Abstract

During the past decade, investments in large-scale irrigation development in sub-Saharan Africa (SSA) have re-emerged. Given past experiences, this revival is not without controversy. This chapter examines whether large-scale irrigation construction in SSA is economically viable by estimating how much it would cost if the Mwea Irrigation Scheme in Kenya, one of the best-performing irrigation schemes in SSA, were to be constructed today. The results show that constructing the Mwea Scheme today would be economically viable except in a situation where (1) the shadow price of modern rice varieties falls as low as the world price that prevailed during the late twentieth century, i.e., in 1986–2004, when large-scale irrigation projects mostly disappeared at any project cost level; or (2) the shadow price is at the medium level prevailing in 2014–2018 for a high project cost. There is undoubtedly untapped physical potential in SSA for large-scale irrigation development, but the economically viable potential remains limited. International donor agencies and national governments wanting to construct large-scale irrigation projects are recommended to assess whether their plan is likely to be economically profitable. In addition to proper operation and maintenance, Mwea’s success also points to the importance of adopting modern inputs and improved rice cultivation practices, facilitated by thorough land preparation using tractors and oxen, and improving returns from irrigation investments.

This chapter draws heavily on Kikuchi et al. (2021).

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

To enhance food security and reduce rural poverty, sub-Saharan Africa (SSA) has long been awaiting a Green Revolution (Chap. 1 of this volume; Diao et al. 2008; Ejeta 2010; Sanchez et al. 2009; Otsuka and Larson 2012). Three technological innovations made the Asian Green Revolution possible: high-yielding varieties, chemical fertilizers, and irrigation (Diao et al. 2008; Estudillo and Otsuka 2012). Among these, irrigation is by far the most critical, as an assured water supply is a prerequisite for effective fertilizer application, without which the high-yielding potential of modern seeds is not fully exploited. Among the world’s developing regions, SSA’s irrigation is the least developed (Chap. 7 of this volume; Balasubramanian et al. 2007), despite its rich endowment of fresh-water resources (You et al. 2010; Zwart 2013). However, there have been serious debates in the last few decades regarding what types of irrigation investments are the most profitable and sustainable.

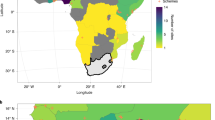

An important mode of irrigation development during the twentieth century comprised large-scale projects to construct or rehabilitate irrigation infrastructure, funded by international donors, implemented by the governments of recipient countries, and operated and maintained by national irrigation agencies (Jones 1995; Inocencio et al. 2007). By the late 1990s, large-scale irrigation projects had nearly disappeared from the global agricultural development agenda for good reasons. One of them was the success of the Green Revolution, which brought about historic low prices of cereal crops. For rice, the world price in 2000 was as low in real terms as 25% of the level prevailing during the pre-Green-Revolution period (Fig. 10.1).Footnote 1 Such low crop prices made it virtually impossible to justify costly large-scale irrigation projects (Inocencio et al. 2007).

World rice price (Thai 5% broken FOB Bangkok), 1948–2018. For 1960–2018, World Bank Pink Sheet 1960–2018 (World Bank 2019) for both current and constant prices; for before 1960, the current price series, compiled by using data from IRRI (2000) and Barker et al. (1985), is linked at 1960 with the World Bank series then deflated by the IMF World Export Price Index (1948–1960) and the world GDP implicit deflator (1960–2017) (World Bank 2020a)

A more serious reason was that many large-scale irrigation projects implemented in the latter half of the last century were characterized by many problems and defects; inadequate designs, faulty construction, less-than-satisfactory achievements, and poor operation and maintenance (O&M) (Plusquellec 2019). When evaluated at the time of construction completion, one-third of the large-scale irrigation projects were found to be ‘failure’ projects (assessed as ‘failure’ if the ex-post internal rate of return [IRR] was less than 10%) (Belli et al. 1998; Inocencio et al. 2007), and the risk of ‘failure’ increased to 50% when evaluated six to eight years after completion (World Commission on Dams [WCD] 2000). The mode of O&M of these schemes was so institutionally defective that many new and rehabilitated irrigation schemes, even non-failure projects, rapidly deteriorated (Adams 1990; Ostrom 1992; World Bank 2005; Borgia et al. 2013). Moreover, the implementation of large-scale irrigation rehabilitation projects created the ‘build-neglect-rebuild’ syndrome, depriving national irrigation agencies of incentives to maintain their irrigation systems well (Huppert et al. 2003; Suhardiman and Giordano 2014). Higginbottom et al. (2021) report that more than 80% of large-scale irrigation projects in SSA implemented in the six decades since 1945 had failed to deliver the promised benefits, with no improvement in the performance throughout the period.

Finally, growing environmental and social concerns worked against large-scale new construction projects involving the construction of large dams and the relocation of inhabitants. Both the WCD and the World Bank proposed alternative agricultural development options, such as improving the performance and productivity of existing irrigation schemes through institutional reforms for O&M, developing small-scale irrigation schemes, and investing in micro-irrigation technology and in-field rainwater management rather than resorting to large-scale irrigation projects (WCD 2000; World Bank 2005).

This virtual ‘ban’ on large-scale irrigation projects was most effective in SSA, where the twentieth century Green Revolution had not taken root, and the irrigation sector was characterized by more handicaps than any other developing region. Moris (1986) and Biswas (1986) pointed out that large-scale irrigation development in SSA was always problematic because of poor design, lack of understanding of grass-root conditions, inadequate technology choice, and inefficient bureaucratic O&M. Olivares (1989), Jones (1995), and Inocencio et al. (2007) criticized large-scale irrigation projects for their high costs and low performance. Higginbottom et al. (2021) attribute the poor performance of large-scale irrigation projects in SSA in the six decades since 1945 to political and institutional factors and highlight the need for greater learning from past investment outcomes. Moigne and Barghouti (1990) stated that new large-scale irrigation projects should not be considered unless lower-cost technologies or production systems with higher returns were identified.

The shift of focus from large-scale projects led by donors and governments to small-scale projects has been apparent since early in the 2000s—from a nearly single-minded focus on physical infrastructure to a greater emphasis on strengthening institutions, and more recently, from promoting public investments in small gravity and pump irrigation to policy reforms to encourage farmer-led investment in micro-irrigation technology (NEPAD 2003; Rockström et al. 2007; World Bank 2007; Burney et al. 2013; de Fraiture and Giordano 2014). By 2017 or so, ‘farmer-led irrigation’ had become the dominant focus of efforts to expand irrigation in SSA (Woodhouse et al. 2017; Lefore et al. 2019).

However, parallel to this development, large-scale irrigation projects have also returned to center stage. For example, a loan agreement was signed in 2007 between Kenya and the Kuwait Fund for Arab Economic Development for financing the Bura Irrigation and Settlement Scheme Rehabilitation Project (Reliefweb 2007; National Irrigation Board [NIB] 2018); a loan agreement was signed in 2010 between Kenya and the Japan International Cooperation Agency (JICA) to finance the Mwea Irrigation Rehabilitation Project (JICA 2010); and in 2017, the World Bank approved a loan for funding the Shire Valley Transformation Program in Malawi (World Bank 2017). Irrigation development in Shire Valley was first envisaged in the 1940s, and its implementation has been considered but abandoned several times since then because the construction costs were considered too high (Harrison 2018).

