J. (2023). Is price commitment a better solution to control carbon emissions and promote technology investment? Management Science, 69(1), 325–341.

Gao, F., & Su, X. (2017). Online and offline information for omnichannel retailing. Manufacturing & Service Operations Management, 19(1), 84–98.

He, P., He, Y., & Xu, H. (2019). Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidy. International Journal of Production Economics, 213, 108–123.

Hintermann, B. (2010). Allowance price drivers in the first phase of the EU ETS. Journal of Environmental Economics and Management, 59(1), 43–56.

Huang, S., Guan, X., & Chen, Y. (2018). Retailer information sharing with supplier encroachment. Production and Operations Management, 27(6), 1133–1147.

Huang, Y.-S., Fang, C.-C., & Lin, Y.-A. (2020). Inventory management in supply chains with consideration of Logistics, green investment and different carbon emissions policies. Computers & Industrial Engineering, 139, 106207.

Ivanov, D., Dolgui, A., & Sokolov, B. (2019). The impact of digital technology and Industry 4.0 on the ripple effect and supply chain risk analytics. International Journal of Production Research, 57(3), 829–846.

Jiang, B., Jerath, K., & Srinivasan, K. (2011). Firm strategies in the “mid tail” of platform-based retailing. Marketing Science, 30(5), 757–775.

Kamble, S., Gunasekaran, A., & Arha, H. (2019). Understanding the Blockchain technology adoption in supply chains-Indian context. International Journal of Production Research, 57(7), 2009–2033.

Li, G., Wu, H., Sethi, S. P., & Zhang, X. (2021b). Contracting green product supply chains considering marketing efforts in the circular economy era. International Journal of Production Economics, 234, 108041.

Li, G., Wu, H., & Zheng, H. (2021a). Technology investment strategy for a competitive manufacturer in the presence of technology spillover. IEEE Transactions on Engineering Management, 70(3), 1162–1173.

Li, G., Xue, J., Li, N., & Ivanov, D. (2022a). Blockchain-supported business model design, supply chain resilience, and firm performance. Transportation Research Part e: Logistics and Transportation Review, 163, 102773.

Li, J., Pisano, G., Xu, Y., & Zhu, F. (2023). Marketplace Scalability and Strategic Use of Platform Investment. Management Science, 69(7), 3958–3975.

Li, Q., Xiao, T., & Qiu, Y. (2018). Price and carbon emission reduction decisions and revenue-sharing contract considering fairness concerns. Journal of Cleaner Production, 190, 303–314.

Li, Z., Pan, Y., Yang, W., Ma, J., & Zhou, M. (2021c). Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Economics, 101, 105426.

Lin, Z. (2014). An empirical investigation of user and system recommendations in e-commerce. Decision Support Systems, 68, 111–124.

Liu, J., & Ke, H. (2021). Firms’ preferences for retailing formats considering one manufacturer’s emission reduction investment. International Journal of Production Research, 59(10), 3062–3083.

Lu, W., Jiang, Y., Chen, Z., & Ji, X. (2022). Blockchain adoption in a supply chain system to combat counterfeiting. Computers & Industrial Engineering, 171, 108408.

Queiroz, M. M., Fosso Wamba, S., De Bourmont, M., & Telles, R. (2021). Blockchain adoption in operations and supply chain management: Empirical evidence from an emerging economy. International Journal of Production Research, 59(20), 6087–6103.

Saberi, S., Kouhizadeh, M., Sarkis, J., & Shen, L. (2019). Blockchain technology and its relationships to sustainable supply chain management. International Journal of Production Research, 57(7), 2117–2135.

Shen, B., Dong, C., & Minner, S. (2022). Combating copycats in the supply chain with permissioned blockchain technology. Production and Operations Management, 31(1), 138–154.

Sheng, J., Joseph, A., & Wang, X. (2017). A multidisciplinary perspective of big data in management research. International Journal of Production Economics, 191, 97–112.

Shulman, J. D., & Geng, X. (2019). Does it pay to shroud in-app purchase prices? Information Systems Research, 30(3), 856–871.

Si, Y., Tian, J., Wang, L., & Sun, X. (2022). Should banks offer concessions? Lending rates for manufacturers’ green products. International Journal of Production Research, 60(12), 3901–3919.

Sun, C., & Ji, Y. (2022). For better or for worse: Impacts of IoT technology in e-commerce channel. Production and Operations Management, 31(3), 1353–1371.

Sundarakani, B., Ajaykumar, A., & Gunasekaran, A. (2021). Big data driven supply chain design and applications for blockchain: An action research using case study approach. Omega, 102, 102452.

Swami, S., & Shah, J. (2013). Channel coordination in green supply chain management. Journal of the Operational Research Society, 64(3), 336–351.

Tawiah, V., Zakari, A., Li, G., & Kyiu, A. (2022). Blockchain technology and environmental efficiency: Evidence from US-listed firms. Business Strategy and the Environment, 31(8), 3757–3768.

Wang, Q., Zhao N., & Wu J. (2022). Reselling or agency selling? The strategic role of live streaming commerce in distribution contract selection. Electronic Commerce Research, 1–34.

Xia, L., Bai, Y., Ghose, S., & Qin, J. (2022). Differential game analysis of carbon emissions reduction and promotion in a sustainable supply chain considering social preferences. Annals of Operations Research, 310(1), 257–292.

