Abstract

This study explores brand strategies that can be profitable for firms involved in a merger. This study simulates some typical scenarios with reference to a merger between Delta Air Lines and Northwest Airlines. A merger model is developed to determine the price and flight frequency endogenously. A demand function is based on the discrete-choice behavior of passengers. First, demand parameters are estimated by application of airline performance data obtained from the United States domestic airline markets. Second, counterfactual experiments are conducted using these models and estimated parameters. Particularly, this study specifically examines unobserved brand quality and marginal costs. Also, this study derives price, flight frequency, product share, profit, and consumer surplus on post-merger equilibria. The author’s experiments suggest that unification to a higher quality brand can be more profitable for merged firms than simultaneous supply both higher and lower quality brands if the marginal costs are uniform across brands.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

As a more flexible model, the Random-Coefficients Logit model (RCL) captures consumer heterogeneity [3]. In the model, econometricians estimate mean utility for all consumers and the distribution of consumer heterogeneity. Gayle [13] applies RCL in airline industry data. However, this study does not employ RCL, because some computation difficulties exist [11, 18, 19, 26].

- 2.

Details were presented by Cardell [8].

- 3.

This commercial database arranges original data from “Airline Origin and Destination Survey (DB1B)” reported by The Bureau of Transportation Statistics (BTS), The United States Department of Transportation (USDOT).

- 4.

The population of Honolulu–MSA was obtained from “Population Change for Metropolitan and Micropolitan Statistical Areas in the United States and Puerto Rico: 2000 to 2010 (CPH-T-2)”.

- 5.

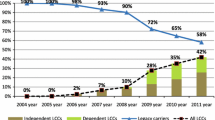

AirTran Airways (FL) was acquired by Southwest Airlines (WN) in 2014.

- 6.

It is noteworthy that some pre-merger and post-merger profits are estimated as negative. The following reason can be inferred. The data used for this study were obtained from direct flight services, with many connecting passengers boarding for the same route segment. These simulation results are based only on one-coupon passengers. This basis might lead to under-estimation in simulation experiments. Differences between data and actual transport volumes are discussed in Appendix 2. Practically speaking, carriers can gain revenue from connecting passengers.

References

Berry, S. (1994). Estimating discrete-choice models of product differentiation. RAND Journal of Economics, 25(2), 242–262.

Berry, S., & Jia, P. (2010). Tracing the woes: An empirical analysis of the airline industry. American Economic Journal: Microeconomics, 2(3), 1–43.

Berry, S., Levinsohn, J., & Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63(4), 841–890.

Bilotkach, V. (2011). Multimarket contact and intensity of competition: Evidence from an airline merger. Review of Industrial Organization, 38(1), 95–115.

Björnerstedt, J., & Verboven, F. (2016). Does merger simulation work? Evidence from the Swedish analgesics market. American Economic Journal: Applied Economics, 8(3), 125–164.

Borenstein, S. (1990). Airline merges, airport dominance, and market power. American Economic Review, Papers and Proceedings, 80(2), 400–404.

Brueckner, J. K., Lee, D., & Singer, E. (2014). City-pairs versus airport-pairs: A market definition methodology for the airline industry. Review of Industrial Organization, 44(1), 1–25.

Cardel, N. S. (1997). Variance components structures for the extreme-value and logistics distribution with application to models of heterogeneity. Econometric Theory, 13(2), 185–213.

Crooke, P., Froeb, L., Tschantz, S., & Werden, G. J. (1999). Effects of assumed demand form on simulated postmerger equilibria. Review of Industrial Organization, 15(3), 205–217.

Doi, N., & Ohashi, H. (2019). Market structure and product quality: A study of the 2002 Japanese merger. International Journal of Industrial Organization, 62, 158–193.

Dubé, J. P., Fox, J. T., & Su, C. L. (2012). Improving the numerical performance of static and dynamic aggregate discrete choice random coefficients demand estimation. Econometrica, 80(5), 2231–2267.

Fageda, X., & Perdiguero, J. (2014). An empirical analysis of a merger between a network and low-cost airlines. Journal of Transport Economics and Policy, 48(1), 81–96.

Gayle, P. G. (2007). Airline code-share alliances and their competitive effects. Journal of Law and Economics, 50(4), 781–819.

Huang, D., Rojas, C., & Bass, F. (2008). What happens when demand is estimated with misspecified model? Journal of Industrial Economics, 56(4), 809–839.

Hüschelrath, K., & Müller, K. (2014). Airline networks, mergers, and consumer welfare. Journal of Transport Economics and Policy, 48(3), 385–407.

