Abstract

The study aims to evaluate the microcredit programs operating across the Pakistan. Microsurvey data collected by Gallup Pakistan at the national level have been used. The sample size of the study consists of 2,070 respondents. The impact of the microcredit program on their clients has been evaluated by using descriptive statistics, multiple regression, the mean difference model (MDM), and quartiles. The study reveals that microcredit program in Pakistan may not be helpful for extreme poor in its operational areas across the country because disbursement of credit to the lower quartile income poor does not yield fruitful income change. Despite an overall positive change (7.76 %) in income, these programs show weak evidences of benefiting the lower quartile community members during the study period. The study suggests that microcredit is not equally beneficial to all segments of the poor.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Poverty and income inequality are correlated, which together form the root of many social and economic problems. More than 80 % of the world’s population lives in countries where income differentials are widening. The poorest 40 % of the world’s population account for only 5 % of global income. On the other hand, the richest 20 % account for 75 % of world income, according to the United Nations Development Program (Ravallion 2010). Among the many initiatives taken against poverty worldwide, microfinance is one of the strongest instruments to effectively alleviate the level of poverty and improve the socioeconomic conditions of the poor and marginalized segments of a community (Donaghue 2004).

Microfinance institutions (MFIs) have received growing attention at both national and international levels during the last two decades, particularly after the award of the Noble Prize to Muhammad Yunus . The major contribution of Muhammad Yunus has been making microfinance facilities accessible to the non-bankable poor on terms and conditions different from formal banking practices (Khan 2010; Khan et al. 2009). Like other developing economies, Pakistan is also suffering from poverty, in spite of adopting multidimensional measures to alleviate the absolute level of poverty. Based on the official statistics, the incidence of absolute poverty has decreased. The head count ratio (HCR) was 30.6 % in 1998–1999, but declined to 23.9 % points and subsequently to 22.3 and approximately 20 % points during 2004–2005, 2005–2006, and 2009–2010, respectively.Footnote 1 Pakistan is addressing the issue of poverty by taking various initiatives. These are, namely, Benazir Income Support Program (BISP), the rights source initiative, vocational training programs, Peoples’ Work Program (PWP-I and II), Pakistan Baitul Mal (PBM), employees’ old age benefit institution, and zakat and microfinance programs (Khan et al. 2013). This study focuses on the microfinance activities and the resulting outcomes in terms of socioeconomic uplifts and reduction in poverty and income inequality in the operational areas of these programs.

Pakistan Poverty Alleviation Fund (PPAF) is a major organization to shape and cater microcredit activities in the country. The PPAF was established as an autonomous body in April 2000 to cater to the microfinance requirements of the country. With an endowment of $100 million, it functions as a wholesale lender to NGOs engaged in providing microfinancing. It is one of the major organizations that has shaped microfinance and community development activities in the country. The PPAF offers its microcredit facilities in 104 districts across the country with the help of 68 partner organizations. It has made a disbursement of Rs. 17,448 million, facilitating around 6.18 million beneficiaries.Footnote 2 There are more than 30 microfinance institutions operating in Pakistan with diverse structures and mechanisms. The share of PPAF in the microfinance sector is more than 44 %. The main objectives of the study are to investigate empirically the following:

-

1.

The outreach and accessibility of MFIs with regard to various categories of the poor and marginalized segments in its working area.

-

2.

Socioeconomic impact of the microcredit programs for various groups of the poor.

-

3.

The distributional effect of these programs for various classes in its operational areas.

2 A Brief Review of Literature

Assessment of microfinance programs is essential for appropriate microfinance functioning. Microfinance assessment helps three major stakeholders: MFIs, donors, and regulatory authorities. The idea of microfinance impact assessment got momentum in the last decade. Broad-based and rigorous studies were conducted by prominent MFIs, aid agencies (AAs), and international financial institutions (IFIs) such as Grameen Bank, Department for Internal Development, the World Bank, and International Monetary Fund (Bauchet et al. 2011; Goldberg 2005; Khandker 2005; Kondo et al. 2008 ; Morduch and Roodman 2009). The existing literature about the impact assessment methods can be broadly divided into three categories:

-

(i)

Experimental methods/randomized control trials (RCTs)

-

(ii)

Counter factual combined (CFC) approach (CFC)

-

(iii)

Parametric methods

Understanding the strengths and weaknesses of each method is imperative in investigating the basic question: “Does microfinance work against poverty?” This question can be answered differently by using different investigation methods. There is no single universal method of microfinance assessment (Odell 2010). Although there are rigorous studies (Banerjee et al. 2009 ; Coleman 2006; Pitt and Khandker 1998; Kondo et al. 2008; Roodman and Morduch 2009) across the world conducted by renowned policy and research institutions, there is no consensus about the impact assessment results and, in some cases, different researchers report contradictory results.Footnote 3

