Abstract

To analyze the ripple effects of CO2 emissions from the introduction of renewable energy power plants, this study developed input–output tables for analysis of next-generation energy systems (IONGES). The results revealed that the environmental benefits obtained from investing in power plants of the same capacity vary significantly depending on the type of renewable energy. Using the IONGES, under assumptions of three carbon taxation methods (upstream, midstream, and downstream), we calculated the taxable CO2 emissions induced when producing each good or service and estimated the carbon tax burden associated with the final demand. We found that, in the upstream method, the taxation effects of one unit of carbon tax is concentrated in energy goods such as coal products and petroleum basic, while the effects are relatively dispersed in the downstream taxation method. If renewable energy is added to the government target level in 2030, taxable CO2 emissions will decrease by 12–13.3%. Compared with the upstream taxation method, in the midstream and downstream methods, the CO2 emissions induced by each final demand are distributed more evenly across various goods and services. Compared to the downstream taxation method, upstream taxation leads to higher CO2 emissions from exports, but lower CO2 emissions from household consumption. This is because energy-intensive industries such as machinery have high export ratios. We analyzed which expenditure categories contribute to the carbon tax burden associated with household consumption. In the case of upstream taxation, households mainly focus on reducing electricity consumption; in the case of downstream taxation, households reduce consumption of various energy-intensive goods and services.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Input–output table for analysis of next generation energy system (IONGES)

- Renewable energy

- Structural CO2 emissions

- Upstream taxation method

- Midstream taxation method

- Downstream taxation method

1 Introduction

The Council of Japan’s Ministry of the Environment is currently discussing a carbon tax scheme for 2050. The method of carbon taxation (upstream or downstream) is an important consideration in these discussions. Policymakers need to quantitatively understand how the tax burden on producers and consumers changes depending on the taxation method. In addition, the spread of renewable energy is expected to change the size of the carbon tax burden in various industries. To quantitatively measure how the introduction of a carbon tax affects industries under the introduction of renewable energy and how different carbon taxation methods affect producers and consumers, we developed an input–output table for analysis of next-generation energy systems (IONGES) for 2011.Footnote 1 This table follows a 2005 study of IONGES (Nakano et al. 2017) and our previously published inter-regional IONGES study (Nakano et al. 2018). IONGES is a table that incorporates renewable energy sectors into the input–output table published by the Ministry of Internal Affairs and Communications (MIC), Japan. The sectors incorporated in the IONGES are power facility construction and power generation for fifteen types of renewable energy. The purpose of this study is to describe the 2011 IONGES table and use it to analyze the ripple effects of CO2 emissions and savings from the construction and operation of renewable-energy power plants. These results measure the potential tax reduction from each power generation technology when a carbon tax is introduced. We also examined the differences in burdens on producers or consumers caused by the three carbon taxation methods: upstream, midstream, and downstream. Detailed quantitative results obtained from the input–output analysis can provide specific ways to implement carbon pricing.

2 History of Environmental Input–Output Analysis in Japan

Input–output analysis was developed by Leontief in the 1930s as a method for assessing the consequences of technological progress on economic development through interdependences between economic agents (Leontief 1951). It can quantitatively capture the interdependences among different sectors at high levels of sectoral resolution. Interdependences emerge because sectors require each other’s outputs as inputs (Nakamura and Nansai 2016). In the 1970s, Leontief argued that pollutants were inevitably emitted as a by-product of input–output relationships between sectors and applied input–output tables to the analysis of environmental (pollution) issues (Leontief 1986a, b). Based on Leontief’s idea, the Ministry of International Trade and Industry (currently the Ministry of Economy, Trade and Industry) created an input–output table for pollution analysis in Japan (MITI 1971). In the 1980s, Hayami et al. (1993) developed an input–output table for environmental analysis in Japan with emission tables for air pollutants (NOx, SOx, CO2) by sector. Using the table for 1985, they conducted pioneering analysis of the environmental effects that new technology development, such as energy-saving housing, exerts on the society through interdependence between economic sectors and on the environmental household account, showing direct and indirect environmental impacts of household consumption behavior (Hayami et al. 1996a, b). Researchers have provided input–output tables for environmental analysis for 1990 (Ikeda et al. 1996), 1995 (Asakura et al. 2001), 2000 (Nakano et al. 2008), and 2005 (Nakano 2009). In Europe, Statistics Netherlands developed the National Accounting Matrix including Environmental Accounts (NAMEA) at the end of the 1980s. It consists of a conventional national accounting matrix extended with environmental accounts in physical units.Footnote 2 The database was linked to input–output tables in European countries and was widely used for regional environmental studies (Marin et al. 2012).

Since the United Nations Conference on Environment and Development (Earth Summit) in 1992, input–output tables have been heavily used for environmental analysis. This increase in its use was driven by the fact that input–output analysis is useful for life cycle assessment (LCA) analysis, which evaluates the lifetime environmental impacts of products and services. LCA analysis was originally used in the engineering field, in which the physical environmental burden associated with the production of a certain product was accumulated sequentially in a bottom-up manner. Since the principle of LCA was highly compatible with that of input–output analysis (analysis of interdependency between sectors) in the social sciences field, the input–output tables of each country have been expanded for LCA analysis as environmentally extended input–output tables (EEIO) since the 1990s (Nakamura and Nansai 2016). In Japan, Hondo et al. (1996, 1998, 2002) created an input–output table for LCA analysis and considered the environmental impact of imported products abroad in their table. The National Institute for Environmental Studies published the Embodied Energy and Emission Intensity Data using input–output Tables (3EIDs) summarizing greenhouse gas (GHG) emissions by sector in the national input–output tables for 1990, 1995, 2000, 2005, 2011, and 2015.Footnote 3 Similar to Hayami’s table for 1985 (Hayami et al. 1993), 3EID provides the environmental burden of each sector in the supplementary table. Meanwhile, in the waste input–output table (WIO) developed by Nakamura and Kondo (2002), waste treatment and recycling sectors (venous industries) that are not specified in the national input–output table were added. Using WIO, they analyzed the interdependence between sectors that produce conventional products (arterial industries) and venous industries. WIO is unique in that it describes input–output relationships of venous sectors in physical units. In 2011, the Ministry of the Environment published an input–output table for environmental analysis, which includes a supplementary table describing water resource inputs and waste emissions in addition to energy inputs and GHG emissions in physical unitsFootnote 4.

