Abstract

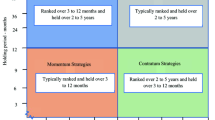

Contrarian and momentum are two types of investment strategies.

You get recessions, you have, market declines. If you don’t understand that’s going to happen, then you are not ready, you won’t do well in the markets.

Peter Lynch

Raj S. Dhankar & Supriya Maheshwari, A Study of Contrarian and Momentum Profits in Indian Stock Market, International Journal of Financial Management, Vol. 4(2), April 2014.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Alonso, A. R. (1990). Overreaction in the Spanish equity market. Journal of Banking & Finance, 14, 469–481.

Ansari, V. A., & Khan, S. (2012). Momentum anomaly: Evidence from India. Managerial Finance, 38, 206–223.

Banz, R. (1981). The relationship between return and market value of common stocks. Journal of Financial Economics, 9, 3–18.

Barberis, N., & Vishny, R. (1998). A model of investor sentiments. Journal of Financial Economics, 49, 307–343.

Baytas, A., & Cakici, N. (1999). Do market overreact: International evidence. Journal of Banking & Finance, 23, 1121–1144.

Brailsford, T. (1992). A test for the winner-loser anomaly in the Australian equity market: 1958–87. Journal of Business Finance and Accounting, 225–241.

Campbell, K. (1997). Long term overreaction in the UK stock market and size adjustments. Applied Financial Economics, 7, 537–548.

Chan, K. (1988). On the contrarian investment strategy. Journal of Business, 61, 147–163.

Cheng, J. W., & Wu, H. (2010). The profitability of momentum trading strategies: Empirical evidence from Honk Kong. International Review of Economics and Finance, 19, 527–538.

Conrad, J., & Kaul, G. (1993). Long term overreaction or biased in computed returns. Journal of Finance, 48, 39–63.

Conrad, J., & Kaul, G. (1998). An anatomy of trading strategies. Review of Financial Studies, 11, 489–519.

Cooper, M., Gutierrez, R., & Hameed, A. (2004). Market states and momentum. Journal of Finance, 59, 1345–1365.

Daniel, K. (1998). Investor psychology and security under-and overreactions. Journal of Finance, 53, 1839–1885.

DeBondt, F., & Thaler, R. (1987). Further evidence on the investor overreaction and stock market seasonality. Journal of Finance, 42, 557–581.

DeBondt, W. F., & Thaler, R. (1985). Does the stock market overreact? The Journal of Finance, XL(3), 793–805.

Dhankar, R. S., & Maheshwari, S. (2013). Behavioural finance: A new paradigm to explain momentum effect. Global Journal of Finance and Management, 5(11), 56–61.

Fama, E. F., & French, K. R. (1988). Permanent and temporary components of stock prices. Journal of Political Economy, 96, 246–273.

Fama, F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Fama, E. F., & French, K. R. (2007). The anatomy of value and growth stock returns. Financial Analyst Journal, 63(6), 44–54.

Fung, A. (1999). Overreaction in the Honk Kong stock market. Global Finance Journal, 223–230.

George, T., & Hwang, C. Y. (2004). The 52-week high and momentum investing. Journal of Finance, 59, 2145–2176.

Griffin, J., Ji, X., & Martin, S. (2003). Momentum investing and business cycle risk: Evidence from pole to pole. Journal of Finance, 58, 2515–2547.

Grinblatt, M., & Han, B. (2002). The disposition effect and momentum. NBER Working Paper Series.

Hong, H., & Stein, J. (1999). A unified theory of underreaction, momentum trading and overreaction in asset markets. Journal of Finance, 54, 2143–2184.

Hurn, S., & Pavlov, V. (2003). Momentum in Australian stock returns. Australian Journal of Management, 28, 141–156.

Ismail, E. A.-F. (2012). Do momentum and contrarian profits exist in the Egyptian stock market. International Research Journal of Finance & Economics, 87, 48–72.

Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: An evaluation of alternative explanations. Journal of Finance, 56, 699–720.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance, 48, 65–91.

