Abstract

Drawing upon an exhaustive administrative dataset on French households, this paper presents new findings on the effects of divorce on living standards and labor supply for both women and men, accounting for public and private transfers and household size. We document the crucial role of within-couple earnings inequality on post-divorce living standards for each partner. Since standard before–after estimates may be biased by confounders (economic conditions, anticipation of divorce, selection issues, etc.), we implement a difference-in-differences framework associated with a nearest neighbor matching approach to assess the causal effects of divorce on both spouses. By doing so, we compare divorced individuals before and just after divorce with individuals who remained married over the same period and who are similar in many characteristics, including individual earning dynamics several years before divorce. Results show that women’s decrease in living standards is larger, on average, than that of men. Child support payments, public transfers, massive female labor market returns, and rapid repartnering mitigate, but do not eliminate, post-divorce gender inequalities. The number of children plays only a minor role in single mothers’ impoverishment; within-couple earnings inequality before divorce, resulting mainly from marital specialization, is the main driver. We document massive labor market reentry after divorce by previously inactive women, which can be viewed as another consequence of this marital specialization.

Similar content being viewed by others

Data availability

Fiscal data are only available through special authorization of the Fiscal Administration.

Notes

“Living standard” of the household usually refers to income per equivalent adult (also called equivalized income or adjusted income). In our benchmark specification, we use the Organization for Economic Cooperation and Development (OECD)-modified equivalence scale to equivalize incomes, taking household composition into account (see further for more details).

Most studies focus on women only and rely on small survey samples, which may lead to concerns about inference and selective panel attrition.

The anticipation of divorce exists if partners change (generally increase) their labor supply in anticipation of divorce. This might produce a downward bias in the before–after estimate of the causal effects of divorce.

Exact matching could have been achieved by introducing classes for each continuous variable. We did not do so, but the similarity of distributions between treated and control groups on the continuous variables suggests that we are close to exact matching (see Appendix Figs. 8, 9, 10, 11, 12, and 13).

A more extended presentation of the literature can be found in Garbinti et al. (2016).

After divorce, at least one spouse generally moves out the common home. Over the period 2010–2013, this was the case for 59% of divorced men and 67% of divorced women (Ferrari et al. 2019). This means that simultaneous moves, which present a higher risk of attrition in panel data, are also frequent. According to Durier (2017), 20% of divorces involve simultaneous moves by both partners in the year following separation.

Even if they guarantee custodial rights (and obligations) for parents

However, each parent may not value the time spent with their children in the same way. Lower living standards could thus be offset by more time spent with children.

The difference may be linked to the matching process (gap in educational attainment or age gap between partners) and may exist before union formation. Furthermore, gender wage discrimination in the labor market may also explain the gender wage gap between spouses: for the same educational level or labor market experience, women may earn less that men (Ponthieux and Meurs 2015).

Within-couple earnings inequality is measured by the man’s pre-divorce share of the couple’s total labor earnings.

This scale assigns a value of 1 to the household head, 0.5 to each additional adult member or child aged 14 and over, and 0.3 to each younger child. In case of shared custody, the child weights are divided equally between the parents. We use the most common equivalence scale, but our results are not influenced by this choice. They remain unchanged when an alternative equivalence scale, with a different weighting for children, is used.

For reasons other than marriage or death of one partner

The Pacte civil de solidarité, or Pacs, was introduced in France in 1999, initially to legalize same-sex partnerships. But within a very short time, different-sex couples massively and increasingly opted for this form of union. Pacs legislation has gradually incorporated rights (and duties) previously granted exclusively to married couples, such as joint taxation from 2005. Like married couples, Pacs partners must file a joint tax return.

As well as excluding very unstable couples that might have specific characteristics, this choice is driven by the difficulty of interpreting and matching tax returns when several events occur in the same year.

Source: French Ministry of Justice

Couples may dissolve a Pacs in order to marry. We exclude them from our analysis.

We include this information in our matching strategy to control for earning dynamics (see below).

We set the upper age limit to 55 because workers in some specific occupations in France can enter retirement or early retirement from this age onwards.

For income earned in the year of marriage, individuals must fill in three distinct tax returns: one for each spouse corresponding to the income earned in the period before marriage and one for the newly married couple including all income earned by both spouses in the period after marriage. To compute equivalized income for individuals in this situation, we would have had to consult these three different tax returns and to match them correctly. This would have raised significant merging and measurement issues.

