Abstract

In this paper, we employ the Heston stochastic volatility model to describe the stock’s volatility and apply the model to derive and analyze trading strategies for dealers in a security market with price discovery. The problem is formulated as a stochastic optimal control problem, and the controlled state process is the dealer’s mark-to-market wealth. Dealers in the security market can optimally determine their ask and bid quotes on the underlying stocks continuously over time. Their objective is to maximize an expected profit from transactions with a penalty proportional to the variance of cumulative inventory cost. We provide an approximate, analytically tractable solution to the stochastic control problem. Numerical experiments are given to illustrate the effects of various parameters on the performances of trading strategies.

Similar content being viewed by others

Notes

Heston’s model stands out from other stochastic volatility models here because there exists an analytical solution for European options that take the correlation between stock price and volatility into consideration (Heston 1993).

The value of \(\eta \) is relatively small when compared with the stock price \(S_t\). The parameter for NASDAQ stock FARO in 2013 is \(1.41\times 10^{-4}\), SMH, \(5.45\times 10^{-6}\) and INTC, \(6.15\times 10^{-7}\) (see Cartea et al. 2015, Chap. 4). However, such a small number will have a great influence on the profitability of a high-frequency trading (HFT) strategy, e.g., market-making strategies in a LOB (see, for instance Rishi Narang 2013, for more on this).

The concept of the adverse selection risk was first introduced by Bagehot (1971) and formalized by Copeland and Galai (1983), Glosten and Milgrom (1985) and others. Adverse selection in the sense that applies to capital markets is defined as a situation in which there is a tendency for bad outcomes to occur, due to asymmetric information between a buyer and a seller.

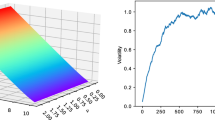

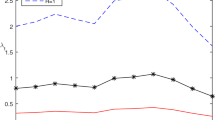

The set of baseline parameters is the same with that for European call options with maturity 2014-05-16, but on daily basis.

Price impact adjustment here refers to whether the dealer’s model takes the price impact phenomena into consideration.

In our experiment, dealers are committed to, respectively, buy/sell one share of stock at their quoting prices.

The right-hand-side term of Eq. (4.2) is integrable.

References

Albrecher, H., Mayer, P., Schoutens, W., Tistaert, J.: The little Heston trap. Wilmott. 1, 83–92 (2007)

Almgren, R.: Optimal execution of portfolio transactions. J. Risk 3, 5–40 (2001)

Almgren, R., et al.: Direct estimation of equity market impact. Risk 18(7), 58–62 (2005)

Almgren, R.: Optimal trading with stochastic liquidity and volatility. SIAM J. Financ. Math. 3(1), 163–181 (2012)

Avellaneda, M., Stoikov, S.: High-frequency trading in a limit order book. Quant. Financ. 8, 217–224 (2008)

Bagehot, W.: The only game in town. Financ. Anal. J. 27(22), 12–14 (1971)

Bayraktar, E., Ludkovshi, M.: Liquidation in limit order books with controlled intensity. Math. Financ. 24(4), 627–650 (2014)

Bouchaud, J., Gefen, Y., Potters, M., Wyart, M.: Fluctuations and response in financial markets: the subtle nature of ‘random’ price changes. Quant. Financ. 4, 176–190 (2004)

Cartea, Á., Jaimungal, S., Penalva, J.: Algorithmic and high-frequency trading. Cambridge University Press, Cambridge (2015)

Cebiroglu, G., Horst, U.: Optimal order display in limit order markets with liquidity competition. J. Econ. Dyn. Control 58, 81–100 (2015)

Chiarella, C., He, X., Wei, L.: Learning, information processing and order submission in limit order markets. J. Econ. Dyn. Control 61, 245–268 (2015)

Colaneri, K., Eksi, Z., Frey, R., Szölgyenyi, M.: Optimal liquidation under partial information with price impact. Stoch. Process. Appl. (2019). https://doi.org/10.1016/j.spa.2019.06.004

