Abstract

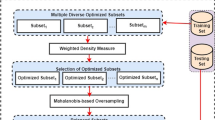

Imbalance modeling of financial risk control refers to a situation where the sample in the data set is unbalanced due to various factors, such as the credit level and repayment ability of different financial customers. In order to evaluate and control risks more accurately, it is necessary to model unbalanced data. This article mainly designs models for unbalanced data sets of financial risk control, and uses different algorithms to compare and analyze the computational capabilities of the algorithms. It studies the financial risk control of benchmarking management optimization algorithms. Experimental data show that the maximum AUC value and accuracy value obtained by the benchmarking management optimization algorithm in the risk control of different financial enterprises exceed 0.85. When creating a model, it is necessary to consider the characteristics of unbalanced data and apply appropriate algorithms and techniques to ensure the reliability and stability of the model. At the same time, it is necessary to continuously optimize and improve the model to adapt to different risk scenarios and customer needs.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Lubbock, A.L.R., Lopez, C.F.: Microbench: automated metadata management for systems biology benchmarking and reproducibility in Python. Bioinformatics 38(20), 4823–4825 (2022)

Di Martino, S., Peron, A., Riccabone, A., Vitale, V.N.: Benchmarking management techniques for massive IIoT time series in a fog architecture. Int. J. Grid Util. Comput. 12(2), 113–125 (2021)

Albahri, O.S., et al.: Multidimensional benchmarking of the active queue management methods of network congestion control based on extension of fuzzy decision by opinion score method. Int. J. Intell. Syst. 36(2), 796–831 (2021)

RajeevKumar, M., Ansari, T.J., Baz, A., Alhakami, H., Agrawal, A., Khan, R.A.: A multi-perspective benchmarking framework for estimating usable-security of hospital management system software based on fuzzy logic, ANP and TOPSIS methods. KSII Trans. Internet Inf. Syst. 15(1), 240–263 (2021)

Khatari, M., Zaidan, A.A., Zaidan, B.B., Albahri, O.S., Alsalem, M.A.: Multi-criteria evaluation and benchmarking for active queue management methods: open issues, challenges and recommended pathway solutions. Int. J. Inf. Technol. Decis. Mak. 18(4), 1187–1242 (2019)

Hendawi, A., et al.: Benchmarking large-scale data management for Internet of Things. J. Supercomput. 75(12), 8207–8230 (2019). https://doi.org/10.1007/s11227-019-02984-6

Cornwell, N., Bilson, C., Gepp, A., Stern, S.E., Vanstone, B.J.: The role of data analytics within operational risk management: a systematic review from the financial services and energy sectors. J. Oper. Res. Soc. 74(1), 374–402 (2023)

Huynh, T.L.D., Shahbaz, M., Nasir, M.A., Ullah, S.: Financial modelling, risk management of energy instruments and the role of cryptocurrencies. Ann. Oper. Res. 313(1), 47–75 (2022). https://doi.org/10.1007/s10479-020-03680-y

Rabin, K., Tiwari, A.K., Hammoudeh, S., Albulscu, C.T.: Financial modeling, risk management of energy and environmental instruments and derivatives: past, present, and future. Ann. Oper. Res. 313(1), 1–7 (2022)

Pekár, J., Pcolár, M.: Empirical distribution of daily stock returns of selected developing and emerging markets with application to financial risk management. Central Eur. J. Oper. Res. 30(2), 699–731 (2022)

Soto-Beltran, L.L., Robayo-Pinzon, O.J., Rojas-Berrio, S.P.: Effects of perceived risk on intention to use biometrics in financial products: evidence from a developing country. Int. J. Bus. Inf. Syst. 39(2), 170–192 (2022)

Kwateng, K.O., Amanor, C., Tetteh, F.K.: Enterprise risk management and information technology security in the financial sector. Inf. Comput. Secur. 30(3), 422–451 (2022)

Christensen, J.H.E., Lopez, J.A., Mussche, P.L.: Extrapolating long-maturity bond yields for financial risk measurement. Manag. Sci. 68(11), 8286–8300 (2022)

Pandey, K.K., Shukla, D.: Stratified linear systematic sampling based clustering approach for detection of financial risk group by mining of big data. Int. J. Syst. Assur. Eng. Manage. 13(3), 1239–1253 (2022). https://doi.org/10.1007/s13198-021-01424-0

Albrecher, H., Azcue, P., Muler, N.: Optimal ratcheting of dividends in a Brownian risk model. SIAM J. Financ. Math. 13(3), 657–701 (2022)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Liu, Y., Yu, J. (2024). Modeling of Financial Risk Control Imbalance Dataset Based on Benchmarking Management Optimization Algorithm. In: Hung, J.C., Yen, N., Chang, JW. (eds) Frontier Computing on Industrial Applications Volume 2. FC 2023. Lecture Notes in Electrical Engineering, vol 1132. Springer, Singapore. https://doi.org/10.1007/978-981-99-9538-7_13

Download citation

DOI: https://doi.org/10.1007/978-981-99-9538-7_13

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-9537-0

Online ISBN: 978-981-99-9538-7

eBook Packages: EngineeringEngineering (R0)