Pensions are rare, given the age range of the population considered.

In most cases, capital income is taxable in France and thus reported on the tax return. This is the case for rents, income from taxable saving accounts, dividends, and interest. More details about taxable and nontaxable capital income can be found in Garbinti et al. (2020).

Child support may be ordered in case of shared custody, but such cases are less common and are associated with considerably lower amounts than those received when one parent has sole custody.

Child support after divorce is determined according to the principle of equal contribution of both parents to the cost of children in proportion to their share of the couple’s total income. The custodial parent is assumed to contribute directly through coresidence with the child, and the noncustodial parent contributes through the child support payment. The level of child support is based on the estimated cost of a child. The advisory scheme applies a scale similar to the OECD-modified scale that we use here. For example, a single child under 14 years old “costs” 0.3/(1.8), i.e., 17% of the couple’s income. This percentage is applied to the income of the noncustodial parent (minus a deduction corresponding to the minimum subsistence level) to determine the amount of child support. Depending on the circumstances, the family judge may deviate from this scale.

We assume a 100% take-up rate for these social and welfare benefits. We are aware that non take-up may exist, especially for minimum income benefits. But, we assume that after a divorce, especially when children are involved, people are generally more likely to receive advice (from lawyers, social workers, or family mediators) and thus to be informed about available public benefits. The take-up rate is thus likely to be high for lone-parent families, and the potential overestimation of living standard resulting from this assumption of a 100% take-up rate may be limited.

See Programmes de qualité et d’efficience, “Famille” (quality and efficiency programs, “Family”), appended to the 2013 draft of the social security financing law (https://www.securite-sociale.fr/files/live/sites/SSFR/files/medias/PLFSS/2013/ANNEXE_1/PLFSS-2013-ANNEXE_1-PQE-FAMILLE.pdf).

This is the case for housing allowances in particular. When dependent children are in the household, allowances are calculated according to the number of children only, whether the household is a couple or a single-parent family. These rules give a specific advantage to single parents.

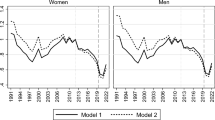

As explained later, this nearest neighbor approach is based on a two-step matching process. First, we match perfectly on certain characteristics (gender, number of children, and within-couple earnings inequality). Second, to account for the other characteristics, we use a propensity score matching process. The propensity score is estimated separately within each of the 24 subsamples (of the possible combinations of the three characteristics), which allows for more flexibility in the specification of this score. This process does not require all 40 variables to be introduced into the estimation of each propensity score to ensure that, for each of the 40 variables, the distribution for the control group is similar to that of the treated group.

As a control group, we could have chosen individuals who will divorce in the near future, but conditioning on a future event (the end of marriage) may introduce some bias due to anticipation, for instance. Moreover, we are unable to distinguish between those who will divorce some years later (because of the short observation window) and those who will stay married. Since the annual divorce rate is around 2% (Costemalle 2017), we can easily assume that most people in our control group are still married in the year following the observation period.

Union duration may influence the risk of divorce. Although we do not have reliable information on this duration, we know the age of all children. Since age of children can be a proxy for union duration, we checked that our matching process leads to similar characteristics in terms of age of children. More precisely, they are similar in the fact of having (or not) at least one child aged under 1; aged 2, 3, 4–6, 7–9, 10–14, 15–17, 18–25, and 26 and older (when disabled).

For the computation of this share, we include all labor and replacement incomes but not capital income because it cannot be individualized from the tax returns.

We compute standardized differences as recommended in Imbens and Wooldridge (2008). They are all far below the rule of thumb of one quarter, which ensures that the means are identical between groups.

We introduced the different kinds of income for the 3 years before divorce into our matching variables. This ensures that, by construction, the common trend assumption is fully verified for these 3 years preceding divorce.

This two-step method has been widely used since Heckman et al. (1997) proposed it to relax the conditional independence assumption.

The usual limitation of this approach is that it does not cancel out time-variant unobserved characteristics.