An input–output table based on supply and use tables is a format used in the System of National Accounts (SNA). It shows the flow of products produced by a certain industry that become inputs for another industry. This input–output table differs from Leontief’s original (product based) input–output table in terms of the analytical method. An attempt is underway to develop physical supply and use tables within the framework of the SNA satellite account, the System of Environmental-Economic Accounting (SEEA) (Kovanda 2019).

The development of multiregional input–output tables (MRIO) has intensified in recent years (Sun et al. 2019). In most cases, the developed database has a supplementary table showing the environmental burden (Nakamura and Nansai 2016). Interest in how the economic activity of one country or region (e.g., consumer activity in developed countries) exerts an environmental impact on another country or region (e.g., China) is increasing. Although it is difficult to create an MRIO due to the significant amount of information required, an attempt is ongoing to create an international platform for the tabulation (Wakiyama et al. 2020).

Considering this background, environmental research using input–output tables has been promoted through collaboration between engineering and social science researchers. However, with the advancement of research, the differences between their aims have become apparent: The purpose of engineering LCA research is to “accurately” measure the environmental impact of a certain product on (possibly) multiple regions; on the other hand, the purpose of input–output analysis in the social sciences is to analyze the effects of technological changes in a part of the economy on society and the environment as a whole. The results of such analysis can provide significant policy implications for solving economic, social, or environmental issues. Vercalsteren et al. (2020) discuss environmentally extended multi-region input–output (EE-MRIO) studies in line with policy needs.

In Japan, the introduction and use of renewable energy has attracted attention as an economic and environmental policy issue since the Great East Japan earthquake of 2011. Therefore, input–output analysis needs to be developed in the context of this new policy issue. Our IONGES fills this gap. At IONGES, renewable energy sectors have been added to the national input–output table, and the interdependences between renewable energy sectors and related sectors have been carefully described. Research using IONGES is expected to have major implications for policy to effectively build next-generation energy systems using renewable energy while simultaneously addressing other social issues (e.g., environmental damage and population aging).

Moriizumi et al. (2015) have also developed the Renewable Energy-Focused Input–Output table (REFIO)Footnote 5 as a Japanese input–output database incorporating renewable energy. REFIO aims at LCA analysis of individual renewable energy installations, while IONGES aims at comprehensive policy research, including the link between renewable energy introduction and carbon tax schemes. In these two databases, renewable energy sectors that are not specified in the national input–output table have been added. REFIO publishes the input structure (only) for each renewable energy sector based on individual information on renewable energy power generation plants, while IONGES has created renewable energy sectors based on published statistical information. The latter is an input–output table describing the supply–demand balance including renewable energy sectors and is suitable for analyzing policy issues such as carbon pricing.

3 Input–Output Model

Figure 1 provides a conceptual diagram of the input–output table. The columns in this figure shows the composition of inputs to the sector, and the rows show the composition of outputs from the sector. In Fig. 1, \(x_{ij}\) is an element of the transaction matrix X of the intermediate goods, and indicates the quantity of i-th goods input to the j-th sector. \(\sum \nolimits_{i} x_{ij} + v_{j} = x_{j}\) shows that the sum of intermediate inputs and the value added in the j-th sector is equal to the production value of the sector, and \(\sum \nolimits_{j} x_{ij} + f_{i} = x_{i}\) shows that the sum of intermediate demand and final demand of the i-th good is equal to the production value of the i-th sector, respectively.

The ratio of \(x_{ij}\) to \(x_{j}\) is called the input coefficient \(a_{ij} = x_{ij} /x_{j}\), and is based on the following equation:

A, with all input coefficients as elements, is called the input coefficient matrix. Using A, the supply and demand balance of all sectors can be shown as follows:

Here, x is the total production vector and f is the final demand vector (million JPY). The Leontief inverse matrix \(\mathbf{B} = \left( {\mathbf{I} - \mathbf{A}} \right)^{ - 1}\) is obtained by solving Eq. (2) for x. The elements in the j-th column of B show the intermediate inputs required directly and indirectly throughout the supply chain to produce one unit of the j-th good. When the j-th column of the Leontief inverse matrix B is represented by Bj, replacing x in Eq. (2) with Bj gives Eq. (3) below:

Here, Ij is a unit vector with the j-th element as 1 and the others as zero. Here,

Ozaki (1980) defined \(\mathbf{U}_{j}\). as the unit structure of the j-th good. The unit structure shows all intermediate goods transactions that occur directly and indirectly through the supply chain of the j-th good. Ozaki (1980) considered the unit structure to indicate the structural unit cost of producing the good.

Equation (5) is obtained by expanding Eq. (4). Each element of \(\mathbf{U}_{j}\) indicates the total amount of each intermediate good required in the entire supply chain of the j-th good. Equation (4) is also expanded as follows:

Here, if e is a unit vector, the following holds:

Equation (6) visualizes the trade structure of intermediate goods between sectors, which occurs throughout the supply chain of the j-th good. In this study, we use \(\mathbf{B} = \left( {\mathbf{I} - \left( {\mathbf{I} - \hat{\mathbf{M}}} \right)\mathbf{A}} \right)^{ - 1}\) as a Leontief inverse matrix, taking into account the leakage effect due to imports.

4 Summary of IONGES

The IONGES has two kinds of tables, one that incorporates renewable energy sectors that existed in 2011 (2011 IONGES) and one that renewable energy sectors up to the composition ratio assumed in 2030 (2030 IONGES).

