Abstract

In the context of the global clean and low-carbon energy transition, hydrogen energy has become an important direction for energy technology innovation in the contemporary world. Many countries around the world have paid great attention to the development of hydrogen energy and leveraged it to the national strategies. This study firstly reviews the development of global hydrogen energy, focusing on the global hydrogen energy supply, hydrogen energy demand, the current situation and development trend of hydrogen energy. Secondly, based on data collected from government websites, key R&D institutions and well-known databases (e.g. CODIS database), a strategic analysis of hydrogen energy policies and technologies of main countries is conducted. In terms of policy, textual analysis is used to analyse the global hydrogen energy layout direction and the strategic positioning, strategic layout and strategic objectives of hydrogen energy in countries such as the United States, European Union, Japan and China. In terms of technology, the keyword search method is used to obtain data on scientific research projects in the field of hydrogen energy, and quantitative analysis is conducted to analyse the characteristics of the technical layout of global hydrogen energy research projects, and to analyse the funding of hydrogen energy projects and the focus of hydrogen energy technology research. Finally, suggestions for the future development of hydrogen energy are discussed.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

With the acceleration of modern industrial processes and the increase in fossil fuel consumption leading to global warming, green and low-carbon development has become a global consensus [1]. In response to climate change, more than 130 countries and regions around the world have proposed carbon neutrality targets, and there is an unprecedented global determination and effort to accelerate the energy transition [2]. Compared with traditional fossil fuels, hydrogen energy is a new type of energy with the advantages of clean and zero carbon, long-term storage, flexibility and efficiency, multi-energy conversion and rich application scenarios [3]. Accelerating the development of hydrogen energy is an effective way to tackle the climate problem, reduce dependence on fossil energy and help achieve deep decarbonization in areas that are difficult to reduce emissions, such as transport, industry and buildings [4]. In addition, with the development of renewable energy, hydrogen energy plays an increasingly important role in the new power system as a power medium and link [5].

Countries around the world attach great importance to the development of hydrogen energy. China, the United States, Europe, Japan and South Korea have elevated the development of hydrogen energy to a high level of national strategy and have continuously increased their support for hydrogen energy research and development and industrialization [6]. At the critical point of global carbon neutrality and economic downturn after the epidemic, hydrogen energy industry has become an important development area for many major countries/regions in the world to cope with global climate change and economic recovery after the epidemic [7, 8]. The literature [9,10,11,12] mainly analyzed the research in the field of hydrogen energy in the US, which is a global leader in the hydrogen fuel cell vehicle market and hydrogen refueling stations. The literature [13, 14] analyses Germany's national hydrogen energy strategy, which focuses on the transport, aviation, steel and chemical industries. The literature [15,16,17] analyses the development of hydrogen energy applications in Japan and South Korea. Due to the scarcity of resources and energy, both countries hope to develop a high level of hydrogen economy and move towards a hydrogen society. The literature [18, 19] analyses the advantages that Australia has in developing the hydrogen energy industry, and that new energy generation, hydrogen power generation and hydrogen export will be the main strategies for the development of hydrogen energy in Australia. China’s hydrogen energy industry chain is currently focused on storage and transportation and hydrogen refueling, which drives the common development of upstream and downstream industries [20]. At present, the hydrogen energy industry chain with fuel cell as the main application has been initially commercialized globally, and it is expected that hydrogen energy will usher in an industrial explosion in the next 5 years [21].

The paper introduces the current situation and forecast of global hydrogen energy supply and demand, analyses the distribution and scale of hydrogen energy projects in operation, construction and planning worldwide, analyses the national hydrogen energy strategies of major countries in the world from the perspective of strategic positioning, strategic layout and strategic objectives, and analyses the progress and R&D direction of hydrogen energy technology in major countries around the world based on the funding of hydrogen technology projects and the focus of hydrogen technology research and development.

