Abstract

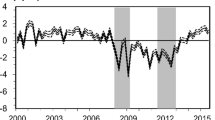

A high degree of correlation among the business cycles of individual countries is usually seen as a key criterion for an optimum currency area. However, the elasticity with which countries react to the common cycle is equally important. A country with a non-unitary growth elasticity relative to the common area will experience cyclical divergences at the peak and trough of the common cycle. Despite being characterised by highly correlated business cycles, the euro area suffers from widely differing amplitudes.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Ansgar Belke, University of Duisburg-Essen, Germany.

Clemens Domnick, University of Duisburg-Essen, Germany.

Daniel Gros, Centre for European Policy Studies, Brussels, Belgium.

Rights and permissions

About this article

Cite this article

Belke, A., Domnick, C. & Gros, D. Business Cycle Desynchronisation: Amplitude and Beta vs. Co-movement. Intereconomics 52, 238–241 (2017). https://doi.org/10.1007/s10272-017-0681-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10272-017-0681-8