Abstract

The poor in India are worst affected due to COVID-19 pandemic. The nationwide lockdown though an effective safety measure, has made their condition more pathetic. As per, World Bank 2020 estimates, there are around 50.7 million people in India living in extreme poverty with income of $1.90 per day. The Government of India has announced several remedial measures to tackle economic as well humanitarian crisis but its effective implementation is a major challenge due to enormity of the problem and the large number of affected people. Moreover, the measures announced are based on top-down approach and not on detailed assessment of impact on different sections of the population. The different segments of the poor have suffered from the impact of the pandemic and subsequent lockdown, in different proportions. They have suffered from severe financial losses. In this chapter, we have made detailed assessment of impact of the pandemic on individuals, different sectors of economy and on Micro, Small and Medium Enterprises (MSMEs). The measures announced by the Prime Minister are discussed along with their implications for the poor and MSMEs. At the lowest end of the spectrum, are the migrant labors who are worst affected. They are required to travel for their homes due to loss of livelihoods and require immediate relief. At the other end, are the skilled labors working in organized or unorganized sectors, who have not lost their jobs but are facing reduction in wages. In order to make the systematic assessment of the requirements, we have grouped the people in three categories namely high impact, medium impact and low impact and have assessed the requirements for each category. So also, it is deliberated as to what extent, the government measures address their requirements. The gaps are identified and detailed suggestions are made. Major structural changes such as extensive use of information and communication technology, development of on-line platforms for education, strengthening of rural infrastructure, development of health infrastructure, creation of employment opportunities in rural as well as in urban areas and provision of credit and capital have been suggested. Furthermore, suggestions have been made to improve credit flow to MSMEs and for launching temporary social security system for the poor.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

10.1 Introduction

The world is witnessing an unprecedented pandemic—COVID-19, triggered by the Corona virus which has brought about situations that mankind was not prepared for. Amongst a range of responses that the world is searching for, one significant area that demands a reasonably fast solution is the way livelihoods and economic activities may be restored in order to bring them back to at least their pre-Covid situation. However, this aspiration seems unrealistic in the background of the magnitude of damage done to economic activities and the uncertainty about addressing the same effectively in the near future. With the requirements of social distancing, the absence of a tested vaccine and no knowledge on how long this virus will prevail, any decision on economic activities will be tempered with the requirements of keeping COVID at bay. There is no denying that this event has completely changed the dynamics of the economic environment—whether it is of the country or a business entity or an individual. It is therefore imperative that they will all have to adjust to and accept the tectonic change brought about in the economic environment as the ‘new-normal’.

While this is true for all business entities, it will have the maximum impact on low-income population. Given the vulnerability and already unbanked/less banked position of these low-income consumers they would find it difficult to cope with this health pandemic during the period of infection and will also take a long time to recover from the damage created.

If, we draw an analogy, with the responses of health professional to reduce the impact on the economic condition of people, we will have three sets of people: (1) Low Impact (just got connected with high-impact people)—keep them in quarantine for 14 days—equivalence would be—giving some money and they will be able to recover, (2) Medium Impact—Got infected but have high immunity and will recover—protecting them from competition for some time, give them time and money-they will be able to recover, and (3) High impact—infected and need ventilation—need special package to come out of this situation.

Likewise the pandemic has impacted the different people in different proportions and even amongst the poor, migrant labors are worst affected whereas those with permanent jobs and houses are not affected to that extent. Therefore, we have classified people in three categories namely high impact, medium impact and low impact on the basis of impact of the pandemic. The pandemic and the subsequent lock down have caused considerable financial losses to the people. The financial loss is caused due to reduction in wages, temporary or permanent loss of livelihood.

There are around 50.7 million people in India living in extreme poverty with income of $1.90 per day (World Bank 2020). It is necessary to classify the poor due to enormity and precipitousness of the problem. There is an urgent need to ensure that relief and rehabilitation measures are implemented effectively and that the poor require help on time. Therefore, it is necessary to decide the priorities and prepare strategy and plan of action. Moreover, the measures announced by the government in response to sudden crisis are based on top down approach without detailed assessment of impact on different sections of people. Therefore, it is possible that there are gaps in the requirements and the measures announced. This chapter identifies such gaps and suggests measures to address these. The measures suggested mainly pertain to financial services sector.

During this, process we will need support of multiple stakeholders like, banks, cooperatives, Mico Finance Institutionsetc. in terms of responding to the new needs of society. In addition, getting data about the victims of economic pandemic is also going to be a daunting task as majority of them are part of unorganized sector in India. So, we need to reduce the information asymmetry and make sure that we do not fall victim to adverse selection.

This chapter is organized as follows. The Sect. 10.2, deals with impact of the pandemic on the poor and the sector wise impact on economy as well as on Micro Small and Medium Enterprises (MSMEs). In Sect. 10.3, measures taken by the Government of India to alleviate the problems, are discussed. The next section deals with implications of the measures by the government on the poor and MSMEs. The Sect. 10.5 deals with classification of the poor and MSMEs on the basis of impact and identifies category wise requirements, government measures and shortcomings. The category wise suggestions for bridging the gap are also given. The next section discusses suggestions by the experts. The Sect. 10.7 deals with the proposals to cope up with the new normal which is followed by concluding section.

10.2 Impact of COVID 19

The Pandemic has impacted labor, both in the organized and the unorganized sector. It has also affected the Micro Small and Medium Enterprises sector and start-ups severely.

-

a.

Impact on individuals at the lower end of the spectrum.

The laborers working under Mahatma Gandhi National Rural Employment Guuarantee Agencyare worst affected as they have lost their jobs on account of the lock down. Most of the labor associated with construction companies, factories, supply chains and automotive sector, have lost their temporary jobs.

In addition, small business men such as florists, tailors, washer men, fishermen, folk artistes, salon owners and artisans, and those in seasonal employment are facing deprived of their livelihoods.

As per NITI Aayog Annual Report 2018, 85% of the total workforce in India is in the unorganized sector. The Government of India (2018), reveals that 71% of the regular employees in the informal sector do not have a written job contract. In view of the lock down and job losses, migrant workers are leaving metro cities in large scale, for their native homes.