2 Overview of the Development of Hydrogen Energy Industry

2.1 Global Hydrogen Energy Supply

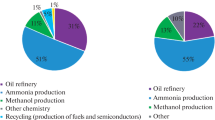

Global hydrogen production reaches 94 million tonnes in 2021, up 5% year-on-year, currently mainly from fossil energy sources. The International Energy Agency predicts that approximately 520 million tonnes of low-carbon hydrogen will be needed to achieve net zero global emissions by 2050. About 306 million tonnes of green hydrogen will come from renewable sources and 197.6 million tonnes of blue hydrogen from natural gas and coal combined with CCS technology; 16 million tonnes of low carbon electrolytic hydrogen will be produced by electrolysis in nuclear and fossil fuel power plants with CCS. In comparison, 87 million tonnes of gray hydrogen is produced from natural gas and coal in 2020, mainly for the chemical and refining industries. The forecast for global hydrogen production in 2050 is shown (Fig. 1).

2.2 Global Hydrogen Energy Demand

In order to achieve net zero global emissions, the International Energy Agency predicts a total global demand for hydrogen energy of 528 million tonnes by 2050. The largest demand for hydrogen will come from transport, accounting for about 39% of the total, or 207 million tonnes, of which 91 million tonnes will be used for road transport, 90 million tonnes for shipping and 50 million tonnes of hydrogen for aviation. The industrial sector will use 187 million tonnes of hydrogen, about 35% of the total, of which 83 million tonnes will be used in the chemical industry, 54 million tonnes in the steel industry and 12 million tonnes in the cement industry. Power generation will account for approximately 19% of the total hydrogen demand, or 102 million tonnes per year. Hydrogen for construction and agriculture, 0.23 billion tonnes, is about 4% of the total. The forecast for global hydrogen demand in 2050 is shown (Fig. 2).

2.3 Global Hydrogen Engineering

According to statistics, there are currently over 1400 hydrogen energy projects operating, constructed, and planned around the world. Among them, there are 227 hydrogen energy projects in operation, with a total hydrogen production scale of about 400 megawatts, mainly distributed in Europe, mainly producing hydrogen through electrolysis of water. The hydrogen produced is mainly used in transportation and industrial fields. The distribution of engineering areas for operation, construction, and planning are as shown in Fig. 3.

3 Strategic Analysis of Hydrogen Energy Policy

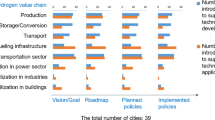

At present, the US, EU, Japan and other major economies in the world are actively laying out their hydrogen energy industries, and have released hydrogen energy development strategies and road maps, setting out a framework of action for hydrogen energy in terms of production, storage and transportation, application as well as technological innovation and investment.

3.1 Analysis of Global Hydrogen Energy Strategic Planning

As sustainable energy development and new energy technologies continue to advance, 35 countries and regions have issued strategies related to hydrogen energy by 2022.

In terms of the spatial layout of global hydrogen energy strategy reports, including 17 European countries, 6 Asian countries, 5 South American countries, 2 North American countries, 2 African countries and 2 Oceanian countries, it can be seen that the largest number of European countries have published hydrogen energy reports, accounting for about 50% of the world, becoming the global wind vane of hydrogen energy development. In terms of global hydrogen energy strategy report time promotion are as shown in Fig. 4, Japan took the lead in putting forward the Basic Hydrogen Energy Strategy in 2017, and in 2019, other countries put forward their national-level hydrogen energy strategic plans one after another, especially in 2020 and 2021 when the global hydrogen energy strategic plan release reaches its peak.

Through the analysis of the strategic planning reports on hydrogen energy in key countries and regions such as China, the US, Japan, Germany, France, the UK and the EU, it can be concluded that: countries generally formulate development strategies from the needs of decarbonization development, energy security, economic growth and the development of applied technologies, focusing on the directions of proton exchange membrane electrolytic hydrogen production, organic liquid hydrogen storage, low-temperature liquid hydrogen storage, hydrogen for power and scenic hydrogen production.

3.2 Analysis of Hydrogen Energy Policies in Major Countries

United States

In order to ensure leadership in emerging technologies, the US attaches great importance to the cultivation of technologies related to the upstream and downstream of the hydrogen energy industry chain, and policies continue to support research and development of hydrogen energy and fuel cell technologies. Table 1 shows the strategic policy and planning objectives for hydrogen energy in the US.

