Abstract

This article aims to examine the literature on digital transformation in the banking sectors and the current commercial banks’ digital transformation landscape in Vietnam. The paper provides examples of some local commercial banks to show that digital banking should be considered an integral part of smart cities. The paper also analyzes the challenges facing Vietnamese banks in their digitalization process to become smarter banks. Next, the study makes some recommendations about how to leverage the digitalization process in the Vietnamese banking system. It can be concluded from this research that digital transformation is key to the banking industry creating value for the customer and keeping pace with innovation in smart cities where people expect real-time, instant gratification. This paper also suggests further research directions.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

9.1 Introduction

In today’s world, the new metric for developed economies is no longer Gross Domestic Product (GDP) or economic growth, but the ability to enable automation, invest in smart infrastructure, capitalize transformation, and leverage new technologies to become smart economies. Banks with their financial services are a key part of the infrastructure of smart economies. To perform significant roles in smart economies, they have to address their digitalization process as a matter of urgency if they are not to be left behind in a market that finds itself in the full throes of transformation. In Vietnam, the digital transformation of the banking system is expected to change the management of banks to be leaner and smarter to fit into a world where technology is pervasive and ubiquitous as well as to support the ambition of smart cities.

A strong wave of digital transformation in the Vietnamese banking system has taken place in the last three years. Most Vietnamese banks have either implemented or are in the process of developing their digital transformation strategies. There are three basic approaches to the digital transformation of banking in Vietnam. The first involves the digitalization of front-end channel developments. The second approach is focusing on digital transformation in the internal process. The third approach is a combination of the first and the second along with the development of stand-alone, digital-only banks. Given the analytic framework of the banking digitalization process in Vietnam, a case study of some Vietnamese commercial banks indicates that banks must transform to provide embedded banking utility driven by behavior, location, sensors, machine learning, and artificial intelligence (AI). This transformation is essential for smart cities to thrive and develop.

After reviewing the current landscape, the article considers the challenges of Vietnamese banks in their digitalization. The foremost challenge is legal framework—a major barrier to accelerating digital transformation in Vietnam. Network security is also an obstacle for the process of digitalization in banking, due to increasing operational fraud, customer fraud, cyberattacks on banking infrastructure, and leaked user data. In addition, Industrial Revolution 4.0 and the Fintech trend promote strong competition for banks. Fintech companies are posing challenges for the banking community by attracting customers and expanding market share, especially in online lending transactions and peer-to-peer lending. The study makes some recommendations to overcome the challenges and leverage the digitalization process in the Vietnamese banking system. It can be concluded from this research that digital transformation is the key for the banking industry to create value for the customer, keep pace with innovation, and perform their role in promoting the development of smart cities.

9.2 Digital Transformation in Banking Concepts

Digital transformation changes the whole business landscape of any organization, regardless of industry, size, maturity, or market. Researchers and practitioners interpret the concept of digital transformation in different ways. While Westerman et al. refer to digital transformation as the “use of technology in order to radically improve performance or reach of enterprises” (2011, p 12), experts at Pricewaterhouse Coopers contend that this process “establishes new technologies based on the Internet with a fundamental impact on the society as a whole” (2013, p 25). Westerman et al. also believe that digital transformation is an “on going digital evolution both strategically and tactically” (2011, p 23).

To maintain the banking industry’s competitiveness, traditional banks should become more agile, embrace innovative culture, and focus on the simplification of providing services anytime in any place to potential clients (Mirković and Lukić 2015). To achieve all those goals, banks found new support in modern big dataFootnote 1 technologies. For many organizations, especially banks, big data and data analytics technologies represent a new source of competitive advantage. Digital banking transformation involves the integration of data, advanced analytics, and digital technology into all areas of a financial institution, changing the way work is done, priorities are set, and services are delivered (Australian Government 2020).

