Abstract

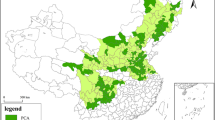

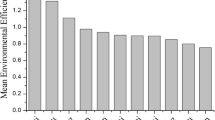

We create a comprehensive policy evaluation system that is based on the concept of integrated basin management. From the point of view of economic development and environmental protection, we set up an equilibrium environmental tax, optimize its allocation and simulate its effects on reducing water pollution. The approach is demonstrated on the case of the Lake Taihu, China, Basin. Several important conclusions are derived from the findings of this study. First, the comprehensive evaluation system used in this study has great applicability. We calculate equilibrium environmental taxes of 6.83 yuan/kg of chemical oxygen demand (COD) by simulation analysis and estimate that the total cumulative environmental tax revenues would be approximately 55 billion yuan. Second, by integrated watershed management modeling, resources can be optimized, and problems of uneven distribution of resources in the region can be resolved. Third, compared with non-adopted environmental tax, an environmental tax policy can exceed reduction targets of 4%. At the same time, it can increase revenue by 0.88 trillion yuan and the Environmental Efficiency Improvement Index (EEII) by three points. Fourth, priorities of environmental governance are the areas of Zhihugang, Nanxi, Tiaoxi, Wujin and East Taihu. Fifth, a single environmental tax rate is likely to cause over- or under-assessment of environmental tax revenue in the long-term. As shown in this study, this problem can be prevented by using the accumulation of countermeasure fees.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Forrester, J. W. (1958). Industrial dynamics: A major breakthrough for decision makers. Harvard Business Review, 36(4), 37–66.

Higano, Y., Mizunoya, T., Sakurai, K., & Kobayashi, S. (2002). An evaluation of water quality improvement new technology based on the social environmental system of Kasumigaura Lake Basin. In Studies in Regional Science, ERSA Conference Paper (p. 253). European Regional Science Association.

Hirose, F., & Higano, Y. (2000). A simulation analysis to reduce pollutants from the catchment area of Lake Kasumigaura. Studies in Regional Science, 30(1), 47–63.

Leontief, W. (1941). The structure of american economy, 1919–1929: An empirical application of equilibrium analysis (p. 181). Cambridge, MA: Harvard University Press.

Ministry of Environmental Protection of the People’s Republic of China. Environmental Quality Standards for Surface Water (GB 3838-2002).

Mizunoya, T., Sakurai, K., Kobayashi, S., & Higano, Y. (2007). A simulation analysis of synthetic environment policy: Effective utilization of biomass resources and reduction of environmental burdens in Kasumigaura Basin. Studies in Regional Science, 36(2), 355–374.

Shen, Z. (2010). Synthetic evaluation of environmental policies for sustainable development in the Taihu economic circle. Ph.D. thesis (pp. 25–26, p. 72). Graduate School of Life and Environmental Sciences, University of Tsukuba.

Shen, Z., & Higano, Y. (2007). Basin management policy of water quality improvement in Taihu Valley. Japan Association for Human and Environmental Symbiosis, 14, 25–34.

Shen, Z., & Higano, Y. (2010). Synthetic evaluation of water pollution emission controls by environmental tax in Taihu Basin. Japan Association for Human and Environmental Symbiosis, 17, 99–108.

Shen, Z., Kusano, E., Chien, H., & Koyama, O. (2014). Predictive analysis of nitrogen balances resulting from the production and consumption of livestock products in the Huang-Huai-Hai Region, China. Japan Agricultural Research Quarterly, 48(3), 331–342.

Shen, Z., Mizunoya, T., & Higano, Y. (2012). Agriculture and sustainable development: Policies analysis of the Taihu economic circle in China. International Journal of Foresight and Innovation Policy (IJFIP), 8(2/3), 210–235.

The State Council. (1998). The national ninth five-year plan and 2010 long range plan on water pollution prevention and control for the Tai Lake Basin.

The State Council. (2002). The national tenth five-year plan on water pollution prevention and control for the Tai Lake Basin.

The State Environmental Protection Administration of China, SEPA and the National Bureau of Statistics of China NBS. (2006). China green national accounting study report 2004 (CGNASR 2004), http://www.gov.cn/english/2006-09.

Wang, Q. G., Gu, G., & Higano, Y. (2006). Toward integrated environmental management for challenges in water environmental protection of Lake Taihu Basin in China. Environmental Management, 37(5), 579–588.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Details of the Modeling System

Appendix: Details of the Modeling System

The main characteristics of the models are presented in this appendix. For further information on the simulation models, please refer to Shen (2010).

-

1.