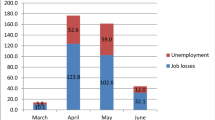

Thus, the pandemic has caused long-term livelihood shocks and occupational displacement requiring the poor to socially readjust. In this scenario, it is being predicted that India would go into recession, which would further affect the unorganized sector and semi-skilled jobholders. As being reported by Centre for Monitoring of Indian Economy (CMIE), unemployment in the organized sector has increased to 27% (Nanda 2020). It is reported that the lower-rung of the society faces the battle of hunger and poverty—battling an economic pandemic in addition to the health pandemic.

In addition to financial distress, a globally observed development is that social distancing norms, movement restrictions and isolation from community have led to substantial increase in anxiety and depression, drug addiction and violence against women and children (WHO 2020). In India too, the number of domestic violence complaints registered in police stations are reported to have surged during the COVID lockdown (Ratnam 2020).

-

b.

Sector wise impact on economy

The impact of the pandemic on different sectors of the economy in terms of Gross Value Added (GVA) is given in Table 10.1.

It is observed from Table 10.1 that all impacted sectors are labor intensive and a majority of them are in the unorganized sectors. Furthermore, the financial sector is worst hit and will be wary of lending—leading to further financial distress. In India, rural areas are relatively less affected by COVID 19 and consequently, the agriculture sector has not been severely affected. This offers opportunities for employment and further investment.

-

c.

Sector wise impact on MSMEs

It is observed that in India, urban areas have been majorly hit by the pandemic and rural areas have been relatively less impacted (BloombergQuint, July 5, 2020). The Table 10.2 gives details of the number of registered MSMEs and the corresponding employment generated in rural and urban areas. (Updated record of unregistered Micro enterprises is not available).

As per Table 10.2, in the absence of information regarding the MSMEs that were impacted by COVID-19 and given that the urban areas were more affected than rural areas, it may be inferred that all the 3.09 crores enterprises situated in urban India were badly affected displacing 6.12 crores labourers from their livelihood.

The social category-wise and gender-wise impact can be assessed from Fig. 10.1 which gives this distribution of MSMEs as on 2019. It is observed that the percentage of Scheduled Castes/Scheduled Tribes category owners of MSMEs is 16.5, 7.15 and 1.09 respectively. Thus, given their social vulnerability, large number owners of micro enterprises in this category are likely to be affected. Similar is the situation in Other Backward Class category with 49.83% owners of micro enterprises.

Figure 10.1 further reveals that women own 20.44% of Micro enterprises—the highest proportion as compared to women owners of small and medium enterprises. Micro enterprises owned by women are likely to be very highly impacted by the COVID-19 situations. While identifying the affected people and executing the relief and rehabilitation measures, it is necessary to give extra attention to this vulnerable population.

10.3 Measures Taken by Government of India to Alleviate the Problems

The policy response of the government of India had been summarized by the Prime Minister of India, in his address to the nation. He has affirmed that post-COVID India will be strikingly different and that there will be five distinguishing pillars of the new-normal.

The Prime Minister elaborated on each of the five supporting structures namely (1) Economy (2) Infrastructure (3) System (4) Demography and (5) Demand, that will define the new normal (India Today, May 12, 2020).

-

A.

Economy: There is going to be a quantum jump in the economy. Two sectors in India have potential for growth and generation of employment. The first being the manufacturing sector, has high potential to grow as India has third largest pool of scientists and engineers in the World. Some of the small units manufacturing hosiery products were agile to re-position themselves and responded to the new requirements by manufacturing masks, hand gloves etc. Similarly, in the health-care sector manufacturing organizations have responded very efficiently to the call of the hour by expanding the production capacity for generic medicines and ‘private protective equipment’. In the health care sector, in addition to the manufacturing units, there is wide scope for creation of employment and these opportunities must be seized immediately.

There is very high scope for its expansion because of the availability of expert doctors and health care professionals in India. Thus Indian entrepreneurs supported by favorable policies of government, financing institutions can take a great leap forward.

-

B.

Infrastructure—An infrastructure that can be the new image of India;

India will have world class infrastructure through public private partnership. Therefore, construction of roads, waterways, dams and power generation will be taken up in a big way. This will create new jobs in short run. These activities will require skilled and unskilled labor in large numbers. These jobs can be given on priority basis, to the persons who had lost their livelihood.

Development of industries, business centers and markets should be undertaken across the transport routes.

-

C.

System: As per the Prime Minister’s announcement India will create a system that can fulfill the dreams of the twenty-first century.

The government of India has already started taking steps in this direction. As per, the World Bank Ease of Doing Business Report, 2020; India was placed at 63rd position (2019) making an improvement of 14 places from its 77th position (2018). India’s ranking improved basically on four parameters:

-

i.

Starting a Business—The starting of business is made easier in India by fully integrating multiple application forms into a general incorporation form,

-

ii.

Dealing with Construction Permits—This cost of obtaining permits has been reduced significantly. For constructing a warehouse, this cost was reduced to 4% of a warehouse cost from 5.7% in the previous year,

-

iii.

Trading across Borders—A single electronic platform has been developed for submission of documents, port infrastructure has improved and import and export process have been made easier.

-

iv.

Resolving Insolvency—The processes for resolution of insolvency have been made easier. As a consequence, recovery rate of resolving insolvency has improved significantly to 71.65 from 26.5%. Moreover, the time taken for resolving insolvency has also come down significantly to 1.6 years from 4.3 years.

-

i.

-

D.

Demography—India’s demography is vibrant.

India is the youngest nation in the world with, 62.5% of its population in the working age group of 15–59 years. This proportion is increasing and will be at the peak of 65% in around 2036. This indicates that India has the potential to leverage its demographic dividend for about 15 years and grow economically stronger during this period.

-

E.

Demand—the demand and supply chain need to be utilized and strengthened.

Recovery of Indian economy post COVID will be propelled by huge domestic demand but demand and supply chains need to be strengthened.

The Prime Minister had announced Rs. 20 lakh crore financial package which will touch upon four Ls namely (i) Land, (ii) Labor, (iii) Liquidity and (iv) Law—and added that local manufacturers like MSMEs and cottage industries will be benefited from same (India Today, May 12, 2020).