To assess mean changes in living standards (our main specification), we do not directly estimate Eq. (3) with an ordinary least squares regression. With an OLS regression on model 3, exp(\( {\hat{\beta}}^{OLS} \)) − 1 would be commonly interpreted as the expected percentage change in living standard due to a 1-unit increase in a variable X0 (for instance, an additional child or a change from 0 to 1 for a dummy variable). But, this interpretation is a potentially unsatisfactory approximation (Jensen’s inequality easily shows that \( \exp \left(E\left(\ln \left(\frac{Y_1}{Y_0}\right)\right)\le E\left(\frac{Y_1}{Y_0}\right)\right) \). To avoid this approximation, we run the following nonlinear regression model:

$$ \frac{Y_1}{Y_0}=\exp \left({X}_{i0}\gamma +{T}_{i1}\times {X}_{i0}\beta +\left({e}_{i1}-{e}_{i0}\right)\right) $$(5)Doing so, β directly corresponds to our coefficients of interest (the vector of proportional changes). For the sake of readability, we directly express the variable β in percentage (i.e., after multiplying them by 100) in the regression tables.

(Yi, t + 1 − Yi, t − 1)/Yi, t − 1, where Yi, t − 1 is the living standard of individual i in t − 1 (the year before divorce), divorce occurs in t, and t + 1 stands for the year after divorce.

Since incomes are adjusted by family size (see Section 3.2).

In most cases, it is the mothers who received child-related welfare benefits since they are generally the custodial parent. These benefits are not shared between parents after divorce (the sole exception is family allowances, at the parents’ request, but only a very small share of the divorced population with children is concerned).

Divorced men must pay more taxes because they no longer benefit from tax breaks for children and from joint income taxation for married couples, whose taxable income is equal to the reported income divided by a coefficient reflecting the family composition. This coefficient (called the quotient conjugal) is 2 for a couple, with an addition for each child (0.5 for each of the first two children and 1 from the third child onward, called the quotient familial). For instance, the taxable income of a married couple with three children corresponds to their reported income divided by 4. This is a powerful tool for reducing income taxes, especially when the gap between partners’ income is wide or they have a large number of children.

For example, living with a child generally means having two bedrooms, whereas a childless couple needs only one.

It assumes that a lone parent with one child needs 40% ((√2 = 1.4) of extra income to maintain his/her living standard, while with the OECD-modified scale, he or she is assumed to need 30% (1.3). This holds until at least five children. In cases of six or more children, the OECD-modified scale assumes lower economies of scale (1 + 5 × 0.3 = 2.5) than the square root of the household size (\( \sqrt{6}= \) 2.45).

We can notice a sharp increase for women who were breadwinners. One possible interpretation is that women who were breadwinners subsequently repartner with men who have higher earnings relative to themselves as observed for cohabitants in Australia by Foster and Stratton (2020).

Another hint as to this positive selection of the population that repartners may be given by looking at the counterfactual of the repartnering group, which has higher average income growth (an increase of more than 6% over the period for the married counterfactuals vs. 4% in the nonrepartnered population).

Results not shown but available upon request

We define inactivity as receiving neither labor nor replacement income, or as receiving less than 1 month of minimum wage over the year. For collinearity reasons, we do not enter the share of income provided by the man before separation because 99% of inactive women were providing less than 20% of the couple’s joint earnings.

Unfortunately, our administrative database does not include education or labor market experience to assess human capital.

As is the case for women, for collinearity reasons, we do not enter the share of income provided by the man before separation because 95% of inactive men were providing less than 20% of the couple’s earnings.

See Appendix Table 17.

This result is consistent with Manting and Bouman (2006) on Dutch data.

“taxe d’habitation”

With the exception of family allowances at that moment and a part of child care support allowances

Allocations familiales, allocation de rentrée scolaire, complément familial, prestation d’accueil du jeune enfant (PAJE)

Allocation de Soutien Familial

A significant feature for the short-term consequences of separation is that welfare benefits may be a bit higher just after divorce compared to the following years for two main reasons. First, the minimum income benefit is temporarily increased the year following separation. Second, the means-tested condition may be a bit less restrictive just after divorce than the following years. Indeed, over the period we study, the means-tested condition the year N (the year after divorce) is based on the individual income of the divorcee during the year N − 2 (when she/he was married). So, for example, it does not take into account child support payments received the year just after divorce. These payments will be included in the means-tested conditions 2 years after divorce.

It allows to avoid the scale effect due to the introduction of the individuals eligible for the control group and thus gives a better view of the potential differences between groups.