Copeland, T.E., Galai, D.: Information effects and the bid-ask spread. J. Financ. 38, 1457–1469 (1983)

Cox, J., Ingersoll, J., Ross, S.: A theory of the term structure of interest rates. Econometrica 53(2), 385–407 (1985)

Fodra, P., Labadie, M.: High-frequency market-making with inventory constraints and directional bets. Preprint. (2012). arXiv:1206.4810

Fodra, P., Labadie, M.: High-frequency market-making for multi-dimensional markov processes. (2013). arXiv:1303.7177

Gatheral, J., Schied, A.: Dynamical models of market impact and algorithms for order execution. In: Fouque, J.-P., Langsam, J.A. (eds.) Handbook on Systemic Risk, pp. 579–599. Cambridge Univercity Press, Cambridge (2013)

Guéant, O., Lehalle, C., Fernandez-Tapia, J.: Optimal portfolio liquidation with limit orders. SIAM J. Financ. Math. 3, 740–764 (2012)

Guéant, O., Lehalle, C., Fernandez-Tapia, J.: Dealing with the Inventory Risk: A Solution to the Market Making Problem. Math. Financ. Econ. 1–31 (2012)

Guéant, O., Lehalle, C., Fernandez-Tapia, J.: Dealing with the inventory risk: a solution to the market making problem. Math. Financ. Econ. 7(4), 477–507 (2013)

Gould, M., Porter, M., Williams, S., McDonald, M., Fenn, D., Howison, S.: Limit order books. Quant. Financ. 13(11), 1709–1742 (2013)

Glosten, L., Milgrom, P.: Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. J. Financ. Econ. 13, 71–100 (1985)

Heston, S.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6(2), 327–343 (1993)

Ho, T., Stoll, H.: Optimal dealer pricing under transactions and return uncertainty. J. Financ. Econ. 9, 47–73 (1981)

Hendershott, T., Jones, C., Menkveld, A.: Does algorithmic trading improve liquidity? J. Financ. 66, 1–33 (2011)

Lehalle, C.A., Mounjid, O., Rosenbaum, M.: Optimal liquidity-based trading tactics, (2018). arXiv:1803.05690

Mitra, S.: A review of volatility and option pricing, (2009). arXiv:0904.1292 [q-fin.PR]

Moro, E., et al.: Market impact and trading profile of hidden orders in stock markets. Phys. Rev. E 80(6), 066102 (2009)

Narang, Rishi K.: Inside the black box: a simple guide to quantitative and high frequency trading, 2nd edn. Wiley, London (2013)

Platania, F., Serrano, P., Tapia, M.: Modelling the shape of the limit order book. Quant. Financ. 18(9), 1575–1597 (2018)

Saito, T., Takahashi, A.: Derivatives pricing with market impact and limit order book. Automatica 86, 154–165 (2017)

Schneider, M., Lillo, F.: Cross-impact and no-dynamic-arbitrage. Quant. Financ. 19(1), 137–154 (2019)

Tóth, B., et al.: Anomalous price impact and the critical nature of liquidity in financial markets. Phys. Rev. X 1(2), 021006 (2011)

Wyart, M., Bouchaud, J., Kockelkoren, J., Potters, M., Vettorazzo, M.: Relation between bid-ask spread, impact and volatility in order-driven markets. Quant. Financ. 8, 41–57 (2008)

Yang, Q., Gu, J., Ching, W., Siu, T.: On optimal pricing model for multiple dealers in a competitive market. Comput. Econ. 53(1), 397–431 (2019)

Yong, J., Zhou, X.Y.: Stochastic Control Hamiltonian Systems And HJB Equations, vol. 43. Springer, Berlin (1999)

Zabaljauregui, D., Campi, L.: Optimal market making under partial information with general intensities, (2019). arXiv:1902.01157, 2019