Why have these types of irrigation investments been resurrected? One possible reason could be the food crisis in 2008, which raised food prices sharply. The world rice price soared in 2008 to a historic high level in current prices, nearly four times as high as the 2001 price (Fig. 10.1). This surge in food prices may have reminded policymakers in SSA and international donors of the vulnerability of the world’s food production and the need to enhance food security by increasing domestic food production. This has prompted them to bring back large-scale irrigation projects to increase food production (Lankford et al. 2016).Footnote 2

Another reason could be recent advances in yield-increasing technology and its dissemination through proper rice cultivation training (see Chaps. 1 and 2 of this volume for overviews). The adoption of modern inputs and improved rice cultivation practices are facilitated by thorough land preparation using tractors and oxen (Chap. 7 of this volume). For rice, the present technology gives a yield of 6 t/ha/season, or even higher, if grown under excellent conditions; and farmers in a few large-scale irrigation schemes in SSA are attaining that yield level for two crops per year (Nakano et al. 2012; Bartier et al. 2014).Footnote 3 The availability of such technologies also improves the ex-ante economic performance of large-scale irrigation projects, particularly when coupled with higher crop prices. It is further enhanced by adopting improved rice milling technologies and proper post-harvest rice management practices encouraged by quality-based pricing (Chaps. 7, 12 and 13 of this volume); hence, policymakers could be encouraged to promote such projects.

The recent re-emergence of large-scale irrigation projects has evoked many heated reactions, mostly critical (Burney et al. 2013; Lankford et al. 2016; Merrey and Sally 2017; Woodhouse et al. 2017; Harrison 2018). These studies share the same basic question, raised explicitly by Crow-Miller et al. (2017, 195): ‘do these new projects have different justifications from those of the past?’ The mode of large-scale irrigation development in the latter half of the last century was so defective that many projects failed to attain their planned level of performance. Unless national governments and international donors are confident that they have found effective remedies for previous defects, it is not clear why they would invest in new large-scale projects. The recent story of the Bura Rehabilitation Project in Kenya reported by Business Today (KNA 2018) is alarming: the current rehabilitation project, which commenced in 2013, was only 30% complete as of 2018, 38 months behind schedule.Footnote 4 The problems are the same as those found in many project completion reports of failed large-scale irrigation projects implemented 20 to 40 years ago. The original Bura Irrigation Settlement Project, implemented in 1979–1987, was the most infamous dam project in SSA following its disastrous failure; however, the failure had been anticipated before the project began (Chambers 1969; Moris 1973), and the details of the failure were widely reported (Moris 1986; Adams 1990; World Bank 1990). The recent Bura Project could be another example of ‘informed amnesia […], where the major actors involved in irrigation development tend to ignore past mistakes, despite ample proof of the futility of their efforts’ (Veldwisch et al. 2009, 21).

In this paper, we approach this problem with a basic economic question: has the construction of large-scale irrigation schemes in SSA, once abandoned because of high investment costs and low profitability, become economically justifiable in this century? To answer this question, we examine if it would be economically justifiable today to construct the Mwea Irrigation Scheme (abbreviated hereafter as Mwea Scheme), an existing well-performing successful irrigation scheme in Kenya, by estimating how much it would cost if the scheme were newly constructed as it is now.

In the next section, we give an overview of large-scale irrigation projects implemented during the last four decades of the twentieth century, mostly financed by the World Bank, with special reference to the cost structure of these projects. In the third section, we present the estimated costs of a modern-day Mwea Scheme construction project. The fourth section examines the project's economic viability compared with recent large-scale projects under implementation, appraisal, or study. We assess some of the broader policy implications in our conclusion in Sect. 10.5.

2 Irrigation Projects in the Twentieth Century and Their Cost Structure

Before proceeding to the cost estimation of the Mwea Scheme, we first review large-scale irrigation projects implemented during the last four decades of the twentieth century, with a particular focus on their cost structure. Large-scale irrigation projects generally have a specific cost structure that has been molded partly by the nature of the project as a public construction project and partly by the history of project implementation during irrigation development in the latter half of the twentieth century, which few studies have documented explicitly. We document the cost structure using the project completion reports of 182 large-scale irrigation projects implemented in developing regions worldwide during the latter half of the twentieth century.Footnote 5 Although this dataset includes only 19 SSA projects, these projects share the same salient features of irrigation projects in SSA found by Inocencio et al. (2007): compared to other developing regions in the world, (1) the project size, measured by the total irrigated area, was smaller; (2) the unit cost was higher; and (3) the risk of failure was higher.

The costs of large-scale irrigation projects consist of both direct construction costs and various indirect, overhead costs. In this study, the cost structure of public irrigation projects is explored by classifying the project costs into four cost groups:

-

(1)

Costs for civil works directly related to constructing the infrastructure, including materials and equipment used, and indirect construction costs such as field administration and supervision, safety control, and contractor’s profit (henceforth referred to as ‘Civil-work’ costs);

-

(2)

Overhead costs for management, including preparatory surveys and studies, system designing, engineering management and supervision during the implementation, and general project administration and management (‘Management’ costs);

-

(3)

Overhead costs for agricultural support, O&M equipment, O&M planning, and training of irrigation officials, water users’ groups, and farmers (‘Ag-support’ costs); and

-

(4)

Other-overhead costs, such as land acquisition/compensation, relocation, settlement construction, other social infrastructure, and environmental measures (‘Other-overhead’ costs).

‘Management’ costs and ‘Civil-work’ costs are ordinary costs in all construction projects, including irrigation. As we have emphasized the importance of rice cultivation training in Chap. 2 of this volume, ‘Ag-support’ costs as well as ‘Other-overhead’ costs, which are indispensable to the success of the projects, are largely specific to large-scale irrigation projects.

Table 10.1 shows the cost structure of twentieth-century irrigation projects in terms of the percentage share of the component costs in the total project cost. At the mean of the sample projects, the share of overhead costs (i.e., ‘Management’ cost, ‘Ag-support’ cost, and ‘Other-overhead’ cost) in SSA averaged 39%, more than in other regions. The difference between SSA and other regions is particularly large for ‘Management’ and ‘Ag-support’ costs.Footnote 6

The unit total project cost and four unit-component-costs are all correlated negatively with project size (Fig. 10.2). The strong scale economy of irrigation project construction costs was pointed out by Inocencio et al. (2007) for the total project cost and by Fujiie et al. (2011) for some overhead costs. This study reveals that the ‘Civil-work’ cost, which includes indivisible elements, such as dams, headworks, and heavy construction equipment, also had a strong scale economy.

