Abstract

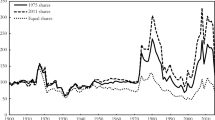

Notwithstanding characteristic volatility and variance between individual commodities, it is clear that after 2002 (and before the last quarter of 2008) commodity prices rose beyond their historic trend (Figure 6.1). This is, of course, not the first time that there have been spikes in commodity prices. However, the duration of the current price surge has already exceeded that of previous rises in commodity prices in the 1950s and 1970s. I will argue that there are persuasive reasons to believe that they will be sustained in the near and medium term, if not the long term, notwithstanding the sharp and very rapid fall across the board in commodity prices in late 2008.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Copyright information

© 2010 Raphael Kaplinsky

About this chapter

Cite this chapter

Kaplinsky, R. (2010). Asian Drivers, Commodities and the Terms of Trade. In: Nissanke, M., Mavrotas, G. (eds) Commodities, Governance and Economic Development under Globalization. Palgrave Macmillan, London. https://doi.org/10.1057/9780230274020_6

Download citation

DOI: https://doi.org/10.1057/9780230274020_6

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-349-30116-4

Online ISBN: 978-0-230-27402-0

eBook Packages: Palgrave Economics & Finance CollectionEconomics and Finance (R0)