References

Aassve A, Betti G, Mazzuco S, Mencarini L (2007) Marital disruption and economic well-being: a comparative analysis. J R Stat Soc Ser A 170(3):781–799

Abbas H, Garbinti B (2019) De la rupture conjugale à une éventuelle remise en couple : l’évolution des niveaux de vie des familles monoparentales entre 2010 et 2015. France Portrait Social

Ananat EO, Michaels G (2008) The effect of marital breakup on the income distribution of women with children. J Hum Resour 43(3):611–629

Andress H-J, Borgloh B, Brockel M, Giesselmann M, Hummelsheim D (2006) The Economic Consequences of Partnership Dissolution--A Comparative Analysis of Panel Studies from Belgium, Germany, Great Britain, Italy, and Sweden. European Sociological Review 22(5):533–560

Angelov N, Johansson P, Lindahl E (2016) Parenthood and the gender gap in pay. J Labor Econ 34(3):545–579

Bedard K, Deschênes O (2005) Sex preferences, marital dissolution, and the economic status of women. J Hum Resour 40(2)

Belmokhtar Z., Mansuy J. (2016) En 2013, neuf prestations compensatoires sur dix sous forme de capital, Infostat Justice, n°144

Bertrand M, Kamenica E, Pan J (2015) Gender identity and relative income within households. Q J Econ 130(2):571–614

Bianchi SM, Subaiya L, Kahn JR (1999) The gender gap in the economic well-being of nonresident fathers and custodial mothers. Demography 36(2):195–203

Bianchi S, Lesnard L, Nazio T, Raley S (2014) Gender and time allocation of cohabiting and married women and men in France, Italy, and the United States. Demogr Res 31(8):183–216

Boheim R, Ermisch J (2001) Partnership dissolution in the UK - the role of economic circumstances. Oxf Bull Econ Stat 63(2):197–208

Bonnet C, Solaz A, Algava E (2010) Changes in labour market status surrounding union dissolution in France. Population 65(2):273–308

Bourreau-Dubois C, Doriat-Duban M (2016) Covering the costs of divorce: the role of the family, the state and the market. Population 71(3):457–477

Bratberg E, Tjøtta S (2002) Income effects of divorce in families with dependent children, Working paper in Economics, University of Bergen, n° 20/02

Bratberg E, Tjøtta S (2008) Income effects of divorce in families with dependent children. J Popul Econ 21:439–461

Browning M, Chiappori P, Weiss Y (2014) Economics of the family. Cambridge University Press

Burkhauser R, Duncan G, Hauser R, Berntsen R (1991) Wife or frau, women do worse: a comparison of men and women in the United States and Germany after marital dissolution. Demography 28(3):353–360

Carrasco V., Dufour C., 2015, Les décisions des juges concernant les enfants de parents séparés ont fortement évolué dans les années 2000, Infostat Justice n° 132

Charles K, Stephens M (2004) Job displacement, disability, and divorce. J Labor Econ 22(2):489–522

Cigno A (2012) Marriage as a commitment device. Rev Econ Househ 10(2):193–213

Costemalle V (2017) Formations et ruptures d’unions : quelles sont les spécificités des unions libres ? France Portrait Social Insee Références

Dehejia R (2005) Practical propensity score matching: a reply to Smith and Todd. J Econ 125(1–2):355–364

Dewilde C, Uunk W (2008) Remarriage as a way to overcome the financial consequences of divorce - a test of the economic need hypothesis for European women. Eur Sociol Rev 24:393–407

Duncan G, Hoffman S (1985) A reconsideration of the economic consequences of marital dissolution. Demography 22(4):485–497

Durier S. (2017), Après une rupture d’union, l’homme reste plus souvent dans le logement conjugal, Insee Focus, n° 91

Feijten P, Van Ham M (2010) The impact of splitting up and divorce on housing careers in the UK. Hous Stud 25(4):483–507

Ferrari G, Bonnet C, Solaz A (2019) Will the one who keeps the children keep the house? Residential mobility after divorce by parenthood status and custody arrangements in France. Demogr Res 40 - Article 14:359–394

Finnie R (1993) Women, men, and the economic consequences of divorce: evidence form Canadian longitudinal data. Can Rev Sociol Anthropol 30(2):205–241

Foster G, Stratton L (2020) Does female breadwinning make partnerships less healthy or less stable? J Popul Econ forthcoming

