Abstract

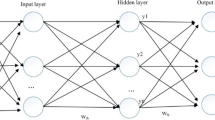

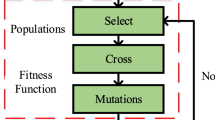

To further explore the influence path of internet finance on the risk prevention and management of commercial banks, the backpropagation neural network optimization algorithm was used to predict the risk value and the change of the risk level of commercial banks under the background of internet environment was empirically studied and analyzed. The results showed that the maximum size of genetic algebra and the number of individuals significantly impacted the algorithm’s optimization performance when the genetic algorithm was used for parameter optimization. Through continuous attempts, the prediction effect was the best when the genetic algebra was 62, and the individual number was 45. The training network showed that the test set’s fitting degree was 96.07%, and the prediction error was 0.84%, which was much better than those before optimization. When the predicted risk value was more significant than 0.39, the bank should be vigilant and strengthen risk prevention. The development of internet finance can reduce commercial banks’ business risk levels, reduce their dependence on traditional business, and decrease commercial banks’ business risk levels. It can be seen that commercial banks can effectively improve risk management ability and efficiency promoted by technological development, so the level of business risk they undertake can be reduced.

Similar content being viewed by others

References

Al-Malkawi, H. A. N., & Pillai, R. (2018). Analyzing financial performance by integrating conventional governance mechanisms into the GCC Islamic banking framework. Managerial Finance, 44(5), 604–623.

Bai, C., Shi, B., Liu, F., et al. (2019). Banking credit worthiness: Evaluating the complex relationships. Omega, 83, 26–38.

Baumann, O., Bergenholtz, C., Frederiksen, L., et al. (2018). Rocket internet: Organizing a startup factory. Journal of Organization Design, 7(1), 13.

Bidabad, B. (2019). Fluctuations and business cycles prevention by new financial instruments and banking structure reform. International Journal of Accounting & Finance Review, 4(1), 35–50.

Burke, J. J., Hoitash, R., & Hoitash, U. (2019). The heterogeneity of board-level sustainability committees and corporate social performance. Journal of Business Ethics, 154(4), 1161–1186.

Chen, C., Zhou, S., & Chang, Q. (2020). The role of computer security management in preventing financial technology risks. International Journal of Computers and Applications, 14, 1–9.

Friday, D., Ryan, S., Sridharan, R., et al. (2018). Collaborative risk management: A systematic literature review. International Journal of Physical Distribution & Logistics Management, 48(3), 231–253.

Hou, J., Wang, C., & Liu, P. (2018). How to improve the competiveness of natural gas in China with Energy Internet and “The Belt and Road Initiative”. International Journal of Energy Research, 42(15), 4562–4583.

Hung, J. L., He, W., & Shen, J. (2020). Big data analytics for supply chain relationship in banking. Industrial Marketing Management, 86, 144–153.

Jung, J., Herbohn, K., & Clarkson, P. (2018). Carbon risk, carbon risk awareness and the cost of debt financing. Journal of Business Ethics, 150(4), 1151–1171.

Kotula, M., Ho, W., Talluri, S., et al. (2018). Managing risk in strategic sourcing: A cross-sectional and multi-national case study. IEEE Engineering Management Review, 46(2), 74–86.

Lucey, B. M., Vigne, S. A., Ballester, L., et al. (2018). Future directions in international financial integration research—A crowdsourced perspective. International Review of Financial Analysis, 55, 35–49.

Mackay, J., Munoz, A., & Pepper, M. (2019). A disaster typology towards informing humanitarian relief supply chain design. Journal of Humanitarian Logistics and Supply Chain Management, 9(1), 22–46.

Mutua, C. N., & Juma, D. (2018). Influence of strategic sourcing on procurement performance of kenyan commercial banks. The Strategic Journal of Business and Change Management, 5(2), 1415–1445.

Pakurár, M., Haddad, H., Nagy, J., et al. (2019). The impact of supply chain integration and internal control on financial performance in the Jordanian banking sector. Sustainability, 11(5), 1248.

Pimentel Da Silva, G. D., & Branco, D. A. C. (2018). Is floating photovoltaic better than conventional photovoltaic? Assessing environmental impacts. Impact Assessment and Project Appraisal, 36(5), 390–400.

Rose, C., & Stegemann, J. (2018). From waste management to component management in the construction industry. Sustainability, 10(1), 229.

Song, X., Deng, X., & Wu, R. (2019). Comparing the influence of green credit on commercial bank profitability in china and abroad: Empirical test based on a dynamic panel system using GMM. International Journal of Financial Studies, 7(4), 64.

Tang, L., Yuan, S., Tang, Y., et al. (2019). Optimization of impulse water turbine based on GA-BP neural network arithmetic. Journal of Mechanical Science and Technology, 33(1), 241–253.

Tarnovskaya, V., & Biedenbach, G. (2018). Corporate rebranding failure and brand meanings in the digital environment. Marketing Intelligence & Planning, 36(4), 455–469.

Thomalla, F., Lebel, L., Boyland, M., et al. (2018). Long-term recovery narratives following major disasters in Southeast Asia. Regional Environmental Change, 18(4), 1211–1222.

Wang, R., Yu, C., & Wang, J. (2019). Construction of supply chain financial risk management mode based on Internet of Things. IEEE Access, 7, 110323–110332.

Wilkinson, S., Antoniades, H., & Halvitigala, D. (2018). The future of the Australian valuation profession: New knowledge, emerging trends and practices. Property Management, 36(3), 333–344.

Xu, R., Mi, C., Mierzwiak, R., et al. (2020). Complex network construction of Internet finance risk. Physica A: Statistical Mechanics and its Applications, 540, 122930.

Yang, C. L., Shieh, M. C., Huang, C. Y., et al. (2018). A derivation of factors influencing the successful integration of corporate volunteers into public flood disaster inquiry and notification systems. Sustainability, 10(6), 1973.

Zeng, H., Deng, Y., & Huang, C. (2019). The implementation of chinese acoustic model efficiency optimization based on convolutional neural network. Journal of Physics: Conference Series, 1168(5), 052030.

Zhang, Y., Chen, X., Liu, X., et al. (2018). Exploring trust transfer between internet enterprises and their affiliated internet-only banks: An adoption study of internet-only banks in China. Chinese Management Studies, 12(1), 56–78.

Zhu, C., & Chen, L. (2018). An analysis of the development of China’s commercial banks under the structural reform of the supply side. Journal of Accounting, Business and Finance Research, 4(1), 1–8.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All Authors declare that they have no conflict of interest

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Li, Q., Xu, Z., Shen, X. et al. Predicting Business Risks of Commercial Banks Based on BP-GA Optimized Model. Comput Econ 59, 1423–1441 (2022). https://doi.org/10.1007/s10614-020-10088-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-020-10088-0