10.4 Implications of the Package for the Poor People and Micro Small and Medium Enterprises

In order to alleviate the sufferings in the short term, the following measures have been announced:

-

i.

Food distribution: About two-thirds of the population will be covered under the Pradhan Mantri Garib Kalyan Anna Yojana (Food scheme). Everyone under this scheme will get 5 kg of wheat and rice for free in addition to the current 5 kg allocation for the next 3 months. In addition, 1 kg of preferred pulse (based on regional preference) will be given free of cost to each household under this Food scheme for the next three months. This distribution will be done through Public Distribution Scheme (PDS) and can be availed in two installments (Times of India, June 30, 2020).

-

ii.

Direct benefit transfer: Farmers currently receive INR 6000/- every year through the PM-KISAN scheme (minimum income support scheme) in three equal installments. The government will now be giving the first installment upfront for fiscal year starting April 2020. About 86.9 million farmers are expected to benefit from this immediately.

-

iii.

Mahatma Gandhi National Rural Employment Guarantee Act: (MNREGA) The government of India has started rural employment scheme in 2006. The wage for MNREGA workers has now been increased from INR 182/- to INR 202/- per day. Such increase will benefit 50 million families. The wage increase will amount into an additional income of INR 2000/- per worker. Funds allocation to MGNREGA has been increased by Rs. 40,000 crores.

-

iv.

Economic stimulus measures for MSMEs: The major economic stimulus to MSMEs is Rs. three lakh crores lending facility offered through banks. These loans will be fully guaranteed by the Government of India. There are around 63.4 million such enterprises in India and there are credit delivery challenges which need to be overcome.

-

a.

Small enterprises are expecting a cash handout for payment of employee wages and tax waivers in addition. The government, on the other hand, is encouraging them reboot by borrowing more, albeit on easier terms.

-

b.

With increase in eligibility criteria for medium and small enterprises, micro enterprises with investment of Rs. 25 lac and below will be sidelined and larger firms will be eligible.

-

c.

EPF contribution: Employee Provident Fund (EPF) support for business and workers has been extended for 3 months providing liquidity support of Rs. 2500 crores. In addition, statutory provident fund contribution for those who were covered earlier has been reduced to 10 from 12% (Dhawan, May 13, 2020).

-

a.

10.4.1 Suggestions for Easing Out the Credit Delivery Challenges

All micro enterprises should be made eligible for additional 20% working capital. Out of this additional disbursement meant for disbursement to the wages etc. should be made in ‘near-cash’ form using digital infrastructure bank correspondents and payment banks that provide the last mile connectivity.

-

v.

Insolvency and Bankruptcy Code (IBC): Threshold of default under section 4 of the IBC has been increased from Rs 1 lakh to Rs 1crore with the intention to prevent triggering of insolvency proceedings against MSMEs. If the current situation continues beyond 30 April 2020, sections 7, 9 and 10 of IBC will be suspended for 6 months in an effort to stop companies at large, from being forced into insolvency proceedings.

-

vi.

Regulatory measures: All lending institutions are being permitted to allow a moratorium of six months on repayment of installments for term loans outstanding as on March 1, 2020. Lending institutions permitted to allow deferment of 3 months on payment of interest with respect to all such working capital facilities outstanding as of March 1, 2020.

10.5 Category Wise Requirements, Measures Taken by the Government and Identification of Gaps

The classification of the people in high, medium and low impact categories is done on the basis of financial impact of the pandemic. The pandemic has adversely impacted income of households and the firms and has increased health related expenditure. This has resulted in reduction in consumption of goods and services available in the market. The financial uncertainties have increased the stress within the households. In addition, the lock down has eliminated the possibilities of spending time with the friends or in social gatherings. Such occasions were the easily available to households and individuals in pre-pandemic time, as stress busters. Thus the pandemic has impacted consumption of market as well as non-market utilities (World Health Organization 2009).

The impact is different on the different types of people depending upon their status of employment such as permanent, temporary or causal and also the place of employment viz. migrant or local.

For those who are in acute poverty such as migrant labors, the pandemic has caused severe financial as well as social distress. In some cases, human capabilities are impaired or there is a loss of life. So also, financial distress has resulted into sale of financial as well as physical assets (World Health Organization 2009).

While deciding on the impact categories; we have considered only the current impact of pandemic on household and firms and not the long term effect on their lives. Furthermore, while judging the impact, post-pandemic condition of the poor, is compared with the corresponding pre-pandemic the situation. As such, the assessment is judgmental and not based on survey, estimates or calculations.

The categorization will help prioritizing the resource allocation. In this section we have identified category-wise requirements for revival along with the corresponding measures announced by the government. Furthermore, shortcomings of the measures have been identified and suggestions have been given to fill up the gap. The details are given in Table 10.3. This classification and analysis is done only for marginalized sections of society.

10.5.1 High Impact Category

This category comprises jobless and homeless people mainly comprising street vendors and migrant works with many of them having left their place of work for their homes. These are unskilled or semi-skilled laborers. It will be necessary to identify their immediate requirements such as food shelter etc. Thereafter, affected people should be connected to Government agencies or Non-Government Organizations (NGOs) for ensuring that the schemes announced by the government are effectively implemented and reach these people for whom these measures were intended. This can be done with the help of Panchayats, local leaders.

As they have lost their livelihood, the immediate requirement is providing them with livelihood opportunities. Some of them will require long term loans for starting/re-starting small businesses. These should be provided at highly subsidized rates with flexible repayment schedules adjusted to their cash flows.

Table 10.3 draws attention to the fact that the measures announced by the government do not fulfill the requirements to put the economic pandemic on the track of recovery. The jobs under MNREGA scheme are provided for only 100 days in a year and these are temporary in nature. By and large, these will be available only after the monsoon season i.e. in October 2020. It is necessary to create employment opportunities for them. This issue can be addressed by skilling, re-skilling and up-skilling the migrant laborers and by creating a technology platform for employment exchange connecting the job-seekers with the employers. Long term collateral free loans at highly subsidized rates should be made available to them.

