Abstract

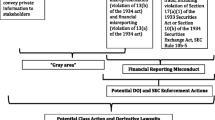

The trustworthiness of financial statements is crucial for economic behaviour of all actors involved. Without the presumption of a true and fair display of a company’s financial situation trade is made more and more difficult – especially when liability is limited – as (potential) creditors and investors are more likely to enter and maintain a business relationship with a solvent company. Therefore, and to avoid additional charges for risk compensation, it is necessary for the company to present its performance in the best possible way – though, there is only a thin line between the use of allowed options in financial statements and deceit. This paper analyses the possible responses in case this border is crossed and false or misleading statements in bookkeeping and accounting are used.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Beckenkamp M. 2011. Vertrauen, Sanktionen und Anreize aus spieltheoretischpsychologischer Perspektive. ZIS: 137–142.

Dannecker G. 2012. preliminary notes to §§ 331 ff. In: Staub, Großkommentar HGB 7/2 5th edition. Berlin: De Gruyter.

Dannecker G. 2012a. § 331. In: Staub, Großkommentar HGB 7/2 5th edition. Berlin: De Gruyter.

Dannecker G, Fischer-Fritsch J. 1989. Das EG-Kartellrecht in der Bußgeldpraxis. FIW-Schriftenreihe, Forschungsinstitut für Wirtschaftsverfassung und Wettbewerb e.V. Köln, Köln, Berlin, Bonn, München.

Earle T, Siegrist M, Gutscher H. 2007. Trust, Risk Perception and the TCC Model of Cooperation. In: Siegrist M, Earle T, Gutscher H (eds). Trust in Cooperative Risk Management, Uncertainty and Scepticism in the Public Mind: 1–50.

Gürtler F. 2012. preliminary notes to § 1. In: Göhler E (eds). Gesetz über Ordnungswidrigkeiten 16th edition. Beck, München.

Hannigan B. 2003. Company Law, 5th edition. Oxford: Oxford University Press.

Ivancewich JM, Duening TN, Gilbert JA, Konopaske R. 2003. Deterring White Collar Crime. The Academy of Management Executive: 114–127.

Krahnen JP. 2006. Die Stabilität von Finanzmärkten – Wie kann die Wirtschaftspolitik Vertrauen schaffen. Zeitschrift für Wirtschaftspolitik: 54–60.

Luce RD, Rauffa H. 1957. Games and decisions. New York: Dover Publications.

Rogall K. 2006. preliminary notes to § 1. In: Karlsruher Kommentar zum OWiG 3rd edition. München:Beck.

Schürmann C. 2010. Genau Durchleuchtet, Wirtschaftswoche v. 12.7.2010; 28: 77–88.

Silverstone H, Sheetz M. 2007. Forensic Accounting and Fraud Investigation for Non-Experts, 2nd edition. Hoboken, NJ: John Wiley & Sons.

Solomon J, Solomon A. 2004. Corporate Governance and Accountability. Hoboken, NJ: John Wiley and Sons.

Sutherland E. 1940. White Collar Criminality. American Sociological Review, 5: 1–12. Reprinted in Gilbert Geis (eds.) White Collar Criminal – the offender in business and professionws 2006: 40–52.

Van Erp J. 2010. Regulatory Disclosure of Offending Companies in the Dutch Financial Market: Consumer Protection or Enforcement Publicity. Law and Policy: 407–433.

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer Fachmedien Wiesbaden

About this paper

Cite this paper

Kern, U. (2013). Criminalising Annual Accounts. In: Vollmar, J., Becker, R., Hoffend, I. (eds) Macht des Vertrauens. Springer Gabler, Wiesbaden. https://doi.org/10.1007/978-3-8349-4453-5_7

Download citation

DOI: https://doi.org/10.1007/978-3-8349-4453-5_7

Publisher Name: Springer Gabler, Wiesbaden

Print ISBN: 978-3-8349-4452-8

Online ISBN: 978-3-8349-4453-5

eBook Packages: Business and Economics (German Language)