The impact assessment outcomes in terms of poverty alleviation and socioeconomic uplift of the financially marginalized poor are sensitive to the selection of impact assessment methods. This has been evident from the study of renowned scholars such as Khandker (1998, 2005) and Morduch (1998, 2009). Why cannot a single microfinance impact assessment method be used as a universal impact assessment method? This question is of central importance in the literature on microfinance impact assessment. There can be various possible reasons. First, none of the existing microfinance impact assessment methods are error free; therefore, no impact assessment method in isolation can cover the scope of microfinance impact assessment. Second, the impact assessment experiments cannot be performed in an entirely controlled environment. The researchers have control over some factors (selection of location, clients and non-clients, etc.), while many other aspects (the difference between intrinsic abilities of clients, enthusiasm toward work, the difference in social, cultural and political values, etc.) are uncontrollable, thus yielding differences in the outcome of the same experiment. Third, heterogeneity in the operational areas and differences in participants’ demographic characteristics are other hurdles to adopt a universal standard for microfinance impact assessment. However, a comparative analysis of the existing microfinance impact assessment methods will point out the relative importance of each method and its suitability in different situations.

Morduch (1998) evaluates the impact of microfinance programs on the well-being of poor marginalized groups. He conducted a survey in Bangladesh with the help of a well-established microfinance organization, using a panel data about the various demographic and non-demographic characteristics of the respondents. He finds a positive impact of microfinance programs on income smoothening and consumption smoothening. Coleman (1999) finds that provision of microfinance facilities can significantly increase the income of beneficiaries of these programs and, thus, change their status in the society. He took a sample of 900 clients of three different MFIs and investigated the impact of these programs on clients’ earnings. He used a multiple linear regression model to measure the influence of a set of explanatory variables on a dependent variable Y (the income of the client).

Morduch and Haley (2002) evaluate the existing literature of impact assessment resulting from the intervention of microfinance programs in different parts of the world, using certain socioeconomic characteristics as a benchmark of microfinance program evaluation. They come to the conclusion that microfinance programs have a positive impact in terms of smoothing of earning and increasing the income level of clients, but point out that there is less evidence to support a positive impact in terms of improvement in health, nutrition, and primary school enrollment. Gallup Pakistan (2005) uses the CFC approach and finds that there has been a positive impact of PPAF microfinance activities on the consumption , income, and assets of the borrowers. However, the study did not explore the impact of the PPAF microfinance on poverty. Salma (2004) evaluates the impact of a microfinance program of the Development Program for the Hard-core Poor (PPRT) and the Ikhtiar Loan Scheme (ILS) of the Amanah Ikhtiar Malaysia (AIM). She focuses on two important goals: outreach of these programs and economic impacts resulting from these programs. She compares the socioeconomic conditions of PPRT beneficiaries with AIM beneficiaries and with non-clients as well. She uses various statistical techniques and concludes that more than four-fifths of AIM participants have crossed the poverty-line income as compared to less than one-third of the PPRT participants.

Kondo et al. (2008) use various impact assessment tools to investigate the impact of a microfinance program in the Philippines. She observes a significant impact on per capita income , food expenditure, and total expenditure, but with regressive features. Moreover, she points that MFIs are growing as a business and they tend to focus just on the disbursement of loans and their repayments, having nothing to do with creating opportunities for the poor and ensuring profits for them.

Shirazi and Khan (2009) investigate the impact of microcredit on poverty alleviation in Pakistan. They use a microsurvey of Gallup Pakistan (2005), which consists of 3,000 respondents. This survey comprises a control group of 1,500 respondents, while the remaining 1,500 respondents comprise the experimental group. They use the CFC approach for the impact assessment of microcredit on poverty alleviation in the working area of the PPAF. The study concludes that microcredit has reduced the absolute level of poverty by 3.05 % during the study period.

Khan (2011) uses microdata collected from 300 respondents through a detailed questionnaire from the clients of Islamic Relief (Pak). He also collected the same information, from the same intervention area of Islamic Relief, from about 100 respondents as a control group. He uses the mean difference model (MDM) to investigate the impact of the microfinance program of Islamic Relief (Pak). He further uses a logistic regression model for investigating the impact on social uplift and poverty alleviation of the respondents. He concludes that the respondents who avail the facility of Islamic microfinance are approximately 10 % more likely to increase their socioeconomic welfare as compared to non-clients.

Abiola (2011) applies a financing constraint approach to investigate whether MFIs have improved their access to credit for microfinance activities or otherwise. The study was conducted in Nigeria, using cross-sectional data to investigate the dependence of MFIs on their own internal funds. The findings of the study show that MFIs reduce financial constraints of microbusinesses. Roodman and Morduch (2009) find that small loans neither improve poor people’s status nor help reduce poverty, and argue that microfinancing is not a miracle solution for poverty reduction . However, they admit that the poor need financial services for their survival and it is their basic right—like access to clean water and electricity, financial services are essential to a healthy and modern life.

We have tried to summarize the pros and cons of various contemporary impact assessment approaches, to provide a snapshot of their suitability in different circumstances. Tables 3.1 and 3.2 provide the key highlights of contemporary microfinance impact assessment methods, with their pros and cons and suitability of application in different situations.