Xie, S., Gong, Y., Kunc, M., Wen, Z., & Brown, S. (2023). The application of blockchain technology in the recycling chain: A state-of-the-art literature review and conceptual framework. International Journal of Production Research, 61(24), 8692–8718.

Xu, X., & Choi, T. M. (2021). Supply chain operations with online platforms under the cap-and-trade regulation: Impacts of using blockchain technology. Transportation Research Part E: Logistics and Transportation Review, 155, 102491.

Xu, X., He, P., Xu, H., & Zhang, Q. (2017). Supply chain coordination with green technology under cap- and-trade regulation. International Journal of Production Economics, 183, 433–442.

Xu, X., Zhang, M., Dou, G., & Yu, Y. (2023). Coordination of a supply chain with an online platform considering green technology in the blockchain era. International Journal of Production Research, 61(11), 3793–3810.

Yenipazarli, A. (2016). Managing new and remanufactured products to mitigate environmental damage under emissions regulation. European Journal of Operational Research, 249(1), 117–130.

Ying, W., Jia, S., & Du, W. (2018). Digital enablement of blockchain: Evidence from HNA group. International Journal of Information Management, 39, 1–4.

Zhang, J., Cao, Q., & He, X. (2019). Contract and product quality in platform selling. European Journal of Operational Research, 272(3), 928–944.

Zhang, S., & Zhang, J. (2020). Agency selling or reselling: E-tailer information sharing with supplier offline entry. European Journal of Operational Research, 280(1), 134–151.

Zhou, Y., Guo, J., & Zhou, W. (2018). Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. International Journal of Production Economics, 196, 198–210.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Nos. 72001064, 72101242, 71871153, 72371179 and 72271075), China Postdoctoral Science Foundation (No. 2020M682053), the Fundamental Research Funds for the Central Universities (No. JZ2022HGTB0303), and the sponsorship of the Tang Scholar of Soochow University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proofs

Appendix: Proofs

Proof of Proposition 1

Under an agency mode, we compare the optimal solutions of cases \(A - \overline{E}\,\overline{B}\) and \(A - \overline{E}B\), and those of the optimal solutions of cases \(A - EB\) and \(A - E\overline{B}\). We obtain \(p_{A}^{{\overline{E}B}} - p_{A}^{{\overline{E}\,\overline{B}}} = \frac{\alpha \gamma (1 - \lambda )}{{2(1 - \alpha \lambda )}} > 0,\) \(\Pi_{A - M}^{{\overline{E}B}} - \Pi_{A - M}^{{\overline{E}\,\overline{B}}} = \frac{{(2 - \lambda + \gamma (1 - \lambda ))^{2} - (2 - \lambda )^{2} }}{8(2 - \lambda )} > 0,\) \(\Pi_{A - P}^{{\overline{E}B}} - \Pi_{A - P}^{{\overline{E}\,\overline{B}}} = \frac{\lambda }{{8(2 - \lambda )^{2} }}((2 - \lambda + \gamma (1 - \lambda ))(2 - \lambda + (3 - \lambda )\gamma ) - (2 - \lambda )^{2} ) > 0\). Moreover, we have \(p_{A}^{EB} - p_{A}^{{E\overline{B}}} = \frac{4k(1 - \lambda )\gamma }{{(2 - \lambda )(8k - (2 - \lambda )\tau^{2} )}} > 0\), \(e_{A}^{EB} - e_{A}^{{E\overline{B}}} = \frac{\tau (1 - \lambda )\gamma }{{8k - (2 - \lambda )\tau^{2} }} > 0\), \(\Pi_{A - M}^{EB} - \Pi_{A - M}^{{E\overline{B}}} = \frac{{k(2 - \lambda + (1 - \lambda )\gamma )^{2} - k(2 - \lambda )^{2} }}{{(2 - \lambda )(8k - (2 - \lambda )\tau^{2} )}} > 0\), and \(\Pi_{A - P}^{EB} - \Pi_{A - P}^{{E\overline{B}}} = \frac{8k\lambda }{{(2 - \lambda )^{2} (8k - (2 - \lambda )\tau^{2} )^{2} }}\left( {(2 - \lambda + (1 - \lambda )\gamma )(k(2 - \lambda + (3 - \lambda )\gamma ) - \frac{{(2 - \lambda )\gamma \tau^{2} }}{4}) - k(2 - \lambda )^{2} } \right)\)\(> \frac{8k\lambda }{{(8k - (2 - \lambda )\tau^{2} )^{2} }}((k(1 + \gamma ) - \frac{{\gamma \tau^{2} }}{4}) - k) > 0\), where the second inequality follows from \(k > \frac{{\tau^{2} }}{4}\).