Experts at Pricewaterhouse Coopers contend that “digital transformation is used to influence three organisational dimensions” (2013, p 36). The first or external dimension, means “focusing on customer experience digitally.” The second or internal dimension means “the organisational processes and structures.” The third or global dimension, means “all sectors and functions.” In general, digital transformation leads to superior performance by influencing organizational dimensions “internally, externally, and comprehensively.” In banks, there are three levels of digital transformation, namely front-end only, wrap and digitize, and go digital native as shown in Fig. 9.1 (Pham Tien Dung 2020).

9.2.1 Digitize Front-End Only

The simplest approach of digital transformation is the front-end only, focusing on the primary ways a customer interacts with a bank, such as website and app. Mostly a cosmetic fix, digitizing the front-end only means the bank designs an appealing mobile app and web interface but keeps the organization’s workflows, culture, and back-end infrastructure intact.

Fixing the front-end might help reduce customer churn. However, the gains may not last if the back-end cannot meet or exceed customer expectations. In fact, costs could increase if banks must add employees to maintain the new digital front-end or assign an additional Information Technology (IT) team to design and build solutions to fulfill customer requests. In the long run, digitizing the front-end without making additional investments could cost more than sticking with the status quo. Still, it is a starting point for banks facing budget or organizational constraints that hinder a more extensive transformation.

9.2.2 Wrap and Digitize

With the wrap and digitize approach, banks fix the front-end and go one step further, gradually replacing legacy infrastructure with digital technology, integrating the middle and back offices along the way. In this approach, employees might be transitioned to higher-value roles in new centers of excellence, as this conversion eliminates the need for certain manual tasks. As wrap and digitize focuses on individual improvements, it can take some time before the full scope of the bank’s processes has been overhauled.

9.2.3 Go Digital Native

In this approach, financial institutions build digital native banks that fully utilize digital customer interfaces and back-end. This strategy can deliver significant cost savings as well as the ability for the bank to adapt quickly when change comes.

Reducing costs is one reason to go digital native, but the main reason is enhancing agility. Digital native lets banks adapt to rapidly changing customer tastes, and furthermore, it allows them to test and iterate. The digital core and open architecture also allow flexible approaches for partnering with third parties to offer a range of products and services. It is possible to set up a fully functional, digital native bank using third-party architecture in the cloud.

Over the last 50 years, with the development of technology, the banking system has witnessed significant changes. We have moved from the branch as the only channel available for access to banking services to multi-channelFootnote 2 and then omni-channelFootnote 3 capability, corresponding to the different levels of digitalization. At the first level, banks are simply adding technology on top of the old traditional banking model, and the final level takes banks to digital omni-channel for customers exclusively accessing banking via digital. Understanding these three levels allows us to figure out the road map for Vietnamese banks to retrofit into smart cities. It is obvious that, like every other service platform, banking is being placed in smart economies that expect real-time, instant gratification.

9.3 The Current Commercial Banks’ Digital Transformation Landscape in Vietnam

In the last five years in Vietnam, branch-based expansion is no longer a target strategy of banks, and there has been a considerable need to facilitate access to the core utility of the bank. This need, combined with the design possibilities afforded by technologies like mobile, allowed for some spectacular rethinking of how banking could be better embedded in smart cities. The current landscape in banking digital transformation gives us a concise overview of the positions of Vietnamese banks in the process of technological adaption.

Vietnam’s banking sector consists of four state-owned commercial banks, 31 joint-stock commercial banks, nine wholly-foreign-owned banks, two joint-venture banks, two policy banks and one cooperative bank. In addition, there are 48 foreign bank branches currently operating in Vietnam (see Fig. 9.2).

Source State Bank of Vietnam (2020)

Vietnamese banks by assets 2019.

