Abstract

Background

The determinants of consumer mobility in voluntary health insurance markets providing duplicate cover are not well understood. Consumer mobility can have important implications for competition. Consumers should be price-responsive and be willing to switch insurer in search of the best-value products. Moreover, although theory suggests low-risk consumers are more likely to switch insurer, this process should not be driven by insurers looking to attract low risks.

Methods

This study utilizes data on 320,830 VHI healthcare policies due for renewal between August 2013 and June 2014. At the time of renewal, policyholders were categorized as either ‘switchers’ or ‘stayers’, and policy information was collected for the prior 12 months. Differences between these groups were assessed by means of logistic regression. The ability of Ireland’s risk equalization scheme to account for the relative attractiveness of switchers was also examined.

Results

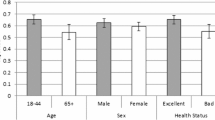

Policyholders were price sensitive (OR 1.052, p < 0.01), however, price-sensitivity declined with age. Age (OR 0.971; p < 0.01) and hospital utilization (OR 0.977; p < 0.01) were both negatively associated with switching. In line with these findings, switchers were less costly than stayers for the 12 months prior to the switch/renew decision for single person (difference in average cost = €540.64) and multiple-person policies (difference in average cost = €450.74). Some cost differences remain for single-person policies following risk equalization (difference in average cost = €88.12).

Conclusions

Consumers appear price-responsive, which is important for competition provided it is based on correct incentives. Risk equalization payments largely eliminated the profitable status of switchers, although further refinements may be required.

Similar content being viewed by others

Notes

This may not always be the case. For example, specific health insurance cover can be strongly linked to employment or certain eligibility criteria (e.g., Medicare or Medicaid in the United States).

Currently there are three other insurers competing in the market in conjunction with the incumbent VHI.

A contract is specified as providing for non-advanced cover if not more than 66 % of the full cost for hospital charges in a private hospital or prescribed minimum benefits, if lower, is always provided. Advanced contracts are contracts that are not non-advanced [39].

In 2013, VHI had 54 % share of the market and paid 67 % of total market claims [40].

HIA data suggest that roughly three in ten policyholders have access to work group schemes [28].

As this is a voluntary market, the other option faced by consumers is to drop coverage entirely. Those who did so were excluded from the analysis.

Average market premiums were calculated based on quarterly data provided by the HIA.

Pseudo R 2 statistics for all models are quite low, however this tends to be the norm in logistic regression analysis [41].

However, it is unclear whether the cost of investing in risk selection strategies for these individuals would outweigh the benefit.

As discussed, this rate relates to the policy level, not the individual level.

References

Thomson, S., Busse, R., Crivelli, L., van de Ven, W., Van de Voorde, C.: Statutory health insurance competition in Europe: a four-country comparison. Health Policy. (2013)

Laske-Aldershof, T., Schut, E., Beck, K., Gress, S., Shmueli, A., Van de Voorde, C.: Consumer mobility in social health insurance markets: a five-country comparison. Appl. Health Econ. Health Policy 3, 229–241 (2004)

Duijmelinck, D.M.I.D., Mosca, I., van de Ven, W.P.M.M.: Switching benefits and costs in competitive health insurance markets: a conceptual framework and empirical evidence from the Netherlands. Health Policy. (2014)

Lako, C.J., Rosenau, P., Daw, C.: Switching health insurance plans: results from a health survey. Health Care Anal. 19, 312–328 (2011)

Kiil, A.: What characterises the privately insured in universal health care systems? A review of the empirical evidence. Health Policy 106, 60–75 (2012)

DOH: the path to universal healthcare: white paper on universal health insurance, Dublin (2014)

Buchmueller, T.C., Feldstein, P.J.: The effect of price on switching among health plans. J. Health Econ. 16, 231–247 (1997)

Cutler, D.M., SJ, Reber: Paying for health insurance: the trade-off between competition and adverse selection. Q. J. Econ. 113, 433–466 (1998)

Royalty, A.B., Solomon, N.: Health plan choice: price elasticities in a managed competition setting. J. Hum. Resour. 34, 1–41 (1999)

Feldman, R., Finch, M., Dowd, B., Cassou, S.: The demand for employment-based health insurance plans. J. Hum. Resour. 24, 115 (1989)

Schut, F.T., Hassink, W.H.J.: Managed competition and consumer price sensitivity in social health insurance. J. Health Econ. 21, 1009–1029 (2002)

Schut, F.T., Gress, S., Wasem, J.: Consumer price sensitivity and social health insurer choice in Germany and The Netherlands. Int. J. Health Care Finance Econ. 3, 117–138 (2003)

Frank, R.G., Lamiraud, K.: Choice, price competition and complexity in markets for health insurance. J. Econ. Behav. Organ. 71, 550–562 (2009)

Van den Berg, B., Van Dommelen, P., Stam, P., Laske-Aldershof, T., Buchmueller, T., Schut, F.T.: Preferences and choices for care and health insurance. Soc. Sci. Med. 66, 2448–2459 (2008)