Similarly, under a reselling mode, we compare the optimal solutions of cases \(R - \overline{E}\,\overline{B}\) and \(R - \overline{E}B\), \(R - E\overline{B}\) and \(R - EB\), we have \(p_{R}^{{\overline{E}B}} - p_{R}^{{\overline{E}\,\overline{B}}} = \frac{\gamma }{2} > 0,w_{R}^{{\overline{E}B}} = w_{R}^{{\overline{E}\,\overline{B}}} ,\Pi_{R - P}^{{\overline{E}B}} - \Pi_{R - P}^{{\overline{E}\,\overline{B}}} = \frac{4 + 3\gamma }{{24}} > 0,\Pi_{R - M}^{{\overline{E}B}} - \Pi_{R - M}^{{\overline{E}\,\overline{B}}} = - \frac{{\gamma^{2} }}{8} < 0\). Besides, we have \(p_{R}^{EB} - p_{R}^{{E\overline{B}}} = \frac{\gamma }{2} > 0,w_{R}^{EB} = w_{R}^{{E\overline{B}}} ,e_{R}^{EB} = e_{R}^{{E\overline{B}}} ,\) \(\Pi_{R - M}^{EB} - \Pi_{R - M}^{{E\overline{B}}} = - \frac{{\gamma^{2} }}{8} < 0,\) and \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{E\overline{B}}} = \frac{\gamma }{8}(\gamma + \frac{8k}{{6k - \tau^{2} }}) > 0\).

Proof of Proposition 2

Under an agency mode, we compare the optimal solutions of cases \(A - \overline{E}\,\overline{B}\) and \(A - E\overline{B}\), cases \(A - EB\) and \(A - \overline{E}B\). We have \(p_{A}^{{E\overline{B}}} - p_{A}^{{\overline{E}\,\overline{B}}} = \frac{{(2 - \lambda )\tau^{2} }}{{2(8k - (2 - \lambda )\tau^{2} )}} > 0\), \(\Pi_{A - M}^{{E\overline{B}}} - \Pi_{A - M}^{{\overline{E}\,\overline{B}}} = \frac{{(2 - \lambda )^{2} \tau^{2} }}{{8(8k - (2 - \lambda )\tau^{2} )}} > 0\), \(\Pi_{A - P}^{{E\overline{B}}} - \Pi_{A - P}^{{\overline{E}\,\overline{B}}} = \frac{{(2 - \lambda )\lambda \tau^{2} (16k - (2 - \lambda )\tau^{2} )}}{{8(8k - (2 - \lambda )\tau^{2} )^{2} }} > 0\) where the third inequality follows from \(k > \frac{{\tau^{2} }}{4}\). Moreover, \(p_{A}^{EB} - p_{A}^{{\overline{E}B}} = \frac{{(2 - \lambda + (1 - \lambda )\gamma )\tau^{2} }}{{2(8k - (2 - \lambda )\tau^{2} )}} > 0\), \(\Pi_{A - M}^{EB} - \Pi_{A - M}^{{\overline{E}B}} = \frac{{(2 - \lambda + (1 - \lambda )\gamma )^{2} \tau^{2} }}{{8(8k - (2 - \lambda )\tau^{2} )}} > 0\), and \(\Pi_{A - P}^{EB} - \Pi_{A - P}^{{\overline{E}B}} = \frac{{\lambda (2 + \gamma (1 - \lambda ) - \lambda )(16k(1 + \, \gamma )\tau^{2} - (2 + \gamma (3 - \lambda ) - \lambda ) \, \tau^{4} )}}{{8(8k - (2 - \lambda )\tau^{2} )^{2} }} > 0\).

Similarly, under a reselling mode, we compare the optimal solutions of cases R-\(\overline{E}\,\overline{B}\) and R-\(E\overline{B}\), R-EB and R-\(\overline{E}B\). We have \(p_{R}^{{E\overline{B}}} - p_{R}^{{\overline{E}\,\overline{B}}} > 0,w_{R}^{{E\overline{B}}} - w_{R}^{{\overline{E}\,\overline{B}}} = \frac{2k}{{6k - \tau^{2} }} - \frac{1}{3} > 0\), \(\Pi_{R - P}^{{E\overline{B}}} - \Pi_{R - P}^{{\overline{E}\,\overline{B}}} = \frac{{12k\tau^{2} - \tau^{4} }}{{18(6k - \tau^{2} )^{2} }} > 0\), and \(\Pi_{R - M}^{{E\overline{B}}} - \Pi_{R - M}^{{\overline{E}\,\overline{B}}} = \frac{{\tau^{2} }}{{6(6k - \tau^{2} )^{2} }} > 0\). Moreover, \(p_{R}^{EB} - p_{R}^{{\overline{E}B}} = \frac{{2\tau^{2} }}{{3(6k - \tau^{2} )}} > 0,w_{R}^{EB} - w_{R}^{{\overline{E}B}} = \frac{{\tau^{2} }}{{3(6k - \tau^{2} )}} > 0\), \(\Pi_{R - M}^{EB} - \Pi_{R - M}^{{\overline{E}B}} = \frac{{\tau^{2} }}{{6(6k - \tau^{2} )}} > 0\), and \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{\overline{E}B}} = \frac{{6k(2 + 3\gamma )\tau^{2} - (1 + 3\gamma )\tau^{4} }}{{18(6k - \tau^{2} )^{2} }} > \frac{{(1 + 3\gamma )\tau^{2} }}{{18(6k - \tau^{2} )^{2} }} > 0\).

Proof of Proposition 3

The results are immediately obtained by respectively comparing the optimal profits of the manufacturer and the platform in Sects. 4.1.1 and 4.2.1.