10.5.2 Medium Impact Category

This group comprises owners and employees of MSMEs, self-employed skilled workers, (electricians, plumbers, gardeners, painters, tailors, domestic help etc.) and such others who are likely to get back their jobs after the pandemic. These people require medium term financial support with moratorium on repayments. A portion of their receivables will remain unpaid during the period of lockdown and for some time thereafter out of which some receivables may turn bad. Such ‘bad’ receivables may be required to be written off. The measures announced by the government only provide support for working capital requirements. They require infusion of medium term funds in addition to more working capital, to tide over the losses incurred during lockdown period.

Banks should provide medium term loan towards infusion of funds. The working capital requirement could be addressed by providing Factoring services on priority basis with a counter guarantee by the government in deserving cases. In addition, they should be provided with interest waiver and partial waiver of the principal.

10.5.3 Low Impact Category

This group comprises skilled labor working in organized and some unorganized MSMEs. The people, who have not lost jobs, but facing a wage cut, are included in this category. They require short term loans to tide over immediate financial crunch. Their requirements can be for consumption purposes, for children’s education expenses, for repayment of EMIs etc. These are necessary to ensure that they are not pushed out of the formal banking to money-lenders.

As against these requirements, the government has provided only for deferment of repayment installments and no financial assistance is made available. They should be provided with collateral freeshort-term loans at concessional rates.

10.6 Suggestions by the Experts Not Yet Implemented by the Government of India

The government of India has taken several steps to alleviate the impact of the economic pandemic. However, experts(mentioned below) have suggested certain measures which are yet to be taken. Some of these are:

-

i.

Helping affected people and small firms with waiver or reimbursement of loan installments.

-

ii.

Cushion the effect of lockdown due to staying home. As reaching out to the people is difficult, the state governments and local governments should be given the liberty to use resources at optimum level.

-

iii.

Creation of health infrastructure in India (Singh, June 1, 2020).

-

iv.

Creation of Special Purpose Vehicle (SPV) for limiting Government exposure while providing adequate liquidity to industry. Thereafter the Reserve Bank of India can buy government bonds in the market through SPV and inject liquidity in the market (Subbrao, May 11, 2020).

The experts have expressed different opinions on the impact of pandemic on the economy. Some have expressed optimism indicating that economy will revive fast after the pandemic subsides. This is because, the pandemic not being a a natural disaster, our infrastructure, transport system factories and talent are intact and can be deployed once the pandemic subsides(Subbarao, May 11, 2020) On the other hand, others have expressed that demand and supply both will be affected and recovery will take a long time (Panagariya, April 26, 2020).

10.7 Coping with a New Normal

It is widely discussed that life of human beings will not be the same any more. Social distancing and physical distancing will become a way of life. Further, health and hygiene will assume more importance where wearing masks and frequent use of sanitizers will no longer be seen as applicable to specific situations or to an elite class but will become a necessity across all strata of society. However, the new normal will not be restricted to these Covid-induced practices. It is expected that society will witness a change in the way people prioritize their requirements. There could a tectonic shift in the way education is imparted, businesses are run, communities function and families live. Education may not continue to be only for the privileged, businesses will have to innovate and behave more responsibly, communities will be required to be more inclusive and at the smallest level, families will value health and happiness more than material possessions. This ‘new normal’ will also throw up new requirements that the government and its people must together address. These requirements may demand structural changes and/or change in the approaches in dealing with issues. Some of these situations and requirements are discussed below.

We have suggested structural changes and requirements namely, use of technology, development of rural infrastructure, creation of employment opportunities and provision of capital and credit to MSMEs.

In India, remote rural areas lack adequate infrastructure such as roads, transport, communications etc. therefore development of rural infrastructure will improve connectivity and accessibility to these areas which will provide a vigorous push to economic development (Samanta 2015). In addition, development of information and communication technology network will build faster communication network facilitating industrial growth and development of economy (Sein and Harindranath 2004). This will create increased employment opportunities for youth in India.

In view of large scale unemployment, there is a need to create employment opportunities in rural as well as urban areas. India has largest the largest proportion of young population amongst the nations in the world, but it is not possible to take advantage demographic dividend due to high level of unemployment. Therefore creation of employment opportunities will boost up economic growth (Sinha 2013).The promotion of MSMEs can create employment opportunities on a large scale. However growth of this sector is hindered by inadequate supply of capital and credit (Thampy 2010).

-

a.

Structural changes required

The measures taken by the government and action suggested in support of the disadvantaged will not be effective unless some structural changes are undertaken and effected.

We suggest the following structural changes in the context of social distancing and post-Covid requirements:

-

i.

Use of technology

It is expected that the after-Covid environment will encourage business organizations and educational institutions to leverage technology significantly, such that it will impact the personal and professional lives of people. This will require enhancement of IT infrastructure both at the end of manufacturers/service providers and at the end of employees and customers/clients. Further, extensive use of IT by educational institutions, business organizations and banks will require a robust cyber security system that will instill confidence in the users. This comprehensive IT infrastructure will then become a powerful mode to deliver services.

-

a.

Online education

Educational institutions starting from schools will have to adopt information technology to facilitate on line and blended learning. With the IT infrastructure in place, one could expect significant expansion in reach and access to education. While this could impact the level/extent/quality of engagement between teachers and students, it will permit students to learn at their pace and convenience. Further, it is also expected that competition in offering online education will lead to lowering of costs.

-

b.

Work from home

The new normal will witness massive expansion of Information Technology (IT) infrastructure even in remote areas of India to facilitate use of technology. Business and industries will adopt automation. Business organizations will now explore the possibilities of identifying the tasks that may be completed from home and permit employees to do so from their homes. Contrary to the belief that such tasks may all be knowledge based and IT enabled, even the manufacturing sector can explore such possibilities. For example, garment manufacturers could permit tailors to work from home by providing the necessary machines and material that needs to be stitched together. Similarly, assembly of parts, packaging etc. can also be permitted to be completed from home subject to adherence of strict quality norms. This provision of ‘work from home’ will bring about benefits like reduction of overheads and also help in maintaining social distancing norms at a given period without reduction of workforce or requirement of more space. Further, this will also create employment opportunities for the women who were constrained to remain at home for various reasons.

-

c.