Using the data in Fig. 10.2 together with some sample-specific characteristics, regression equations are estimated for the unit total project cost and four unit-component-costs (Table 10.2). The project size has a highly significant negative coefficient for all the unit costs, suggesting that the scale economy exists in all the component costs. ‘Ag-support’ cost has the highest size-elasticity, closely followed by ‘Management’ cost. The unit total project cost of rehabilitation projects is significantly lower than that of new construction projects, brought about by lower ‘Civil-work,’ ‘Management,’ and ‘Other-overhead’ costs. ‘Failure’ projects have higher unit total project costs than ‘successful’ ones due to higher ‘Civil-work’ costs. There is a tendency that newer projects have lower unit ‘Civil-work’ and ‘Management’ costs, reducing the total project cost. This suggests that the performance of twentieth-century irrigation projects improved as project experience accumulated. The most important result of the regression analyses is that the SSA regional dummy is not statistically significant in all the regression equations, implying that the higher unit project costs required to develop irrigation infrastructure in SSA were due mainly to the small size of the irrigation projects, not for SSA-specific reasons.

We try to estimate the construction costs of the Mwea Scheme by using the four component costs.

3 Estimation of Project Costs of the Mwea Scheme

3.1 The Mwea Irrigation Scheme

Mwea Irrigation Scheme is situated 65 km south of Mount Kenya, 90 km northeast of Nairobi, and 650 km northwest of Mombasa. It is a river-diversion surface irrigation scheme, taking water from two tributaries in the Upper Tana basin on the heavily watered south-eastern slopes of Mt. Kenya. This favorable water potential, coupled with a gently sloping terrain and fertile black soil of volcanic origin, makes the Mwea plain an ideal physical environment for constructing an irrigation scheme (Moris 1973). Construction began in 1954 as a settlement scheme to provide farmland to landless people (Chambers 1973).

The abundant water sources in the area have made it possible to expand the irrigated area rapidly. Starting from 2,000 ha in the 1950s, the Scheme’s net irrigable area increased to 6,000 ha by the late 1980s (Table 10.3). A modernization-rehabilitation project, implemented in 1989–1992 with assistance from JICA (henceforth referred to as Mwea Project 1990), eventually expanded the Scheme’s irrigable area to 8,500 ha. Another modernization-rehabilitation project by JICA completed in 2022 (henceforth referred to as Mwea Project 2022) expands the irrigable area to 12,400 ha, including three out-grower sections previously developed by farmers themselves with World Bank assistance.

The favorable water and soil conditions have made the Mwea Scheme one of the most effective rice irrigation schemes in SSA and indeed the world. The average farmer’s rice yield at Mwea from 1961 to 1971 was 6.4 t/ha/season (Chambers 1973). This was an exceptionally high-yield level for irrigated rice in the twentieth century among developing countries. Even after the rice Green Revolution, 4 t/ha/season was the target yield of many irrigation projects but was rarely attained. The Mwea Scheme was the only successful large irrigation scheme in East Africa (Chambers and Moris 1973) or, by some accounts, even in Africa (Biswas 1986).

The scheme experienced radical changes in its O&M institutional framework at the turn of the century; the management of the Scheme by the National Irrigation Board (NIB) was taken over by farmers’ groups in 1998 (Kabutha and Mutero 2002). The mode of O&M was further reformed in 2003 to a joint-management arrangement between NIB and farmers’ groups (water-users associations) (Baldwin et al. 2015). The farmers’ takeover of Scheme management resulted from their protests against the NIB management under which they had been treated as quasi-slave tenants with virtually no discretion as to their rice production and marketing.

This joint management by the NIB and farmers seems to have been successful, having had little effect on the Scheme’s yield performance.Footnote 7 Rice yields slightly declined from 4.8 t/ha in 1988 to 4.6 t/ha in 1997 (Table 10.3) because of the shift in rice variety from traditional Sindano, which recorded an average yield of 6 t/ha over six years, to Basmati, which had higher quality but lower yield. The average rice yields were 5.0 t/ha in 2011 and 6.2 t/ha in 2017 (averaged over two years) with recently developed high-yielding Basmati varieties. The cropping intensity has improved from earlier 1.0/year to nearly 2.0/year by 2017, mainly resulting from the introduction of water rotations and rice ratoon harvesting. It is important to note that the rice market has been well developed in Kenya since the liberalization in 1999, facilitating farmers to continue adopting improved rice varieties, modern agricultural inputs, and proper rice cultivation practices such as land preparation by tractors (Mano et al. 2022). These were in place even before the liberalization under the strict control by the irrigation bureaucracy but have come under farmers’ own discretion since then. Farmers in Mwea have received agricultural training since 1991, when it was initiated under a JICA project.Footnote 8 Also remarkable has been the recent development in rice milling technology (Chap. 12 of this volume). Therefore, the Mwea Scheme, as of 2017, could be considered a top-class irrigation scheme in SSA.

3.2 Estimation of the Project Costs for Constructing the Mwea Scheme

Expenditure data for constructing the Mwea Scheme at its initial phase from 1954 to 1968 are reported by Sandford (1973). Although the current study’s primary purpose is to estimate the total cost of constructing the Mwea Scheme as operating in 2017, we check the investment costs and its economic performance at the initial stage. We, therefore, estimate the costs of two ‘new construction’ projects, i.e., the Mwea ‘As of 1968’ Project with an irrigable area of 3,128 ha and the Mwea ‘As of 2017’ Project with 8,500 ha.Footnote 9

Table 10.4 summarizes the estimated costs for constructing the Mwea Scheme and compares them with those of twentieth-century irrigation projects. The unit project cost at the initial phase of 1954–1968 is estimated to be US$ 10,071 /ha in 2016 prices, which is higher than the average unit cost of twentieth-century ‘successful’ new construction projects in SSA, probably because the Mwea Scheme is smaller than the average system size of successful projects, at 13,000 ha (Tables 7 and 12 of Inocencio et al. 2007).Footnote 10

The total project cost to construct the Mwea Scheme as of 2017 is estimated in two steps: we first estimate the ‘Civil-work’ cost and then add the overhead costs by assuming three levels for the ratio of the total project cost to ‘Civil-work’ cost (‘TPC/CWC’ ratio).Footnote 11 For the low estimate of 1.5, the unit project cost is estimated to be US$13,706/ha, substantially higher than in the initial construction phase. This cost increase is expected because the Mwea Project 1990 both rehabilitated the existing irrigation infrastructure and constructed new ones. If the high estimate of 2.0 is applied, the unit project cost would be US$18,275/ha, which is more than twice as high as that of the twentieth-century ‘successful’ new construction projects in SSA.

4 Economic Viability of Mwea Scheme Construction

We examine the economic profitability of constructing the Mwea Scheme as of 2017 as a new scheme by estimating the IRR of the investment based on the estimated project costs. The primary purpose of this study is to examine whether it is economically worth investing in large-scale irrigation projects financed and implemented by public institutions to enhance food security in SSA. The IRR we estimate is the ‘economic’ IRR, not the ‘financial’ IRR that measures private profitability. Although the IRR is the most used method to assess both ex-ante and ex-post economic performance of large-scale irrigation projects, it has often been criticized for its many defects (Tiffen 1987; World Bank 2010). The most serious weakness is its inability to assess the sustainability of projects: benefits may decline over time, as was the case for many twentieth-century irrigation projects (Plusquellec 2019). The static nature of IRR also makes it difficult to cope with the risk and uncertainty associated with the estimation of costs and benefits. Tiffen (1987) states that given this uncertainty, an IRR of 8% or less should be ruled out as within the margin of error that could include a negative outcome. Although all these arguments remain valid, we use the IRR because’ cost–benefit analysis can be a powerful tool when appropriately applied’ (World Bank 2010, 50).