Pendzialek, J.B., Danner, M., Simic, D., Stock, S.: Price elasticities in the German Statutory Health Insurance market before and after the health care reform of 2009. Health Policy. 119, 654–663 (2015)

Boonen, L.H.H.M., Laske-Aldershof, T., Schut, F.T.: Switching health insurers: the role of price, quality and consumer information search. Eur. J. Health Econ. (2015)

Gress, S., Groenewegen, P., Kerssens, J., Braun, B., Wasem, J.: Free choice of sickness funds in regulated competition: evidence from Germany and The Netherlands. Health Policy 60, 235–254 (2002)

Van Dijk, M., Pomp, M., Douven, R., Laske-Aldershof, T., Schut, E., de Boer, W., de Boo, A.: Consumer price sensitivity in Dutch health insurance. Int. J. Health Care Finance Econ. 8, 225–244 (2008)

Strombom, B.A., Buchmueller, T.C., Feldstein, P.J.: Switching costs, price sensitivity and health plan choice. J. Health Econ. 21, 89–116 (2002)

Kolstad, J.T., Chernew, M.E.: Quality and consumer decision making in the market for health insurance and health care services. Med. Care Res. Rev. 66, 28S–52S (2009)

Reitsma-van Rooijen, M., de Jong, J.D., Rijken, M.: Regulated competition in health care: switching and barriers to switching in the Dutch health insurance system. BMC Health Serv. Res. 11, 95 (2011)

Hirschman, A.O.: Exit, Voice and Loyalty: Responses to Decline in Firms, Organizations and States. Harvard University Press, Cambridge (1970)

Van Vliet, R.C.J.A.: Free choice of health plan combined with risk-adjusted capitation payments: are switchers and new enrolees good risks? Health Econ. 15, 763–774 (2006)

Behrend, C., Buchner, F., Happich, M., Holle, R., Reitmeir, P., Wasem, J.: Risk-adjusted capitation payments: how well do principal inpatient diagnosis-based models work in the German situation? Results from a large data set. Eur. J. Health Econ. 8, 31–39 (2007)

HIA: market figures. http://www.hia.ie/sites/default/files/HIA_Mar_Newsletter_2015.pdf (2015). Accessed 26 June 2015

Turner, B., Shinnick, E.: Community rating in the absence of risk equalisation: lessons from the Irish private health insurance market. Health Econ. Policy Law. 8, 209–224 (2013)

Armstrong, J.: Risk equalisation and voluntary health insurance markets: the case of Ireland. Health Policy 98, 15–26 (2010)

HIA: the private health insurance market in Ireland 2014., Dublin (2014)

Keegan, C., Thomas, S., Normand, C., Portela, C.: Measuring recession severity and its impact on healthcare expenditure. Int. J. Health Care Finance Econ. 13, 139–155 (2013)

HIA: Report on the Health Insurance Market: By Millward Brown Lansdowne to the Health Insurance Authority., Dublin (2012)

De Jong, J.D., van den Brink-Muinen, A., Groenewegen, P.P.: The Dutch health insurance reform: switching between insurers, a comparison between the general population and the chronically ill and disabled. BMC Health Serv. Res. 8, 58 (2008)

Dormont, B., Geoffard, P.-Y., Lamiraud, K.: The influence of supplementary health insurance on switching behaviour: evidence from Swiss data. Health Econ. 18, 1339–1356 (2009)

Shmueli, A., Bendelac, J., Achdut, L.: Who switches sickness funds in Israel? Health Econ. Policy Law 2, 251–265 (2007)

Breyer, F., Bundorf, M.K., Pauly, M.: Health care spending risk, health insurance, and payment to health plans. In: Handbook of Health Economics, pp. 691–762. Elsevier, Massachusetts (2012)

Turner, B.: Premium inflation in the Irish private health insurance market: drivers and consequences. Ir. J. Med. Sci. (2013)

The Competition Authority: Competition in the Private Health Insurance Market, Dublin (2007)

HIA: August 2014 Newsletter. http://www.hia.ie/assets/files/Newsletters/HIA_Aug_Newsletter_2014.pdf (2014). Accessed 20 June 2015

Greene, W.H.: Econometric Analysis. Prentice Hall, Upper Saddle River (2003)

HIA: Guide to 2013 Risk Equalisation Scheme., Dublin (2013)

VHI: VHI Healthcare Annual Report and Accounts 2012, Dublin (2012)

Hosmer, D.W., Lemeshow, S., Sturdivant, R.X.: Applied logistic regression. Wiley, Hoboken (2000)

Acknowledgments

The authors would like to thank VHI Healthcare for access to their policyholder database. This research was funded by the Health Research Board PHD/2007/16.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Keegan, C., Teljeur, C., Turner, B. et al. Switching insurer in the Irish voluntary health insurance market: determinants, incentives, and risk equalization. Eur J Health Econ 17, 823–831 (2016). https://doi.org/10.1007/s10198-015-0724-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-015-0724-7