Creation of a technology platform to connect employers, banks and job-seekers

In India, there are perennial complaints by industry and business houses about the lack of employability of graduates from the colleges and universities. On the other hand, there are an equal number of unemployed, qualified youth in search of good opportunities. There is an information asymmetry between employment opportunities and labour—skilled, semi-skilled and unskilled. In order to address this asymmetry, there is a need to create a technology platform to help the employers connect with the job-seekers. This platform would allow registered employers to announce opportunities/roles with specific qualification, skill-set requirements, experience, location, vacancies, salary etc. Similarly, job-seekers could register giving details of qualifications, skill-sets acquired, age, experience, location preference etc.

This will help industries, business houses and MSMEs for selecting persons with right type of skills. Technology intervention can facilitate merit based selection, promote healthy competition and reduce malpractices in the job market. It can also help job seekers in developing the right type of skill sets required by the industry and business.

The same platform may also be used by skilled technicians seeking to be self-employed or by entrepreneurs seeking to set up small businesses to apply for loans. The system should have in-built prioritization and preference for:

-

Entrepreneurs who propose set up business in the rural sector or agri-based business

-

Skilled technicians seeking to settle down in rural areas

-

Job-seekers seeking employment in rural areas.

-

-

d.

Training—re-skilling and up-skilling:

With the reverse migration of labour heading back to their home-towns and looking for employment opportunities in the vicinity, it is likely that some of the skilled labour may not find suitable jobs and are likely to take up other jobs that they are not trained in. This will lead to de-skilling (lack of use of skills leading to loss of skills) and may require re-skilling, upskilling or development of new skills. This can be done on online platforms using technology.

-

e.

Reduction of overheads and facilitating supply of credit for MSMEs:

The major challenges faced by MSMEs in India are credit constraints and cost inefficiency. The credit requirements of this sector are not fulfilled in spite of the policy of directed lending adopted by the banks in India (Banerjee and Duflo 2014). This is mainly because banks face serious challenges in respect of financial information (Thampy 2010). Challenges related to cost and improving efficiency can be overcome through use of information technology (Todd and Javalgi 2007). MSMEs will make use of IT enabled services for functions such as Finance (preparation of financial statements etc.), HR, training, and marketing. This will reduce overheads for MSMEs. The use of cloud computing will help MSMEs in several aspects in addition to reduction in overheads, such as easy deployment process, easier access to latest information and communication technologies, automatic updates and upgrades, scalability, flexibility, and improved disaster recovery and back-up capabilities (Kumar et al. 2017).

-

f.

Reduction of human interaction wherever possible

Social distancing norms will require minimization of physical meetings and contacts. There will be an attempt to identify those tasks that can be either completed on-line or be replaced by technology. For example, the role of receptionists may be replaced by information kiosks, checking in at airports may be automated, robots deployed to serve at restaurants etc.

-

ii.

Strengthening rural infrastructure

a. Provide good IT infrastructure to improve connectivity

At present there is inadequate IT infrastructure in rural India with related maintenance support services almost absent. Under the post-Covid environment, reverse migration, establishment of MSMEs and service providers in rural India will all increase the need for better IT infrastructure. Along with providing a more robust IT infrastructure, there will be a need to create awareness, provide training and handholding in the initial stages of development. Once the government provides the basic IT infrastructure, more private players will enter this market as they will find it lucrative.

-

b.

Provide robust infrastructure that will match urban amenities and enhance ease of living and doing business

-

Provision of stable electricity, water and better connectivity:

Uninterrupted power supply, adequate water and good connectivity (rail, road and air) are basic requirements not just for business organizations but also for families to be attracted to live in rural India. These have been the major constraints in the development of industries and business centers in rural India, which if addressed, will attract more business organizations and in turn, create employment opportunities.

-

Establishment of good educational institutions and reliable medical facilities

The former President of India Dr. APJ Abdul Kalam, has mentioned that lack of basic amenities such as good educational institutions and medical facilities are the major hindrances for development of rural India. If these are made available in rural areas, more people would prefer to settle there to take advantage of other benefits such as reduced commutation, cheaper accommodation, a life closer to nature with more tranquility and peace.

-

To provide platforms either technological or physical to encourage marketing of locally made products

-

Marketing in rural areas is a major issue due to lack of connectivity, warehouses and links to markets. This in turn, leads to spoilage of produce and reduced bargaining power resulting in reduced prices. This can be overcome by improving infrastructure of roads, development of storage facilities along with development of technology platforms for establishing links between sellers in rural areas and the buyers.

-

Care should be taken to restrict the number of business organizations that will be permitted to operate in any given village based on the size of the village and its natural resources so that the native characteristics of the village are not adversely impacted.

-

iii.

Creation of employment opportunities in urban and rural India

-

a.

Provide attractive subsidies for setting up of manufacturing and Agri-based MSMEs in rural areas

According to newspaper reports around 120 million migrant workers are leaving for their homes from metro and urban centers. The government has assured them jobs under MGNERGA. But these are temporary jobs and this should only be a stop gap arrangement. This is an opportunity for the country to encourage reverse migration. The governments and private sector should join hands for setting up industries and business enterprises in the rural areas of the different states. The rural areas will be able to provide land and labor at rates much cheaper than the urban areas supportive government policies including improvement in supply chain infrastructure will complete the eco-system. This will reduce burden on metro and urban centers which have become unmanageable.

-

b.

Provide attractive subsidies and tax concessions for starting or reviving service sectors like travel and tourism, health, education, IT etc.

IT, Education, Health, Travel and Tourism sectors are expected to grow and flourish. India has pool of IT engineers and talented doctors; in addition, medical services in India are among the cheapest in the world. This is expected to attract massive investment in health care sector in India, so that foreign nationals are attracted due cost advantage and world class expertise. Medical tourism will also prosper. In addition to manufacturing, these sectors will create employment in the near future.

-

c.

Reverse migration—moving towards the rural and tier 3 cities. A large number of labourers are moving back to their home towns leading to reverse migration. This has resulted in loss of livelihoods and the need to creating employment opportunities for these laborers. The government must leverage this situation and take up and complete pending infrastructure projects relating to roads, bridges, dams etc. as they all have a potential for large-scale employment.

-

d.