4.1 The Internal Rate of Return (IRR)

In this study, the IRR is defined as r that equates the costs and the benefits of the irrigation project, evaluated at the time of the project completion:

where K = project investment (US$/ha), R = returns from the investment (US$/ha/year), c = O&M cost (US$/ha/year), m = average gestation period of investment in years, J = the number of years during which only partial return accrues, N = lifespan of the scheme in years, and r = internal rate of return. It is assumed that the partial return, [j(R \(-\) c)/(J + 1)], increasing linearly from the year which is (J \(-\) 1) years before the project completion, eventually reaches the full return, (R \(-\) c), in the year following project completion. The returns from investment (R) received by farmers, local traders, and millers in Mwea and urban traders and retailers in Nairobi are measured as the increase in value-added (income) adjusted for the opportunity cost of the non-land inputs used in rice production:

where P = shadow price of rice in Nairobi retail market (US$/ton of milled rice), α = rice milling rate, β = value-added ratio, Y = increase in paddy production (t/ha/year) due to the project, y = paddy yield per season, and γ = cropping intensity (no. of crops/year). Since the area where Mwea Scheme was constructed had been vacant except for extensive stock grazing (Moris 1973), we assume no output in the area before the project.

Note that the costs and benefits in Eq. (10.1) are confined to those directly related to the project. There are indirect costs, such as adverse environmental effects, as well as indirect benefits, such as positive linkage and multiplier effects of increased agricultural production, both brought about by the project. These indirect costs and benefits are not included in this study, as is the case for irrigation project reports in general, because of the difficulty in obtaining necessary data.

Substituting Eq. (10.2), Eq. (10.1) can be re-written as:

The ‘r’ that satisfies Eq. (10.3) can be obtained using the Goal Seek function of Microsoft EXCEL.

Because we aim to obtain general policy implications to overcome the food security problem in sub-Saharan Africa, we assume Thai 5% broken as representative of ordinary quality rice in the world market. Thai 5% broken price is comparable to that of Pakistani long grain, which accounted for 59% of imported rice to Kenya in 2017 (International Trade Center 2022). We used the Thai 5% broken price in Tanzania and the Mombasa CIF price as a parameter value of shadow price P for the ‘As of 1968’ project as in Kikuchi et al. (2021). In this chapter, we adjust these border prices to the Nairobi retail market prices to take into account the value added generated by post-harvest marketing activities for the ‘As of 2017’ project.Footnote 12

We compare these hypothetical cases, applicable to SSA in general, with the case using the price of improved Basmati, which accounts for most rice cultivated in Mwea (Njeru et al. 2016; Mano et al. 2022; Chap. 12 of this volume), to reflect the current situations in Kenya.Footnote 13 The other variables and parameters assumed in the IRR estimation are given in Kikuchi et al. (2021) SP-M Section II, together with their data sources (SP-M Table II-1 for the ‘As of 1968’ project and ‘As of 2017’ project). Note that paddy yield parameter 9.3 t/ha/year for the ‘As of 2017’ project is obtained from our primary survey on farmers cultivating the improved Basmati, which likely underestimates yield for the high-yielding variety.

4.2 Results of Estimation

The results of the IRR estimation are summarized in Table 10.5. In the late twentieth century, the World Bank and other international donor agencies used interest rates of 10–12% as the threshold levels of the IRR, below which projects were considered unacceptable (Belli et al. 1998; Inocencio et al. 2007). The interest rate for lending has declined this century.Footnote 14 However, considering the argument that an IRR less than 8% could be within the margin of error, it is desirable for a project to have an IRR of higher than 8%, or even more preferably, than 10%.

The ‘As of 1968’ project is a ‘successful’ project, even for the lower rice price and the lower value-added ratio. Sandford (1973) estimated the project's net present value (NPV) with the lower rice price for three discount rates, 5%, 10%, and 15%. The NPV declines as the rate increases but remains positive at 15%, and its declining trend indicates that it would reach nil at the discount rate of about 18%, consistent with our estimation for value-added ratio β = 0.8 and the rice price of US$89/t.

The ‘As of 2017’ results show that the IRR is sensitive to the value-added ratio. If β = 0.8, that is, if there is no opportunity cost for non-land factors, the IRR is higher than 8% regardless of the rice price and project cost level. For β = 0.5—that is, if the opportunity costs of non-land factors are fully accounted for at market prices—the case that is closest to the contemporary Mwea situation, the IRR is lower than 8% for the low rice price of US$481 /t with any project cost level and for the medium price of US$600 /t with high project cost. The new construction of the Mwea Scheme with the irrigation infrastructure as of 2017 is not economically viable for the rice price as low as the level prevailing during the late twentieth century (Fig. 10.1). This result is consistent with the fact that costly large-scale irrigation projects mostly disappeared then (Inocencio et al. 2007). At the middle-level rice price prevailing over the last decade, the economic viability of medium- to high-cost irrigation projects could be insufficient if the value-added ratio were low. The rice price at the level prevailing during the mini rice price crisis of 2008–2013 brings up the IRR to more than 8% for the high-cost project even for β = 0.5. Using the rice price and yield that improved Basmati commands, the new construction of the Mwea Scheme is definitely economically viable. This Basmati price, if adjusted to an international price (the FOB Bangkok), is about US$1,000/t in 2016 prices, which is nearly 70% higher than the highest peak price of Thai 5% broken (US$595/t) in 2008.

4.3 Other Large-Scale Irrigation Projects in the Twenty-First Century

As noted, the Mwea Scheme is one of the most successful irrigation schemes in SSA in terms of water availability, rice yield, and cropping intensity. It is a simple river-diversion type surface irrigation scheme with no water storage capacity, making its construction cheaper than those requiring the construction of dams or the use of pumps. The investment project to construct it is successful. However, the Mwea Scheme might be an exception because of the adoption of proper rice farming intensification practices, in contrast to other large-scale unviable irrigation construction projects in SSA. Here we compare the performance of our Mwea ‘As of 2017’ project with some large-scale projects under implementation, appraisal, or study in this century. The analyses conducted for these additional large-scale irrigation projects and studies are given in SP-M Chapter IV in Kikuchi et al. (2021). We have assumed P = US$600 /t for all the cases to reflect the medium Nairobi retail market price of Thai 5% broken, rather than the high Mombasa CIF price US$550 used in the original paper.Footnote 15

Like many other large-scale irrigation schemes in SSA, the Mwea Scheme is a rice scheme in which rice is the best (i.e., most profitable) crop to be planted. Our observations clearly indicate that rice is the farmers’ most preferred crop in the scheme—not only for farmers in the main scheme, who are requested by the scheme’s central management to plant rice, but also for farmers in out-grower areas, who can cultivate any crop at their discretion, yet still plant rice without exception. Some projects to be compared in this section may include non-rice projects. In this comparison, we assess the project performance of these projects by converting their project benefits in value to rice yield (‘paddy equivalent’). It is reasonable to use rice as the standard of comparison as long as the economic performance of rice is better than, or comparable to, other staple food crops, which are important for the food security in SSA.Footnote 16