Through analysis, it can be concluded that the US hydrogen energy strategy is positioned as a reserve emerging technology. The US hydrogen energy is laid out in five main areas: transportation fuels, power generation and grid balancing, residential and commercial building fuel, industrial and long-distance transportation raw materials, and industrial fuel.

European Union

The development of hydrogen energy in the EU mainly relies on the large-scale development of renewable energy sources and perfect natural gas pipeline infrastructure to promote the construction of green hydrogen production and hydrogen energy storage and transportation systems, and to achieve the deep decarbonization of hydrogen energy in transport, industry and buildings to support the energy transition and the green and low-carbon development of the European economy. Table 2 shows the strategic policies and planning objectives of the EU on hydrogen energy.

Through the analysis, it can be concluded that the EU’s strategic positioning of hydrogen energy is to position hydrogen energy as an important guarantee to promote deep decarbonization and facilitate the energy transition. The EU hydrogen energy is laid out for decarbonization in industry, the application of hydrogen fuel cell vehicles such as heavy trucks and coaches, aviation and shipping transport, hydrogen power generation, and hydrogen for households and buildings.

Japan

Japan is the first country in the world to have a national strategy for hydrogen energy development, with a clear policy orientation and progressive refinement of its content, due to the constraints of resource and energy scarcity, and a strong focus on the development of hydrogen energy-related technologies and the continued introduction of fiscal and tax incentives. Table 3 shows Japan’s strategic policies and planning objectives regarding hydrogen energy.

Through the analysis, it can be concluded that: Japan’s strategic positioning of hydrogen energy is to position hydrogen energy as an important way to guarantee energy security and consolidate industrial foundation. Japan’s hydrogen energy is laid out in the fields of transportation (hydrogen fuel cell vehicles and hydrogen refueling stations), hydrogen energy power generation, and domestic fuel cell combined heat and power supply.

China

China has introduced a number of national-level planning policies to guide and encourage the development of the hydrogen energy industry and to accelerate the development of the whole industrial chain of hydrogen energy in “production, storage, transmission and transportation”. Table 4 shows China’s strategic policies and planning objectives for hydrogen energy.

Through the analysis, it can be concluded that the strategic positioning of hydrogen energy in China is to make hydrogen energy an important part of the future national energy system, an important carrier for the green and low-carbon transformation of energy-using terminals, a strategic emerging industry and a key development direction for future industries. China’s hydrogen energy is laid out in the fields of transportation, energy storage, power generation and industry.

4 Strategic Analysis of Hydrogen Energy Technology

4.1 Analysis of Global Hydrogen Energy Technology Layout

The analysis of over 3000 hydrogen research projects from 2017 to 2022 is based on data collected from government websites, key R&D institutions and well-known databases (e.g. CODIS database) for major countries around the world.

The technological layout of global hydrogen research projects is characterized by the following: the range of hydrogen technologies for electricity involved in hydrogen energy projects in various countries is expanding; the investment in different technologies in hydrogen energy projects in various countries is gradually increasing; hydrogen energy projects in various countries are most deployed in the field of hydrogen for electricity, followed by electrolytic hydrogen production and hydrogen storage.

4.2 Analysis of Hydrogen Energy Technology in Major Countries

United States

The emphasis on and support for hydrogen energy has increased each year from $13.06 million in 2018 to $7.1 billion in 2022 in the US. From 2018 to 2021, US hydrogen energy technology R&D funding focuses on advanced hydrogen production, storage and transportation, fuel cell technology, and hydrogen gas turbine research, and in 2022 the US focuses on clean hydrogen production, hydrogen transportation and storage infrastructure, and end-use hydrogen including co-generation, and hydrogen power generation, as shown in Fig. 5 and expanding into emerging market applications for hydrogen energy, including medium and heavy duty trucks, data centers, ports, steel manufacturing, stationary power, and building heating.