Different approaches have been evaluated on the basis of their strengths and weaknesses and on their potential to investigate the impact of microfinance programs. These approaches are compared to find out the optimal approach in terms of compatibility with the objectives of MFIs. The initiation of microfinance programs was aimed at alleviating the absolute level of poverty and improving the socioeconomic lives of the poor on a sustainable basis (Yunus 2003). Some important impact assessment studies (Odell 2010; Banerjee et al. 2009; Bauchet et al. 2011; Coleman 2006; Roodman and Morduch 2009; Rahman 2010; Khan 2011; Khan et al. 2011; Morduch 1998) have gauged the impact of microfinance on socioeconomic variables. Our study also uses the same socioeconomic variables. The degree assigned to different approaches, against each objective of microfinance, is based on their suitability, objectivity, robustness, and feasibility. For example, RCTs are scientifically rigorous to report short-term impact assessment results (15–18 months), but fail to report a change in slow-growing variables such as alleviation in poverty and socioeconomic uplift. Similarly, quasi-experimental methods such as the CFC approach have the potential to report short- and long-run changes in socioeconomic variables, but lack internal validity. Same is the case with the parametric approaches of impact assessment as CFC.

It is evident from Table 3.2 that none of the approaches in isolation can fulfill the objective of microfinance assessment. Moreover, the comparison of different impact assessment approaches reveals a tradeoff between scientific robustness and program objectivity.

Finally, though microfinance is considered as a strong instrument that can alleviate the absolute level of poverty and improve distribution patterns in an economy, different studies across the world do not affirm this belief unanimously. Studies vary from positive impacts to negative impacts with different magnitudes.

3 Data and Methodology

3.1 Source of Data and the Collection Method

The data about the respondents were collected for the loan year, 2004–2007, and the previous year, 2003–2006, by Gallup Pakistan. The difference between the two time periods is at least 1 year. A sample size of 2,070 respondents was selected across the country. The selection of clients was carried under the condition that the selected client should have taken at least one loan during the period January 2004 and December 2007. The multistage sampling procedure was then adopted to minimize the selection bias of the study. This study uses before and after loan period data for the clients to show that socioeconomic and demographic characteristics remain the same, while changes in socioeconomic conditions come from the utilization of credit if other factors remain constant.

3.2 The Methodology

Various statistical and econometric techniques have been applied to investigate the impact of microcredit programs. Techniques used in this chapter have been given below with a short description of justification.

-

Descriptive statistics of demographic and non-demographic characteristics have been calculated to assess the basic socioeconomic profile of the clients.

-

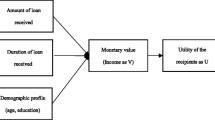

A multiple regression model has also been used to investigate the determinants of household income. Theoretically, important demographic variables such as age, education level, household size, and square of education, and some non-demographic variables such as dummy variables for clients’ credit utilization have been used.

-

T-paired sample test has used to investigate the difference between variables of interest (household income, household expenditure, etc.) before taking a loan and after the utilization of the loan.

-

The sectorwise income of the clients has been investigated before and after the utilization of the loan, and thus, the statistically significant difference has been considered as a positive impact of the microcredit and vice versa.

-

Socioeconomic well-being of the clients has been measured in the operational areas by per capita income of individuals, households, and per capita consumption .Footnote 4

-

Investigating the outreach to the poor and marginalized segments, various quartiles and deciles of household earning before and after the loan have been calculated. This is a way to judge the access to outreach of the MFIs. This technique will enable us how the MFIs are targeting poverty in its operational areas.

-

Finally, distributional change due to the microcredit program for various classes of the poor has been investigated by the quartile approach.

4 Result and Discussion

Descriptive statistics of demographic characteristics and other economic information have been used to evaluate the lending methodology of MFIs. The average age limit is 39.5 years, which reflects that MFIs on average select mature clients for microcredit activities. The average household size is 5.8 or approximately 6 members in the working areas of MFIs. Education is a dominant determinant of household income. Average education in the working area of the MFIs is 4.1 years, which shows that the average education of the clients is primary level. The average earnings of the individual and household before a loan is Rs. 5,283 and Rs. 11,008, respectively. Keeping in mind the outreach of MFIs in targeting the poor and marginalized segments, we have used the then official poverty line of Rs. 878.64 per adult equivalent per month for the year 2006–2007 and the same poverty line has been used by the survey in 2005–2006.Footnote 5 A later section of this chapter discusses in detail the outreach and targeting poverty strategies of the MFIs.

Descriptive statistics of sectorwise income of the clients are calculated and reported in Table 3.3 (Table 3.4).

Descriptive statistics of respondents’ earning from various sources have been calculated and presented in Table 3.3 for the study period 2003–2006 to 2004–2007. These statistics show that a major earning of clients is small enterprises, followed by livestock and agriculture, respectively, during the study period. Skewness and kurtosis values for both the periods are positive with high magnitudes, representing high fluctuations in the earning of clients. This phenomenon hints that MFIs have unevenly distributed among the poor and marginalized segments. As this issue is of great importance, we have devoted a separate section to investigate it. A pie chart of clients’ earning from various sources illustrates this point (Fig. 3.1).

It is obvious from both the charts that earning sources are more or less consistent during the study period. Microenterprise is the dominant source in terms of earning of clients, followed by livestock and agriculture, respectively, in the operational areas of MFIs. Three dominant sectors—microenterprise, livestock, and agriculture—constitute 85–88 % of the total earnings of clients, from the previous year to the current year.