Vietnam has many favorable conditions for the development of digital banking, thanks to its population of 96 million people with a golden population structure (56 million people participating in the labor market) (General Statistics Office of Vietnam 2020). According to the report of the payment department of the State Bank of Vietnam (SBV), in 2019, Vietnam’s online population reached a total of 64 million internet users. E-commerce sales have a high growth rate of 30% a year. Seventy two percent of the Vietnamese population owns a smartphone but most Vietnamese—69% of the adult population—do not have a bank account. At the same time, Vietnam has a technical foundation for digital banking development with almost 19,000 ATMs and 270,000 point-of-sale (POS) terminals in place in 2019. To date, 78 banks offer internet payment solutions. Mobile payment is available at 47 banks, and 29 banks accept quick response (QR) code payment with 30,000 QR code payments in 2019 (see Fig. 9.3).

Source State Bank of Vietnam (2020)

Vietnamese payment system.

Real-time payment systems are enabled by the National Payment Corporation of Vietnam (NAPAS) while the National Credit Information Center of Vietnam (CIC) provides credit information infrastructure. The country’s national identification database is still under development.

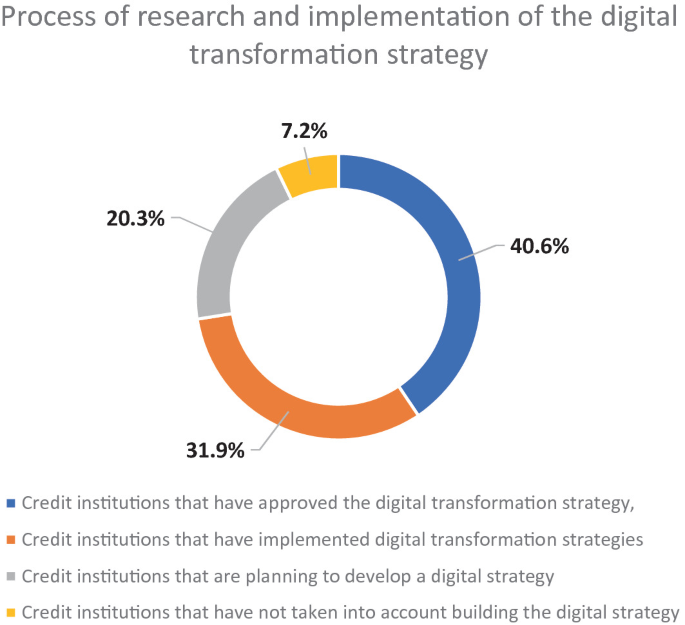

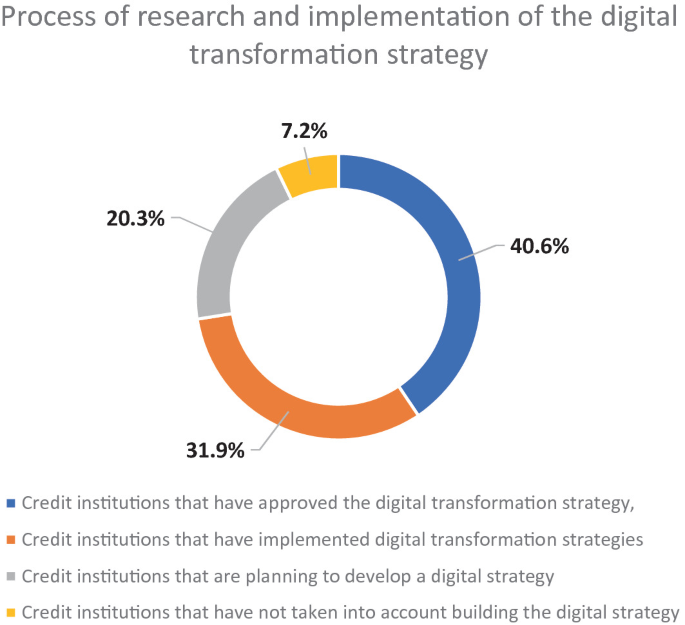

In Vietnam, a strong wave of digital transformation has taken place within banks in the last three years. The majority of Vietnamese banks have either implemented or are in the process of developing their digital transformation strategies. In fact, by the end of 2019,

-

40.6% of Vietnamese credit institutions have approved the digital transformation strategy;

-

31.9% have implemented the digital transformation strategy;

-

20.3% are planning to develop a digital strategy;

-

and only 7.2% of the credit institutions have not taken into account building the digital strategy (see Fig. 9.4).