Acknowledgements

The authors would like to thank the anonymous referee for the helpful comments and suggestions. This research work was supported by Research Grants Council of Hong Kong under GRF Grant Numbers 17301214 and 17301519, National Natural Science Foundation of China Under Grant Number 11671158, IMR and RAE Research Funding, Faculty of Science, The University of Hong Kong. Tak-Kuen Siu would like to acknowledge the Discovery Grant from the Australian Research Council (ARC), (Project No.: DP190102674).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A. Proof of Proposition 2

Proof

-

(a)

Let \(\Big (\delta _t^a,\delta _t^b\Big )_{t\ge 0}\in {\mathcal {A}}\). Then by Dynkin’s formula we have

$$\begin{aligned}&\displaystyle {\mathbb {E}}_t\left[ \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_{T_R}, \nu ^{t,\nu }_{T_R},T_R\Big )\right] \\&\quad =\displaystyle \phi (q,\nu ,t)+{\mathbb {E}}_t\bigg [ \int _t^{T_R} \Big (\phi _t+\theta (\alpha -\nu ^{t,\nu }_u)\phi _{\nu }+\frac{1}{2}\xi ^2\nu ^{t,\nu }_u \phi _{\nu \nu } \\&\qquad +\left[ \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u-1,\nu ^{t,\nu }_u,u\Big )- \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u,\nu ^{t,\nu }_u,u\Big )\right] \lambda ^a(\delta _u^a)\\&\qquad \displaystyle +\left[ \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u+1,\nu ^{t,\nu }_u,u\Big )- \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u,\nu ^{t,\nu }_u,u\Big )\right] \lambda ^b(\delta _u^b)\Big ) \mathrm{d}u\bigg ]\\&\qquad \displaystyle +\,{\mathbb {E}}_t\left[ \int _t^{T_R}\xi \sqrt{\nu _u^{t,\nu }}\phi _\nu (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}, \nu _u^{t,\nu },u)\mathrm{d}B_u\right] , \end{aligned}$$where \(T_R{=}\min \left\{ R, T, \inf \{s>t; {\mathbb {E}}_t\left[ \int _t^s \nu _u^{t,\nu } \phi ^2_\nu \left( q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}},\nu _u^{t,\nu },u\right) \mathrm{d}u\right] {\ge } R\}\right\} \). Note that \(T_R \rightarrow T\), as \(R\rightarrow \infty \) ( by condition (iii)). The stopped process

$$\begin{aligned} \left\{ \int _t^{T_R}\xi \sqrt{\nu _u^{t,\nu }}\phi _\nu \Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}, \nu _u^{t,\nu },u\Big )\mathrm{d}B_u\right\} _{R\ge 0} \end{aligned}$$is then a martingale under the probability measure \(\mathcal{P}\).

From Condition (i), we have

$$\begin{aligned}&{\mathbb {E}}_t\left[ \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_{T_R}, \nu ^{t,\nu }_{T_R},T_R\Big )\right] \nonumber \\&\quad =\displaystyle \phi (q,\nu ,t)+{\mathbb {E}}_t\bigg [ \int _t^{T_R} \Big (\phi _t+\theta (\alpha -\nu ^{t,\nu }_u)\phi _{\nu }+\frac{1}{2}\xi ^2 \nu ^{t,\nu }_u\phi _{\nu \nu } \nonumber \\&\qquad \displaystyle +\left[ \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u-1,\nu ^{t,\nu }_u,u\Big ) -\phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u,\nu ^{t,\nu }_u,u\Big )\right] \lambda ^a(\delta _u^a)\nonumber \\&\qquad \displaystyle +\left[ \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u+1,\nu ^{t,\nu }_u,u\Big )- \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_u,\nu ^{t,\nu }_u,u\Big )\right] \lambda ^b(\delta _u^b)\Big ) \mathrm{d}u\bigg ]\nonumber \\&\quad \le \displaystyle \phi (q,\nu ,t)-{\mathbb {E}}_t\Bigg [\int _t^{T_R}\bigg (-\frac{\gamma }{2} \left( q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}\right) ^2\nu ^{t,\nu }_u\nonumber \\&\qquad \displaystyle +\Big (\delta _u^a+\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q, (\delta _t^a,\delta _t^b)_{t\ge 0}}-1\Big )^2\Big )\lambda ^a(\delta _u^a) \nonumber \\&\qquad \displaystyle +\Big (\delta _u^b-\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}} +1\Big )^2\Big )\lambda ^b(\delta _u^b)\bigg )\mathrm{d}u\Bigg ]\nonumber \\&\quad \le \displaystyle \phi (q,\nu ,t)-\Bigg \{{\mathbb {E}}_t\bigg [\int _t^{T_R} \Big (\delta _u^a+\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}} -1\Big )^2\Big )\mathrm{d}N^a_u\nonumber \\&\qquad \displaystyle +\Big (\delta _u^b-\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}} +1\Big )^2\Big )\mathrm{d}N_u^b\nonumber \\&\qquad \displaystyle -\frac{\gamma }{2}\int _t^{T_R}\left( q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}} \right) ^2\nu ^{t,\nu }_u\mathrm{d}u\bigg ]\Bigg \}. \end{aligned}$$(4.1)Meanwhile, we have

