Collection

The Industrial Organization of Vertically-Related Industries

- Submission status

- Closed

Industrial organization (IO) is concerned with the functioning of markets, firms and industries, in particular the way in which firms compete with each other when markets are imperfectly competitive. A classic topic in IO refers to vertically-related industries. Firms that sell products in final consumer markets usually require inputs, which are provided by other firms or organizations in an upstream industry. This leads to a vertical supply chain including upstream and downstream firms (in which the relationship between them may be exclusive or not), which is needed to produce a final product. Moreover, the choice of the downstream firms relative to the input provision is twofold: make or buy it. Real world examples of vertically-related industries include, automotive, banking, software, energy, telecommunications, for instance. Furthermore, considering labour input, also the analysis of a relationship between an upstream labour union and a downstream firm can be modelled as a vertical structure.

In the last few years, IO literature has made extensive progress in analyzing various issues which arise in vertically-related markets, even if many other still deserve to be investigated in more detail. On the one hand, activities and decisions taken by downstream firms affect the profits of upstream suppliers, hence the latter care about the activities of the former.

On the other hand, when upstream firms have market power, taking into account how the whole vertical supply chain operates is required to understand the functioning of final markets and the results they obtain in terms of efficiency and overall welfare. In this perspective, traditional IO issues, such as how contractual arrangements (e.g. an exclusive dealing contract) between vertically-related firms, the presence of switching costs or a vertical merger affect the level of competitiveness and market efficiency, become crucial in assessing product market outcomes and addressing regulation policies.

This collection aims to bring together original research articles that shed light on the mechanism underlying the buyer-supplier relationships in a context of strategic interactions. We welcome theoretical, empirical and behavioural contributions, as well as review articles providing a critical assessment of the IO literature on vertically-related markets.

This collection is intentionally broad. Research is welcomed on a range of themes, from classic topics in the IO of vertically-related industries which focus on the strategic and the efficiency effects of vertical integration and vertical contracting (e.g., through double marginalization and the hold-up problem) to new themes centered around the dynamics of vertically-related industries (firm entry and innovation, among others), corporate governance and market regulation.

A non-exhaustive list of possible topics covered by the collection is the following: · Vertical integration; · Optimal contractual arrangements; · Buyers’ sourcing strategies; · Unionized oligopoly; · Horizontal mergers; · Intra-brand and inter-brand competition; · Competition in distribution channels; · International trade and competition; · Firm dynamics: market entry and exit; · R&D investments in bilateral vertical relationships; · Innovation and Intellectual Property Rights (IPRs); · Technological complementarities and switching costs; · Strategic inventories in vertical industries; · Two-sided markets and vertical technology industries; · Managerial delegation in vertical markets; · Biased agents in a vertical structure; · Regulation policy.

Editors

-

Dr Domenico Buccella

Kozminski University, Warsaw, Poland

-

Dr Luciano Fanti

Università di Pisa, Italy

-

Dr Nicola Meccheri

Università di Pisa, Italy

-

Dr Marcella Scrimitore

Università del Salento, Italy

Articles (5 in this collection)

-

-

Secret contracting and Nash-in-Nash bargaining

Authors

- Emanuele Bacchiega

- Olivier Bonroy

- Content type: Original Article

- Published: 25 October 2021

- Article: 156

-

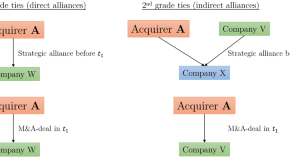

The role of related strategic alliances before mergers and acquisitions

Authors

- Leonhard Brinster

- Content type: Original Article

- Open Access

- Published: 27 September 2021

- Article: 126

-

Deal motivations and bargaining power: do executives show their hand in SEC filings?

Authors

- Stephen N. Jurich

- M. Mark Walker

- Content type: Review

- Published: 25 March 2021

- Article: 60

-

A model of market competition as a prize contest or a model of strife for market domination

Authors

- Gerasimos T. Soldatos

- Content type: Original Article

- Published: 01 February 2021

- Article: 28