Provide training for skilling, re-skilling and up-skilling to equip unskilled labour (that cannot be imparted on a technology platform) to avail of new opportunities. This will be essential to manage the increased competition in the informal sector because of a sudden surge of job losses in the organized sector.

-

e.

Issue of special identity cards for migrant workers under skilled, semi-skilled and unskilled categories and provide concessions on travel, health services, insurance, education etc.

-

f.

Leveraging government agenda to ‘make local and use local’

The emphasis will be on Indian or local manufacturing and consciously using local made goods. This will be a new form of nationalism in post COVID-19 era. This will boost ‘Make in India’ program creating jobs making use of domestic demand. In order to develop sustainable demand for domestic or local goods the local industries will be thriving for continuous improvement in quality, supported by continuous improvement in technology. Care should be taken to support these entrepreneurs with necessary training in other functional aspects such as marketing, quality control etc.

The revolution will be similar to the one that had happened in Japan after World War-II. In medium term, India will develop competitive global brands.

-

iv.

Provision of credit and capital

-

a.

Investment in agriculture

Investment in agriculture, both in public and private sectors have not increased significantly since the introduction of economic reforms in India in 1991. Our agriculture productivity is just about one third of agriculture productivity in USA or China. This is due to the low level of adoption of farming technology, use of low-yielding seed varieties, high proportion of dry land farming, lack of warehousing and cold storage facilities. Therefore, it is high time to invest extensively in research and development in agriculture, technology development, development of high yielding seed varieties, construction of warehousing and cold storage facilities and undertaking minor irrigation projects. This will attract agro-based industries to rural India which will in turn create job opportunities and will also provide a market for local produce.

-

b.

Special loans and subsidies for fresh start-ups that manufacture for local consumption

The government has appealed to the people of India to encourage local production by choosing local products over imported ones. This will be a successful model only if the local producers are able to manufacture a variety of quality products at affordable costs. To support the manufacturers in this endeavor, the government should provide an ecosystem that provides financial help in form of subsidies and concessional loans as well as seed capital till these achieve break even.

-

c.

Flow of credit to Self Help Groups (SHG), MSMEs, Farmer Producers Organizations (FPOs), small businesses

The government has taken measures to enhance the credit that can be made available to SHGs, MSMEs, FPOs and small businesses. However, in view of the large proportion of non-performing assets, banks are wary of extending credit to these borrowers who do not have collaterals or a credit history. There is a need to change the norms and procedures adopted by banks. The government should issue suitable directives to the banks to expedite the credit disbursement.

-

d.

Provision of initial financial support for skilled, self-employed technicians/entrepreneurs.

There is large scale migration of skilled and self-employed technicians (such as plumbers/carpenters etc.); some of them would like to start business/work at their home town or in its vicinity. Such migrants should be given financial assistance in form of soft loans at subsidized rates with flexible repayment programs. If required, they should also be given loans for consumption purposes till their small business activities reach a level of financial sustainability.

-

e.

Connecting Factoring with MSMEs on a technology platform—with a preferred status for high impact MSMEs

One of the major constraints faced by MSMEs is availability of adequate working capital. Most MSMEs in the manufacturing sector are suppliers to large scale industries and have an on-going relationship with them. However, due to the scale of operations, the MSMEs are at a disadvantage while negotiating the terms of credit with the large scale industries (the purchasers). This pushes them to increasingly depend on banks for their working capital requirements. It is here that Factors can play a significant role by financing of receivables. Currently, the proportion of receivables financed by factors for working capital is much lower than possible.

Accessibility of factoring services can be substantially enhanced by creating a technology platform under the supervision of the Reserve Bank of India. Through this, registered MSMEs can provide information about their purchasers, purchaser-wise average value of receivables and their ratings. Factors can approach MSMEs for providing services and charge according to ratings of buyers and sellers. This will reduce turn-around time, develop and strengthen associations between factors and MSMEs. In addition to the expanding of market for factoring services in India, this will reduce the burden on banks and also improve the working capital availability for MSMEs.

-

v.

Other suggestions

-

a.

Measures to ensure mental health, happiness and well-being:

-

Online Counseling centers: People in the high impact group, especially migrant laborers are under severe mental stress as they have lost the job and shelter. They need immediate psychological support. The government and Non-Government Organizations should setup online counseling centers for these people.

-

Newer ways to measure success—not based only on GDP. At present, the success of a country, state or an individual is measured by income and wealth. Of late, there has been a trend to also consider the Human Development Index and the Happiness quotient of countries. COVID 19 could be expected to trigger the pursuit of measurement metrics and tools that are more holistic and not just focused on economic prosperity. The post COVID era will require Gross Happiness Index as a measure of success rather than Gross Domestic Product. At the individual level, the lockdown and the uncertainties that come with it along with the opportunity of staying with the family have compelled many people in India to appreciate the old values of family bonding and re-visit their goals in life. It is likely that they value ‘pursuit of happiness’ as a measure of success rather than ‘pursuit of money and wealth’.

-

Temporary Social security system: In view of the large number of affected people and large-scale displacement, it is possible that in spite of implementation of all the measures, some people will remain unemployed and there might be some households left out, in which there is no person with a livelihood. It is necessary to set up temporary social security system for those such households while simultaneously providing training to equip at least one member with livelihood skills/opportunities.

-

-

b.

Measures for effective implementation of government policies and programs

-

India post: India post has the reach to provide the last mile connectivity in India. They can act as Business Correspondents (BC) for banks and other financial institutions including Factors. They can help as facilitators for adoption of technology in rural India by providing training and handholding. Similarly, farmer producer organizations (FPO) may also play the role of BCs as they have a strong network and reputation among the farmers.

-

Forming association of multiple stakeholders—In order to implement policies and programs for relief, effectively, it is suggested that an association of multiple stakeholders such as government agencies, non-government organizations, panchayat members and local leaders be formed. This association may agree on a common agenda where each member will undertake to implement one portion of the collective responsibility. This will facilitate coordination and immediate feedback on the efficacy of the policies and programs. This dynamic feedback loop will help the government and society in minimizing the damage and overcome the challenges arising from of this situation.

