Abstract

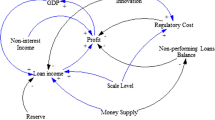

There are many factors influencing the development of the bank industry, and scholars have paid much attention to the influence of these factors on the development of the bank industry. In order to better promoting the healthy and steady development of China’s bank industry, studying the influence of the factors on the development of the bank industry, this paper uses Vensim PLE software to build a simulation model for the development of the bank industry. This paper simulates and analyzes the impact of the changes in money supply and supervision level on the profit level of the bank industry. The simulation results show that the profit level of the bank industry will increase when the money supply is reduced. Higher levels of regulation make banks less profitable. The simulation results also show that the change of money supply has no obvious effect on the nonperforming loan balance.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Lu, M.F., Zhou, J.Y.: A review of the development footprint of Chinese banking industry over the past 70 years and a study of future trends. J. Univ. Jinan (Soc. Sci. Edn.) 29(4), 5–19+157 (2019)

Shu, H.T., Cao, L.K.: An overview of the development and evolution of China’s corporate financing policy – from the perspective of 40 years of reform and opening up. Enterp. Econ. 12, 41–47 (2018)

Li, M.H., Liu, L.Y., Sun, S.: Is it good for banks to develop non-interest businesses? – Based on the empirical analysis of china’s banking industry. Stud. Int. Finan. 11, 11–22 (2014)

Qiu, Z.X., Liu, H., An, S.Y.: On the impact of administrative monopoly on Chinese banking market structure. J. Finan. Res. 2, 175–191 (2015)

Peng, J.G., Wang, S.J., Guan, T.Y.: Does interest rate liberalization narrow interest margins of commercial bank? Empirical evidence based on Chinese banking industry. J. Finan. Res. 7, 48–63 (2016)

Gu, H.F., Yang, L.X.: Monetary policy, bank size differences and credit transmission characteristics: evidence from China’s banking industry in 2006–2015. Stud. Int. Finan. 12, 53–64 (2017)

Dong, N., Fu, L., Xu, S.: The impact of direct financing on the franchise value of China’s banking industry: an empirical study based on Panzar-Rosse model. Stud. Int. Finan. 6, 65–74 (2017)

Meng, C., Yang, X.C.: Market concentration changes and performances of China’s banking industry. Rev. Ind. Econ. 1, 87–100 (2017)

Wang, Y., Shi, Y.D.: Heterogeneity of technological finance nurturing banks—empirical evidence from China’s regional banks. Stud. Sci. Sci. 35(12), 1821–1831 (2017)

Jiang, H., Huang, M.: The impact of debt structure on bank risk-taking: an empirical study based on China’s listed banks. Stud. Int. Finan. 7, 54–65 (2017)

Jiang, H.S., Fei, X.: The impact of asset securitization on bank credit channels—based on the panel data of European banking industry. Finan. Econ. 9, 12–26 (2017)

Guo, Y., Zhao, J.: Deposit competition, shadow banking and bank systemic risk: evidence from the listed banks in China. J. Finan. Res. 6, 81–94 (2017)

Wang, J.B., Li, B.: Empirical study on the effects of China’s monetary policy on risk taking behaviors of commercial banks. J. World Econ. 40(1), 25–43 (2017)

Yao, S.Ã.: Bank development and human development in WAEMU countries: evidence from panel data estimation. Int. J. World Policy Dev. Stud. 4(6), 50–59 (2018)

Zhu, N., Liang, L., Shen, Z.Y., et al.: Endogenous efficiency of Chinese commercial banks and its decomposition under the China’s new normal economy. J. Finan. Res. 7, 108–123 (2018)

Fang, Y., Chen, M., Yang, P.P.: The spillover effect and channel identification of financial market to banking systemic risk. Nankai Econ. Stud. 5, 58–75 (2018)

Yang, K.S., Liu, R.X., Feng, Q.: The impact and countermeasures of the finalisation of Basel III. J. Finan. Res. 2, 30–44 (2018)

Wang, L.J.: A study on deleveraging and the stability of banking system – based on the empirical evidence of China’s banking industry. Stud. Int. Finan. 10, 55–64 (2018)

Shen, C., Zhao, S.M.: The study on the impact of market competition degree and non-interest income on bank returns. Nankai Econ. Stud. 1, 50–66 (2018)

Li, S.F.: The impact of bank regulation and supervision on competition: evidence from emerging economies. Emerg. Mark. Finan. Trade 55(10), 2334–2364 (2019)

Gao, B., Li, Y., Li, M.: Analysis of residential mortgage loan and bank risk: empirical evidence from China’s commercial banks. Ind. Econ. Res. 4, 101–112 (2019)

