Abstract

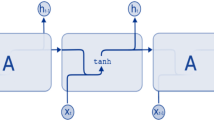

Stock price forecasting is a prominent topic in quantitative finance, as accurate prediction is essential due to the complexity of the market. This research work employs variational mode decomposition (VMD) to decompose stock data into several variational modes, further used to train a long short-term memory (LSTM) network with attention mechanism. The primary goal of this research is to enhance the accuracy of stock price prediction by exploring the effectiveness of VMD and attention mechanism techniques. From the experiment analysis, the efficacy of VMD is quantified as mean absolute error (MAE) score-163.91 and root mean square error (RMSE) score-192.39 from the results of LSTM with VMD. The efficacy of the attention mechanism is quantified as MAE score-94.16 and RMSE score-117.12 of from the results of VMD + LSTM + attention. The experimental results indicate that the application of VMD and attention mechanism to an LSTM model leads to improved predictions.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Investopedia article. https://www.investopedia.com/terms/c/chartist.asp, as this article explain about how he used charts for prediction

Balaji AJ, Ram DH, Nair BB (2018) Applicability of deep learning models for stock price forecasting an empirical study on BANKEX data. Proc Comput Sci

Selvin S, Vinayakumar R, Gopalakrishnan EA, Menon VK, Soman KP (2017) Stock price prediction using LSTM, RNN and CNN-sliding window model. In: International conference of advances in computing, communication and informatics ICACCI

Sujadevi VG, Mohan N, Sachin Kumar S, Akshay S, Soman KP (2019) A hybrid method for fundamental heart sound segmentation using group-sparsity denoising and variational mode decomposition. In: Biomedical engineering letters. Springer

Ramakrishnan R, Vadakedath A, Krishna UV, Premjith B, Soman KP (2022) Analysis of text-semantics via efficient word embedding using variational mode decomposition. In: 35th Pacific Asia conference on language, information and computation

Talati D, Patel M, Patel B (2022) Stock market prediction using LSTM technique. IJRASET J 10(VI). ISSN: 2321-9653

Wei D (2019) Prediction of stock price based on LSTM neural network. In: International conference of artificial intelligence and advanced manufacturing (AIAM). https://doi.org/10.1109/AIAM48774.2019.00113

Liu X, Shi Q, Liu Z, Yuan J (2021) Using LSTM neural network based on improved PSO and attention mechanism for predicting the effluent COD in a wastewater treatment plant. IEEE Access. National Center for Biotechnology Information. http://www.ncbi.nlm.nih.govhttps://doi.org/10.1109/ACCESS.2021.3123225

Lahmiri S (2016) A Variational mode decomposition approach for analysis and forecasting of economic and financial time series. Int J Expert Intell Syst 219:0957–4174. https://doi.org/10.1016/j.eswa.2016.02.025

Dragomiretskiy K, Zosso D (2014) Variational mode decomposition. IEEE Trans Signal Process 62(3)

Yang H, Liu S, Zhang H (2017) Adaptive estimation of VMD modes number based on cross correlation coefficient. J Vibroeng 19(2)

Lahmiri S (2015) Long memory in international financial markets trends and short movements during 2008 financial crisis based on variational mode decomposition and detrended fluctuation analysis. J Phys A Stat Mech Appl

Lokesh S, Mitta S, Sethia S, Kalli SR, Sudhir M (2018) Risk analysis and prediction of the stock market using machine learning and NLP. Int J Appl Eng Res 13(22):16036–16041. ISSN 0973-4562

Lahmiri S (2016) Intraday stock price forecasting based on variational mode decomposition. J Comput Sci 2016:23–77

Lahmiri S, Boukadoum M (2014) Biomedical image denoising using variational mode decomposition of economic and financial time series. In: 2014 IEEE biomedical circuits and systems conference (BioCAS) proceedings. https://doi.org/10.1109/BioCAS.2014.6981732

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Arul Goutham, R., Premjith, B., Nimal Madhu, M., Gopalakrishnan, E.A. (2023). Forecasting Intraday Stock Price Using Attention Mechanism and Variational Mode Decomposition. In: Ranganathan, G., Papakostas, G.A., Rocha, Á. (eds) Inventive Communication and Computational Technologies. ICICCT 2023. Lecture Notes in Networks and Systems, vol 757. Springer, Singapore. https://doi.org/10.1007/978-981-99-5166-6_36

Download citation

DOI: https://doi.org/10.1007/978-981-99-5166-6_36

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-5165-9

Online ISBN: 978-981-99-5166-6

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)