Flow of the Market

The first equation presents the flow balance in the commodity flow balance market. In Eq. (1), the left-hand side describes supply and the right-hand side describes demand. The total amount of production in each industry should be greater than or equal to the sum of intermediate demand and final demand, based on basic principles of the market economy. Here, consumption and investment are estimated by the sum of all private and government economic activities derived from the I–O structure expressed in the following equation:

where \(X_{(t)}\) denotes the endogenous column vectors for products of each industry (En); \(A_{1}\) denotes the exogenous matrices of input coefficients of goods to each industry (Ex); \(C_{(t)}\) denotes the endogenous column vectors for private consumption of goods (En); \(Gc_{(t)}\) is the endogenous column vectors of governmental consumption of goods (En); \(I_{(t)}\) is the endogenous column vectors for fixed capital formation by industry of each sector (En); \(EX_{(t)}\) is the endogenous column vectors for the export of goods (En); and \(IM_{(t)}\) is the endogenous column vectors for good imports (En).

-

2.

Value Balances of Industries

The left-hand side of Eq. (2) shows the revenue and the right-hand side shows the cost. Price rates P of all industries are set to 1 at the benchmark year 2006:

where \(P_{(t)}\) stands for the endogenous row vectors for prices of goods (En); \(\widetilde{X}_{(t)}\) is the diagonalized matrices from \(X_{(t)}\) (En); \(\delta\) is the exogenous row vectors for depreciation of each industrial sector (Ex); \(Yh_{(t)}\) is the endogenous row vectors for national revenue of each industrial sector (En); \(\varphi\) is the exogenous row vectors for profit of each sector (Ex); \(\tau\) is the exogenous row vectors for total tax of each industrial sector (Ex); \(Te_{(t)}\) is the exogenous row vectors for the environmental tax of each industrial sector (En).

-

3.

The Private Sector Consumption

The share of cost for goods or services to disposable revenue is constant. A fraction of the disposable revenue is saved, but all the rest is disbursed for consumption.

where \(\widetilde{C}_{(t)}\) is the diagonalized matrices from \(C_{(t)}\) (En); \(S_{c(t)}\) is the endogenous row vectors for private saving (En); \(TBn_{(t)}\) is the endogenous row vectors for the net investment in local bonds (En); \(\text{ccr}\) is the exogenous row vectors of cost share for goods in the private consumption sector (Ex); \(\text{scr}\) is the exogenous value for the ratio of savings to revenue (Ex); and \(\ell\) is a row vector for summation.

-

4.

The Balance of Government Revenues and Expenditures

$$T_{gi(t)} = T_{go(t)}$$(7)$$T_{gi(t)} = T_{(t)} + Te_{(t)} + X_{(t)}^{bio} + \text{TS}_{(t)} + \text{BBF}_{(t - 1)}$$(8)$$T_{go(t)} = S_{g(t)} + S_{(t)}^{1} + S_{(t)}^{2} + S_{(t)}^{3} + S_{(t)}^{4} + S_{(t)}^{5} + S_{(t)}^{6} + \text{BBF}_{(t)}$$(9)

where \(T_{gi(t)}\) is fiscal revenue (En); \(T_{go(t)}\) is the fiscal expenditures (En); \(T_{(t)}\) is the summation of government revenue from normal taxation, excluding the environmental tax revenue (En); \(T_{e(t)}\) is the summation of environmental tax revenues \(Te_{ij(t)}^{m}\), which is calculated based on the water pollution released by industry m in municipality j of zone i at time t (En); \(X_{(t)}^{\text{bio}}\) is the summation of \(X_{ij(t)}^{\text{bio}}\), which is the revenue from biomass gasification technology in municipality j of zone i at time t (En);\(\text{TS}_{(t)}\) is the summation of \(\text{TS}_{ij(t)}\), which is a subsidy for direct treatment technology in municipality j of zone i at time t (En); \(\text{BBF}_{(t)}\) is the balance brought forward (BBF) of countermeasure fees in the Taihu Basin; \(S_{(t)}^{1}\) is the summation of \(S_{ij(t)}^{1}\), which is the subsidy and investment for reducing water pollution emission from households in municipality j of zone i at time t (En); \(S_{(t)}^{2}\) is the summation of \(S_{ij(t)}^{2m}\), which is a subsidy in the capital control for reducing water pollution emission by high-emission industry m, in municipality j of zone i at time t (En); \(S_{(t)}^{3}\) is the summation of \(S_{ij(t)}^{3}\), which is an investment in the direct treatment technology for reducing water pollution in Lake Taihu, in municipality j of zone i at time t (En); \(S_{(t)}^{4}\) is the summation of \(S_{ij(t)}^{4m}\), which plays the same role as \(S_{ij(t)}^{2m}\), but \(S_{ij(t)}^{4m}\) originates from environmental taxes (En); \(S_{(t)}^{5}\) is the summation of \(S_{ij(t)}^{5m}\), which is an incentive fee for encouraging the low emission industry m in municipality j of zone i at time t, less than \(S_{ij(t)}^{4m}\) (En); \(S_{(t)}^{6}\) is the summation of \(S_{ij(t)}^{6}\), which is an investment in biomass gasification technology for the effective utilization of biomass resources in municipality j of zone i at time t (En).