Garbinti B, Jeandidier B, Lim H (2016) Les justifications empiriques de la compensation financière après divorce. Can J Law Soc 31(2):183–202

Garbinti B, Goupille-Lebret J, Piketty T (2020) Accounting for wealth inequality dynamics: methods, estimates and simulations for France. J Eur Econ Assoc

Heckman JJ, Ichimura H, Todd PE (1997) Matching as an econometric evaluation estimator: evidence from evaluating a job training programme. Rev Econ Stud 64:605–654

Henman P, Mitchell K (2001) Estimating the cost of contact for nonresident parents: a budget standards approach. J Soc Policy 30:495–520

Hoffman SD (1977) Marital instability and the economic status of women. Demography 14(1):67–76

Holden K, Smock P (1991) The economic costs of marital dissolution: why do women bear a disproportionate cost? Annu Rev Sociol 17:51–78

Imbens, G. W., and Wooldridge J. M. (2008): Recent developments in the econometrics of program evaluation, NBER Working Paper no. 14251

Jarvis S, Jenkins SP (1999) Marital splits and income changes: evidence for Britain. Popul Stud 53:237–254

Jauneau Y, Raynaud E (2009) Des disparités importantes d’évolutions de niveau de vie, Les revenus et le patrimoine des ménages. Insee

Johnson WR, Skinner J (1986) Labor supply and marital separation. Am Econ Rev:455–469

Kalmijn M, Alessie R (2008) Life course changes in income: an exploration of age and stage effect in a 15-year panel in the Netherlands. Netspar Panel Papers:10

Lafortune J., Low C. (2019), Collateralized marriage, mimeo

Leopold T (2018) Gender differences in the consequences of divorce: a study of multiple outcomes. Demography 55(3):769–797

Manting D, Bouman AM (2006) Short- and long-term economic consequences of the dissolution of marital and consensual unions. The example of the Netherlands. Eur Sociol Rev 22(4):413–429

Martin H, Périvier H (2018) Les échelles d’équivalence à l’épreuve des nouvelles configurations familiales. Rev Écon 69(2):303–334

McKeever M, Wolfinger NH (2001) Reexamining the economic costs of marital disruption for women. Soc Sci Q 82(1):202–217

McManus PA, DiPrete TA (2001) Losers and winners: the financial consequences of separation and divorce for men. Am Sociol Rev 66(2):246–268

Merz, J., Garner, T., Smeeding, T. M., Faik, J., & Johnson D. (1994). Two scales, one methodology - expenditure based equivalence scales for the United States and Germany. FFB-Discussion paper 08, Research Institute on Professions (Forschungsinstitut Freie Berufe (FFB)), Leuphana University of Lüneburg.

Mortelmans D, Defever C (2018) Chapter 9. Income trajectories of lone parents after divorce: a view with Belgian register data. In: Bernardi L, Mortelmans D (eds) Lone parenthood in the life course. Springer Open, pp 191–211

Mulder CH, Wagner M (2010) Union dissolution and mobility: who moves from the family home after separation? J Marriage Fam 72(5):1263–1273

Ongaro F, Mazzuco S, Meggiolaro S (2009) Economic Consequences of Union Dissolution in Italy: Findings from the European Community Household Panel. European Journal of Population / Revue européenne de Démographie 25(1):45–65

Peterson R (1996) A re-evaluation of the economic consequences of divorce. Am Sociol Rev 61(3):528–536

Politis DN, Romano JP, Wolf M (1999) Subsampling. Springer, New York

Ponthieux S, Meurs D (2015) Gender inequality. In: Bourguignon F, Atkinson A (eds) Handbook of income distribution. Elvesier

Poortman A-R (2000) Sex differences in the economic consequences of separation. Eur Sociol Rev 16(4):367–383

Poortman A-R (2005) Women’s work and divorce: a matter of anticipation? A research note. Eur Sociol Rev 21(3):301–309

Rault W., Bailly E., 2013, Are heterosexual couples in civil partnerships different from married couples?, Popul Soc, n° 497

Romano JP, Shaikh AM (2012) On the uniform asymptotic validity of subsampling and the bootstrap. Ann Stat 40(6):2798–2822

Rosenbaum P, Rubin D (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70(1):41–55