10.8 Conclusion

Covid 19 as a pandemic has impacted almost all countries of the world and while this crisis is being addressed, there seems some hope at the end of the tunnel since many countries are striving to invent a vaccine to cure this disease. However, this disease has also created an economic pandemic that has severely impacted the livelihoods of a large number of people, more so in developing countries like India. The unfortunate truth is that there is no single solution for this pandemic and recovery of economies will require a multitude of parallel interventions.

The Government of India has announced various measures to provide short-term and medium-term relief but given the nature of damage done, these measures are not sufficient. We have classified the affected people as low-impact, medium impact and high-impact categories and have suggested measures to appropriately address the requirements of each category either by matching the announced measures to the requirements or by identifying gaps and by suggesting new measures.

Among the measures suggested are (1) use of technology (2) strengthening rural infrastructure, (3) creation of employment opportunities in urban and rural India (4) providing credit and capital and lastly, a few other suggestions and (5) measures to ensure positive mental health, happiness and well-being of those impacted (6) measures to ensure effective implementation of policies and programs.

Finally, the authors observe that the success of any program or policy depends to a great extent on the quality of the decision making process. In this context, given the gravity, magnitude and impact of this economic pandemic, it is imperative that all organizational processes are agile in their responses and all leaders, quick and empathetic in the decision making to ensure that the benefits of the measures taken reach the intended beneficiaries in time.

Considering the magnitude of relief and rehabilitation measures, it is necessary that the Governments, NGOs and the Corporate across the World, join hands in partnership, based on understanding and respect for each others’ strengths. It appears that pandemic is likely to last for a year or even more. Therefore, this an opportunity to develop these partnerships on long term basis which will be beneficial for the people. On financial front also there is a need to make measured responses by taking a long term view and release the funds in stages as the situation is dynamic and the requirements are likely to change for different sections of the people, during the course of incidence of impact of the pandemic.

References

Banerjee, A. V., & Duflo, E. (2014). Do firms want to borrow more? Testing credit constraints using a directed lending program. Review of Economic Studies, 81(2), 572–607.

BloombergQuint. (2020, July 5). Maruti Suzuki says witnessing better sales demand in rural than urban areas. Available at https://www.bloombergquint.com/business/maruti-suzuki-says-witnessing-better-sales-in-rural-than-urban-areas. Accessed 7 July 2020.

Dhawan, S. (2020, May 13). PF contribution rule changed! Contribute only 10% for next 3 months if earning above Rs 15,000. Available at https://www.financialexpress.com/money/pf-contribution-rule-changed-contribute-only-10-for-next-3-months-if-earning-above-rs-15000/1957960/#:~:text=Those%20earning%20a%20basic%20salary,cent%20from%2012%20per%20cent. Accessed 15 May 2020.

Government of India. (2018). Annual report periodic labor force survey, government of India, ministry of statistics and programme implementation. Available at http://www.mospi.gov.in/sites/default/files/publication_reports/Annual%20Report%2C%20PLFS%202017-18_31052019.pdf. Accessed 20 May 2020.

India Today. (2020, May 12). PM Modi shares 5 pillars that will make India self-reliant in Covid-19 times. Available at https://www.indiatoday.in/india/story/pm-modi-speech-5-pillars-atm-nirbhar-india-self-reliance-covid-19-lockdown-1677293-2020-05-12. Accessed 15 June 2020.

Kumar, D., Samalia, H. V., & Verma, P. (2017). Exploring suitability of cloud computing for small and medium-sized enterprises in India. Journal of Small Business and Enterprise Development, 24(4), 814–832.

Ministry of Micro, Small and Medium Enterprises. (2019). Annual report, 2018–19. Available at https://msme.gov.in/sites/default/files/Annualrprt.pdf. Accessed 25 May 2020.

Nanda, P. K. (2020, May 5). India’s unemployment rate climbs to 27.1%, 121.5mn out of work: CMIE, Livemint. Available at https://www.livemint.com/news/india/india-s-unemployment-rate-climbs-to-27-1-121-5mn-out-of-work-cmie-11588683100926.html. Accessed 2 July 2020.

NITI Ayog Annual Report 2017–18. Available at https://niti.gov.in/sites/default/files/2019-04/Annual-Report-English.pdf. Accessed 1 July 2020.

Panagariya. (2020, April 26). ABP news. Available at https://www.youtube.com/watch?v=fhwxpASds6A. Accessed 1 June 2020.

Ratnam, D. (2020). Domestic violence during Covid-19 lockdown emerges as serious concern. Available at https://www.hindustantimes.com/india-news/domestic-violence-during-covid-19-lockdown-emerges-as-serious-concern/story-mMRq3NnnFvOehgLOOPpe8J.html. Accessed 29 April 2020.

Samanta, P. K. (2015). Development of rural road infrastructure in India. Pacific Business Review International, 7(11), 86–93.

Sein, M. K., & Harindranath, G. (2004). Conceptualizing the ICT artifact: Toward understanding the role of ICT in national development. The Information Society, 20(1), 15–24.

Singh, B. K. (2020, June 1). Biggest challenge to put financial sector back on feet once India unlocks economy: Arvind Panagariya. Available at https://www.livemint.com/news/india/biggest-challenge-to-put-financial-sector-back-on-feet-once-india-unlocks-economy-arvind-panagariya-11591017270659.html. Accessed 30 June 2020.

Sinha, P. (2013). Combating youth unemployment in India. Friedrich-Ebert-Stiftung, Department for Global Policy and Development. Available at https://www.kalsatrust.org.in/images/pdf/LABOUR_AND_EMPLOYMENT/KALSA%20RESERCH%20INSTITUTE%20%20LABOUR%20&%20EMPOWERMENT%20312.pdf. Accessed 12 June 2020.

Statista. (2020). Estimated impact from the coronavirus (COVID-19) on India between April and June 2020, by sector GVA. Available at https://www.statista.com/statistics/1107798/india-estimated-economic-impact-of-coronavirus-by-sector/. Accessed 1 June 2020.

Subbarao. (2020, May 11). India can expect V-shaped recovery post COVID-19: Former RBI gov Subbara. Available at https://www.businesstoday.in/podcast/bulletin/india-can-expect-v-shaped-recovery-post-coronavirus-crisis-dr-duvvuri-subbarao/403423.html. Accessed 1 June 2020.