Proof of Proposition 4

Define \(f_{0} (\lambda ) = \Pi_{A - P}^{{E\overline{B}}} - \Pi_{R - P}^{{E\overline{B}}} = \frac{{2k^{2} }}{{(8k - (2 - \lambda )\tau^{2} )^{2} (6k - \tau^{2} )^{2} }}(4\lambda (6k - \tau^{2} )^{2} - (8k - (2 - \lambda )\tau^{2} )^{2} ),\) for any \(\tau \ge 0\) and \(k \ge \frac{{\tau^{2} }}{4}\), we have \(f_{0} (0) = - (8k - 2\tau^{2} )^{2} < 0\) and \(f_{0} (1) = (4k - \tau^{2} )^{2} (20k - 3\tau^{2} ) > 0\), which implies that there exists a threshold \(\lambda_{3} \in (0,1)\) such that if \(0 < \lambda \le \lambda_{3}\), \(\Pi_{A - P}^{{E\overline{B}}} \le \Pi_{R - P}^{{E\overline{B}}}\), and if \(\lambda_{3} < \lambda \le 1\), \(\Pi_{A - P}^{{E\overline{B}}} \ge \Pi_{R - P}^{{E\overline{B}}}\), where \(\lambda_{3} = \max \{ \lambda |f_{0} (\lambda ) = 0\}\).

In addition, we immediately obtain that if \(0 < \lambda < \lambda_{2} = \frac{2}{3}\), \(f_{1} (\lambda ) = \Pi_{A - M}^{{E\overline{B}}} - \Pi_{R - M}^{{E\overline{B}}} = \frac{k(2 - \lambda )}{{8k - (2 - \lambda )\tau^{2} }} - \frac{k}{{6k - \tau^{2} }} > 0\) and \(e_{A}^{{E\overline{B}}} = \frac{(2 - \lambda )\tau }{{8k - (2 - \lambda )\tau^{2} }} > e_{R}^{{E\overline{B}}} = \frac{\tau }{{6k - \tau^{2} }}\). Moreover, as \(f_{0} (\lambda_{2} ) = 8(2k - \frac{{\tau^{2} }}{3})^{2} > 0\) and \(f_{0} (\lambda = \lambda_{1} ) = \frac{4}{9}(8k - \frac{11}{9}\tau^{2} ) > 0\), we obtain \(\lambda_{2} > \lambda_{1} > \lambda_{3}\).

Proof of Proposition 5

Define

\(f_{2} (\lambda ) \, = \Pi_{A - M}^{{\overline{E}B}} - \Pi_{R - M}^{{\overline{E}B}} = \frac{1}{24}(2 - 3\lambda + 3\gamma ((2 + \gamma )(1 - \lambda ) + \frac{\gamma }{2 - \lambda })),\) then

\(f_{3} (\lambda ) \, = \Pi_{A - P}^{{\overline{E}B}} - \Pi_{R - P}^{{\overline{E}B}} = \frac{1}{72}( - 4 + 9\lambda + 6\gamma ( - 2 + 3\lambda ) + \frac{{9\gamma^{2} ( - 4 + \lambda (7 + ( - 5 + \lambda )\lambda ))}}{{(2 - \lambda )^{2} }}\).

Clearly, given \(3\gamma ((2 + \gamma )(1 - \lambda ) + \frac{\gamma }{2 - \lambda }) > 0\) for any \(\lambda \in (0,1)\), we have \(\{ \lambda |f_{2} (\lambda ) = 0\} > \lambda_{2}\) and if \(3\gamma ((2 + \gamma )(1 - \lambda ) + \frac{\gamma }{2 - \lambda }) > 1\), we have \(\{ \lambda |f_{2} (\lambda ) = 0\} > 1\). The above results imply that there exists \(\lambda_{5} = \min \{ 1,\lambda_{{5^{\prime}}} \}\), if \(\lambda > \lambda_{5}\) then \(f_{2} (\lambda ) > 0\); otherwise, \(f_{2} (\lambda ) \le 0\), where \(\lambda_{5} = \min \{ \lambda |f_{2} (\lambda ) = 0\}\).

Similarly, \(\lambda_{4} > \lambda_{1}\) exists such that if \(\lambda > \lambda_{4}\) then \(f_{3} (\lambda ) > 0\), otherwise, \(f_{3} (\lambda ) \le 0\).

Proof of Proposition 6

Define \(f_{4} (\lambda ) = \Pi_{A - M}^{EB} - \Pi_{R - M}^{EB} = \frac{{\gamma^{2} }}{8} - \frac{k}{{6k - \tau^{2} }} + \frac{{k(2 - \lambda + (1 - \lambda )\gamma )^{2} }}{{(2 - \lambda )(8k - (2 - \lambda )\tau^{2} )}} = f_{1} (\lambda ) + g_{1} (\gamma ,\lambda ,k,\tau )\), where \(g_{1} (\gamma ,\lambda ,k,\tau ) = \frac{{\gamma^{2} }}{8} + \frac{{k(2(2 - \lambda )((1 - \lambda )\gamma )) + (1 - \lambda )^{2} \gamma^{2} )}}{{(2 - \lambda )(8k - (2 - \lambda )\tau^{2} )}} > 0\) for any \(0 \le \lambda \le 1\), \(\gamma ,\tau > 0\), \(k > \frac{{\tau^{2} }}{4}\). From the proof of Proposition 4, \(f_{1} (\lambda_{2} = \frac{2}{3}) = 0\) and for any \(\frac{2}{3} \le \lambda \le 1\), \(\Pi_{A - M}^{EB} \le \Pi_{R - M}^{EB}\). In addition, we have \(f^{\prime}_{1} (\lambda ) < 0\), that is, \(f_{1} (\lambda )\) is decreasing in \(\lambda\). Thus, we determine a threshold \(\lambda_{6} > \lambda_{2} = \frac{2}{3}\), such that \(f_{4} (\lambda_{6} ) = 0\), where \(\lambda_{6} = \min \{ \lambda |f_{4} (\lambda ) = 0\}\).