Sayn I, Jeandidier B, Bourreau-Dubois C (2012) La fixation du montant des pensions alimentaires:des pratiques et un barème. Ministry of Justice. Infostat Justice 116

Smith I (2003) The law and economics of marriage contracts. J Econ Surv 17(2):201–225

Smock P (1993) The economic costs of marital disruption for young women over the past two decades. Demography 30(3):353–371

Smock P (1994) Gender and the short-run economic consequences of marital disruption. Soc Forces 73(1):243–262

Solaz A, Jalovaara M, Kreyenfeld M, Meggiolaro S, Mortelmans D, Pasteels I (2020) Unemployment and separation: evidence from five European countries. J Fam Res, forthcoming. https://doi.org/10.20377/jfr-368

Tach LM, Eads A (2015) Trends in the economic consequences of marital and cohabitation dissolution in the United States. Demography 52(2):401–432

Uunk W (2004) The economic consequences of divorce for women in the European Union: the impact of welfare state arrangements. Eur J Popul 20:251–284

Acknowledgments

We thank Alessandro Cigno, Thomas Deroyon, Xavier D’Haultfoeuille, Lucie Gonzalez, Malik Koubi, Stéfan Lollivier, Thomas Piketty, Corinne Prost, and numerous conference and seminar participants as well as the three anonymous referees for helpful comments and guidance. We are also grateful to Jérôme Accardo and Cédric Houdré for facilitating access to data. This paper presents the authors’ views and should not be interpreted as reflecting those of their institutions or of Banque de France.

Funding

This study was funded by the Agence Nationale de la Recherche (ANR) (Vieillir à deux project, ANR-15-CE36-0009).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflict of interest.

Additional information

Responsible editor: Alessandro Cigno

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2. Tables for the literature review

Appendix 3. The respective role of specialization and of number of children: a simple decomposition

In Section 2.3, we present a simple decomposition of changes in living standards (Eq. (1))

It shows that the variation in living standard for the custodial parent is barely influenced by the number of children (n), but much more sensitive to the within-couple earnings inequality ∝. Figure 4 illustrates graphically this point.

Change in living standard for the custodial mother following divorce, according to within-couple earnings inequality, by number of children. While for a woman who earns as much as her husband before the divorce (α = 0.5), her living standard will decrease from − 31% (with one child) to − 39% (with 4 children), and for a woman who earns 20% of the total income before divorce (α = 0.8), it will decrease from − 72% (with one child) to − 75% (with 4 children). On the contrary, if she was the main income provider in the couple (if the husband earned, for instance, only 20% of the couple’s income), the variation will be much more limited and go from 11% (with one child) to − 2% (with 4 children)

Another way to illustrate this result is to compute first the after–before ratio between living standards \( =\frac{\mathrm{Living}\ \mathrm{standard}\ \mathrm{after}\ \mathrm{divorce}}{\mathrm{Living}\ \mathrm{standard}\ \mathrm{before}\ \mathrm{divorce}} \) and then the change in this ratio with one additional child, on the one hand, and a 10-percentage point increase in the share of man’s earnings in couple earnings, on the other hand (Fig. 5). The ratio decreases by 7.7% when having one child instead of being childless but decreases only by 2.8% when having four children instead of three. On the contrary, within-couple earnings inequality has a much larger effect on the variation in living standards. When the share of man’s earnings in total earnings of the couple before divorce increases from 40 to 50%, the ratio decreases by 16.7% and even by 50% when the share goes from 80 to 90

Change in living standard for the custodial parent resulting from an additional child or a 10-percentage point increase in the within-couple earnings inequality. Interpretation: we compute the variation in the ratio (living standard after divorce/living standard before divorce) with an additional child or a 10-percentage point increase in the share of man’s earnings in the total earnings of the couple

Appendix 4. Dataset and computation of weights

1.1 Dataset

For 2009, the official statistics (Ministry of Justice) report 130,601 divorces in France. Of these, the number of divorces in 2009 for people who married before 2008 ranges between 124,807 and 128,733. Our sample size of 126,250 falls within this interval.

We have information about 2008 earnings for at least 98% of the divorced couples who married before 2008 (column 3, Table 12). For PACS unions, the number of dissolutions reported in official statistics is 17,186 without any indication of the duration of the union. In our sample, we found 9760 couples in a PACS (column 3). Then, we have information about 2008 earnings for at least 57% of the couples who dissolved their PACS in 2009. It is probably even more if we take into account the fact that we include only those who signed their PACS contract before 2008 (whereas the denominator includes all PACS dissolutions whatever the year of the contract).