Multiple regression model has been estimated by using theoretically relevant variables to investigate the determinants of household income (Table 3.5).

Determinants of the household income were specified on the basis of theoretically important and econometrically significant variables and model specification criteria, respectively.Footnote 6 The ultimate specification of the model has been made on the basis of several econometric criteria such as the Ramsey RESET test for general misspecification, the Wald test for linear coefficient restriction, normality of residuals, and the White heteroskedasticity-consistent standard errors and covariance for the presence of heteroskedasticity.Footnote 7 The age of a respondent is considered as an indicator of maturity. The age of the family head (showing maturity) and family size (sharing burdens/helping hands) significantly affects saving decisions and planning for investment at household levels.

The education level of the clients is another important variable that influences investment and production decisions . A highly educated client is expected to possess better understanding, knowledge, and managerial skills, and, thus, has the ability to invest the borrowed money in more efficient, secured, and profitable businesses. Household size is an important variable of household income . Surprisingly, the household size has a positive sign. This phenomenon can be interpreted in this situation in terms of the poor households having no other options for their survival, except to become a part of the labor force irrespective of their age. All regressors are positively related and statistically significant with household income except education square. It represents that households’ income increases with a decreasing rate due to the education level of the respondents. Perhaps, it represents that the higher education of the clients of MFIs is a misfit with their skills in microfinance activities. This empirical finding does not affirm theoretical justification of education of MFIs’ clients accounting for higher earnings.

Various dummy variables (D_06, 07) were used to show the duration of membership of the clients. Average monthly earning of the clients who were attached to MFIs for two or more years (D07) is greater than the average earning of those clients who are members of the MFIs for 1 year or less (D06). This finding is theoretically sound as utilization of credit for more time enhances the expertise of clients, which ultimately increases earning from business.

To investigate the economic impact resulting from the microcredit program of the MFIs on the poor and marginalized segments, this study investigates change in individual income, individual expenditures, total household income and total household expenditures, and other sources of income of households of the clients before and after joining microcredit programs. The difference is thus checked for statistical significance. The null and alternative hypotheses are as follows:

-

(i)

$$ \begin{aligned} H_{0}:\mu_{{{\text{inc}}(T1){\text{after}}}} & = \mu_{{{\text{inc}}({\text{To}}){\text{before}}}} \Rightarrow {\text{Difference}} = 0 \\ H_{1}:\mu_{{{\text{inc}}(T1){\text{after}}}} & \ne \mu_{{{\text{inc}}({\text{To}}){\text{before}}}} \Rightarrow {\text{Difference}} \ne 0 \\ \end{aligned} $$

-

(ii)

Level of Significance: α = 0.01

-

(iii)

Test statistic under H 0 is given by: \( t = \frac{{\overline{d} }}{Sd/\sqrt n } \)

-

(iv)

The critical region is \( \left| t \right| \) ≥ t 0.005, (2070)

As a rule of thumb, when t-estimated value is greater than t-tabulated value, we reject H 0. This means that the difference between the incomes of clients before and after joining the microcredit program is statistically significant. Rejecting the null hypothesis means that the study did not find sufficient evidence to conclude that the microcredit programs in Pakistan have not significantly brought a positive change in the earning level of its clients.

Similarly, the difference between other variables, before and after the utilization of credit, has been investigated and reported in Table 3.6, with corresponding significance levels. Table 3.6 shows that the microcredit programs brought a significant positive change in terms of household income , the individual’s income, and household expenditures. Two variables—other sources of household earnings and other sources of individual earnings—are statistically insignificant at 1 % significance level. This implies that the clients rely on the microcredit facility provided by MFIs. Perhaps they do not have much difficulty in terms of repayment of their loans or they do not have other sources of funding (Table 3.7).

We have further estimated the economic impact of the microcredit programs profession-wise. As discussed earlier, microenterprise, livestock, and agriculture are dominant sectors for the utilization of microcredit in the intervention areas of the MFIs. Therefore, the sectorwise impact has also been investigated. Monthly personal income from all sources except daily wage and others are statistically significant at 95 % confidence level.

Income and consumption are often used as a proxy of economic welfare indicators (Rahman 2010). Table 3.8 shows per capita income of individuals and households, and per capita consumption to investigate the economic welfare of the clients in the operational areas. The statistical significance of per capita values was estimated before and after the loan period and found to be statistically significant with 99 % confidence interval. The concept of per capita income in terms of macroeconomics is used as a proxy of economic welfare of the residents of a country. The higher the GDP per capita, the higher the economic welfare, and vice versa. By looking into the per capita income of households and per capita consumption, it seems that the average number of the total clients is not poor in the working areas of the MFIs. There may be two possibilities: First, perhaps the MFIs did not identify their target group for microcredit activities according to the official definition of poverty (calories intake approach Rs. 878.64Footnote 8 per adult per month). Second, The MFIs may not extend the microcredit facility to the poor and extremely poor because it may think these groups have a high chance of default.