Similarly, we define \(f_{5} (\lambda ) = \Pi_{A - P}^{EB} - \Pi_{R - P}^{EB} = \frac{{2k\lambda (2 - \lambda + (1 - \lambda )\gamma )(4k(2 - \lambda + (3 - \lambda )\gamma ) - (2 - \lambda )\gamma \tau^{2} )}}{{(2 - \lambda )^{2} (8k - (2 - \lambda )\tau^{2} )^{2} }} - \frac{{(k(4 + 6\gamma ) - \gamma \tau^{2} )^{2} }}{{8(6k - \tau^{2} )^{2} }}\)\(= f_{0} (\lambda ) + g_{2} (\lambda ,\gamma ,k,\tau )\). From Proof of Proposition 4, \(f_{0} (\lambda_{3} ) = 0\) and for any \(\lambda_{3} \le \lambda \le 1\) \(\Pi_{A - P}^{EB} \ge \Pi_{R - P}^{EB}\). For any \(0 \le \lambda \le 1\), \(g_{2} (\lambda ,\gamma ,k,\tau ) \ge 0( < 0)\) strongly depends on \(k,\gamma ,\tau\). Define \(\lambda_{7} = \min \{ \lambda |f_{5} (\lambda ) = 0\}\), then we have \(\lambda_{7} \ge \lambda_{3} ( < \lambda_{3} )\) is also strongly depend on \(\gamma\),\(\tau\), and \(k\).

Under the reselling mode, when the manufacturer invests and does not invest in green technology, from Eqs. (4)–(7) we respectively obtain \(CS_{R}^{EB} - CS_{R}^{{E\overline{B}}} = CS_{R}^{{\overline{E}B}} - CS_{R}^{{\overline{E}\,\overline{B}}} = \frac{{\gamma^{2} }}{8} > 0\).

From the equilibrium profits of the manufacturer and the platform in Sect. 4.2, we obtain that \(\Pi_{R}^{EB} - \Pi_{R}^{{E\overline{B}}} = \Pi_{R - M}^{EB} - \Pi_{R - M}^{{E\overline{B}}} + \Pi_{R - P}^{EB} - \Pi_{R - P}^{{R\overline{B}}}\) \(= \frac{k\gamma }{{6k - \tau^{2} }} > 0\) and \(\Pi_{R}^{{\overline{E}B}} - \Pi_{R}^{{\overline{E}\,\overline{B}}} = \Pi_{R - M}^{{\overline{E}B}} - \Pi_{R - M}^{{\overline{E}\,\overline{B}}} + \Pi_{R - P}^{{\overline{E}B}} - \Pi_{R - P}^{{\overline{E}\,\overline{B}}} = \frac{\gamma }{6} > 0\). Besides, \(EI_{R}^{{\overline{E}B}} - EI_{R}^{{\overline{E}\,\overline{B}}} = \mu\)\((D_{d}^{{\overline{E}B}} + D_{r}^{{\overline{E}B}} - D_{d}^{{\overline{E}\,\overline{B}}} - D_{r}^{{\overline{E}\,\overline{B}}} ) = \mu (\frac{1}{2}(1 - p_{R}^{{\overline{E}B}} + \gamma ) + \frac{1}{2}(1 - p_{R}^{{\overline{E}B}} ) - (1 - p_{R}^{{\overline{E}\,\overline{B}}} )) = 0\).

Then, from Eq. (3), we obtain that for any \(\mu > 0\)\(SW_{R}^{EB} - SW_{R}^{{E\overline{B}}} \, = CS_{R}^{EB} - CS_{R}^{{E\overline{B}}} + \Pi_{R}^{EB} - \Pi_{R}^{{E\overline{B}}} = \frac{{\gamma^{2} }}{8} > 0\), \(SW_{R}^{{\overline{E}B}} - SW_{R}^{{\overline{E}\,\overline{B}}} = CS_{R}^{{\overline{E}B}} - CS_{R}^{{\overline{E}\,\overline{B}}} + \Pi_{R}^{{\overline{E}B}} - \Pi_{R}^{{\overline{E}\,\overline{B}}} - (EI_{R}^{{\overline{E}B}} - EI_{R}^{{\overline{E}\,\overline{B}}} ) > 0\).