$$\begin{aligned} \displaystyle {\mathbb {E}}_t\left[ \int _t^{T_R}\left( q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}\right) ^2 \nu ^{t,\nu }_u\mathrm{d}u\right]\le & {} \displaystyle {\mathbb {E}}_t\left[ \int _t^{T}\left( q_u^{t,q, (\delta _t^a,\delta _t^b)_{t\ge 0}}\right) ^2\nu ^{t,\nu }_u\mathrm{d}u\right] \\= & {} \displaystyle \int _t^{T}{\mathbb {E}}_t\left[ \left( q_u^{t,q, (\delta _t^a,\delta _t^b)_{t\ge 0}}\right) ^2\nu ^{t,\nu }_u\right] \mathrm{d}u\\< & {} \infty , \end{aligned}$$and

$$\begin{aligned}&\displaystyle \left| {\mathbb {E}}_t\left[ \int _t^{T_R} \left( \delta _u^a+\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}} -1\Big )^2\right) \mathrm{d}N^a_u\right. \right. \\&\qquad \left. \left. +\left( \delta _u^b-\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q, (\delta _t^a,\delta _t^b)_{t\ge 0}}+1\Big )^2\right) \mathrm{d}N_u^b\right] \right| \\&\quad \le \displaystyle {\mathbb {E}}_t\left[ \int _t^{T} |\delta _u^a+\beta - \frac{\gamma \eta ^2}{2}\Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}-1\Big )^2|\mathrm{d}N^a_u\right. \\&\qquad \left. +|\delta _u^b-\beta -\frac{\gamma \eta ^2}{2}\Big (q_u^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}} +1\Big )^2|\mathrm{d}N_u^b\right] \\&\quad <\displaystyle \infty . \end{aligned}$$Since \(\phi \) satisfies a polynomial growth condition, we haveFootnote 7

$$\begin{aligned} \left| \phi \Big (q^{t,q,(\delta _t^a,\delta _t^b)_{t\ge 0}}_{T_R},\nu ^{t,\nu }_{T_R},T_R\Big )\right| \le C\left( 1+\max _{u\in [t,T]} |q_u^{t,q,(\delta _t^{*,a},\delta _t^{*,b})_{t\ge 0}}|^n+ |\nu _{T_R}^{t,\nu }|^m\right) .\nonumber \\ \end{aligned}$$(4.2)Directly applying the dominated convergence theorem and sending R in Eq. (4.1) to infinity yields