-

5.

Models of Environmental Policy Intervention

-

(1)

Biomass Gasification Technology

The financial budget for biomass gasification is as follows:

where \(\text{Tec}_{ij(t)}^{\text{bio}}\) is the amount of biomass gasification in municipality j of zone i at time t (En); \(\theta_{1}\) is the setup cost for each biomass gasification unit (Ex); \(I_{ij(t)}^{\text{bio}}\) is the investment for construction of a biomass gasification unit in municipality j of zone i at time t (En); \(\theta_{2}\) is the administrative and maintenance expenses for each biomass gasification unit (En); \(X_{ij(t)}^{\text{bio}}\) is the amount of production by investment in biomass gasification in municipality j of zone i at time t (En); \(Xn_{ij(t)}^{\text{bio}}\) is the net revenue from investment in biomass gasification in municipality j of zone i at time t (En); \(P_{(t)}^{\text{bio}}\) is the market price of energy (En); \(C_{0}^{\text{bio}}\) is the biogas production cost per m3 (Ex); \(\sigma_{q}^{\text{bio}}\) is the coefficient of biogas production efficiency (Ex); \(Gas_{ij(t)}^{\text{bio}}\) is the biogas capacity for biomass gasification in municipality j of zone i at time t (En); \(y\) is the capital recovery period (En).

The reduction in water pollutants and air pollutants resulting from biomass gasification is computed as follows:

where \(kw^{n}\) is the dissolution coefficient of Eutrophication material n in municipality j of zone i (Ex); \(k_{\text{air}}^{n}\) is the coefficient of exhaust reduction of air pollutant and greenhouse gas (Ex); \(\text{Gas}_{ij(t)}^{n}\) is the amount of exhaust reduction of air pollutants and GHG in municipality j of zone i at time t (En); \(K_{ij(t)}^{\text{bio}}\) is the amount of unused biomass resources in municipality j of zone i at time t (En).

-

(2)

Reduction of Water Pollutants by Direct Treatment Technology

Water pollutants are usually dumped into Lake Taihu via rivers and streams. In addition, the water pollutants from materials are constantly dissolved in the lake and directly affect the quality of its water. Therefore, the introduction of direct treatment technology aimed at the direct removal of pollutants may be an effective approach. In this study, we consider three technologies, namely chemical coagulation, biochemistry and vegetation, as shown in Table 7. The direct water pollutants reduction effect depends on the level of direct treatment technologies, as well as the total amount of investment. It can be estimated as follows:

where \(\text{QTL}_{ij(t)}^{n}\) is the reduction in the amount of water pollution n by direct treatment devices d in municipality j of zone i at time t (En); \(ke_{f}^{n}\) is the effect coefficient of the investment made for reducing water pollutants n by direct treatment devices (Ex); \(\text{DI}_{ij(t)}^{d}\) is the investment for setting up the direct treatment devices d in municipality j of zone i at time t (En); \(\text{DM}_{ij(t)}^{d}\) is the maintenance cost for the direct treatment devices d in municipality j of zone i at time t (En).

-

(3)

Environmental Tax

As an available means of economic policy, an environmental tax can influence the production activities that harm the environment by levying taxes. The optimal environmental tax rate as a scale variable is simulated and analyzed in this study. Changes in tax rate vary with changes in water pollution reduction goals and changes in the water pollution emission equivalent from each industrial sector. The fundamental equations are as follows.

where \(Te_{ij(t)}^{m}\) is the environmental tax revenue, which is calculated based on the water pollution emissions of industry m in municipality j of zone i at time t (En); \(\tau_{\text{eco}}\) is the environmental tax rate, which is a scalar (En); \(Qhe_{ij(t)}^{m}\) is the total noxious equivalents of industry m in municipality j of zone i at time t (En); \(Vhe^{n}\) is the equivalent conversion rate of n pollutants (COD = 1, T-N = 4 and T-P = 200 are calculated based on Shen et al. 2012); \(k_{e}^{n}\) is the emission coefficients of industry m as shown in Table 4 (Ex); \(\text{TS}_{(t)}\) is the summation of \(\text{TS}_{ij(t)}\), which is a subsidy for direct treatment technology in municipality j of zone i at time t (En); \(\text{BBF}_{(t)}\) is the balance brought forward (BBF) of countermeasure fees in the Taihu Basin; \(\text{GFI}_{ij(t)}^{{}}\) is the collected funds for water pollution reduction in municipality j of zone i at time t; \(\text{GFO}_{ij(t)}\) is the expenditure for water pollution reduction in municipality j of zone i at time t.