The first example is the Shire Valley Transformation Program in Malawi. The planned unit project costs of this project are US$15,000/ha, the same level as the medium estimate for the Mwea ‘As-of-2017’ project. This project is not a pure new construction project as a large part of the net irrigated area is already irrigated by pumps (World Bank 2017). To achieve an IRR of 11%, as targeted in the project appraisal report, the required performance of irrigated agriculture in the project area must be better than that of the Mwea Scheme at present: in terms of ‘paddy equivalent,’ a yield of 10.1 t/ha/year is required.Footnote 17

The second example is from several irrigation developments envisaged by the Millennium Challenge Corporation in Burkina Faso, Mali, Senegal, and Ghana, the indicative unit project costs of which are US$34,300/ha, US$17,200/ha, US$14,800/ha, and US$5,600/ha, respectively (Merrey and Sally 2017). If the target IRR of these projects is 10%, the required levels of crop performance in ‘paddy equivalent’ are 20.2, 10.1, 8.7, and 3.3 t/ha/year, respectively.Footnote 18 The projects in Burkina Faso and Mali require crop production performance beyond that of the Mwea Scheme, while the other projects are attainable with the crop production performance level of the Mwea Scheme. In particular, the performance level needed for the project in Burkina Faso is far higher than the level actually attained in the Mwea Scheme.

The third example is the ongoing Mwea Irrigation Development Project supported by JICA (the ‘Mwea Project 2022’). This is a modernization/rehabilitation project with a unit project cost of US$20,783/ha (JICA 2010), higher than our high estimate for new construction and an ex-ante IRR of 10.8%. The crop performance required to satisfy this IRR is 13.3 t/ha/year (8.7 t/ha/season) in ‘paddy equivalent,’ which exceeds the actual yield of 9.3 t/ha/year.Footnote 19

It should be noted that the unit project costs of these recent large-scale irrigation projects tend to be higher than those of the twentieth-century ‘success’ projects (Table 10.4), and yet these projects tend to aim at an IRR of more than 10%. The crop performance that satisfies the target IRR is accordingly higher than that of the last century. The Mwea case suggests the importance of adopting modern inputs and improved rice cultivation practices, which are facilitated by proper land preparation using tractors and oxen, to realize such high benefits.

A fourth example is You et al. (2010), who examine how much irrigation potential Africa would have for large-scale irrigation development if the water stored by the existing dams were diverted for irrigation.Footnote 20 They show a potential area of 15 million ha in SSA if the unit investment cost (K) is US$3,000/ha and the project selection criterion is IRR > 0%. The potential shrinks to 1.35 million ha if the selection criterion is raised to IRR > 12%. The mean IRR for the projects in SSA with IRR > 12% is 15.2%. Our follow-up calculation of IRR for K = US$8,000/ha, using their assumptions, gives IRR = 6.4% for this mean, which indicates that the economically viable potential of large-scale irrigation development in SSA would shrink from 1.35 million ha to one-half or even less, using a more plausible level of the unit investment cost. There could be some economically viable large-scale irrigation projects in SSA, but the extent of such potential projects would be tiny compared to their maximum estimate of 15 million ha.

The fifth example is You et al. (2014), who apply the same framework to Kenya. This paper states, ‘We showed that there is considerable scope for the expansion of […] dam-based […] irrigation in Kenya’ (34). They estimate the potential for large-scale irrigation development in Kenya to be 1.0 million ha if K = US$5,000/ha and IRR > 0% and 460,000 ha if K = US$8,000/ha and IRR > 12%.Footnote 21 Our follow-up calculation of the net crop return ([R–c] in Eq. 10.1), using their assumptions, reveals a possible overestimation of irrigation benefit. For example, an IRR of 74%, the highest IRR reported for a dam project for K = US$8,000/ha, requires (R–c) = US$26,000/ha/year, which is 200 t/ha/year in ‘paddy equivalent,’ a level of crop performance which, no doubt, is impossible to attain. Allowing for a possible benefit overestimation, the ‘paddy equivalent’ crop performance required for their cut-off IRR of 12% is reproduced as 11 t/ha/year, a level higher than the crop performance of the Mwea Scheme, the best irrigation scheme in Kenya, attained in 2017. All this suggests that the claimed large-scale irrigation potential should be adjusted downward accordingly.

5 Conclusions

The historical trend of the world rice price in Fig. 10.1 reminds us that the boom in irrigation investment in the last quarter of the twentieth century was induced and enhanced by repeated food crises in the 1960s and 1970s (Hayami and Kikuchi 1978). The pause in large-scale irrigation investment from the late 1990s until recently may have been due as much to the low-price regime in the world rice market—making it difficult to justify costly irrigation projects—as to concerns about the poor performance of large-scale irrigation projects.

Our exercise in evaluating the economic viability of large-scale irrigation development by estimating the costs of constructing the Mwea Scheme, one of the best irrigation schemes in SSA, as a brand-new scheme, shows that the investment performance of such a project exceeds the acceptable IRR level of 8‒10% when a high-price regime of 2008–2013 prevails in the world rice market. The results imply that medium or high rice prices, coupled with the high performance of irrigated agriculture (i.e., more than 9 t/ha/year in terms of rice yield), could justify large-scale irrigation development if the project costs are less than US$15,000/ha. Though rare, some irrigation schemes in SSA attain such high levels of crop performance. We doubt that there is significant untapped potential in SSA for large-scale irrigation developments that are economically justifiable. Should we pursue the untapped potential, however small it is?

For the answer to this question to be ‘Yes,’ many conditions must be satisfied. In the case of Mwea, proper rice cultivation training was provided since the establishment of the Mwea scheme, while the rice market has been well developed since the liberalization in 1999. Farmers have adopted modern inputs and improved rice cultivation practices facilitated by thorough land preparation using tractors and oxen since the early period of irrigation development (Veen 1973), making Kenya one of the top five SSA countries in terms of rice productivity (Chap. 1 of this volume.). These observations are consistent with the importance of proper rice cultivation training and complementary technologies, as emphasized throughout this volume (see Chaps. 2 and 7 for overviews and other chapters for specific cases).Footnote 22

Furthermore, we would ask, contra the ‘Hiding Hand’ thesis of Hirschman (1967), whether we have invented a way to overcome the ‘malevolent hiding hand’ that often works in large-scale irrigation projects. Have we found ways to prevent cost under-estimation and benefit overestimation? How to break the vicious cycle of the ‘build-neglect-rebuild’ syndrome to prevent moral hazard in scheme maintenance? What about appropriate institutional frameworks for effective O&M for scheme sustainability? The rising project overhead costs, including planning, preparing, and training for O&M, are one reason for the escalation of project costs in recent years. However, expenditures for these purposes may be insufficient to realize a good return on the investment unless sufficient resources are allocated every year after project completion to operate and maintain the scheme and to build institutional capacity for O&M. This has rarely been fulfilled.