We now investigate the outreach of the MFIs. This study uses the official poverty line of Rs. 878.64 per adult equivalent per month (2006–2007), and the same poverty line has been used by the survey in 2005–2006.Footnote 9 If we multiply 878.64 with the average household size, then the resulting outcome will be Rs. 5,100. This is the minimum amount required by each household to satisfy its basic needs per month. This amount can be used as a proxy of the poverty line for the clients of the MFIs. Table 3.9 represents quartile earning of individuals and households along with minimum and maximum values per month. In the working areas of the MFIs, minimum earning is Rs. 2,000 per month per household. The first quartile, which is equivalent to the 25th percentile, is equal to Rs. 8,000, representing that 25 % of the survey households have an income less than Rs. 8,000 per month. The members of these households are either lying on the poverty line or just below it. It is a surprising fact that less than 25 % of the total targeted households are poor according to the official definition of poverty. According to this finding, out of the total clients (2070), less than 500 clients are poor. This indicates that a selection bias has been committed either by considering some other benchmark of poverty or by ignoring the target group intentionally due to the high chance of default. Of the total clients, 31 % have an income between Rs. 8,000 and Rs. 10,000 per month. It shows that 25 % clients of MFIs do not fall under the official definition of the poor. The remaining 44 % of the total clients comprise the non-poor and quasi-non-poor. In a nutshell, about 25 % of the total clients of the MFIs in Pakistan are the poor according to the official poverty line of that time, while 75 % of the total clients are either the non-poor or quasi-non-poor or vulnerable to poor.Footnote 10

This disbursement pattern of credit favors the MFIs in two different ways: First, targeting the non-poor and quasi-non-poor reduces the chance of default and assures regular periodic repayments from clients. Second, the earning of these groups is relatively flexible as compared to the poor and ultra-poor, so the MFIs can charge a desirable level of interest for the further expansion of credit facility. Quartile earning of households has been represented in Fig. 3.2 (Table 3.10).

Table 3.9 uses household income data after the utilization of credit. Surprisingly, the household earning in the first quartile does not show any change. This implies that microcredit cannot help the lower quartile income poor in terms of their socioeconomic well-being .Footnote 11 The study deduces another result from this finding that microcredit provision is perhaps not a proper tool to help the extreme poor and ultra-poor. We have to design some other programmes to help these people and to minimize the intensity of their poverty level . Second and third quartile earning has improved after the utilization of credit. The findings support the theoretical justification of proper utilization of credit disbursement for those clients who are either lying on the poverty line or vulnerable to poverty. Microcredit cannot bring a positive change in the socioeconomic life of the extreme poor and ultra-poor. Microcredit may be a proper instrument to protect the vulnerable to poor from falling into the poor or the ultra-poor category (Table 3.11).

This last section shows the impact of the microcredit programs on the distribution pattern in the operational areas. As discussed in the earlier sections, microcredit does not suit to the poor and ultra-poor because they are not credit worthy. Findings of this study affirm this statement. The lower quartile (which comprises the ultra-poor and extreme poor) represents no improvement in the distribution pattern. The second quartile (which comprises the vulnerable to poor group) has shown dramatic improvement in the distribution pattern. The earning of the vulnerable to poor group improved by 16.67 % during the study period. The third quartile and the upper quartile (which consist of the non-poor community) represent a 7.78 % improvement in the distribution pattern as compared to the previous years. The overall improvement in the distribution pattern of the household income during the study period was observed as 7.78 %.

5 Conclusion and Policy Implications

The study reveals the following important results:

-

1.

Demographic characteristics such as age, education, and family size, and non-demographic characteristics such as experience and utilization of credit for a long time period are the significant determinants of household income in the working areas of the MFIs.

-

2.

The MFIs do not focus on the extreme poor and marginalized segments in its operational areas across Pakistan because less than 25 % of the total credit are allocated for the poor, ultra-poor, and extreme poor, while the remaining amount (more than 75 %) are disbursed among the vulnerable to poor, quasi-poor, and non-poor.

-

3.

The socioeconomic impact of the microcredit program of the MFIs across the different clients is not the same. We did not notice any positive change in the lower quartile of household income (which comprises the extreme poor, ultra-poor, and the poor), while the household income of the middle and upper quartile increased by 16.67 and 6.6 %, respectively.

-

4.

Interestingly, the MFIs overall economic impact is noticed as 7.78 % during the study period. This is a very impressive figure which represents that the distribution pattern in the operational areas has improved by the same magnitude. However, unfortunately, this improvement excludes the poor, ultra-poor, and extreme poor.

6 Policy Implications

Taking into consideration the findings of the study, we suggest the following policy implications:

-

1.

The overall economic impact of microcredit of the MFIs on their clients in the operational areas is positive, representing the probability of success of this facility for non-operational rural areas and urban slums.

-

2.

We have noted in the earlier section that MFIs in Pakistan do not pay proper attention to the lower quartile poor in its operational areas. Perhaps microcredit is not fit for this segment (as we did not notice any positive income change). This experience shows that financing the extreme and ultra-poor through microcredit is not beneficial in uplifting the socioeconomic life of these people. Wage employment along with social safety nets may be the more suitable options for such classes of poor (Please see Appendix 2 for suggested measures against each category of poor).