-

(4)

Production Function and Curtailment

This production function is of Harrod–Domar–Leontief type. Capital stock is the total quantity of capital used in the production of goods and services, including buildings, equipment, tools, machines and pollution abatement technologies. The capital stock, as a collective supply determinant, is especially important for the long-run expansion of the economy. Changes in environmental investment and subsidies for idling capital stock affect the effective utilization of capital stock. For example, policies to inhibit capital investment in sectors which have high pollution emission coefficients and adjust the capital stock of each industry can improve the capital efficiency and promote vigorous socioeconomic development in the basin.

where \(\alpha^{m}\) is the ratio of capital to production in industry m (Ex); \(K_{ij(t)}^{m}\) is the production capital stock of industry m in municipality j of zone i at time t (En); \(fr^{m}\) is the subsidy rate to reduce capital investment in heavy pollution industries for water pollution reduction (Ex).

-

6.

Environmental Efficiency Improvement Index (EEII)

The Environmental Efficiency Improvement Index is defined by comparing the driving force (DF) to the variable quantity of environmental pressure (EP) in a certain time period; it is used to evaluate how much the environment is improved in different periods. If EEII is larger or equal to zero, the increase in DF is larger than the increase in EP and the environment can be efficiently improved. If EEII is smaller than zero, the increase of DF is smaller than the increase of EP and the environment cannot be efficiently improved. The EEII is expressed as follows:

-

7.

Pollutant Constraints Variable

The best limit target is assumed to be less than the capacity of the environment. Decreases in pollution from 0 to 20% are simulated to determine the best environmental policies to improve the water quality of the basin.

where \(Q^{n}_{2006}\) is the initial value of water pollution n, which flows into Lake Taihu (Ex); \(Q^{n}_{ij(t)}\) is the amount of water pollution n that flows into Lake Taihu, in municipality j of zone i at time t (En); \(\psi_{(t)}\) is the reduction target of water pollution n (Ex); \(Q_{1\,ij(t)}^{n}\), \(Q_{2\,ij(t)}^{n}\), \(Q_{3\,ij(t)}^{n}\) are amounts of water pollution n that flow into Lake Taihu from household, industry m and land use, respectively, in municipality j of zone i at time t (En); \(\text{BQ}_{ij(t)}^{n}\) is the amount of reduced water pollution n obtained by biomass gasification technology in municipality j of zone i at time t (En); \(\text{QTL}_{ij(t)}^{n}\) is the amount of reduced water pollution n by direct treatment technology in municipality j of zone i at time t (En).

-

8.

The Objective Function

The Green Gross Regional Product (GGRP) is an accounting system that deducts natural resources depletion costs and environmental degradation costs from the Gross Regional Product (GRP) to assess the quality of economic development (CGNASR 2004). In this study, the factor of GGDP is a GDP variant that does not include the cost of environmental protection payments for reducing water pollutant emission T-N, T-P and COD in the study area. On the basis of the maximization of the GRP and minimization of the costs of environmental management, the GGRP is selected as an economic growth indicator to assess the quality of real economic development. The best level of socioeconomic activity is to satisfy a given level of water pollution reduction obtained by maximizing GGRP under given restrictions for T-N, T-P and COD. The objective function in the model maximizes the GGRP in each zone considering capital stocks, investments for production and treatment, consumption and other related variables and constraints described above, subject to the contribution of pollutants and future changes for each sector in the zones. In other words, how the total pollution increases or decreases due to increasing GRP can be determined as one main macroeconomic indicator, with the environmental tax and the pollutants reduction targets applied in the model assuming that it will continue without any external impact on the long-term trend of economic development in the study area.

\(\rho\) is the social discount rate (=0.05)

\(\text{Cost}_{(t)}\) is the investment and expenditure for environmental preservation at time t (En); \(kc_{0}\) is one vector for coefficients of environmental investment and expenditure (Ex).

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Higano, Y., Shen, Z., Mizunoya, T. (2020). Analysis of Spatial Effects of Environmental Taxes on Water Pollution in China’s Taihu Basin. In: Thill, JC. (eds) Innovations in Urban and Regional Systems. Springer, Cham. https://doi.org/10.1007/978-3-030-43694-0_19

Download citation

DOI: https://doi.org/10.1007/978-3-030-43694-0_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-43692-6

Online ISBN: 978-3-030-43694-0

eBook Packages: Economics and FinanceEconomics and Finance (R0)