In recent years, project development in the US has focused on electrolytic hydrogen production technology and hydrogen for electric power, with the number of projects in these two categories accounting for over 70% of the total number of projects in the field of hydrogen for electric power. This is shown in Fig. 6.

For hydrogen electrolysis technology, the US laid out both proton exchange membrane electrolysis hydrogen production technology from 2018 to 2020, and began to focus on solid oxide electrolysis hydrogen production technology from 2019. In 2019, the frontier laid out research on low-cost, durable electrode materials for alkaline anion exchange membrane electrolytic cell electrode material. In terms of hydrogen technology for electric power, the US laid out both proton exchange membrane fuel cell technology and solid oxide fuel cell technology from 2018 to 2022, and began to focus on hydrogen gas turbine and co-generation technology research and development in 2021 and 2022, respectively. In 2022, in addition to hydrogen production and use, the US focused on the layout of large-capacity, long-cycle hydrogen storage technology, with special attention to solid-state hydrogen storage and geological hydrogen storage Technologies.

Germany

The EU provides funding for hydrogen energy research and development in Germany through the EU research framework program “Horizon 2020” and “Horizon Europe”, with a focus on hydrogen production from renewable energy sources, high-capacity, long-cycle hydrogen storage and fuel cells for vehicles, as well as on the application of hydrogen energy in industry, transport and power generation, as shown in Fig. 7.

In recent years, German projects in the field of hydrogen energy for electricity have focused on hydrogen technology for electricity, accounting for more than 50% of the total number of projects in the field of hydrogen energy for electricity, as shown in Fig. 8.

In terms of electrolytic hydrogen production technology, Germany has laid out solid oxide electrolytic hydrogen production technology for four consecutive years from 2019 to 2022, and in 2020, carried out R&D on low-cost and durable electrode materials for alkaline anion exchange membrane electrolyzers, but Germany has not laid out research on proton exchange membrane electrolytic hydrogen production technology. In terms of hydrogen storage technology, Germany is focusing on low-temperature liquid hydrogen storage technology and metal solid hydrogen storage material R&D in 2018–2020, and on underground salt cavern hydrogen storage and organic liquid hydrogen storage technology in 2021 and 2022 respectively. In terms of hydrogen technology for electricity, Germany has laid out proton exchange membrane fuel cell technology and solid oxide fuel cell technology for four consecutive years from 2018 to 2021, carried out R&D on co-generation technology in 2021, and focused on hydrogen gas turbine technology from 2021 to 2022. In 2022, Germany mainly focuses on the layout of solid oxide electrolysis hydrogen production technology, proton exchange membrane fuel cell technology and hydrogen gas turbine technology.

Japan

Japan’s New Energy Industry and Technology Development Organization (NEDO) has increased its funding for hydrogen energy year by year, from ¥15.1 billion in 2018 to ¥193.5 billion in 2022, with funding focused on hydrogen supply chains, fuel cells, hydrogen refueling stations, hydrogen gas turbines, etc. In 2022, it has funded research and development on the use of hydrogen in the steel-making process, focusing on the application of hydrogen energy in transport, industry, power generation and construction as shown in Fig. 9.

In recent years, in the field of hydrogen for electricity, project development in Japan has also focused on hydrogen technology for electricity, accounting for more than 60% of the total number of projects in the field of hydrogen for electricity, as shown in Fig. 10.

For electrolytic hydrogen production technology, Japan conducted research and development on proton exchange membrane electrolytic hydrogen production technology and solid oxide electrolytic hydrogen production technology in 2018, and then focused mainly on research on proton exchange membrane electrolytic hydrogen production technology. For hydrogen for electricity, Japan has laid out proton exchange membrane fuel cell technology, solid oxide fuel cell technology and hydrogen gas turbine technology for five consecutive years from 2018 to 2022, with more than 70 projects deployed for proton exchange membrane fuel cell technology. In 2022, in addition to hydrogen production and hydrogen use, Japan has also laid out organic liquid hydrogen storage and scenic hydrogen production technologies.