Li, J.: Can asset securitization ease bank credit risk? – Empirical evidence from China’s banking sector. Stud. Int. Finan. 6, 57–66 (2019)

Zhang, D.Y., Zhang, Z.W.: An empirical study based on regional commercial banks in China. J. Finan. Res. 4, 111–129 (2019)

Su, Q., Meng, N.N.: How does local government intervention affect regional financial inclusion? – Spatial econometric analysis based on provincial panel data. Stud. Int. Finan. 8, 14–24 (2019)

Wang, X.B., Xu, Q.Y., Xin, F.F.: Empirical study on the impact of deposit insurance system on commercial banks’ interest rate risk. J. Manage. Sci. China 22(5), 110–126 (2019)

Tian, Y.H., Govindan, K., Zhu, Q.H.: A system dynamics model based on evolutionary game theory for Green supply chain management diffusion among Chinese manufacturers. J. Clean. Prod. 80(1), 96–105 (2014)

Sana, S.S., Ferro-Correa, J., Quintero, A., et al.: A system dynamics model of financial flow in supply chains: a case study. RAIRO-Oper. Res. 52(1), 187–204 (2018)

Rebs, T., Thiel, D., Brandenburg, M., et al.: Impacts of stakeholder influences and dynamic capabilities on the sustainability performance of supply chains: a system dynamics model. J. Bus. Econ. 89(7), 893–926 (2019)

Liu, C., Xu, F.H., Lu, Y.: Multi-target interactions of monetary policy based on system dynamics. Syst. Eng. 33(4), 82–91 (2015)

Dong, Z., Li, X.T., Dong, J.C.: Simulation of financing structure based on system dynamics. Syst. Eng. Theor. Pract. 36(5), 1109–1117 (2016)

Li, Z.M., Zhong, C.L., Liu, J.J., et al.: A simulation study of the development of China’s trust industry based on system dynamics. Manage. Rev. 30(4), 3–11 (2018)

Zhong, Y.G., Xia, X.J., Qian, Y., et al.: System Dynamics. 2th Edition. Science Press, Beijing (2015)

Tan, R.Y.: An empirical study on the relationship between financial development and economic growth in China. Econ. Res. J. 10, 53–61 (1999)

Sun, J., He, C.: Internet finance innovation and traditional bank transformation based on big data. Finan. Econ. 1, 11–16 (2015)

Ge, Z.Q.: Bank mergers and acquisitions, the growth of commercial banks and the development of China’s banking industry. Stud. Int. Finan. 2, 30–36 (2005)

Zheng, R.N., Niu, M.H.: A study on the relationship between non-interest business and bank characteristics in China’s banking industry. J. Finan. Res. 9, 129–137 (2007)

Li, L., Suo, Y.F.: Economic volatility, non-performing loans and systemic risks in the banking sector. Stud. Int. Finan. 6, 55–63 (2009)

Rose, P.S., Hudgins, S.C.: ANK Management and Financial Services, 8th edn. China Machine Press, Beijing (2013)

Jin, P.H., Zhang, X., Gao, F.: The effect of monetary policy on bank risk taking: from the banking industry perspective. J. Finan. Res. 2, 16–29 (2014)

Liu, W.J.: The Construction of System Dynamics Model of Financial Efficiency from the Perspective of Capital Running. Ocean University of China, Qingdao (2011)

Wang, G.G.: 70 years of banking in China: brief history, main features and historical experience. Manage. World 35(7), 15–25 (2019)

Zhao, B.G., Gou, J.K.: Network hatred: obstruction and decomposition of order construction in virtual public domain. J. Beijing Univ. Posts Telecommun. (Soc. Sci. Edn.) 17(4), 41–49 (2015)

Acknowledgments

This paper was supported by Guizhou Key Laboratory of Big Data Statistics Analysis (No. Guizhou Science and Technology Cooperation Platform Talent [2019] 5103).

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 ICST Institute for Computer Sciences, Social Informatics and Telecommunications Engineering

About this paper

Cite this paper

Li, C.G., Zuo, X.T. (2021). Simulation Study on the Development of Chinese Bank Industry Based on System Dynamics. In: Song, H., Jiang, D. (eds) Simulation Tools and Techniques. SIMUtools 2020. Lecture Notes of the Institute for Computer Sciences, Social Informatics and Telecommunications Engineering, vol 369. Springer, Cham. https://doi.org/10.1007/978-3-030-72792-5_35

Download citation

DOI: https://doi.org/10.1007/978-3-030-72792-5_35

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-72791-8

Online ISBN: 978-3-030-72792-5

eBook Packages: Computer ScienceComputer Science (R0)