$$\begin{aligned} \phi (q,\nu ,t)\ge & {} \displaystyle {\mathbb {E}}_t\bigg [\int _t^{T} \Big (\delta _u^a+\beta -\frac{\gamma \eta ^2}{2}(q_u^{t,q,(\delta _t^a, \delta _t^b)_{t\ge 0}}-1)^2\Big )\mathrm{d}N^a_u\\&\displaystyle +\left( \delta _u^b-\beta -\frac{\gamma \eta ^2}{2}(q_u^{t,q, (\delta _t^a,\delta _t^b)_{t\ge 0}}+1)^2\right) \mathrm{d}N_u^b\\&\displaystyle -\frac{\gamma }{2}\int _t^{T}\left( q_u^{t,q,(\delta _t^a, \delta _t^b)_{t\ge 0}}\right) ^2\nu ^{t,\nu }_udu\bigg ]\\\ge & {} V^{(\delta _t^a,\delta _t^b)_{t\ge 0}}(q,\nu ,t). \end{aligned}$$Since \(\Big (\delta _t^a,\delta _t^b\Big )_{t\ge 0}\in {\mathcal {A}}\) is arbitrary, we conclude that

$$\begin{aligned} \phi (q,\nu ,t)\ge V(q,\nu ,t) \quad \text{ for } \text{ all } (q,\nu ,t)\in {\mathbb {Z}}\times \mathfrak {R}_+\times [0,T]. \end{aligned}$$(4.3) -

(b)

Apply the above argument to \(\Big (\delta _t^a,\delta _t^b\Big )_{t\ge 0}=\Big (\delta _t^{*,a},\delta _t^{*,b}\Big )_{t\ge 0}\). The calculations above give equality and hence

$$\begin{aligned} \phi (q,\nu ,t)=V^{\Big (\delta _t^{*,a},\delta _t^{*,b}\Big )_{t\ge 0}}(q, \nu , t)\le V(q,\nu ,t) \end{aligned}$$(4.4)for all \((q,\nu ,t)\in {\mathbb {Z}}\times \mathfrak {R}_+\times [0,T]\). Combining (4.3) and (4.4), we get the results in (b). \(\square \)

1.2 B. Proof of Theorem 2

Proof

Due to our choice of “mean-variance” objective function, we are able to simplify the problem with an ansatz on the form of the value function:

Then, we have

The ask–bid spread \(\delta _t^{*,a} + \delta _t^{*,b} = \frac{2}{k}-2h(\nu ,t)\) is independent of the inventory. Substituting Eq. (4.5) and the linear approximation of the order arrival terms into Eq. (2.9) and grouping terms of q yields

By the Feynman–Kac formula, \(g(\nu ,t)=0\). Grouping terms in the coefficients of \(q^2\) yields

whose solution can be directly obtained using the Feynman–Kac formula

Grouping terms in the coefficients of \(q^0\) yields

Thus,

By now, we have got an approximation to the solution of the HJB equation, which is given by

We now analyze the difference between the approximate and the exact solutions under the Heston stochastic volatility model. Let

Suppose that \(V(q,\nu ,t)=w^q(t,\nu )+V^i(q,\nu ,t)\), where \((w^q)_{q\in {\mathbb {N}}}\) is a family of functions in \({{\mathcal {C}}}^{1,2}(t,\nu )\), and \({\mathbb {N}}\) is the set of natural numbers. Substituting the above expression into Eq. (2.9) yields

where

We first note that

and that

Since \(\delta _t^{*,a}\) and \( \delta _t^{*,b}\) are relatively small and \(\delta _t^{*,a}+\delta _t^{*,b}\) is independent of q, we have

That is, the differences between the exact and the approximate ask quotes can be very small. (Similar arguments can be directly applied to the bid side.) \(\square \)

Rights and permissions

About this article

Cite this article

Yang, QQ., Ching, WK., Gu, J. et al. Trading strategy with stochastic volatility in a limit order book market. Decisions Econ Finan 43, 277–301 (2020). https://doi.org/10.1007/s10203-020-00278-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-020-00278-8

Keywords

- Limit order book (LOB)

- Dynamic programming (DP)

- Hamilton–Jacobi–Bellman (HJB) equation

- Market impact

- Stochastic volatility (SV) model