Table 1 shows the types of power and their component ratios (equipment composition, power generation composition) in 2030 IONGES. Table 2 shows the specifications of each type of power generation plants, which is basis for estimating the input coefficients.Footnote 6

In IONGES, the average producer price (17 JPY/kWh) in the MIC input–output table is applied to existing power sources such as nuclear, thermal, and large-scale hydro, and to renewable energy power sources. This follows the single price principle adopted in the MIC input–output table. With this assumption, the value of electricity can be easily converted to a physical quantity (kWh) using the producer price.

However, electricity from renewable energy is actually purchased at a price higher than the producer price under the feed in tariff (FIT) scheme. In IONGES, the difference between the purchase price and the producer price is treated as a “subsidy”. In other words, it represents a deduction item in the value added sector.Footnote 7

To create the input coefficient vector for the construction of each renewable energy facility or type of power generation, the total facility construction cost or total operation cost were determined based on the latest data at the time of creation. The total amount was then divided into individual input elements with reference to technical data from published papers and interviews for each type of renewable energy and created input coefficient vectors.

At the 2030 IONGES, we carefully described the biomass fuel input in woody biomass, methane fermentation gasification, and waste power generation sectors to analyze the impact of biomass power generation on the regional economy more accurately than it had been done before. For example, we described the input flow of the intermediate goods “woody biomass power generation sector → biomass fuel sector → forestry” clearly. We estimated the input of methane gas from the waste or sewage treatment sectors to the methane fermentation gasification power generation sector and the steam input from the waste treatment sector to the waste power generation sector. As a result, we were able to analyze the production spillovers that the demand for electricity from these power sectors induced in each fuel supply sector.

The effective utilization of compost or fermentation heat produced as by-products from waste treatment facilities is essential for the sustainable operation of power generation from methane fermentation of biomass (Yuyama et al. 2006; MLIT 2015). In the 2030 IONGES, we described a situation in which compost and fermentation heat are effectively used for regional agriculture, and the inputs of organic fertilizer and fuel oil used to heat greenhouses are mitigated accordingly. The value of compost and fermentation heat, which are by-products of waste treatment facilities, are not described in the MIC input–output table. Therefore, the total production values of the waste treatment sectors in 2030 IONGES became larger than that in the MIC table. We considered that this increase value added in the waste treatment sector.

Fuel wood inputs are a major cost in the woody biomass power generation sector. Therefore, it is reasonable to assume that a certain percentage of the subsidy of the power generation sector (defined as the difference between the FIT and the producer price of electricity) is spent on securing fuel wood. In the 2030 IONGES, the subsidy was allocated to the power generation sector and the fuel supply sector, and the fuel input to the power generation sector was reduced by the amount allocated to the latter.

Below, we outline the features of the IONGES by examining unit structures defined in Eq. (6) for some renewable energy sectors. Figure 2 shows the unit structure of methane fermentation gasification power (livestock manure) calculated by Eq. (6). It shows the trade structure of intermediate goods that one unit (one million JPY) of this power generation activity produces for the entire economy. A dot in the figure indicates that there is an intermediate goods transaction occurring, and the diameter of the dot indicates the relative size of the transaction volume. The order of the sectors in Fig. 2 is “order of triangularization” (Ozaki 1980).

Unit structure of power generation from methane fermentation (livestock manure). The sector numbers are as follows: 1. Construction, 2. Machine, 3. Information machine, 4. Primary information goods, 5. Other final industrial products, 6. Steel, 7. Non-ferrous, 8. Food, 9. Stone products, 10. Textile, 11. Rubber/Plastic/Leather goods, 12. Wood products, 13. Chemical products, 14. Inorganic chemistry, 15. Ore, 16. Agricultural products, 17. Marine products, 18. Ceramic raw materials, 19. Forestry, 20. Crude oil/Natural gas, 21. Fuel, power, 22. Metal products, 23. Repair, 24. Services, 25. Commerce/Finance/Insurance, 26. Secondary information services, 27. Primary information services, 28. Education/Research, 29. Unknown

Triangulation is the rearranging of input–output sectors in order of processing degree. Goods and services produced by all sectors fall into the following categories: raw materials, intermediate processing products, final products, and energy and business services used in all production processes (e.g., financial and information services). Then, sectors are rearranged in the order in which the final products are at the top. Such rearranging makes it easier to interpret the trade structure of intermediate goods. Figure 2 shows the cyclical structure of the intermediate goods transaction triggered by the following supply chain of methane fermentation gasification power; briefly, it is as follows: waste treatment sector that supplies methane gas for power generation activity → transportation sector that services the waste treatment sector → repair sector that services these sectors → other sectors supplying mechanical and chemical products to repair sectors. Figure 2 shows that intermediate transactions in information goods and services cause a new economic circulation as a result of recent digitization. Although the relative volume is small, there is also a supply chain from the agriculture sector to waste treatment sectors via through livestock manure inputs. This chain will be important in analyzing the effects of generating power from methane fermentation gasification on the local economy.

Figures 3 and 4 show the unit structure of facility construction and power generation of offshore wind power, respectively. In Fig. 3, we can identify a large-scale triangularity structure for offshore wind power facility construction. Also, in Fig. 4, we confirmed two triangularity structures for offshore wind power generation. One of them is related to the material supply chain necessary for maintenance of facilities, and the other is related to the non-material management service for power generation activities. These two triangularity structures are closely linked through the repair sector. Recently, the New Energy and Industrial Technology Development Organization (NEDO 2019) developed a condition monitoring system (CMS) that utilizes artificial intelligence (AI) to make timely maintenance possible and streamline the operation costs of wind power generation. It is thought that, in the future, when maintenance services using CMS become widespread, the triangular structure related to management services, shown in the lower right of Fig. 4, will become more substantial than it is now, the supply chain during operation will be extended, and the ripple effect will be greater. In other words, new business opportunities in a renewable-energy society cause a new economic cycle and have a positive impact on the economy. Although the demand for facility construction is limited, the demand for facility operation is persistent, so extending the supply chain during operation is expected to have a significantly positive economic impact. It can be concluded that the spread of smart social technology in a renewable-energy society should bring about a sustainable economic cycle.