Fig. 9.4

Source State Bank of Vietnam (2020)

Process of research and implementation of the digital research strategy.

With the planning of digital strategies, Vietnamese commercial banks expect to reap the benefits of digital transformation in the next three to five years. While 82.5% of banks expect revenue growth of at least 10%, 58.1% of banks expect that over 60% of customers will use digital channels, and 44.4% of banks expect the customer growth rate to be more than 50%.Footnote 4

Currently, about 70% of credit institutions have average willingness to deploy technologies such as Open API, Data Analytics, ISO 20022, and Mobility (see Fig. 9.5).

Source State Bank of Vietnam (2020)

The level of technology availability.

Pham Tien Dung (2020) pointed out that there are three basic approaches to the digital transformation of banking in Vietnam.13 The first involves the digitalization of front-end channel developments and includes innovation in mobile banking, e-know your customer (eKYC), QR code payment, virtual assistants/chatbots, and 24/7 call centersFootnote 5 (front-end only).

The second approach focuses on digital transformation in the internal process with developments including online real-time trading systems, robotic process automation, and the application of artificial intelligence and third-party data in risk management (wrap and digitize). Digitizing the information database and the utilization of technologies and tools such as big data warehousing, automated data collection, cloud computing, data analytics, artificial intelligence, open application programming interface (API) and blockchain are still in their infancy. However, looking forward, they present significant growth potential.

The third approach is a combination of the first and the second along with the development of stand-alone, digital-only banks (go digital native). TPBank and Vietinbank are examples of the first approach while Vietcombank and Techcombank are examples of the second approach. TPBank and Vietinbank operate on an omni-channel platform to ensure a consistent customer experience. They aim to become smarter at analyzing customer behavior and obtaining customer insights. This will enable them to provide personalized products and services and, in turn, gain a competitive advantage in the market (Australian Government 2020).

VPBank, with the launch of the digital-only bank Timo (Timo is now cooperating with Bản Việt Bank), as well as the recently launched YOLO are two examples of the third approach.

Notable Initiatives of Digital Transformation in Banking in Vietnam

LiveBank: TPBank

TPBank launched LiveBank in 2017. The bank provides 24/7 automated banking services through approximately 250 LiveBank stations nationwide. LiveBank offers the usual functions of an ATM. Additionally, customers can open new deposit accounts, scan thumbprints, and obtain new debit cards on the spot. LiveBank applies innovative technologies such as eKYC, optical character recognition (OCR), QR code, cash recycler, and biometrics.

iPay: A Mobile Banking App from Vietinbank

Vietinbank launched the latest version of its iPay mobile banking app in December 2019. The bank added 50 new functionalities and improved the user experience through consumer deals, high speed, and strong security.

Timo: A Fully Digital Bank

Through the strategic partnership with VP Bank, Timo was launched in 2016 as Vietnam’s first digital lifestyle bank. This service includes a mobile app and allows customers to request a new debit card. Two of Timo’s unique functions are its versatile online account management and “Timo Hangouts,” which are described as laid-back “atmosphere spaces” instead of traditional bank branches. New customers can make an appointment to attend a “Timo Hangout” to complete KYC requirements.

BIDV: Digital Banking Centre

BIDV established its Digital Banking Centre in 2019 as an innovation hub to build advanced and modern customer-centric products. BIDV launched the “BIDV Home” mobile app, allowing customers to get a home loan easily with mobile devices. Using BIDV Home, customers can apply for BIDV-financed housing loans at competitive interest rates, get consultation online before visiting a transaction office, and track the loan application progress.