Matching with the information about the dwelling in 2008 (using the housing tax returnFootnote 52) results in some losses (column 4). We get 122,939 formerly married couples and 9442 couples formerly in a PACS, i.e., at least 95% of divorcees and at least 55% of former PACS partners.

In a further step, we match the divorced couples with their 2010 income and housing tax returns (1 year after divorce). We recover 113,794 divorced couples (i.e., a loss of 7.5%) and 9007 former PACS couples (loss of 4.5%) (column 5).

To build our main sample, we select divorced and former PACS couples for which we recover at least one partner who did not marry/enter a PACS/cohabit in 2010. It includes 97,289 couples: 91,732 ex-married couples and 5557 former PACS couples (column 6).

This represents 132,094 individuals who were formerly married and 8039 who were formerly in a PACS union.

Finally, as we are also interested in labor supply after divorce, we focus on individuals aged between 20 and 55 years old. The upper age limit is set to 55 because, in France, withdrawals from the labor market may occur at this age. We exclude the highest percentile of the distribution of changes in living standards and end up with a main sample including 120,692 divorcees or former PACS partners (64,393 women and 56,299 men).

1.2 Weights and attrition correction

Among the divorces for which we collect the fiscal information in 2010 (column 5), we recovered the two partners in 2010 in 74% of cases and one partner (man or woman) in the remaining 26%. As French resident citizens have to fill in a tax return whatever their income (even when null), we may assume that the non-follow-up by the tax administration is random. But, we could also suspect nonrandom attrition if the non-follow-up is connected to a residential move because the divorcee joined another household (parents’ home, for instance, or collective home) and is not immediately registered.

Since our coverage is almost exhaustive before divorce, we decided to reweight our database on this basis. We computed weights based on calibration margins (as a survey designer to would do correct for nonresponse in a survey) using the “MACRO CALMAR” program developed by the French National Statistical Institute (INSEE). We use available information on earnings and dwelling in 2008 (the coverage of the population is almost exhaustive) to compute calibration margins. We then calibrate weights for men and women separately in order to keep couples for which only one spouse was recovered. We thus ensure that our reweighted sample is representative of the divorces and PACS dissolutions in 2009 in France.

Appendix 5. Descriptive statistics

Appendix 6. Computation of social benefits

Welfare benefits include family benefits, minimum benefits, and housing allowances. Almost all these benefits are means-testedFootnote 53 over the period we study, and their amount increases with the number of children.

First, for family benefits, we calculate the four most important types (family allowances, school allowances, family income supplement, and child care support).Footnote 54 They represent more than 92% of all family benefits distributed. Though related to our topic, we did not impute family support allowanceFootnote 55 due to the lack of information. Entitlement to this benefit is indeed conditional upon the absence of child support payments. In our data, when no child support is reported, it is not possible to distinguish between a nonpayment and zero child support decided in the divorce judgment. However, this benefit is not systematically requested (and then rarely received) and it consists of very small amounts relative to the set of other family benefits (88 euros monthly per child in 2010).

Second, we compute minimum income for nonworking individuals. Some part of the minimum benefit is maintained in case of low-paid activity to encourage people on welfare to return to work.

Third, we compute housing allowances for tenants. These are means-tested allowances, and they depend on the number of children.

We assume a 100% take-up rate for these social and welfare benefits. We are aware that non-take-up may be substantial, especially for minimum income benefits. The computed amount of public transfers can then be viewed as an upper bound and may cause an overestimation of living standard in some cases.Footnote 56 However, people who divorce are generally more likely to receive advice from lawyers, social workers, or family mediators and thus to be informed about available public benefits, especially when they have children. For this reason, we believe that the take-up rate is likely to be very high for lone-parent families.

Appendix 7. Assessing the quality of matching

We use more than 40 economic and demographic covariates to match the divorcees with their still-married twins. Regarding the economic characteristics, we use all types of individual incomes for both men and women: wages, overtime work, unemployment benefits, pensions, and self-employment incomes—which are also split into profits from commercial and noncommercial occupations and farm profits. We also use information on the previous trends in men’s and women’s earnings not only 1 year before divorce but also 2 years and 3 years before (this information is reported in the fiscal tax data) and whether they were unemployed for a long period. Regarding demographic characteristics, we use the number and ages of children. These covariates are expected to be a good proxy for marriage duration, on which we do not have information for the whole sample. We also use information on housing situation (homeownership; type of home: house or apartment) and place of residence (Paris, Paris area “Ile de France” excluding Paris, and elsewhere).