Under the agency selling mode, when the manufacturer invests and does not invest in green technology, from Eqs. (4)–(7) we respectively obtain \(CS_{A}^{EB} - CS_{A}^{{E\overline{B}}} = \frac{1}{4}\left( {2(p_{A}^{EB} )^{2} + \gamma^{2} + 2\gamma (1 + e^{EB} \tau ) + 2(1 + e_{A}^{EB} \tau )^{2} - 2p_{A}^{EB} (2 + \gamma + 2e_{A}^{EB} \tau )} \right) - \frac{1}{2}(1 + e_{A}^{{E\overline{B}}} \tau - p_{A}^{{E\overline{B}}} )^{2}\) \(= \frac{{\gamma (32k^{2} (4 + 5\gamma - \lambda (2 + (4 - \lambda )\gamma )) - 8k(2 - \lambda )(\lambda (2 - \lambda (1 - \gamma ) - 3\gamma ) + 4\gamma )\tau^{2} }}{{4(2 - \lambda )^{2} (8k - (2 - \lambda )\tau^{2} )^{2} }} + \frac{{(2 - \lambda )^{2} (2 - (2 - \lambda )\lambda )\gamma \tau^{4} )}}{{4(2 - \lambda )^{2} (8k - (2 - \lambda )\tau^{2} )^{2} }}\) \(> \frac{{8k + (2 - \lambda )(2 - (2 - \lambda )\lambda )\gamma \tau^{4} )}}{{4(2 - \lambda )(8k - (2 - \lambda )\tau^{2} )^{2} }} > 0,CS_{A}^{{\overline{E}B}} - CS_{A}^{{\overline{E}\,\overline{B}}} \, = \frac{\gamma (4 - 2\gamma + \gamma (5 - (4 - \lambda )\lambda ))}{{8(2 - \lambda )^{2} }} > 0,\) where the inequalities follows from \(k > \frac{{\tau^{2} }}{4}\) and \(\lambda \in (0,1)\).

The proof of Proposition 1 shows that \(\Pi_{A - M}^{EB} > \Pi_{A - M}^{{E\overline{B}}}\), \(\Pi_{A - P}^{EB} > \Pi_{A - P}^{{E\overline{B}}}\), \(\Pi_{A - M}^{{\overline{E}B}} > \pi_{A - M}^{{\overline{E}\,\overline{B}}}\) and \(\Pi_{A - P}^{{\overline{E}B}} > \Pi_{A - P}^{{\overline{E}\,\overline{B}}}\), i.e., \(\Pi_{A}^{EB} > \Pi_{A}^{{E\overline{B}}}\) and \(\Pi_{A}^{{\overline{E}B}} > \Pi_{A}^{{\overline{E}\,\overline{B}}}\).

In addition, given that \(EI_{A}^{{\overline{E}B}} - EI_{A}^{{\overline{E}\,\overline{B}}} = \mu (D_{d}^{{\overline{E}B}} + D_{r}^{{\overline{E}B}} - D_{d}^{{\overline{E}\,\overline{B}}} - D_{r}^{{\overline{E}\,\overline{B}}} ) = \frac{\mu \gamma }{{4 - 2\lambda }} > 0\). Then, from Eq. (3) we obtain that \(SW_{A}^{EB} - SW_{A}^{{E\overline{B}}} \, = CS_{A}^{EB} - CS_{A}^{{E\overline{B}}} + \Pi_{A}^{EB} - \Pi_{A}^{{E\overline{B}}} = CS_{A}^{EB} - CS_{A}^{{E\overline{B}}} > 0\), \(SW_{A}^{{\overline{E}B}} - SW_{A}^{{\overline{E}\,\overline{B}}} = CS_{A}^{{\overline{E}B}} - CS_{A}^{{\overline{E}\,\overline{B}}} + \Pi_{A}^{{\overline{E}B}} - \Pi_{A}^{{\overline{E}\,\overline{B}}} - (EI_{A}^{{\overline{E}B}} - EI_{A}^{{\overline{E}\,\overline{B}}} )\)\(= \frac{\gamma (4u( - 2 + \lambda ) + 2(3 - \lambda )(2 - \lambda ) + \gamma (7 - (6 - \lambda )\lambda ))}{{8(2 - \lambda )^{2} }}.\) Define \(SW_{A}^{{\overline{E}B}} - SW_{A}^{{\overline{E}B}} = 0\), we obtain that \(\mu_{0} = \frac{1}{4}(6 + \gamma (4 - \frac{1}{2 - \lambda } - \lambda ) - 2\lambda )\). Clearly, if \(\mu < \mu_{0}\), then \(SW_{A}^{{\overline{E}B}} \ge SW_{A}^{{\overline{E}\,\overline{B}}}\), otherwise \(SW_{A}^{{\overline{E}B}} < SW_{A}^{{\overline{E}\,\overline{B}}}\). Moreover, take derivatives of \(\mu_{0}\) with respect to \(\gamma\) and \(\lambda\), and we have \(\frac{{\partial \mu_{0} }}{\partial \gamma } = \frac{1}{4}(4 - \frac{1}{2 - \lambda } - \lambda ) > 0,\;\;\frac{{\partial \mu_{0} }}{\partial \lambda } = \frac{1}{4}( - 2 - \gamma (1 + \frac{1}{{(2 - \lambda )^{2} }})) < 0\).