Unit structure of offshore wind power facility construction. The sector name corresponding to each sector number is the same as in Fig. 2

Unit structure of offshore wind power generation. The sector name corresponding to each sector number is the same as in Fig. 2

5 Structural CO2 Emissions of Renewable Energy

To confirm the ripple effects of the CO2 emitted due to the construction and operation of renewable-energy plants, we calculated the “structural” CO2 emissions (t-CO2) associated with the one unit (1 million JPY) of facility construction (k_C) or generation (k_G) for renewable energy of type k.

where \(b_{ik\_m}\) is an element of the Leontief inverse matrix. It shows the amount of the i-th intermediate goods needed directly or indirectly as a structural input from the economy for one unit of facility construction or renewable energy generation of type k. \(e_{i}\) is the CO2 emission intensity of producing one unit of the i-th goods. Under the producer price of electricity (17 JPY/kWh), \(S{CO}_{{2k_{G} }}\). (t-CO2) represents the “structural” CO2 emissions for electricity generation of (\(1 \times 10^{6} \div 17 = 5.88 \times 10^{4} \,{\text{kWh}}\)). The structural operating CO2 emissions per unit of the power generation of this power plant can be calculated as follows:

With respect to the CO2 emissions from facility construction, assuming that the unit price of facility construction of the k-th renewable energy type is \(\alpha_{k}\) (10,000 JPY/kW), the equipment utilization rate is \(\beta_{k}\), the lifetime power generation provided by one unit (1 million JPY) of the k-th renewable energy facility is as follows:

Here, 8760 is the total number of hours in a year. By dividing the “structural” CO2 emissions associated with one unit of facility construction of the k-th renewable energy power generation facility by Eq. (10), the CO2 emissions from facility construction per unit of lifetime power generation is defined as follows:

The assumed construction unit price \(\alpha_{k}\) (10,000 JPY/kW), the equipment utilization ratio \(\beta_{k}\), and the useful life \(\gamma_{k}\) (years) assumed for each type of renewable energy are shown in Table 2.

Equation (12) is used to calculate the total CO2 emissions that the power plant of the k-th renewable-energy type can reduce with respect to thermal power during its useful life.

\(\widehat{{S{CO}_{2Thermal\_G} }}\) is the CO2 emission induced by generating 1 kWh of thermal power. The expression in parentheses in Eq. (12) indicates the CO2 emissions that the 1-kW renewable-energy power generation equipment can reduce per hour with respect to thermal power generation. Because the existing thermal power plant can be used, the CO2 emissions induced by the construction of the thermal power plant are not included in this calculation.

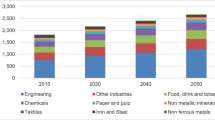

The vertical axis in Fig. 5 indicates the structural CO2 emissions per unit of power generated, based on Eq. (9). The horizontal axis shows the structural CO2 emissions of constructing each type of power generation facility per unit of lifetime power it generates, as calculated using Eq. (11). The diameter of the circle indicates the relative magnitude of the power generation of each source assumed in 2030. As shown in Fig. 5, the operation and construction of methane fermentation and waste incineration power generation facilities have large structural CO2 emissions. It should be noted, however, that these facilities perform waste treatment as well as power generation functions, so the total structural CO2 emissions include those produced from waste treatment. Since the structural CO2 emissions from thermal power generation (operation) are 641 g-CO2/kWh, the values of renewable power generation are clearly much lower, as shown by the vertical axis.

Structural CO2 emissions. Diameter of a circle indicates the magnitude of the power generation composition ratio assumed in 2030. The average CO2 emission intensity during operation of a thermal power plant is 641 g-CO2/kWh. Abbreviations: Shome solar power for homes, Sbusi solar power for businesses, OnW onshore wind power, OffW offshore wind power, SHy small hydropower, FGeo flash type geothermal, BGeo binary type geothermal, Wood woody biomass, Meth methane fermentation, Waste waste incineration

Figure 6 shows the calculation result of Eq. (12) for each type of renewable energy. Renewable-energy types with relatively large equipment utilization rates and long useful lives, such as small and medium hydropower, geothermal, woody biomass power, and waste incineration generation, have a large total lifetime CO2 reduction effect with respect to thermal power. The total lifetime CO2 reduction effect from methane fermentation power generation is also large compared to solar and wind power. By multiplying the amount of CO2 reduction shown in Fig. 6 by the projected carbon tax (JPY/CO2-t), the total lifetime cost reduction from carbon tax per capacity (kW) of each renewable energy power generation facility can be calculated.

Net lifetime CO2 reductions per kW for each power plant (compared to thermal power plants). Abbreviations are same as Fig. 5

6 Analysis of the Carbon Taxation Method

Using the 2011 and 2030 IONGES data, we analyzed the effects of the following three carbon taxation methods on economic society: (i) Upstream taxation, (ii) Midstream taxation, and (iii) Downstream taxation. Upstream taxation is a method of taxing raw coal, crude oil, and LNG at the time of production or at the time of customs clearance. The carbon tax would be passed on to the price of the raw fuel. Furthermore, imported petroleum products would be taxed at the time of customs clearance. Midstream taxation is a method of taxing petroleum and coal products manufacturers, electric power companies, and gas manufacturing companies. These vendors would pass the carbon tax on the prices of petroleum and coal products, electricity and city gas they sell. In this case, the energy end-user (such as a household) indirectly pays the imputed carbon tax, as well as directly pays the tax when using kerosene, gasoline, or city gas. Downstream taxation is a method of taxing those who ultimately use petroleum and coal products, electricity, and city gas. In this case, unlike the case of midstream taxation, no carbon tax is imposed on the power producer. Moreover, end-users of energy (such as households) not only pay carbon taxes passed on to consumer goods and services, but also on fossil fuel-produced energy contained in electricity and direct use of kerosene, gasoline, and city gas. Tax collection costs are expected to increase from upstream to downstream.