Below, we check the quality of our matching on two aspects: the overlapping assumption and the balance of the covariates.

1.1 Overlapping assumption

The overlapping assumption states that for each observation in the treated group, one observation with similar characteristics can be found and matched with it. Presenting graphs of the propensity score for treated and for the population from which the control group is extracted is a usual way of verifying if this assumption holds. Since we extract our control group from a quasi-exhaustive dataset of married couples, the probability of finding a twin for each of our divorced couples is very high. For all our 24 subsamples of divorced individuals, we have no problem finding a nearest neighbor. Figure 6 gives a detailed illustration of the differences in propensity scores between treated, potential controls before matching and chosen controls after matching for childless men whose share of couple income was above 60%. We observe that the propensity score distribution for divorced couples is overlapped by the nondivorced one. It is then very easy to find a nearest neighbor for each divorced couple (Fig. 6).

Figure 7 presents the distribution of propensity score matching obtained for treated and controls only and for the corresponding four subsamples of men whose share of couple income was above 60% depending on the number of children before divorce. It is also noticeable that the propensity score of the nearest neighbor chosen (the control group) perfectly fits the divorced one (Figs. 6 and 7). This is not so surprising since the number of married couples used to find a nearest neighbor is above 10 million, i.e., more than 100 times the number of divorced couples to match with: the probability of finding a close neighbor is then very high. We do not present all the 24 graphs here, but we have similar results whatever the matching subsample.

1.2 Balance of covariates

The second point to check is whether the matching correctly balances the covariates. Our purpose is to balance numerous characteristics of the couple in 2008 (before the divorced couples split): age of each ex-partner, place of residence, homeownership, married (vs. PACS), house (vs. apartment, etc.), number and age of child(ren), number of dependent persons, and a wide range of earnings for both men and women (labor income, unemployment benefits, pensions, self-employment incomes—detailed in profits from commercial and noncommercial occupations and farm profits) and earnings from previous year and for 2 years and 3 years before. To assess the balancing, all differences in means were tested with a t test and turned out to be nonsignificant at the 10% level. In this kind of subsamples we have (with a very large number of observations), the t test is generally considered to be too demanding because the large number of observations leads to the conclusion that small differences in means are significant. An alternative method for testing the equality between the means is to compute “standardized differences” (also referred as “normalized differences”; see Imbens and Wooldrige 2008).

For the 4 samples where the man was providing more than 60% of the couple’s income, Tables 14 and 15 give the means of all covariates used in the matching for the treated (divorced couples) and the control group and the standardized differences. Table 16 presents the distribution of the standardized differences for all the 24 subsamples. Whatever the subsamples, they turn out to be very small, with a maximum below 0.08 and a median below 0.04. Since the rule of thumb is to conclude to nonsignificant differences when they are below 0.25, it thus confirms that our treated and control groups have identical means for all our matching variables.

It may be useful to go beyond the means and confirm that the matching results in similar distributions of covariates in the treated and control groups. Figure 8 shows that this is the case. After matching, the distributions for the treated and control groups are so similar that they are often impossible to distinguish. In Figs. 9, 10, 11, 12, and 13, for some variables, we compare the distributions of the treated and control groups.Footnote 57 As it turns out, the differences between the covariate distributions are definitively very small and the distributions are often impossible to disentangle one from another for the four subsamples defined by the number of children of men whose share in the couple’s income was higher than 60%. Findings for all our matching variables and for all the 20 other subsamples are similar, and no subsample presents any distinctive feature.

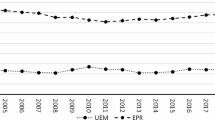

Appendix 8. Presence of unemployment benefits after divorce

Rights and permissions

About this article

Cite this article

Bonnet, C., Garbinti, B. & Solaz, A. The flip side of marital specialization: the gendered effect of divorce on living standards and labor supply. J Popul Econ 34, 515–573 (2021). https://doi.org/10.1007/s00148-020-00786-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-020-00786-2