Proof of Proposition 9

Under an agency selling mode, when the manufacturer does not invest in green technology, we compare the optimal profits if the platform applies BCT to analyze its effect, that is, \(\Pi_{A - M}\) in Sects. 4.1.1 and 4.1.2. Taking the first derivative of \(\frac{{\partial \Pi_{A - M}^{{\overline{E}B}} }}{\partial \alpha }\) with respect to (w.r.t) \(\alpha\), we have \(\frac{{\partial \Pi_{A - M}^{{\overline{E}B}} }}{\partial \alpha } = \frac{1}{4}\lambda (1 + 2\gamma + \frac{{\alpha \gamma^{2} (1 - \lambda )(4 - \alpha (1 + \lambda )(3 - \alpha \lambda ))}}{{(1 - \alpha \lambda )^{3} }})\), and \(\max_{\lambda ,\alpha } \{ (4 - \alpha (1 + \lambda )(3 - \alpha \lambda ))\} > 0\). Combining that when \(\alpha = 0\), \(\Pi_{A - P}^{{\overline{E}B}} - \Pi_{A - P}^{{\overline{E}\,\overline{B}}} = - \Pi_{A - P}^{{\overline{E}\,\overline{B}}} < 0\) and when \(\alpha = \frac{1}{2}\), \(\Pi_{A - P}^{{\overline{E}B}} - \Pi_{A - P}^{{\overline{E}\,\overline{B}}} = \frac{\lambda }{{8(2 - \lambda )^{2} }}((2 - \lambda + \gamma (1 - \lambda ))(2 - \lambda + (3 - \lambda )\gamma ) - (2 - \lambda )^{2} ) > 0\), we immediately obtain that there exists a threshold \(0 < \alpha_{1} < \frac{1}{2}\), such that \(\Pi_{A - P}^{{\overline{E}B}} \ge \Pi_{A - P}^{{\overline{E}\,\overline{B}}}\) for any \(\alpha_{1} < \alpha < 1\).

Using a similar method, we analyze the case that the manufacturer invests in green technology. Given \(\frac{{\partial \Pi_{A - M}^{EB} }}{\partial \alpha } > 0\), \(\Pi_{A - P}^{EB} - \Pi_{A - P}^{{E\overline{B}}} < 0\) when \(\alpha = 0\), and \(\Pi_{A - P}^{EB} - \Pi_{A - P}^{{E\overline{B}}} = \frac{8k\lambda }{{(2 - \lambda )^{2} (8k - (2 - \lambda )\tau^{2} )^{2} }}\)\(\left( {(2 - \lambda + (1 - \lambda )\gamma )(k(2 - \lambda + (3 - \lambda )\gamma ) - \frac{{(2 - \lambda )\gamma \tau^{2} }}{4}) - k(2 - \lambda )^{2} } \right) > \frac{8k\lambda }{{(8k - (2 - \lambda )\tau^{2} )^{2} }}((k(1 + \gamma ) - \frac{{\gamma \tau^{2} }}{4}) - k) > 0\).when \(\alpha = \frac{1}{2}\), then we derive a threshold \(0 < \alpha_{2} < \frac{1}{2}\), such that \(\Pi_{A - P}^{EB} \ge \Pi_{A - P}^{{E\overline{B}}}\) for any \(\alpha_{2} < \alpha < 1\).

Proof of Proposition 10

Under a reselling mode, when the manufacturer does not invest in green technology, we compare the profits if the platform applies and does not apply BCT to explore its effect, that is, \(\Pi_{R - P}^{{\overline{E}B}}\) and \(\Pi_{R - P}^{{\overline{E}\,\overline{B}}}\). From Sects. 4.2.1 and 4.2.2. We immediately obtain that when \(\alpha = 1\), \(\Pi_{R - P}^{{\overline{E}B}} - \Pi_{R - P}^{{\overline{E}\,\overline{B}}} = \frac{{\alpha (1 + \gamma )^{2} }}{16} - \frac{1}{18} > 0\), when \(\alpha = \frac{1}{2}\), \(\Pi_{R - P}^{{\overline{E}B}} - \Pi_{R - P}^{{\overline{E}\,\overline{B}}} = \frac{4 + 3\gamma }{{24}} > 0\), and when \(\alpha = 0\), \(\Pi_{R - P}^{{\overline{E}B}} - \Pi_{R - P}^{{\overline{E}\,\overline{B}}} = - \frac{1}{18} < 0\). Taking the derivative of \(\Pi_{R - P}^{{\overline{E}B}}\) w.r.t \(\alpha\), we obtain that \(\frac{{\partial \Pi_{R - P}^{{\overline{E}B}} }}{\partial \alpha } = \frac{(1 + (2 - \alpha )\gamma )(1 - \alpha + (2 - \alpha (5 + \alpha ))\gamma )}{{4(1 + \alpha )^{3} }}\). Define \(g(\alpha ) = 1 - \alpha + (2 - \alpha (5 + \alpha ))\gamma\). Given that \(g(\alpha )\) is decreasing in \(\alpha\), and \(g(0) > 0\), \(g(1) = - 4\gamma < 0\), which implies that \(\Pi_{R - P}^{{\overline{E}B}}\) is increasing in \(\alpha\) first and then decreasing in \(\alpha\) in \((0,1)\). Then, combining the above results, we obtain a threshold \(\alpha_{3}\) such that \(\Pi_{R - P}^{{\overline{E}B}} \le \Pi_{R - P}^{{\overline{E}\,\overline{B}}}\) if \(0 < \alpha \le \alpha_{3}\), and \(\Pi_{R - P}^{{\overline{E}B}} > \Pi_{R - P}^{{\overline{E}\,\overline{B}}}\) if \(1 > \alpha > \alpha_{3}\).