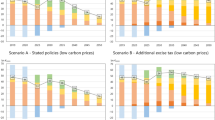

For this analysis, we created three types of CO2 emissions unit (CO2 emissions per unit production value of each input–output sector) vectors. The 3EID database from the National Institute for Environmental Studies has estimated CO2 emissions of each MIC Input–Output sector, and we made it correspond to our IONGES. Here, we independently estimated the CO2 emissions of the renewable energy sectors in IONGES. By recomposing it as shown in Figs. 7, 8 and 9, we have estimated taxable CO2 emissions allocated to each input–output sector under each upstream, midstream, and downstream taxation method.

In Fig. 7, taxable CO2 emissions are allocated mainly to energy conversion sectors (coal/petroleum products, electricity, and city gas sectors). In Fig. 8, taxable CO2 is allocated to sectors that ultimately consume fossil fuels and it is considered that there is no CO2 emission associated with electricity consumption. In Figs. 7 and 8, the sum of CO2 emissions of cells filled in the same pattern are equal to each other. The allocation method of CO2 emissions of Fig. 8 corresponds with the framework of 3EID. In Fig. 9, all CO2 emissions from electricity and city gas production are allocated to the final consumers of these energies. In Fig. 8a, b (which are only presented differently for convenience of explanation; the allocation of taxable CO2 is the same in both) and Fig. 9, the sums of taxable CO2 emissions in cells filled with the same pattern are equal to each other.

By dividing the total taxable CO2 emissions allocated to each sector (indicated by the cells filled with dots at the bottom) in Figs. 7, 8 and 9 by the output of that sector, we have prepared three types of CO2 emission unit vectors. Using these unit vectors and the 2011 or 2030 IONGES, taxable CO2 emissions are ultimately induced when producing each good/service are calculated as follows.

\(\mathbf{E}^{\varvec{prod}{\left( \it \varvec{k} \right)}}\): Vector with elements of taxable CO2 emissions embodied in each good or service under taxation method (k)

\(\mathbf{E}^{{\left( \varvec{k} \right)}}\): Vector with elements of CO2 emission units under taxation method (k)

\(\left( {\mathbf{I} - \left( {\mathbf{I} - \hat{\mathbf{M}}} \right)\mathbf{A}} \right)^{ - 1}\): Leontief inverse matrix of 2011 or 2030 IONGES.

Value of each element of vector \(\mathbf{E}^{\varvec{prod}{\left( \it \varvec{k} \right)}}\) is proportional to the amount of carbon tax transferred to selling price of each good or service.

The taxable CO2 emissions induced by final demand were calculated by the following equation. This calculation results show the carbon tax burden associated with consumption of goods and services by people.

\(\mathbf{E}^{{\it \varvec{FD}}{\left( \varvec{k} \right)}}\): Vector with elements of taxable CO2 emissions induced by final demand under taxation method (k)

\(\widehat{{\mathbf{E}^{{\left(\it \varvec{k} \right)}} }}\): Diagonal matrix with elements of CO2 emission units under taxation method (k)

\(\mathbf{F}\): Vector of final demand

\(\mathbf{D}^{{\left(\it \varvec{k} \right)}}\): Vector with elements of taxable CO2 emissions from final demand energy under taxation method (k).

All elements of the vector \(\mathbf{E}^{\varvec{prod}{\left( \it \varvec{k} \right)}}\) are sorted in descending order and illustrated in Fig. 10. The figure is the result of using the Leontief inverse matrix of IONGES for 2030, and it shows the results under the taxation methods of upstream and downstream. Figure 10 can be interpreted as marginal carbon tax cost showing how much cost of each good or service increases by one unit of carbon taxation. In the upstream taxation method, the taxation effects of one unit of carbon tax are concentrated in energy goods such as coal products and petroleum basic, while in downstream taxation method, the effects are relatively dispersed. In upstream taxation method, the taxation effects on goods such as coal products and petroleum basic are great. Yabe and Hayashi (2020) argued that if the carbon tax exceeds 10,000 JPY/t-CO2, coal-fired thermal power generation will be replaced by LNG thermal power generation, and CO2 emission unit of electricity will decrease. The Japan Center for Economic Research (JCER 2019) states that under 10,000 JPY of carbon tax, CO2 emissions can be reduced by 80% compared to 2013 in 2050. Figure 10 indicates the carbon tax burden amount (JPY) for the production of every 100 JPY worth of each product or service, when assuming carbon taxation of 10,000 JPY/t-CO2.

Figure 11 shows the calculation results of Eq. (14) using the 2030 IONGES under three taxation method assumptions. The taxable CO2 emissions induced by final demand are between 1.07 and 1.10 billion t-CO2. These values are 12% (under midstream or downstream taxation method) to 13.3% (under upstream taxation method) lower than the calculation results when using 2011 IONGES. In other words, if renewable energy is introduced to the government target level in 2030, taxable CO2 emissions will decrease by 12–13.3%. Assuming that the carbon tax is 10,000 JPY/t-CO2, there will be a tax revenue of 10.7–11.0 trillion yen in 2030.

Under the upstream taxation method, 90% or more of those tax revenues are collected at time of sale of secondary products. On the other hand, under the midstream taxation method, about 75% of carbon tax revenue is collected at time of sale of the secondary product and about 24% is collected at the sale of the third product. Under the downstream taxation method, their values are 61 and 32% respectively. With the downstream taxation method, the carbon tax burden associated with service consumption will increase. Compared with the upstream taxation method, in the midstream and downstream taxation methods, the induced CO2 emissions are distributed more evenly across various goods and services.

Under the upstream taxation method, the most taxable CO2 comes from the 529 million t-CO2 from household consumption and 293 million t-CO2 from exports. Under the downstream taxation method, these amounts change to 544 million t-CO2 from household consumption and 270 million t-CO2 from exports. Compared to the downstream taxation method, upstream taxation led to higher CO2 emissions from exports, but lower CO2 emissions from household consumption. This is because energy-intensive industries such as machinery have high export ratios. This suggests that the impact of a carbon tax on export competitiveness varies with the taxation method.