-

3.

The experience of Pakistani MFIs shows that an appropriate class of the poor for microcredit may be the vulnerable to poor group. This class has the potential to utilize the credit and can improve its income-consumption pattern significantly than other categories of the poor.

-

4.

Microcredit is not equally beneficial for all poor classes . Microcredit as a magic bullet against poverty may not work effectively across all classes of the poor. The disbursement of credit to the lower quartile income poor may not yield fruitful income change.

-

5.

Demographic characteristics such as age, and non-demographic characteristics of the clients such as experience and utilization of credit for a long time period are the significant determinants of household income in the working areas of Pakistani MFIs. This finding has an important policy implication. By targeting mature and experienced clients, utilization of credit for a longer duration can enhance the chance of optimal utilization of credit for productive purposes.

Notes

- 1.

Pakistan Economic Survey 2010–2011.

- 2.

Pakistan Poverty Alleviation Fund annual report 2008–2009 (www.ppaf.org.pk).

- 3.

Khandker, in his 1998 and 2005 studies, uses quasi-experimental and panel data techniques, respectively. He investigated the impact of microcredit on poverty. He affirms positive impact of microfinance for clients in terms of poverty alleviation, especially for women and the extreme poor. Morduch (1999) and Roodman and Morduch (2009) reinvestigated the results of Khandker (1998, 2005) and concluded that he has exaggerated the results. For some important variables (women and the extreme poor), they found negative signs.

- 4.

For more details, see Kondo (2008).

- 5.

Pakistan economic survey 2005–2006 (over view of the economy) p. xvii (http://www.accountancy.com.pk/docs/economic-survey-of-pakistan-2005-06.pdf).

- 6.

Khan (2011), “Financing non bankable masses: An analytical study of conventional verses Islamic microfinance programs [A case study of Sungi development foundation and Islamic relief (PAK)].” Dissertation submitted in partial fulfillment of the requirements of MS Economics Degree: IIIE, IIU Islamabad.

- 7.

See Appendix 1.

- 8.

Pakistan economic survey 2005–2006.

- 9.

Pakistan economic survey 2005–2006 (over view of the economy) p. xvii (http://www.accountancy.com.pk/docs/economic-survey-of-pakistan-2005-06.pdf).

- 10.

For details of the poor and poverty categories, see Appendix 2.

- 11.

This statement is relevant for this case only. We cannot generalize the result for any other study.

References

Abiola B (2011) Impact analysis of microfinance in Nigeria. Int J Econ Finan 3(4):217

Banerjee AV, Duflo E, Glennerster R, Kinnan C (2009) The miracle of microfinance? Evidence from a randomized evaluation. IFMR Research, Centre for Micro Finance, Chennai

Bauchet J, Marshall C, Starita L, Thomas J, Yalouris A (2011) Latest findings from randomized evaluations of microfinance. In: Access to finance forum, vol 2

Coleman BE (1999) The impact of group lending in Northeast Thailand. J Dev Econ 60(1):105–141

Coleman BE (2006) Microfinance in Northeast Thailand: who benefits and how much? World Dev 34(9):1612–1638

Donaghue K (2004) Microfinance in the Asia Pacific. Asian-Pac Econ Lit 18(1):41–61

Goldberg N (2005) Measuring the impact of microfinance: taking stock of what we know. Grameen Foundation USA Publication Series, Washington DC

Khan Z (2010) Commercial verses cooperative microfinance program: an investigation of efficiency, performance and sustainability. Dialogue (1819–6462) 5(2)

Khan Z (2011) A comparative analysis of conventional verses Islamic microfinance program: a case study Islamic relief Pakistan and Sungi development foundation. International Islamic University Islamabad (IIUI), Islamabad

Khan Z, Asmatullah, Yasin HM (2011) Cooperative microfinance myth or reality: an economic analysis of the welfare of the marginalized segments. In: 8th international conference on Islamic economics and finance. Qatar Foundation, Doha, Qatar

Khan Z, Khan A, Ullah A (2009) Cooperative microfinance: a new option for government and development organizations. J Manag Sci 3(2):180–191

Khan Z, Sulaiman J, Ibrahim M, Shah WH (2013) Social safety nets and sustainable economic development: a theoretical perspective with reference to Pakistan economy. Dialogue 8(2):199

Khandker SR (1998) Fighting poverty with microcredit: experience in Bangladesh. Oxford University Press

Khandker SR (2005) Microfinance and poverty: evidence using panel data from Bangladesh. World Bank Econ Rev 19(2):263–286

Kondo T, Orbeta A, Dingcong C, Infantado C (2008) Impact of microfinance on rural households in the Philippines. IDS Bull 39(1):51–70

Morduch J (1998) Does microfinance really help the poor? New evidence from flagship programs in Bangladesh. In: Research program in development studies. Woodrow School of Public and International Affairs, Princeton

Morduch J, Haley B (2002) Analysis of the effects of microfinance on poverty reduction. NYU Wagner Working Paper

Morduch J (1999) The microfinance promise. J economic literature 1569–1614

Morduch J (2009) Borrowing to save: Perspectives from portfolios of the poor. Financial Access Initiative