Various other types of irrigation development have been identified and documented in SSA, which are likely to be more profitable than large-scale projects and to deliver benefits sooner (Woodhouse et al. 2017). When planning a large-scale irrigation project, a serious assessment must be made of these irrigation alternatives based on detailed grass-root studies of the area planned for the project. Unless the problems and defects inherent in large-scale irrigation development are overcome, we conclude that the promotion of such projects results in a substantial waste of resources.

Notes

- 1.

In this study, Thai 5% broken or Thai A1 super (broken rice) is taken as representative rice of ordinary quality in the world rice market, used to obtain widely applicable implications. However, farmers in Mwea cultivate high-quality Basmati 370 for sales and a small amount of high-yield variety BW196 only for home consumption.

- 2.

- 3.

This is in sharp contrast to ordinary large schemes in SSA, where rice yield ranges from 2 to 5 t/ha/season with cropping intensity generally less than 2.0 (Balasubramanian et al. 2007, 81–85).

- 4.

Long delays between signing the agreement and project implementation are common: the Bura project agreement was signed in 2007, work started in 2013. Similarly, the JICA Mwea rehabilitation project agreement was signed in 2010; work began in 2017.

- 5.

These irrigation projects, for which project costs are reported with appropriate breakdown, are selected from 314 irrigation projects in the database prepared by Inocencio et al. (2007). Their study analyzed many aspects of large-scale irrigation projects in SSA in comparison with those in other developing regions in the world but did not touch the cost structure of irrigation projects.

- 6.

For more details, see SP-M Table I-6 in Sub-section I-2–2 of the Supplementary Material (hereafter referred to as SP-M) of Kikuchi et al. (2021).

- 7.

Under the Irrigation Act No. 14 2019, NIB was replaced by a new National Irrigation Authority with a broader mandate than NIB had.

- 8.

31 May 2022 interview of Mr. Masato Tamura, who was a JICA training specialist in the early 90 s.

- 9.

For the details of the cost estimation, see SP-M Section I-1 of Kikuchi et al. (2021) for ‘As of 1968’ Project and SP-M Section I-2 for ‘As of 2017’ Project.

- 10.

In this study, as in Inocencio et al. (2007), a large-scale irrigation project is considered ‘successful’ if its ex-post IRR \(\ge \) 10%.

- 11.

For details in the estimation of the ‘Civil-work’ cost and the overhead costs, see SP-M Sub-section I-2–1 and Sub-section I-2–2 of Kikuchi et al. (2021), respectively.

- 12.

To obtain the Nairobi retail price, we added the importers’ handling charge and margin (assuming 10% based on Kikuchi et al. 2016b), transport costs from Mombasa to Nairobi (550 km) in a 20 t container at the assumed rate of US$ 0.11/t/km (Rashid and Minot 2010), and the retailer margin at the rate of 1.08 (Kikuchi et al. 2016a) to the Mombasa CIF price (Kikuchi et al. 2021).

- 13.

The price of improved Basmati used is its Nairobi retail market price adjusted down for the rice tariff and its related costs in the same manner adopted for Thai 5% broken.

- 14.

The Bank’s interest rate in the 2010s is lower than these averages, ranging about 1% in 2014 to about 5% in 2018 (World Bank 2020b).

- 15.

The analyses conducted for these additional large-scale irrigation projects and studies are given in SP-M Section IV of Kikuchi et al. (2021). Common assumptions on variables and parameters to estimate IRR, or the crop performance required to attain the planned IRR of these projects and studies, are presented in SP-M Table IV-1.

- 16.

See the SP-M Sub-section IV-3 in Kikuchi et al. (2021) for further justifications for using rice as the standard of comparison.

- 17.

See SP-M Table IV-2 in Kikuchi et al. (2021) for the results of our analyses of the Shire Valley Project, variables and parameters assumed, analyses conducted, and data sources. Two-thirds of the target area is newly developed fields, while the rest is improvement of fields that used to have one cycle of 2t/ha/crop.

- 18.

See SP-M Table IV-3 in Kikuchi et al. (2021) for Millennium Challenge Corporation’s projects.

- 19.

For JICA Mwea Rehabilitation Project, see SP-M Table IV-4 in Kikuchi et al. (2021).

- 20.

- 21.

For details of our additional examination of You et al. (2014) data, see SP-M Sub-section IV-2-2 and SP-M Table IV-6.

- 22.

Chapters 3–6 of this volume provide new evidence on the impact of training by agricultural extension in the intensification of rice production in Tanzania, Cote d’Ivoire, Mozambique, and Uganda. We confirm that positive impacts of training were realized even without any improvement in irrigation, marketing, or credit programs.

References

Adams WM (1990) How beautiful is small? Scale, control and success in Kenyan irrigation. World Dev 18(10):1309–1323

Balasubramanian V, Sie M, Hijimans RJ, Otsuka K (2007) Increasing rice production in sub-Saharan Africa: challenges and opportunities. Adv Agron 94:55–133

Baldwin E, Washington-Ottombre C, Dell’Angelo J, Cole D, Evans T (2015) Polycentric governance and irrigation reform in Kenya. Governance September 2015. https://doi.org/10.1111/gove.12160

Barker R, Herdt RW, Rose B (1985) The rice economy of Asia. Resources for the Future and IRRI, Washington, D.C. and Manila

Bartier B, Jamin JY, Ouedraogo H, Diarra A, Barry B (2014) Irrigation investment trends and economic performance in the Sahelian countries in West Africa. In: Namara R, Sally H (eds) Irrigation in West Africa: current status and a view to the future. IWMI, Colombo, p 21–35

Belli P, Anderson J, Barnum H, Dixon J, Tan JP (1998) Handbook on economic analysis of investment operations. UNDP. https://www.adaptation-undp.org/sites/default/files/downloads/handbookea.pdf

Biswas AK (1986) Irrigation in Africa. Land Use Policy 3(4):269–285

Borgia C, García-Bolaňosa M, Li T, Gómez-Macpherson H, Comas J, Connor D, Mateos L (2013) Benchmarking for performance assessment of small and large irrigation schemes along the Senegal Valley in Mauritania. Agric Water Manag 121(C):19–26

Burney JA, Naylor RL, Postel SL (2013) The case for distributed irrigation as a development priority in sub-Saharan Africa. PNAS 110(31):12513–12517

Chambers R (1969) Settlement schemes in tropical Africa. Routledge and Kegan Paul, London

Chambers R (1973) The history of the scheme. In: Chambers R, Moris J (eds) Mwea: An irrigated rice settlement in Kenya. Weltforum Verlag, Munich, pp 64–78

Crow-Miller B, Webber M, Molle F (2017) The (re)turn to infrastructure for water management? Water Altern 10(2):195–207

de Fraiture C, Giordano M (2014) Small private irrigation: a thriving but overlooked sector. Agric Water Manag 131(C):167–74 https://doi.org/10.1016/j.agwat.2013.07.005

Diao X, Headey D, Johnson M (2008) Toward a green revolution in Africa: What would it achieve, and what would it require? Agric Econ 39(S1):539–550

Ejeta G (2010) African Green Revolution needn’t be mirage. Science 327:831–832

Estudillo JP, Otsuka K (2012) Lessons from the Asian Green Revolution in rice. In: Otsuka K, Larson DF (eds) An African Green Revolution: finding ways to boost productivity on small farms. Springer, New York and London, pp 17–42

