Abstract

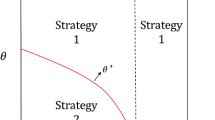

The present paper attempts to push forward the studies of brand extension by formulating the problem and making use of the optimal stopping theory, to determine the optimal timing of the brand extension in a stochastic market. The main findings are as follows. If each customer gets wealthier stochastically over time, luxury fashion brand producer should postpone the timing of extending its brand to a new market, while if the number of customer increases stochastically, she/he should postpone that timing if the market uncertainty is less than a threshold level; she/he should accelerate the timing if the market uncertainty is more than a threshold level.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Aaker DA (1991) Managing brand equity. Free Press, New York

Ambler T, Styles C (1997) Brand development versus new product development: toward a process model of extension decisions. J Product Brand Manag 6(4):222–234

Baldursson F, Karatzas I (1997) Irreversible investment and industry equilibrium. Finance Stochast 1:69–90

Bentolila S, Bertola G (1990) Firing costs and labor demand: how bad is Eurosclerosis. Rev Econ Stud 57(3):381–402

Caballero R, Pindyck R (1996) Uncertainty, investment, and industry evolution. Int Econ Rev 37(3):641–662

Dawar N, Anderson PF (1994) The effects of order and direction of multiple brand extensions. J Bus Res 30(2):119–129

Dixit AK (1989) Hysteresis, import penetration, and exchange rate pass through. Q J Econ 104:205–228

Farzin YH, Huisman KJM, Kort PM (1988) Optimal timing of technology adoption. J Econ Dyn Control 22:779–799

Fujita Y (2007a) Toward a new modeling of international economics: an attempt to reformulate an international trade model based on real option theory. Physica A 383(2):507–512

Fujita Y (2007b) Excess entry theorem reconsidered for a stochastically fluctuating economy with irreversible decisions. Stud Appl Econ 1:201–208

Fujita Y (2007c) A new analytical framework of agile supply chain strategies. Int J Agile Syst Manag 2(4):345–359

Fujita Y (2008a) Competition and welfare for a stochastically fluctuating market with irreversible decisions. Physica A 387(12):2846–2850

Fujita Y (2008b) A new look at fashion brand management-product switching strategies in the face of imitation. Res J Text Apparel 12(3):38–46

Fujita Y (2016) Optimal amount and timing of investment in a stochastic dynamic Cournot competition. Theor Econ Lett 6(1):1–6

Grime I, Smith G (2005) The Impact of brand extension on brand personality: experimental evidence. Eur J Mark 39(1/2):129–149

Kapferer J-N (1992) Strategic brand management. Kogan Page Limited, London

Kim CK, Lavack AM (1996) Vertical brand extensions: current research in managerial implications. J Prod Brand Manage 5(6):24–27

Kotler P, Armstrong G (2006) Principles of marketing. Pearson Prentice Hall, New Jersey

Leahy JV (1993) Investment in competitive equilibrium: the optimality of myopic behavior. Q J Econ 108(4):1105–1133

Martinez E, Pina JM (2003) The negative impact of brand extensions on parent brand imge. J Prod Brand Manage 12(7):432–448

McDonald R, Siegel D (1986) The value of waiting to invest. Q J Econ 101:707–727

Milewicz J, Herbig P (1994) Evaluating the brand extension decision using a model or reputation building. J Product Brand Manage 3(1):39–47

Nijssen JE (1999) Success factors of line extensions of fast-moving-consumers goods. Eur J Mark 33(5–5):450–469

Wood L (2000) Brands and brand equity: definition and management. Manag Decis 38(9):662–669

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Fujita, Y. (2017). Analytical Modeling Research for Luxury Fashion Products: Optimal Timing of Brand Extension in a Stochastic Market. In: Choi, TM., Shen, B. (eds) Luxury Fashion Retail Management. Springer Series in Fashion Business. Springer, Singapore. https://doi.org/10.1007/978-981-10-2976-9_7

Download citation

DOI: https://doi.org/10.1007/978-981-10-2976-9_7

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-2974-5

Online ISBN: 978-981-10-2976-9

eBook Packages: Business and ManagementBusiness and Management (R0)