Using a similar method, we explore the effect of \(\alpha\) on the platform's BCT application when the manufacturer invests in green technology by comparing the profits of the platform in Sects. 4.2.3 and 4.2.4. Taking the derivative of \(\Pi_{R - P}^{EB}\) w. r. t \(\alpha\), we obtain:

\(\frac{{\partial \Pi_{R - P}^{EB} }}{\partial \alpha } = \frac{{(2k( - 1 + ( - 2 + \alpha )\gamma ) - ( - 1 + \alpha )\gamma \tau^{2} )(8k^{2} ( - 1 + \alpha + ( - 2 + \alpha (5 + \alpha ))\gamma ) + 2k(1 + (4 - \alpha (11 + 2\alpha ))\gamma )\tau^{2} + ( - 1 + 3\alpha )\gamma \tau^{4} )}}{{(4k(1 + \alpha ) - \tau^{2} )^{3} }}\).

Apparently, \(\frac{{\partial \Pi_{R - P}^{EB} }}{\partial \alpha }\) is decreasing in \(\alpha\) in \((0,1)\), combining \(\frac{{\partial \Pi_{R - P}^{EB} }}{\partial \alpha }(\alpha = 0) = \frac{{(k(2 + 4\gamma ) - \gamma \tau^{2} )^{2} }}{{(4k - \tau^{2} )^{2} }} > 0\) and \(\frac{{\partial \Pi_{R - P}^{EB} }}{\partial \alpha }(\alpha = 1) = - \frac{{4k(1 + \gamma )(16k^{2} \gamma + k(1 - 9\gamma )\tau^{2} + \gamma \tau^{4} )}}{{(8k - \tau^{2} )^{3} }} < 0\), where the inequality follows from \(k > \frac{{\tau^{2} }}{4}\). The results imply that \(\Pi_{R - P}^{EB}\) is increasing in \(\alpha\) first and then decreasing in \(\alpha\) in \((0,1)\). In addition, from Proof of Proposition 2, we obtain that \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{E\overline{B}}} < 0\) when \(\alpha = 0\), \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{E\overline{B}}} = \frac{\gamma }{8}(\gamma + \frac{8k}{{6k - \tau^{2} }}) > 0\) when \(\alpha = \frac{1}{2}\), and \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{E\overline{B}}} = k^{2} (\frac{{4(1 + \gamma )^{2} }}{{(8k - \tau^{2} )^{2} }} - \frac{2}{{(6k - \tau^{2} )^{2} }}) > 0\) when \(\alpha = 1\). Then, we obtain a threshold \(\alpha_{3}\), \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{E\overline{B}}} \le 0\) if \(0 < \alpha \le \alpha_{4}\), and \(\Pi_{R - P}^{EB} - \Pi_{R - P}^{{E\overline{B}}} > 0\) if \(\alpha_{4} < \alpha \le 1\).

Proof of Proposition 11

From the Proof of Proposition 2, we immediately obtain that:

-

(i) Under the agency selling mode, \(p_{A}^{{E\hat{B}}} > p_{A}^{{\overline{E}\hat{B}}}\), \(\Pi_{A - M}^{{E\hat{B}}} > \Pi_{A - M}^{{\overline{E}\hat{B}}}\), \(\Pi_{A - P}^{{E\hat{B}}} > \Pi_{A - P}^{{\overline{E}\hat{B}}}\).

-

(ii) Under the reselling mode, \(p_{R}^{{E\hat{B}}} > p_{R}^{{\overline{E}\hat{B}}}\), \(w_{R}^{{E\hat{B}}} > w_{R}^{{\overline{E}\hat{B}}}\), \(\Pi_{R - M}^{{E\hat{B}}} > \Pi_{R - M}^{{\overline{E}\hat{B}}}\), \(\Pi_{R - P}^{{E\hat{B}}} > \Pi_{R - P}^{{\overline{E}\hat{B}}}\),

where \(\hat{B} \in \{ B,\overline{B}\}\). The results suggest that under either selling mode, the manufacturer decides to invest in green technology in stage 3′.

From the Proof of Proposition 1, we immediately determine that given the manufacturer’s optimal decision in stage 3', the following results hold:

-

(i)

\((i)\) Under the agency selling mode, \(p_{A}^{EB} > p_{A}^{{E\overline{B}}}\), \(\Pi_{A - M}^{EB} > \Pi_{A - M}^{{E\overline{B}}}\), \(\Pi_{A - P}^{EB} > \Pi_{A - P}^{{E\overline{B}}}\), \(e_{A}^{EB} > e_{A}^{{E\overline{B}}}\).

-

(ii)

Under the reselling mode, \(p_{R}^{EB} > p_{R}^{{E\overline{B}}}\), \(w_{R}^{EB} = w_{R}^{{E\overline{B}}}\), \(e_{R}^{EB} = e_{R}^{{E\overline{B}}}\), \(\Pi_{R - M}^{EB} < \Pi_{R - M}^{{E\overline{B}}}\), \(\Pi_{R - P}^{EB} > \Pi_{R - P}^{{E\overline{B}}}\). The results suggest that under either selling mode, the platform chooses to apply BCT in stage 2′ while the manufacturer prefers the platform to select an agency selling mode.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhao, N., Sun, J. & Wang, Q. Decarbonization investment in a supply chain with a retail platform based on blockchain technology. Ann Oper Res (2023). https://doi.org/10.1007/s10479-023-05696-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05696-6