FAO and WFP (2022) Hunger hotspots. FAO-WFP early warnings on acute food insecurity: June to September 2022 Outlook. Rome. https://docs.wfp.org/api/documents/WFP-0000139904/download/?_ga=2.13574004.2134344741.1654890341-67065628.1637678351

Fujiie H, Maruyama A, Fujiie M, Takagaki M, Merrey DJ, Kikuchi M (2011) Why invest in minor projects in sub-Saharan Africa? an exploration of the scale economy and diseconomy of irrigation projects. Irrig Drain 25(1):39–60

Harrison E (2018) Engineering change? the idea of ‘the scheme’ in African irrigation. World Dev 111:246–255

Hayami Y, Kikuchi M (1978) Investment inducements to public infrastructure: irrigation in the Philippines. Rev Econ Stat 60:70–77

Higginbottom TP, Adhikari R, Dimova R, Redicker S, Foster T (2021) Performance of large-scale irrigation projects in sub-Saharan Africa. Nat Sustain 4(6):501–508. https://doi.org/10.1038/s41893-020-00670-7

Hirschman AO (1967) Development projects observed. The Brookings Institution, Washington, DC

Huppert W, Svendsen M, Vermillion DL (2003) Maintenance in irrigation: multiple actors, multiple contexts, multiple strategies. Irrig Drain 17(1–2):5–22

Inocencio A, Kikuchi M, Tonosaki M, Maruyama A, Merrey D, Sally H, de Jong I (2007) Costs and performance of irrigation projects: a comparison of sub-Saharan Africa and other developing regions. IWMI Research Report 109. International Water Management Institute

International Trade Center (2022) Trade map: trade statistics for international business development. https://www.trademap.org/Bilateral_TS.aspx?nvpm=1%7c404%7c%7c586%7c%7c1006%7c%7c%7c4%7c1%7c1%7c1%7c2%7c1%7c1%7c1%7c1%7c1. Accessed 13 Aug 2022

IRRI (2000) World rice statistics. International Rice Research Institute, Manila

JICA (1988) Kenya kyowakoku Mwea-chiku kangai keikaku jizen chosa hokokusho [Preliminary-survey report on irrigation plan of Mwea area in the Republic of Kenya]. Japan International Cooperation Agency, Tokyo. http://open_jicareport.jica.go.jp/pdf/10729622.pdf. Accessed 13 Jan 2020

JICA (1989) Basic design study report on the project for Mwea Irrigation Settlement Scheme Development in the Republic of Kenya. Japan International Cooperation Agency, Tokyo. http://open_jicareport.jica.go.jp/833/833/833_407_10759017.html. Accessed 13 Jan 2020

JICA (1997) Kenya Mwea kangai nogyo kaihatsu keikaku gaiyo [Mwea Irrigation Agricultural Development Project: Outline]. The Japan International Cooperation Agency, Tokyo. http://open_jicareport.jica.go.jp/pdf/11440146_01.pdf. Accessed 13 Jan 2020

JICA (2010) Mwea kangai kaihatsu jigyou Jizen hyouka hyo [Project appraisal list: Mwea Irrigation Development Project]. https://www2.jica.go.jp/ja/evaluation/pdf/2010_KE-P27_1_s.pdf. Accessed 17 Jan 2020

JICA Research Institute & Nippon Koei (2018) Estimation of construction cost for Mwea Irrigation Development Project: an Empirical Analysis of Expanding Rice Production in Sub-Sahara Africa Phase 2 (Final report). JICA Research Institute, Tokyo

Jones WJ (1995) The World Bank and irrigation. The World Bank, Washington, DC

Kabutha C, Mutero C (2002) From government to farmer-managed smallholder rice schemes: the unresolved case of the Mwea Irrigation Scheme. In: Blank HG, Mutero CM, Murray-Rust H (eds) The changing face of irrigation in Kenya. IWMI, Colombo. http://publications.iwmi.org/pdf/h030840.pdf

Kikuchi M, Haneishi Y, Tokida K, Maruyama A, Asea G, Tsuboi T (2016a) The structure of indigenous food crop markets in sub-Saharan Africa: the rice market in Uganda. J Dev Stud 52(5):646–664

Kikuchi M, Haneishi Y, Maruyama A, Tokida K, Asea G, Tsuboi T (2016b) The competitiveness of domestic rice production in East Africa: a domestic resource cost approach in Uganda. J Agric Rural Dev Trops Subtrop 117(1):57–72

Kikuchi M, Mano Y, Njagi TN, Merrey D, Otsuka K (2021) Economic viability of large-scale irrigation construction in Sub-Saharan Africa: What if Mwea Irrigation scheme Were constructed as a brand-new scheme? J Dev Stud 57(5):772–789. https://www.tandfonline.com/doi/full/10.1080/00220388.2020.1826443

KNA (2018, Nov 14) Hope for farmers as Sh7.35B irrigation project set to be revived. Business Today. https://businesstoday.co.ke/hope-farmers-sh7-35-billion-gravity-irrigation-project-set-revived/

Lankford B, Makin I, Matthews N, McCornick PG, Noble A, Shah T (2016) A compact to revitalise large-scale irrigation systems using a leadership-partnership-ownership “Theory of Change.” Water Altern 9:1–32

Lefore N, Giordano M, Ringler C, Barron J (2019) Sustainable and equitable growth in farmer-led irrigation in sub-Saharan Africa: What will it take? Water Altern 12(1):156–168

Mano Y, Njagi TN, Otsuka K (2022) An inquiry into the process of upgrading rice milling services: the case of Mwea Irrigation Scheme in Kenya. Food Policy 106(C)

Merrey DJ, Sally H (2017) Another well-intentioned bad investment in irrigation: the millennium challenge corporation’s “compact” with the Republic of Niger. Water Altern 10:195–203

Moigne GL, Barghouti S (1990) How risky is irrigation development in sub-Saharan Africa? In: Barghouti S, Moigne GL (eds) Irrigation in sub-Saharan Africa: the development of public and private systems. World Bank Technical Paper 123, p 45–59

Moris J (1973) The Mwea environment. In: Chambers R, Moris J (eds) Mwea: an irrigated rice settlement in Kenya. Weltforum Verlag, Munich, pp 16–63

Moris J (1986) Irrigation as a privileged solution in African development. Dev Pol Rev 5:99–123

Nakano Y, Bamba I, Diagne A, Otsuka K, Kajisa K (2012) The possibility of a rice Green Revolution in large-scale irrigation schemes in sub-Saharan Africa. In: Otsuka K, Larson DF (eds) An African Green Revolution: finding ways to boost productivity on small farms. Springer, New York and London, pp 43–70

NEPAD (2003) Comprehensive Africa agricultural development programme (CAADP). New Partnership for Africa’s Development, Midrand, South Africa. https://www.nepad.org/caadp/publication/au-2003-maputo-declaration-agriculture-and-food-security. Accessed 20 July 2019