Hüschelrath, K., & Müller, K. (2015). Market power, efficiencies, and entry evidence from an airline merger. Managerial and Decision Economics, 36(4), 239–255.

Kim, E. H., & Singal, V. (1993). Mergers and market power: Evidence from the airline industry. American Economic Review, 83(3), 549–569.

Knittel, C. R., & Metaxoglou, K. (2011). Challenges in merger simulation analysis. American Economic Review, Papers and Proceedings, 101(3), 56–59.

Knittel, C. R., & Metaxoglou, K. (2014). Estimation of random-coefficient demand models: Two empiricists’ perspective. Review of Economics and Statistics, 96(1), 34–59.

Kwoka, J., & Shumilkina, E. (2010). The price effect of eliminating potential competition: Evidence from an airline merger. Journal of Industrial Economics, 58(4), 767–793.

Luo, D. (2014). The price effects on the Delta/Northwest airline merger. Review of Industrial Organization, 44(1), 27–48.

Nevo, A. (2000). Mergers with differentiated products: The case of the ready-to-eat cereal industry. RAND Journal of Economics, 31(3), 395–421.

Peters, C. (2006). Evaluating the performance of merger simulation: Evidence from the U.S. airline industry. Journal of Law and Economics, 49(2), 627–649

Richard, O. (2003). Flight frequency and mergers in airline markets. International Journal of Industrial Organization, 21(6), 907–922.

Small, K. A., & Rosen, H. S. (1981). Applied welfare economics with discrete choice models. Econometrica, 49(1), 105–130.

Su, C. L., & Judd, K. L. (2012). Constrained optimization approaches to estimation of structural models. Econometrica, 80(5), 2213–2230.

Weinberg, M. C. (2011). More evidence on the performance of merger simulations. American Economic Review, Papers and Proceedings, 101(3), 51–55.

Weinberg, M. C., & Hosken, D. (2013). Evidence on the accuracy of merger simulation. Review of Economics and Statistics, 95(5), 1584–1600.

Werden, G. J., & Froeb, L. M. (1994). The effects of mergers in differentiated products industries: Logit demand and merger policy. Journal of Law, Economics, & Organization, 10(2), 407–426.

Werden, G. J., Joskow, A. S., & Johnson, R. L. (1991). The effects of mergers on price and output: Two case studies from the airline industry. Managerial and Decision Economics, 12(5), 341–352.

Yamamoto, R. (2019). Merger forms and welfare: Evidence from the U.S. airline industry. Journal of the Eastern Asia Society for Transportation Studies, 13, 442–462.

Yamamoto, R., & Mizutani, F. (2017). Research on mergers in the air transportation industry. Journal of Economics & Business Administration, 216(1), 63–75. (in Japanese).

Acknowledgements

This work was supported by JSPS Grant-in-Aid for JSPS Fellows Grant Number JP15J05368 and KAKENHI Grant Number 20K13617. The author declares that these fundings were not involved in the study design, modeling, analysis, outcomes, interpretation, discussion, conclusion, or writing of the article. The author appreciates Professor Kenichi Shoji for database subscription, and FASTEK for English language editing.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1

A correlation matrix of main variables described in Sect. 11.4 is presented herein (Table 11.11).

Appendix 2

The dataset used for this study is based on direct flight services. As described in Sect. 11.4, observations of airfare paid by passengers and the number of fared-passengers are obtained from O&D survey data. Also airlines’ operation performance data on each route segment are used, with combination of both records. Therefore, some differences are generated between observations and actual transport volumes.

The numbers of one-coupon passengers on the market segment recorded in O&D survey data are smaller than transport volumes on the same segment recorded in operation performance data (T-100). The latter includes the number of passengers who used this route as part of a connection. However, the ticket fares of flight services should be obtained. Difficulties arise in extracting the portion that corresponds to specific segments. In practice, revenue gains from connecting passengers might be large for carriers, as Table 11.12 shows.

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Yamamoto, R. (2023). Brand Strategy in Airline Mergers: Simulation Examples with Delta and Northwest. In: Mizutani, F., Urakami, T., Nakamura, E. (eds) Current Issues in Public Utilities and Public Policy. Kobe University Monograph Series in Social Science Research. Springer, Singapore. https://doi.org/10.1007/978-981-19-7489-2_11

Download citation

DOI: https://doi.org/10.1007/978-981-19-7489-2_11

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-7488-5

Online ISBN: 978-981-19-7489-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)