Figure 12 shows taxable CO2 emissions induced by household consumption by expenditure category. This is the result of a calculation where the final demand vector \(\mathbf{F}\) in Eq. (14) is replaced with \(\mathbf{F}_{{\it \varvec{household}}}\), which indicates the final consumption in households. In the figure, the bar corresponding to “Household” in Fig. 11 is categorized as per consumption item. The calculation results of taxable CO2 emissions induced by household consumption using Eq. (14) is 529 (in the case of downstream taxation using 2030 IONGES) to 647 (in the case of midstream taxation using 2011 IONGES) million t-CO2. The number of Japanese households in 2011 is 53.8 million, so this corresponds to 9.8–12.0 t-CO2 per household. Under the upstream taxation method, the ratio of induced CO2 emissions from the energy related expenditure category is large. The ratio is 52.2% (using 2011 IONGES) and 51.7% (using 2030 IONGES) under upstream taxation, while it is around 48.0% (using 2011 IONGES) and 46.5% (using 2030 IONGES) under midstream and downstream taxation methods. Particularly under the downstream taxation method, the ratio of CO2 emissions induced by electricity consumption is significantly small (the ratio under downstream taxation is 5.5%, whereas the ratio under upstream and midstream taxation is approximately 19.5%). Under the upstream and midstream taxation methods, consumers will pay attention mainly to saving electricity, while under the downstream taxation method, they will pay attention to saving goods and services generally produced using energy, including electricity. Especially in the case of downstream taxation, the energy used for power generation is apparently allocated to households. As a result, in the case of downstream taxation, households apparently consume a wide variety of energy (including energy converted to electricity), which cause households to become interested in fuels that generate electricity.

7 Discussion

The purpose of carbon taxation is summarized in Table 3. Its purpose is roughly divided into three categories, and the purpose of each category is divided into two according to the degree of innovation required to achieve the purpose. A relatively large carbon tax introduction effect can be expected for purposes in the two lightly filled cells. In order to minimize cost increase associated with introduction of carbon tax, consumers will choose goods and services with as little embodied CO2 as possible, or introduce home solar power generators. However, careful consideration of the relationship between the carbon tax system and the system that has already been introduced is required, for example the Feed-in Tariff system.

Changes in the industrial structure, such as the transformation of economic structures into services, will promote energy saving throughout society. While progress in services is a phenomenon common to developed economies, we must also pay attention to the economic importance of heavy industries such as steel and chemicals. Ozaki (1980) clarified that the improvement in productivity of basic materials industries increased the productivity of the machinery industries that used them as raw materials. Furthermore, in recent years, the utilization of information and communication technology has increased the equipment ratio in service industries. As a result, the improvement in productivity of machinery industries will spread to service industries. Specifically, the energy productivity of the Japanese steel industry is the highest in the world (IEA 2014), so if the carbon tax system works effectively on a global basis, the Japanese steel industry should have international competitiveness. A single country’s carbon tax system cannot be expected to reduce global energy consumption. An internationally coordinated carbon tax system is needed.

For the purposes of technological innovation, the carbon tax system alone cannot achieve the goal, and collaboration with science and technology policy is important. Since technological innovation requires a large amount of development funds, social consensus building is essential with respect to which technological development should be prioritized and which alternative technology paradigm should be chosen. These problems cannot be solved only by a carbon tax system. However, it may affect investors’ decisions to fund these innovations. The scheme of a carbon tax system will differ depending on which targets in Table 3 are included in the policy targets.

8 Conclusion

In this study, we developed the 2011 and 2030 Input–output table for analysis of next generation energy system (IONGES) to analyze the ripple effects of CO2 emissions from the construction and operation of renewable-energy power plants. Using the IONGES tables, we estimated the lifetime CO2 reduction of each renewable energy power generation facility compared to thermal power generation. This allowed us to compare the reduction in carbon tax costs of each renewable energy power plant with respect to thermal power generation for a given capacity (kW).

According to the calculation results, the lifetime CO2 reduction effect (from thermal power generation) per capacity for each type of renewable energy power generation facility varies significantly. In discussing the use of carbon tax revenues, Takeda (2007) revealed that replacing tax revenues with capital tax cuts would have a positive economic effect. Therefore, promoting investment in renewable energy plants by reducing the capital tax will reduce carbon emissions in the long term, and thus, it would be an economically and environmentally desirable policy. However, strategies are needed regarding which renewable energy generation plants should be invested in. Our results suggest that the environmental benefits obtained from investing in power plants of the same capacity vary significantly depending on the type of renewable energy.

Furthermore, according to the Japanese Ministry of the Environment (2018), an emission trading system has been proposed as a measure to ensure businesses that emit large amounts of CO2 reduce their emissions. Therefore, an emission trading system should be used to promote the introduction of renewable energy to electric businesses. In doing so, the quantitative evidence in Figs. 5 and 6 for renewable energy power generation could be used to contribute to the design of these schemes.

Using the IONGES tables, we also conducted an analysis of the effects of the differences in the upstream, midstream, and downstream methods. We found that taxable CO2 emissions are ultimately induced when producing each good or service. As a result, in the upstream taxation method, the effects of one unit of carbon tax are concentrated in energy goods such as coal products and petroleum basic, while in the downstream taxation method, the effects are relatively dispersed. In the upstream taxation method, the taxation effects on goods such as coal products and petroleum basic are significant.