NIB (2010) Final design report: consultancy for detailed design, tender documents preparation and construction supervision. Mwea Irrigation Scheme Water Management Improvement Project, vol 1. GIBB Africa Ltd., Nairobi

NIB (2018) Bura irrigation rehabilitation project. National Irrigation Board (Kenya). https://nib.or.ke/projects/flagship-projects/bura-gravity-project

Njeru TN, Mano Y, Otsuka K (2016) Role of access to credit in rice production in sub-Saharan Africa: the case of Mwea Irrigation Scheme in Kenya. J Afr Econ 25(2):300–321

Olivares J (1989) The agricultural development of sub-Saharan Africa: the role and potential of irrigation. Nat Resour Forum 13(4):268–274. https://doi.org/10.1111/j.1477-8947.1989.tb00349.x

Ostrom E (1992) Crafting institutions for self-governing irrigation systems. ICS Press and Institute for Contemporary Studies, San Francisco, California

Otsuka K, Larson DF (2012) Towards a green revolution in sub-Saharan Africa. In: Otsuka K, Larson DF (eds) An African Green Revolution: finding ways to boost productivity on small farms. Springer, New York and London, pp 281–300

Plusquellec H (2019) Overestimation of benefits of canal irrigation projects: decline of performance over time caused by deterioration of concrete canal lining. Irrig Drain 68(3):383–388

Rashid S, Minot N (2010) Are staple food markets in Africa efficient? Spatial price analyses and beyond. Paper presented at the COMESA policy seminar “Food price variability: causes, consequences, and policy options” on January 25–26 2010 in Maputo, Mozambique under the COMESA-MSU-IFPRI African Agricultural Markets Project (AAMP). https://www.researchgate.net/publication/46470919_Are_Staple_Food_Markets_in_Africa_Efficient_Spatial_Price_Analyses_and_Beyond

Reliefweb (2007) Kenya: Kuwait finances the Bura Irrigation and Settlement Scheme Rehabilitation Project. Report from Government of Kenya on Dec 13 2007. https://reliefweb.int/report/kenya/kenya-kuwait-finances-bura-irrigation-and-settlement-scheme-rehabilitation-project. Accessed July 20 2019

Rockström J, Lannerstad M, Falkenmark M (2007) Assessing the water challenge of a new green revolution in developing countries. PNAS 104:6253–6260

Sanchez P, Denning G, Nziguheba G (2009) The African Green Revolution moves forward. Food Secur 1:33–44

Sandford S (1973) An economic evaluation of the scheme. In: Chambers R, Moris J (eds) Mwea: an irrigated rice settlement in Kenya. Weltforum Verlag, Munich, pp 393–438

Suhardiman D, Giordano M (2014) Is there an alternative for irrigation reform? World Dev 57:91–100

Tiffen M (1987) Dethroning the internal rate of return: the evidence from irrigation project. Dev Policy Rev 5:361–377

Veen JJ (1973) The production system. In: Chambers R, Moris J (eds) Mwea: an irrigated rice settlement in Kenya. Weltforum Verlag, Munich, pp 99–131

Veldwisch G, Bolding A, Wester P (2009) Sand in the engine: the travails of an irrigated rice scheme in Bwanje valley, Malawi. J Dev Stud 45:197–226

WFP (2022) 2022 Global report on food crises: Joint Analysis for Better Decisions. https://docs.wfp.org/api/documents/WFP-0000138913/download/?_ga=2.226221786.1379254128.1660037865-461457561.1660037865. Accessed 9 Aug 2022

WCD (2000) Dams and development. The World Commission on Dams. Earthscan, Webber, London. https://www.internationalrivers.org/sites/default/files/attached-files/world_commission_on_dams_final_report.pdf. Accessed 20 July 2019

Woodhouse P, Veldwish GJ, Venot JP, Brockington D, Komakech H, Manjichi A (2017) African farmer-led irrigation development: reframing agricultural policy and investment? Peasant Stud 44:213–233

World Bank (1990) Bura irrigation settlement project; Project completion report. http://documents.worldbank.org/curated/en/503041468046825515/pdf/multi-page.pdf. Accessed 20 July 2019

World Bank (2005) Shaping the future of water for agriculture: a sourcebook for investment in agricultural water management. http://siteresources.worldbank.org/INTARD/Resources/Shaping_the_Future_of_Water_for_Agriculture.pdf. Accessed 20 July 2019

World Bank (2007) Investment in agricultural water for poverty reduction and economic growth in sub-Saharan Africa. http://siteresources.worldbank.org/RPDLPROGRAM/Resources/459596-1170984095733/synthesisreport.pdf. Accessed 20 July 2019

World Bank (2010) Cost-benefit analysis in World Bank projects. http://documents.worldbank.org/curated/en/253101468340140595/pdf/624700PUB0Cost00Box0361484B0PUBLIC0.pdf. Accessed 25 Jan 2020

World Bank (2017) Malawi–Shire valley transformation program. http://documents.worldbank.org/curated/en/379081508551260039/pdf/Malawi-Project-Appraisal-Document-PAD-09282017.pdf. Accessed 20 July 2019

World Bank (2019) World Bank commodity price data (Updated on January 04, 2019). pubdocs.worldbank.org/en/226371486076391711/CMO-Historical-Data-Annual.xlsx. Accessed 20 July 2019

World Bank (2020a) World development indicators. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD https://data.worldbank.org/indicator/NY.GDP.MKTP.KD https://data.worldbank.org/indicator/PA.NUS.FCRF?locations=KE-JP&view=chart. Accessed 23 Jan 2020a

World Bank (2020b) Lending rates & fees. https://treasury.worldbank.org/en/about/unit/treasury/ibrd-financial-products/lending-rates-and-fees#a. Accessed 20 Oct 2020b

You L, Ringler C, Nelson G, Wood-Sichra U, Robertson R, Wood S, Guo Z, Sun Y (2010) What is the irrigation potential for Africa? A combined biophysical and socioeconomic approach. IFPRI Discussion Paper 00993

You L, Xie H, Wood-Sichra U, Guo Z, Wang L (2014) Irrigation potential and investment return in Kenya. Food Policy 47:34–45

Zwart SJ (2013) Assessing and improving water productivity of irrigated rice systems in Africa. In: Wopereis MCS et al (eds) Realizing Africa’s rice promise. CABI International, Boston, USA, p 265–275

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License (http://creativecommons.org/licenses/by-nc-nd/4.0/), which permits any noncommercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if you modified the licensed material. You do not have permission under this license to share adapted material derived from this chapter or parts of it.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 JICA Ogata Sadako Research Institute for Peace and Development

About this chapter

Cite this chapter

Kikuchi, M., Mano, Y., Njagi, T.N., Merrey, D.J., Otsuka, K. (2023). Irrigation in Kenya: Economic Viability of Large-Scale Irrigation Construction. In: Otsuka, K., Mano, Y., Takahashi, K. (eds) Rice Green Revolution in Sub-Saharan Africa. Natural Resource Management and Policy, vol 56. Springer, Singapore. https://doi.org/10.1007/978-981-19-8046-6_10

Download citation

DOI: https://doi.org/10.1007/978-981-19-8046-6_10

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-8045-9

Online ISBN: 978-981-19-8046-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)