Kahneman, D., Slovic, P., & Teversky, A. (1982). Judgement under uncertainty: Heuristics and Biases (pp. 287–293). Cambridge University Press.

Keim, D., & Stambaugh, R. (1986). Predicting returns in the stock and bondt markets. Journal of Financial Economics, 17, 357–390.

Latif, M., Arshad, S., Fatima, M., & Farooq, S. (2011). Market efficiency, market anomalies, causes, evidences and some behavioural aspects of market anomalies. Research Journal of Finance and Accounting, 2(9/10), 1–14.

Lee, C., & Swaminathan, B. (2000). Price momentum and trading volume. Journal of Finance, 55, 2017–2069.

Liu, W., Strong, N., & Xu, X. (1999). The profitability of momentum investing. Journal of Business Finance & Accounting, 26, 1043–1091.

Locke, S., & Gupta, K. (2009). Applicability of contrarian strategy in Bombay stock exchange. Journal of Emerging Market Finance, 165–189.

Maheshwari, S. (2013). What goes up, comes down: Critique of overreaction effect over the last three decades. In: International Conference on Technology and Business Management March (Vol. 18, p. 20).

Mengoli, S. (2004). On the source of contrarian and momentum strategies in the Italian equity market Stefano. The Journal International Review of Financial Analysis, 13, 301–331.

Michello, F. A., Chowdhury, S. H., & Wanorie, T. A. (2013). Lead-lag relationships between stock returns in the Indian stock market. International Research Journal of Applied Finance, IV(4), 592–607.

Moskowitz, T., & Grinblatt, M. (1999). Do industries explain momentum? Journal of Finance, 54, 1249–1290.

Mun, J. C., Vasconcellos, G. M., & Kish, R. (1999). Tests of the contrarian investment strategy evidence from the French and German stock markets. International Review of Financial Analysis, 8(3), 215–234.

Reinganum, M. R. (1983). The anomalous stock market behavior of small firms in January: Empirical tests for tax-loss selling effects. Journal of Financial Economics, 12(89), 104.

Rouwenhorst, K. (1998). International momentum strategies. Journal of Finance, 53, 267–284.

Rouwenhorst, K. (1999). Local return factors and turnover in emerging stock markets. Journal of Finance, 54, 1439–1464.

Sehgal, S., & Balakrishnan, I. (2002). Contrarian and momentum strategies in the Indian capital market. Vikalpa, 27(1), 13–19.

Shefrin, H., & Statman, M. (1985). The disposition to sell winners too early and ride losers too long: Theory and evidence. Journal of Finance, 40, 777–779.

Soares, J. V., & Serra, A. P. (2005). “Overreaction” and “underreaction” evidence for the Portuguese stock market. Faculdade de Economia da Universidadedo Porto—November.

Stock, D. (1990). Winner and loser anomalies in the German stock market. Journal of Institutional and Theoretical Economics, 146(3), 518–529.

Strong, N. (1992). Modelling abnormal returns: A review article. Journal of Business Finance & Accounting, 19, 533–553.

Swallow, S., & Fox, M. (1998). Long run overreaction on the New Zealand stock exchange. Commerce Division Discussion Paper, 48(48).

Tripathi, V., & Aggarwal, S. (2009). The overreaction effect in Indian stock market. Asian Journal of Business and Accounting, 2(1&2), 93–114.

Tripathi, V. (2009). Company fundamentals and equity returns in India. International Research Journal of Finance and Economics, Eurojournals.

Zarowin, P. (1989). Does the stock market overreact to corporate earnings information? Journal of Finance, 44, 1385–1399.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2019 Springer Nature India Private Limited

About this chapter

Cite this chapter

Dhankar, R.S., Maheshwari, S. (2019). Stock Markets Overreaction. In: Capital Markets and Investment Decision Making. Springer, New Delhi. https://doi.org/10.1007/978-81-322-3748-8_5

Download citation

DOI: https://doi.org/10.1007/978-81-322-3748-8_5

Published:

Publisher Name: Springer, New Delhi

Print ISBN: 978-81-322-3746-4

Online ISBN: 978-81-322-3748-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)