9.4 Challenges in Banking Digital Transformation

The current banking transformation landscape demonstrates that Vietnamese banking systems are adapting to the smart world by removing friction and enabling utility to offer better margins, better customer satisfaction, and more dynamic scaling potential. However, the data also reveals that most Vietnamese banks are at the first and second level of digital transformation. To reach the highest level, native digital, banks face major challenges.

9.4.1 Legal Framework

The incomplete legal framework is a major barrier to digital banking transformation in Vietnam. There has been a widening gap between the velocity of financial markets and regulatory change. Although the Vietnamese government and its regulators support and encourage industry adoption of advanced technologies, the regulators have elaborated on rigid regulatory systems built in an analog era where everything was paper-based. This system has worked well in the past, but some features make them ill-suited to today’s challenges. We need to create digitally-native regulation to regulate digital markets and to deploy new technology in the regulatory process.

In March 2017, the SBV established the Fintech Steering Committee. The committee was set up to study and improve the fintech ecosystem and to create an enabling framework to support digital transformation in banking and fintech development in Vietnam. In August 2018, the prime minister of Vietnam issued Decision 986/QD-TTg approving the “development strategy for the Vietnam banking industry to 2025 with the vision toward 2030” (the Banking Strategy). In January 2019, Decision 34/QD-NHNN was published. This decision outlined an action plan to implement the Banking Strategy.

The government of Vietnam has also introduced broader reforms to support the growth of digital banking and financial services. In December 2018, for example, SBV issued Decision 2617/QĐ-NHNN on the “action plan of the banking industry to realize Directive 16/CT-TTG of the government on enhancing the nation’s capability to embrace the 4th industrial revolution technologies by 2020 with the vision towards 2025.”

Although these efforts to retrofit the regulatory system have gained notable successes, Vietnamese financial regulatory frameworks are still risk-adverse, deliberate, and clear. While the government has mandates to promote goals like competition and financial inclusion, the SBV still has as its primary mission to detect and address risk to the financial system and its customers. They are not meant to spot new digital products and services that deserve a regulatory amendment. Despite the development of autonomous networks, smart contracts, smart assets, and infrastructure in finance areas, Vietnam has not yet completed the legal framework for banks to share, store, and exploit data with services such as banking, telecommunications, and insurance. Vietnam is challenged to respond to the accelerated digital transformation by creating clear legal frameworks for user data and information security.

In the future, further regulations should be introduced to improve IT and payment infrastructure and optimize ATM and POS networks. Law should be adopted to tighten information protection and cyber security. It is also important to institute regulatory frameworks to foster the development of digital banking and the fintech ecosystem associated with comprehensive financial inclusion.

9.4.2 Network Security

In Vietnam, along with the rise of smart cities, there is greater need for cybersecurity as more businesses and consumers engage in the digital economy, and as critical systems such as finance and government are increasingly digitalized. In the 2017 Global Cybersecurity Index, Vietnam ranked 101 out of 193 nations (International Telecommunication Union 2017). As well, in 2016 the proportion of computers affected by dangerous viruses in Vietnam was 63.2%, three times the global average. According to the BKAV Corporation—an IT company and network security expert—the cost of cyberattacks in Vietnam increased by 15% to US$540 million between 2016 and 2017 (BKAV 2017).

In banking, security risks such as fraud, customer fraud, cyberattacks on banking infrastructure and leaked user data are increasing. According to Ernst and Young (2018), 8319 cyberattacks occurred on banks last year and 560,000 computers were affected by malware capable of stealing bank account information. Banks faced losses of US$642 million caused by computer viruses, while only 52% of customers worried about security while using online banking.

The banking digitalization process along with the evolution of the payment space means regulators will have to deal with increasingly diverse types of value stores and payment vehicles, many of them exposed to security risks. What we need at a minimum is country-wide AI-based monitoring to keep criminals and terrorists out of the financial system.