We also calculated the taxable CO2 emissions induced by each final demand. The results show the carbon tax burden associated with the final demand of goods and services. If renewable energy is added to the government target level in 2030, taxable CO2 emissions will decrease by 12–13.3%. Compared with the upstream method, in the midstream and downstream methods, the CO2 emissions induced by each final demand are distributed more evenly across various goods and services. Compared to the downstream taxation method, upstream taxation leads to higher CO2 emissions from exports, but lower CO2 emissions from household consumption. This is because energy-intensive industries such as machinery have high export ratios. This suggests that the impact of a carbon tax on export competitiveness varies with the taxation method. Generally, it is said that upstream taxation reduces taxation costs. However, the results of this study suggest that the effects of upstream taxation on Japan’s export competitiveness must be carefully considered.

According to Sugino et al. (2013), to equalize the carbon tax burden among industries, an 85% carbon tax rebate ratio should be applied to energy-intensive trade-exposed (EITE) industries such as pig iron. In our analysis, the carbon tax burden on energy goods will be higher under upstream taxation, so this rebate ratio may need to be increased. Since a trade-off is expected between the magnitude of the tax rebate ratio and the emission reduction effect, it is necessary to carefully consider how upstream taxation should be implemented.

We analyzed which expenditure categories contribute to the carbon tax burden associated with household consumption. The result shows that the distribution of induced CO2 emissions from various consumer goods and services differs greatly depending on the taxation method. In other words, each taxation method delivers a different message to households about the best energy saving behavior. In the case of upstream taxation, households mainly focus on reducing electricity consumption. In the case of downstream taxation, households reduce consumption of various energy-intensive goods and services. In that case, households are also deeply interested in the sources of their electricity. Institutional design of carbon pricing should be made considering the effect different taxation methods can have on the message to consumers.

Finally, we categorized our carbon tax targets. The carbon tax system alone cannot achieve the goal, and collaboration with science and technology policy is important for the required technological innovation. However, it may affect investors’ decisions to fund these innovations. The schemes of a carbon tax system need to be carefully considered according to their purpose, especially when achieving the goal requires innovation. In this regard, analysis of the ripple effects of technological change using input–output tables would have important implications.

We believe that the detailed and quantitative results from this input–output analysis will help determine the appropriate and specific institutional design for the implementation of carbon pricing. In future research, we will use the 2011 and 2030 IONGES developed herein to quantitatively assess the social and environmental effects when different goals are achieved, taking into consideration the best combination of technological progress and economic schemes (e.g., carbon taxes).

Notes

- 1.

Waseda University Institute for Economic Analysis of Next-generation Science and Technology web page http://www.f.waseda.jp/washizu/table.html.

- 2.

European Environment Agency web page https://www.eea.europa.eu/help/glossary/eea-glossary/namea.

- 3.

National Institute for Environmental Studies web page https://www.cger.nies.go.jp/publications/report/d031/eng/index_e.htm.

- 4.

Ministry of the Environment web page https://www.env.go.jp/doc/toukei/renkanhyo.html.

- 5.

Yokohama National University Hondo Laboratory web page http://www.hondo.ynu.ac.jp/renewables/result/refio.html.

- 6.

For the 2011 and 2030 IONGES preparation method, see Washizu and Nakano (2019). The 2011 and 2030 IONGES are published on the Institute for Economic Analysis of Next-Generation Science and Technology, Waseda University, website (http://www.f.waseda.jp/washizu/).

- 7.

In the woody biomass and the methane fermentation biomass power generation sectors, it is assumed that part of the FIT subsidy is used to support fuel procurement.

References

Asakura K, Hayami H, Mizoshita M, Nakamura M, Nakano S, Shinozaki M, Washizu A, Yoshioka K (2001) The input–output table for environmental analysis. Keio University Press (in Japanese)

Hayami H, Ikeda (Washizu) A, Suga M, Ching WY, Yoshioka K (1996a) A simulation analysis of the environmental effects of energy saving housing. Keio Econ Observ Rev 8:115–133

Hayami H, Ikeda (Washizu) A, Suga M, Ching WY, Yoshioka K (1996b) The CO2 emission score table for the compilation of household accounts. Keio Econ Observ Rev 8:90–103

Hayami H, Ikeda (Washizu) A, Suga M, Yoshioka K (1993) Estimation of air pollutions and evaluating CO2 emissions from production activities: using Japan’s 1985 input-output tables. J Appl Input-Output Anal 1(2):29–45

Hondo Y, Nishimura K, Uchiyama Y (1996) Energy requirements and CO2 emissions in production of goods and services: application of input–output table to life-cycle analysis. Central Research Institute of Electric Power Industry (CRIEPI) Research Report, Y95013 (in Japanese)

Hondo Y, Uchiyama Y, Tonooka Y (1998) Environmental burdens associated production in Japan using input–output table. Central Research Institute of Electric Power Industry (CRIEPI) Research Report, Y97017 (in Japanese)

Hondo Y, Moriizumi Y, Tonooka Y (2002) Estimation of energy and greenhouse gas intensities using 1995 Japanese input-output table: inventory data reflecting the actual conditions of overseas production activities, Central Research Institute of Electric Power Industry (CRIEPI) Research Report, Y01009 (in Japanese)

Ikeda (Washizu) A, Suga M, Shinozaki M, Hayami H, Fujiwara K, Yoshioka K (1996) The input-output table for environmental analysis. KEO Monograph Series No. 7, Keio Economic Observatory, Keio University (in Japanese)

International Energy Agency (IEA) (2014) Energy technology perspective 2014

Japan Center for Economic Research (JCER) (2019) Zero emissions under the fourth industrial revolution, https://www.jcer.or.jp/jcer_download_log.php?post_id=47122&file_post_id=47124

Kovanda J (2019) Use of physical supply and use tables for calculation of economy-wide material flow indicators. J Ind Ecol 23(4):893–905

Leontief W (1951) The structure of american economy 1919–1939. International Arts and Sciences Press, New York

Leontief W (1986a) Environmental repercussions and the economic structure: an input-output approach (1970). In: Input-output economics, 2nd edn. Oxford University Press, Oxford, pp 241–260

Leontief W (1986b) Air pollution and the economic structure: empirical results of input-output computations (1972). In: Input-output economics, 2nd edn. Oxford University Press, Oxford, pp 273–293