Morduch J, Roodman D (2009) The impact of microcredit on the poor in Bangladesh: revisiting the evidence. NYU Wagner Research Paper (2011-04)

Odell K (2010) Measuring the impact of microfinance. Grameen Foundation, Washington, pp 1–38

Pitt MM, Khandker SR (1998) The impact of group-based credit programs on poor households in Bangladesh: does the gender of participants matter? J Polit Econ 106(5):958–996

Rahman MM (2010) Islamic micro-finance programme and its impact on rural poverty alleviation. Int J Bank Finan 7(1):7

Ravallion M (2010) Do poorer countries have less capacity for redistribution? J Globalization Dev 1(2)

Roodman D, Morduch J (2009) The impact of microcredit on the poor in Bangladesh: revisiting the evidence. Center for Global Development Working Paper (174)

Salma M (2004) A comparative case study on outreach and impact of Ikhtiar loan scheme and special program for hardcore poor in Seberang Perai Pulau Pinang. Center of Policy Research, University Sains Malaysia

Shirazi NS, Khan AU (2009) Role of Pakistan poverty alleviation fund’s micro credit in poverty alleviation: a case of Pakistan. Pak Econ Soc Rev 47(2):215–228

Yunus M (2003) Expanding microcredit outreach to reach the millennium development goal–some issues for attention. In: International seminar on attacking poverty with microcredit, Dhaka, pp 8–9

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1

Descriptive statistics of demographic characteristics and other economic information