Another solution for increasing network security is cybersecurity education, which is quite new in Asian countries including Vietnam and has not been adequately focused. A 2015 survey by ESET indicated that 78% of internet users in Asia do not have any formal cybersecurity education (ESET 2015). Low capability makes the region vulnerable to cyberattacks, especially Vietnam. Cybersecurity training programs should be organized frequently in cybersecurity training centers. Antivirus software for homes, businesses, and smartphones and public digital signature verification services should be developed by IT companies such as BKAV Corporation and CMC.

9.4.3 The Participation of Fintech and Bigtech Companies

Industrial revolution 4.0 and the Fintech trend promote strong competition. Fintech companies are posing great challenges for the banking community by attracting customers and expanding market share, especially in online lending transactions and peer-to-peer lending, areas that were formerly considered traditional businesses handled in the past by commercial banks. Therefore, if commercial banks do not continue to proactively apply new technology, invest in modern equipment, and set up cooperation with Fintech companies, they will be left behind in the technology competition.

9.5 Conclusions

Increased use of computers, machine learning, robots, and artificial intelligence in all spheres and aspects has significantly changed modern banking business in smart cities. The growth of banks will unblock bottlenecks to promote the development of smart cities. Banks and governments should react promptly to create new opportunities in the process of banking digitalization. To leverage the banking digitalization process, it is also important to carry out a makeover of the technology platform by converting it to a more modular and flexible infrastructure that enables the integration of new technologies and speedy development of new products.

Notes

- 1.

Big data refers to massive complex structured and unstructured data sets that are rapidly generated and transmitted from a wide variety of sources.

- 2.

Multi-channel means that a bank provides services to its customers through more than one channel, which typically include branches, automated teller machines (ATMs), call centers, internet banking and—increasingly—mobile.

- 3.

Omni-channel banking is built on a multichannel strategy that allows anytime, anywhere, any device access with consistent experience across channels. Omni-channel enables interactions across multiple customer touch points where intents are captured, insights are derived, and conversations are personalized and optimized.

- 4.

Data was summarized from the workshop proceedings of the national conference (2021), Transforming the banking industry in uncertainty: turning risks into opportunities.

- 5.

Data was summarized from workshop proceedings of the national conference (2020), Digital transformation of the banking industry in the context of uncertainty.

References

Australian Government, Austrade (2020) Digital banking in Vietnam, a guide to market

BKAV (2017) Viet Nam cyber security overview in 2017 and predictions for 2018, BKAV Global Task Force Blog

Ernst and Young (2018) ASEAN fintech census 2018

ESET (2015) ESET Asia cyber-savviness report 2015, ESET: Bratislava, Slovakia

General Statistics Office of Vietnam (2020) Labor and employment survey report 2020

International Telecommunication Union (2017) Global cybersecurity index (GCI) 2017

Mirković V, Lukić J (2015) Key characteristics of organizational structure that supports digital transformation. Ekonomski vidici XX(2–3)

Pham Tien Dung (2020) Digital banking in Vietnam, conference proceedings digital transformation of the banking industry in the context of uncertainty: turning risks into opportunities

Pricewaterhousecoopers (2013) Annual Report 2013

State Bank of Vietnam (2020) Digitalization in Vietnam payment department

Westerman G et al (2011) Digital transformation: a roadmap for billion-dollar organization. MITSloan Manage Rev

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Ha, M.S., Nguyen, T.L. (2022). Digital Transformation in Banking: A Case from Vietnam. In: Phan, T., Damian, D. (eds) Smart Cities in Asia. SpringerBriefs in Geography. Springer, Singapore. https://doi.org/10.1007/978-981-19-1701-1_9

Download citation

DOI: https://doi.org/10.1007/978-981-19-1701-1_9

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-1700-4

Online ISBN: 978-981-19-1701-1

eBook Packages: Social SciencesSocial Sciences (R0)