Thampy, A. (2010). Financing of SME firms in India: Interview with Ranjana Kumar, former CMD, Indian Bank; vigilance commissioner, Central vigilance commission. IIMB Management Review, 22(3), 93–101.

Times of India. (June 30, 2020). Pradhan Mantra Garib Kalian Yojana: All you need to know. Available at https://timesofindia.indiatimes.com/india/pradhan-mantri-garib-kalyan-yojana-all-you-need-to-know/articleshow/76710804.cms. Accessed 1 July 2020.

Todd, P. R., & Javalgi, R. R. G. (2007). Internationalization of SMEs in India: Fostering entrepreneurship by leveraging information technology. International Journal of Emerging Markets, 2(2), 166–180.

World Bank. (2020). Doing business 2020: Comparing business regulation in 190 economies. Available at http://documents1.worldbank.org/curated/en/688761571934946384/pdf/Doing-Business-2020-Comparing-Business-Regulation-in-190-Economies.pdf.

World Bank estimates. (2020). Available at https://worldpoverty.io/map. Accessed 1 July 2020.

World Health Organization. (2009). WHO guide to identifying the economic consequences of disease and injury. Available at https://www.who.int/choice/publications/d_economic_impact_guide.pdf. Accessed 20 June 2020.

World Health Organization. (2020). Joint Leader’s statement—Violence against children: A hidden crisis of the COVID-19 pandemic. Available at https://www.who.int/news-room/detail/08-04-2020-joint-leader-s-statement—violence-against-children-a-hidden-crisis-of-the-covid-19-pandemic. Accessed 11 Apr 2020.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Authors’ Insights

Authors’ Insights

The measures announced by the government should not be viewed in a static setting. It has to be implemented in a dynamic context, requiring modifications as the situation unfolds. The experts hailed the early imposition of strict nationwide lock down in India, for preventing the spread of the pandemic. It had brought the entire economic activity to a virtual standstill. This has not only put individuals and the firms in financial distress but has caused financial strain on the state governments as well as central government, because near stoppage of economic activities has resulted in huge loss of revenue to the government. The similar situation prevails in most of the countries across the world and therefore, the experts are recommending for relaxation of lockdown and resumption of economic activities in a careful and calculated manner. The Government of India is responding to this suggestion and lockdown is being relaxed gradually.

As per the figures reported by the state governments as well as the Government of India, the spread of the pandemic and the consequent death rate is low as compared to most of the western countries. This gives us time to train medical personnel and to manufacture essential requirements, such as masks, beds and ventilators, as it will not be possible to import these. In India, several NGOs and civil society organizations and the corporates have joined hands with the local governments in an effort to combat the crisis. The individual citizens and the corporates in India have come in a big way to donate to Prime Minister’s Citizen Assistance and Relief in Emergency Situations (PM CARES) created to fight COVID-19 crisis. The corporates are also making funds available under Corporate Social Responsibility for the purpose.

In India, the major issue is lack of adequate health infrastructure. The situation is worst in rural areas. There are reports that adequate number of tests are not conducted and the actual number of infected cases are three times higher than the reported number (which is around 18,000 per day, as on 1 July 2020). Thus the peak may occur in November 2020 or even after that and that the pandemic will last up to June 2021, as it will not be controlled until effective vaccine is discovered and manufactured on a large scale. The most optimistic reports predict the discovery of vaccine by early or mid-2021. Furthermore, there are worrisome reports that some migrant labors have started coming back to metro cities like Mumbai in search of livelihood. This makes the situation still worse for the people in general and for the poor in particular. It is necessary that relief and rehabilitation measures are taken on a massive scale. In addition to providing relief measures there is a need to convince the migrant labors that alternative livelihood will be made available to them at their home town. The local leadership can play crucial role and help them staying at their home towns.

In this difficult time, it is necessary that the government, NGOs and the corporate should join hands to undertake rehabilitation work. They need to cooperate and utilize each other’s strengths. All stakeholders need to be transparent i.e. sharing the actual situation on real time basis and show the concern towards each other. We need to explore the traditional practices and see the relevance, customize it to suit the requirements. In order to build the trust, each stakeholder will have to demonstrate that they are interested in log-term relationship and show the commitment to cross this difficult phase of business and life.

The government of India has announced several measures to mitigate the crisis. However, the response to the crisis should be measured and should be made after taking a long term view of the situation. As Dr. Arvind Pangaria former, Chief Economic Adviser to the Government of India, suggested, The government should make the disbursements of funds in stages; otherwise it will lead to inflationary pressures in the economy.

The pandemic also brings few opportunities for India. It is high time to decrease the digital divide in India, so that the effectiveness of any program can be improved. The technology infrastructure need to be made available at both the ends i.e. customer as well as organizations. Another flip side of is the ability to use technology properly. Organizations will have to create a space for technology literacy for consumers as well as for employees.

The pandemic would take us towards more value co-creation in general and for service industries in particular. The improved connectivity between customers and service providers will enable them to spend more time with each other using the technology. This will lead towards better understanding and enhanced value co-creation.

India has many assets to bank on. India has a demographic advantage with largest proportion of young people in the world who possess higher immunity as compared to older people. Moreover, we have well developed pharmaceutical industry which may develop affordable vaccine at an early date. The faster implementation of suggested measures will go long way to re enforce these strengths and in helping us to come out of crisis.

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License (http://creativecommons.org/licenses/by-nc-nd/4.0/), which permits any noncommercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this chapter or parts of it.

The images or other third party material in this chapter are included in the chapter's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Singh, A.S., Venkataramani, B., Ambarkhane, D. (2021). Post-pandemic Penury of the Financially Marginalized in India: Coping with the New Normal. In: Lee, J., Han, S.H. (eds) The Future of Service Post-COVID-19 Pandemic, Volume 1. The ICT and Evolution of Work. Springer, Singapore. https://doi.org/10.1007/978-981-33-4126-5_10

Download citation

DOI: https://doi.org/10.1007/978-981-33-4126-5_10

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-33-4125-8

Online ISBN: 978-981-33-4126-5

eBook Packages: Business and ManagementBusiness and Management (R0)