Marin G, Mazzanti M, Montini A (2012) Linking NAMEA and Input output for ‘consumption vs. production perspective’ analyses: evidence on emission efficiency and aggregation biases using the Italian and Spanish environmental accounts. Ecol Econ 74:71–84

Ministry of Economy, Trade, and Industry (METI) (2015a) long-term energy supply-demand outlook. http://www.enecho.meti.go.jp/committee/council/basic_policy_subcommittee/mitoshi/pdf/report_02.pdf. Last access: 2018.11.1

Ministry of Economy, Trade, and Industry (METI) (2015b) Specifications of each power supply, http://www.enecho.meti.go.jp/committee/council/basic_policy_subcommittee/mitoshi/cost_wg/pdf/cost_wg_03.pdf. Last access 2018.11.1

Ministry of Economy, Trade, and Industry (METI) (2015c) Materials from the comprehensive resource and energy research committee, long-term energy supply and demand outlook subcommittee, http://www.enecho.meti.go.jp/committee/council/basic_policy_subcommittee/mitoshi/004/. Last access 2018.11.1

Ministry of Economy, Trade, and Industry (METI) (2018a) Opinions on procurement prices, etc. after FY2018, http://www.meti.go.jp/report/whitepaper/data/pdf/20180207001_1.pdf. Last access 2018.11.1

Ministry of Economy, Trade, and Industry (METI) (2018b) Feed in tariff information website, http://www.enecho.meti.go.jp/category/saving_and_new/saiene/statistics/index.html. Last access 2018.11.1

Ministry of International Trade and Industry (MITI) (1971) Input-output table for pollution analysis–sulfur oxide pollution analysis in the Kanto Coastal area. Gov Pollut Data 6(6):17–55 (Pollution Research Center)

Ministry of Land, Infrastructure, Transport and Tourism (MLIT) (2015) Sewage sludge energy technology guidelines, http://www.mlit.go.jp/common/001083170.pdf

Ministry of the Environment (MOE) (2018) Summary of “review committee on carbon pricing”, https://www.env.go.jp/earth/cp_report.pdf. Last access 2019.12.30

Moriizumi Y, Hondo Y, Nakano S (2015) Development and application of renewable energy-focused input-output table. J Jpn Inst Energy 94:1397–1413

Nakamura S, Kondo Y (2002) Input-output analysis of waste management. J Ind Ecol 6(1):39–63

Nakamura S, Nansai K (2016) Input–output and hybrid LCA (Chap. 6). In: Special types of life cycle assessment. Springer, Berlin

Nakano S (2009) The input-output table for environmental analysis 2005: estimation and results. KEO Discussion Paper No.117, Keio Economic Observatory, Keio University (in Japanese)

Nakano S, Hayami H, Nakamura M, Suzuki M (2008) The input-output table for environmental analysis and its application. Keio University Press (in Japanese)

Nakano S, Arai S, Washizu A (2017) Economic impacts of Japan’s renewable energy sector and the feed-in tariff system: using an input–output table to analyze a next-generation energy system. Environ Econ Policy Stud 19(3):555–580

Nakano S, Arai S, Washizu A (2018) Development and application of an inter-regional input-output table for analysis of a next generation energy system. Renew Sustain Energy Rev 82:2834–2842

New Energy and Industrial Technology Development Organization (NEDO) (2019) Outcome report, https://www.nedo.go.jp/library/seika/shosai_201903/20190000000059.html

Ozaki I (1980) The structure of economic development (III): a statistical determination of economic fundamental structure. Mita J Econ 73(5):66–94

Sugino M, Arimura TH, Morgenstern R (2013) The effects of alternative carbon mitigation policies on Japanese industries. Energy Policy 62:1254–1267

Sun Z, Tukker A, Behrens P (2019) Going global to local: connecting top-down accounting and local impacts, a methodological review of spatially explicit input-output approaches. Environ Sci Technol 53(3):1048–1062

Takeda S (2007) Possibility of double dividend in CO2 emission control: evaluation by dynamic applied general equilibrium analysis, mimeo http://shirotakeda.org/ja/research-ja/dd-carbon-ja.html. Last access 2019.12.30

Vercalsteren A, Christis M, Geerken T, Van der Linden A (2020) Policy needs (to be) covered by static environmentally extended input–output analyses. Econ Syst Res 32(1):121–144

Wakiyama T, Lenzen M, Geschke A, Bamba R, Nansai K (2020) A flexible multiregional input–output database for city-level sustainability footprint analysis in Japan. Resour Conserv Recycl 154:104588

Washizu A, Nakano S (2019) Creation and application of the 2011 input-output table for the next-generation energy system. Waseda University, IASS WP 2019-E001,1-18

Yabe K, Hayashi Y (2020) Environmental and economic evaluation of the introduction of CO2 reduction surcharge and storage battery considering the energy chain. J Jpn Soc Energy Resour 40(3):69–77

Yuyama Y, Ikumura R, Ohara A, Kobayashi H, Nakamura M (2006) Evaluation of performance and costs of various biomass conversion technologies. Tech Rep Natl Res Inst Agric Eng 204:61–103

Acknowledgements

This study was supported by a MEXT Grant-in-Aid for Scientific Research (15KT0121, 16K12663, 19KT0037), a Waseda University Grant for Special Research Projects (2019C-308), and the Environment Research and Technology Development Fund (JPMEERF20172007) of the Environmental Restoration and Conservation Agency and MOE.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Washizu, A., Nakano, S. (2021). An Assessment of Carbon Taxation by Input–Output Analysis: Upstream or Downstream?. In: Arimura, T.H., Matsumoto, S. (eds) Carbon Pricing in Japan. Economics, Law, and Institutions in Asia Pacific. Springer, Singapore. https://doi.org/10.1007/978-981-15-6964-7_9

Download citation

DOI: https://doi.org/10.1007/978-981-15-6964-7_9

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-6963-0

Online ISBN: 978-981-15-6964-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)