China

China’s national key special project on hydrogen energy gradually increased R&D on hydrogen energy technologies from 2018, with research focus on proton exchange membrane electrolytic hydrogen production, low temperature liquid hydrogen storage, proton exchange membrane fuel cells, cogeneration and Power-to-X in the last five years, and hydrogen energy applications mainly focusing on power generation and transportation, with an all-round layout of R&D on power hydrogen production, storage, hydrogen use and electric-hydrogen coupling in 2021 and 2022 , as shown in Fig. 11.

In recent years, in the field of hydrogen energy for electricity, project development in China has mainly focused on the field of hydrogen-using technology, with the number of projects in this field accounting for 50% of the total number of projects in the field of hydrogen energy for electricity, as shown in Fig. 12.

For hydrogen production by electrolysis: China will start to lay out R&D on proton exchange membrane electrolysis technology from 2021 and increase R&D efforts in 2022; and lay out R&D on solid oxide electrolysis hydrogen production technology from 2022. For hydrogen storage: China will lay out the R&D of low-temperature liquid hydrogen storage technology every year from 2019, and focus on and lay out the R&D of metal solid hydrogen storage technology from 2022. For hydrogen use: China has been laying out R&D on proton exchange membrane and solid oxide fuel cell technologies since 2018, and on co-generation technologies every year since 2020. For electric-hydrogen coupling: China lays out R&D on hydrogen production technology for scenery in 2018 and 2021, focuses on and lays out R&D on Power-to-X technology from 2021, and lays out R&D on hydrogen-grid interaction technology in 2020 only. In 2022, China lays out R&D on electrolysis hydrogen production, hydrogen storage, hydrogen for power and electric-hydrogen coupling.

5 Summary and Outlook

In summary, in terms of global hydrogen energy strategic layout, countries that have issued hydrogen energy strategies have different development speeds and stages in this field, but the development trend is roughly the same, that is, promoting the improvement of hydrogen energy penetration in production and life, and ensuring the development of low-carbon, clean and sustainable energy. In terms of research and development of science and technology projects, different countries have different development priorities. Compared with other countries, China and Japan all focus on the field of hydrogen gas turbines. In addition, China has focused on co-generation.

With the accelerated development of renewable energy, hydrogen production from renewable energy will become an important direction of hydrogen energy development in the future, and will form different levels of coupling influence with the power grid. Establishing the coordination mechanism of electric-hydrogen coupling with clean electricity as the main source and hydrogen-based energy as the supplement, and building a new physical form of power system with “electricity as the main source and electric-hydrogen coupling”, will promote the coupling application of hydrogen energy in the source, network, load and storage of the new power system, enhance the level of new energy consumption, realize the large capacity and long time storage of electric energy, and realize the interconnection and synergy optimization of various energy networks such as electricity, heating and fuel. It will realize the interconnection and optimization of various energy networks, such as electricity, heating and fuel, enhance the flexible regulation capability of the power grid, and ensure the safe and stable operation of the new power system.

References

Chien, F., Chau, K.Y., Ady, S.U., Zhang, Y., Tran, Q.H., Aldeehani, T.M.: Does the combining effects of energy and consideration of financial development lead to environmental burden: social perspective of energy finance. Environ. Sci. Pollut. Res. Int. 28(30), 40957–40970 (2021)

Ceseña, E.A.M., Mancarella, P.: Energy systems Integration in smart districts: robust optimisation of multi-energy flows in integrated electricity, heat and gas networks. IEEE Trans. Smart Grid 10(1), 1122–1131 (2019)

Yang, R., Zheng, X., Qin, M., et al.: A trifunctional Ni-P/Fe-P collaborated electrocatalyst enables self-powered energy systems. Adv. Sci. (Weinh) 9(22), e2201594 (2022)

Huang, B., Xu, H., Jiang, N., et al.: Tensile-strained RuO2 loaded on antimony-tin oxide by fast quenching for proton-exchange membrane water electrolyzer. Adv. Sci. (Weinh) 9(23), e2201654 (2022)

Jia, Z., Qin, X., Chen, Y., et al.: Fully-exposed Pt–Fe cluster for efficient preferential oxidation of CO towards hydrogen purification. Nat. Commun. 13(1), 6798 (2022)