AGE | EDU | HHS | MXAL | MXBL | OSIAL | OSIBL | |

|---|---|---|---|---|---|---|---|

Mean | 39.5 | 4.1 | 5.8 | 9,806.5 | 8,426.2 | 83.4 | 92.6 |

Median | 40.0 | 4.0 | 5.0 | 10,000.0 | 8,000.0 | 0.0 | 0.0 |

Max | 70.0 | 98.0 | 16.0 | 80,000.0 | 90,000.0 | 8,000.0 | 10,000.0 |

Min | 18.0 | 1.0 | 1.0 | 98.0 | 98.0 | 0.0 | 0.0 |

S.D | 9.3 | 9.0 | 2.0 | 4,407.3 | 4,506.5 | 524.3 | 586.3 |

Skw | 0.1 | 9.7 | 1.2 | 3.1 | 7.1 | 8.8 | 8.8 |

Kurt | 2.7 | 101.2 | 5.6 | 35.3 | 114.1 | 98.3 | 100.7 |

Count | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 |

OSIHBL | OSIHAL | THIAL | THIBL | TMIAL | TMIBL | |

|---|---|---|---|---|---|---|

Mean | 660.7 | 595.1 | 12,818.2 | 11,008.2 | 6,336.0 | 5,283.1 |

Median | 0.0 | 0.0 | 12,000.0 | 10,000.0 | 6,000.0 | 5,000.0 |

Max | 30,000.0 | 30,000.0 | 90,000.0 | 60,000.0 | 90,000.0 | 48,000.0 |

Min | 0.0 | 0.0 | 1,300.0 | 1,900.0 | 0.0 | 0.0 |

S.D | 2,383.9 | 2,053.6 | 6,256.1 | 5,591.3 | 5,430.2 | 4,600.9 |

Skw | 6.2 | 5.4 | 2.3 | 2.2 | 3.2 | 2.2 |

Kurt | 56.5 | 44.3 | 17.3 | 12.9 | 34.1 | 15.5 |

Count | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 | 2,070.0 |

List of abbreviations used for various variables

Abbreviation | Description |

|---|---|

Age | Age of the respondent |

Edu | Education of the respondent |

HHS | Household’s size |

MXBL | Monthly expenditure of household before loan |

MXAL | Monthly expenditure of household after loan |

TMIAL | Total individual income before loan |

TMIBL | Total individual income after loan |

THIBL | Total household income before loan |

THIAL | Total household income after loan |

OSIBL | Other source of income of individual before loan |

OSIAL | Other source of income of individual after loan |

OSIHBL | Other sources of income of household before loan |

OSIHAL | Other source of income of household after loan |

D05 | Year one (2005) D05 |

D06 | Year two (2006) D06 |

D07 | Year three (2007) D07 |

Livestock | Personal monthly income? (Livestock) |

Enterprise | Personal monthly income? (Enterprise) |

Service | Personal monthly income? (Service) |

Daily wage | Personal monthly income? (Daily wage) |

Others | Personal monthly income? (Others) |

Agriculture | Personal monthly income in the previous year? (Agriculture) |

Livestock | Personal monthly income in the previous year? (Livestock) |

Enterprise | Personal monthly income in the previous year? (Enterprise) |

Service | Personal monthly income in the previous year? (Service) |

Daily wage | Personal monthly income in the previous year? (Daily wage) |

Others | Personal monthly income in the previous year? (Others) |

Regression result of determinants of household income | |||

Output of Ramsey RESET test | |||

Ramsey RESET test | |||

F-statistic | 0.033033 | Probability | 0.855798 |

Log likelihood ratio | 0.033160 | Probability | 0.855504 |

Dependent variable: HHIAL | |||

White heteroskedasticity-consistent standard errors and covariance | |||

Variable | Coefficient | Std. error | t-statistic | Prob. |

|---|---|---|---|---|

C | 4,082.776 | 776.9938 | 5.254580 | 0.0000 |

Age | 64.43702 | 14.73756 | 4.372298 | 0.0000 |

Education | 353.2423 | 68.55224 | 5.152892 | 0.0000 |

(Education)^2 | −3.723324 | 0.677554 | −5.495244 | 0.0000 |

Household_Size | 610.2858 | 76.15387 | 8.013851 | 0.0000 |

D_06 | 951.6051 | 274.8672 | 3.462053 | 0.0005 |

D_07 | 1,245.315 | 374.3596 | 3.326521 | 0.0009 |

R-squared | 0.075965 | Mean dependent var | 12,728.94 | |

Adjusted R-squared | 0.073276 | S.D. dependent var | 6,189.882 | |

S.E. of regression | 5,958.783 | Akaike info criterion | 20.22650 | |

Sum squared resid | 7.32E+10 | Schwarz criterion | 20.24556 | |

Log likelihood | −20,917.31 | F-statistic | 28.25285 | |

Durbin–Watson stat | 1.200818 | Prob (F-statistic) | 0.000000 | |

Included observations: 2069 | ||||

White heteroskedasticity-consistent standard errors and covariance | ||||

Variable | Coefficient | Std. error | t-statistic | Prob. |

|---|---|---|---|---|

C | 3,779.080 | 1,750.722 | 2.158584 | 0.0310 |

Age | 72.78585 | 50.16933 | 1.450804 | 0.1470 |

Education | 399.4733 | 269.9845 | 1.479616 | 0.1391 |

(Education)^2 | −4.208619 | 2.826686 | −1.488888 | 0.1367 |

Household_Size | 694.0680 | 476.6797 | 1.456047 | 0.1455 |

D_06 | 1,075.822 | 766.5836 | 1.403398 | 0.1606 |

D_07 | 1,397.099 | 914.3611 | 1.527951 | 0.1267 |

Fitted^2 | −5.08E−06 | 2.96E−05 | −0.171943 | 0.8635 |

R-squared | 0.075980 | Mean dependent var | 12,728.94 | |

Adjusted R-squared | 0.072841 | S.D. dependent var | 6,189.882 | |

S.E. of regression | 5,960.180 | Akaike info criterion | 20.22745 | |

Sum squared resid | 7.32E+10 | Schwarz criterion | 20.24924 | |

Log likelihood | −20,917.30 | F-statistic | 24.21009 | |

Durbin–Watson stat | 1.200905 | Prob (F-statistic) | 0.000000 | |

Wald test of linear restrictions | |||

Wald test | |||

Equation: untitled | |||

Null hypothesis | D(6) = 0 | ||

D(7) = 0 | |||

F-statistic | 40.22184 | Probability | 0.000000 |

Chi-square | 80.44368 | Probability | 0.000000 |

Wald test | |||

Equation: untitled | |||

Null hypothesis | EDU (2) = 0 | ||

EDU^2 (3) = 0 | |||

F-statistic | 19.97667 | Probability | 0.000000 |

Chi-square | 39.95335 | Probability | 0.000000 |

Appendix 2

Categories of poor and poverty | |

|---|---|

Measurement of poverty on the basis of national poverty line | Suggested measures |

(i) Extremely poor, <50 % of the prescribed amount (PA) | (a) Donation |

(b) The provision of basic needs , i.e., food, shelter, education | |

(c) Subsidy, especially on food items and utility services | |

(ii) Ultra-poor >50 % but <75 % of the PA | (a) Donations |

(b) Wage employment | |

(c) To provide basic needs, i.e., food, shelter, education | |

(d) Cash for work | |

(e) Various short-term trainings | |

(f) Subsidy, especially on food items and utility services | |

(iii) Poor >75 % but <100 % of the PA | (a) Donations |

(b) Self-employment | |

(c) The provision of basic needs, i.e., food, shelter, education | |

(d) Cash for work | |

(e) Various short-term trainings | |

(f) Subsidy, especially on food items and utility services | |

(g) Microfinance | |

(iv) Non-poor >100 % of the PA | (a) Various trainings for improvement in productivity |

(b) Self-employment | |

(c) Microfinance | |

Rights and permissions

Open Access This chapter is distributed under the terms of the Creative Commons Attribution Noncommercial License, which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Copyright information

© 2015 Asian Development Bank

About this chapter

Cite this chapter

Khan, Z., Sulaiman, J. (2015). Does Microcredit Help the Poor and Financially Marginalized Communities? Experience of Pakistan. In: Heshmati, A., Maasoumi, E., Wan, G. (eds) Poverty Reduction Policies and Practices in Developing Asia. Economic Studies in Inequality, Social Exclusion and Well-Being. Springer, Singapore. https://doi.org/10.1007/978-981-287-420-7_3

Download citation

DOI: https://doi.org/10.1007/978-981-287-420-7_3

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-287-419-1

Online ISBN: 978-981-287-420-7

eBook Packages: Business and EconomicsEconomics and Finance (R0)