Hydrogen Roadmap Europe. Hydrogen roadmap Europe: a sustainable pathway for the European energy transition. https://www.fch.europa.eu/sites/default/files/Hydrogen%20Roadmap%20Europe_Report.pdf. Accessed 10 Feb 2019

Lin, R., Hu, Q., Liu, Z., et al.: Integrated CuO/Pd nanospike hydrogen sensor on silicon substrate. Nanomaterials (Basel) 12(9), 1533 (2022)

Wang, C., Sun, F.Q., Xu, Y., et al.: Analysis and enlightenment of hydrogen development strategy of world’s major economies. World Sci-Tech. R&D 44(5), 597–604 (2022)

Wang, Y., Gao, L., Liu, Y.: The inspiration of the national hydrogen energy roadmap of US. Fut. Dev. 39(12), 22–29 (2015)

Liu, Y., Xu, F.: Fact sheet on hydrogen and the hydrogen economy. World Sci-Tech R & D 28(1), 101–106 (2006)

Fu, G., Xiong, H.: The models of hydrogen energy development in Japan, Germany and the United States and enlightenments. Macroecon. Manage. 6, 84–90 (2020)

Bao, J., Zhao, Z., Ma, Q.: Overview of the development trends of hydrogen energy technologies. Autom Digest 2, 6–11 (2020)

Xia, F., Zhou, Y.: Current status and perspective of hydrogen energy and fuel cell technologies in Germany. Mar Electr Electron Eng 35(2), 49–52 (2015)

Gronau, S., Hoelzen, J., Mueller, T., Hanke-Rauschenbach, R.: Hydrogen-powered aviation in Germany: a macroeconomic perspective and methodological approach of fuel supply chain integration into an economy-wide dataset. Intl. J. Hydrogen Energy 48(14), 5347–5376 (2023)

Ding, M.: Characteristics, motivation, international coordination of Japan’s hydrogen strategy. Contemp. Econ. Japan 4, 28–41 (2021). (in Chinese)

Lei, C., Li, T.: Key technologies and development status of hydrogen energy utilization under the background of carbon neutrality. Power Gener. Technol. 42(2), 207–217 (2021)

Wang, L., Cao, Y.: Utilization of hydrogen energy and its enlightenment to China’s development. Shanghai Energy Conserv. 5, 444–448 (2021)

Hartley, P.G., Au, V.: Towards a large-scale hydrogen industry for Australia. Engineering 6(12), 1346–1348 (2020)

Xiong, H., Fu, G.: Four typical models of global hydrogen energy industries development and their references for China. Environ. Protect. 49(1), 52–55 (2021)

Gao, X., An, R.: Research on the coordinated development capacity of China’s hydrogen energy industry chain. J. Clean. Prod. 377(134177), 0959–6526 (2022)

Fan, L., Tu, Z., Chan, S.H.: Recent development of hydrogen and fuel cell technologies: a review. Energy Rep. 7, 421–8446 (2021)

Acknowledgment

This work is supported by a research and development project (Research on the Frontiers of Energy Power (Hydrogen Energy) Science and Technology and Development Trends JS83-22-002) of the China Electric Power Research Institute. The authors would like to thank the editors and reviewers for their constructive comments and suggestions to improve the quality of the paper.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2024 The Author(s)

About this paper

Cite this paper

Han, X., Yan, Hg., Kang, Jd., Li, Y. (2024). Strategic Analysis of Hydrogen Energy Policies and Technology Layout in Major Countries. In: Sun, H., Pei, W., Dong, Y., Yu, H., You, S. (eds) Proceedings of the 10th Hydrogen Technology Convention, Volume 1. WHTC 2023. Springer Proceedings in Physics, vol 393. Springer, Singapore. https://doi.org/10.1007/978-981-99-8631-6_43

Download citation

DOI: https://doi.org/10.1007/978-981-99-8631-6_43

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-8630-9

Online ISBN: 978-981-99-8631-6

eBook Packages: Physics and AstronomyPhysics and Astronomy (R0)