Abstract

While it is commonly acknowledged that mini-grids are the new pathway to bridging the high electricity access deficit in Sub-Saharan Africa (SSA), comparably few studies have assessed how existing regulations and tariff policies in SSA affect their potentials to attract the number of private investments required to scale-up deployments. Private investors’ participation is particularly crucial to meet the annual electrification investment needs of $120 billons in SSA. We study the regulatory framework, the tariff structure, and the subsidy schemes for mini-grids in Tanzania. Additionally, using an optimization technique, we assess the profitability of a mini-grid electrification project in Tanzania from a private investment perspective. We find that the approved standardized small power producers’ tariffs and subsidy scheme in Tanzania still do not allow mini-grid for rural electrification projects to be profitable. A further study is required to identify successful business models and strategies to improve mini-grids profitability.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Mini-grids are becoming the mainstream solution to electrification problems in high electricity access deficit countries, especially in Sub-Saharan Africa (SSA), where there is evidence of a significant gap between urban and rural population (IEA; IRENA; UNSD; WB; WHO, 2019). Given the enormous solar energy potential (about 300,000 Giga Watts) of SSA and the declining cost of renewable energy technologies, it is expected that by 2030, solar mini-grid solutions would provide more than 60% of rural electricity access in SSA (IEA, 2017a, b). Large-scale commercial deployments of mini-grids require a degree of profitability to ensure their financial sustainability (Peters et al., 2019). For this to happen, new regulations and cost-reflective electricity tariffs for small power producers are needed to incentivize private sector participation in the power sector. Private investors’ participation is particularly crucial to meet the annual electrification investment needs of $120 billons in the region (IEA, 2019). However, in most SSA countries, non-cost-reflective electricity tariffs as a result of institutional and political pressure to keep tariffs low and high commercial risk of mini-grid projectsFootnote 1 are significant barriers that disincentivize private mini-grid developers from investing in the power sector (Eberhard & Shkaratan, 2012; Peters et al., 2019; IEA et al., 2019).

Amidst these challenges, Tanzania policymakers have implemented innovative policies and regulatory frameworks that have seen increased investments in small power projects. According to the World Bank (2019), Tanzania’s comprehensive approach to mini-grid developments has achieved one of the fastest results in electricity access (56% and 73% increase in national and rural access rates respectively over the past decade) in SSA. The Tanzanian mini-grid model is anchored on public–private partnerships, where the government introduced a regulatory framework and legal and financial support to attract private mini-grid developers (Peters et al., 2019). This remarkable performance makes Tanzania a unique case of interest in Sub-Saharan Africa (Org et al., 2016). Therefore, this study is interested in understanding the factors that account for the proliferation of small power projects in Tanzania. Besides, given the need for increased private sector investments in mini-grid deployments to meet Tanzania's electrification needs, we further investigate whether the current tariff structure in Tanzania is cost-reflective for private commercial mini-grid developers.

Understanding mini-grid projects’ profitability from an investment perspective is particularly crucial for designing optimal regulations and cost-reflective tariff schemes to attract adequate private sector investments in the power sector. However, this is a less explored area in the literature. Comparably, only a few quantitative studies have critically assessed how existing regulations and tariff policies in SSA affect mini-grid projects’ potential to attract the number of private investments required scale-up deployments (Williams et al., 2018). From another perspective, there is no consensus in the literature about whether mini-grid projects in SSA are profitable enough to crowd in private financing of mini-grid projects. On the one hand, some researchers argue that mini-grid projects powered by renewable energy are economically viable and capable of paying-off their financing cost and earning adequate returns for investors (Arowolo et al., 2019). On the other hand, other studies also argue that mini-grid projects in SSA are not economically feasible; thus, it requires subsidies to enable investors to recover their production (Azimoh et al., 2016). This controversy about the profitability of mini-grid projects in SSA further strengthens the motivation of this paper.

Firstly, we review the regulatory policies and the operation of mini-grid systems in Tanzania to draw useful lessons for other SSA countries. Secondly, we use an optimization model to estimate the levelized cost of energy (LCOE) for three mini-grid project designs: Thermal, PV+Battery and Hybrid systems in Mafinga Town. The model uses a derivative-free optimizationFootnote 2 to search for the least costly system. The LCOE for the least costly system is then compared with the regulated mini-grid tariff and the available subsidy schemes in Tanzania to access the mini-grid project's profitability. Mafinga Town, the study's specific location, is based on recommendations by the Electricity and Water Regulatory Authority (EWURA) and the World Resource Institute (WRI). It is one of the preferred locations for private mini-grid investments in Tanzania. Additionally, this choice is also motivated by other factors, including high electricity need (92% unconnected households) and the presence of a high solar resource of 6.24 kWh/m2.

We organize the rest of the paper as follows. Section 2 presents a background of mini-grid development, regulation, financing, and operation in Tanzania. In Sect. 3, we describe both the methodology and the study area chosen for this paper. Section 4 discusses the results from our LCOE model vis-à-vis the current tariff structure in Tanzania. Section 5 concludes with some policy recommendations.

2 History of Mini-Grid Projects in Tanzania

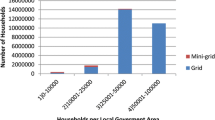

Tanzania has rich experience in terms of mini-grid developments and regulations. The development and operation of mini-grid systems in Tanzania is dated as far back as 1908 during the colonial era, where the colonial masters developed mini-grid systems to power railway workshops, mining and agricultural industries (Org et al., 2016). During the same period, faith-based organizations also developed mini-grid systems to provide social services in a particular part of Tanzania. After independence in 1964, Tanzania continued to develop mini-grid systems to provide electricity access to decentralized communities in the country. Despite Tanzania's long history with mini-grid systems development, electricity access in the country is still low. According to the World Bank (2016b) household electrification survey, only 32.8% of Tanzanians have access to electricity. About 6.2 million rural households in Tanzania lack access to electricity (World Bank, 2016b). Given the dispersed type of settlement in rural Tanzania, grid extension is not a cost-effective option for extending electricity access to rural consumers. Therefore, TANESCO, the national utility company, uses standalone mini-grid systems powered by diesel and natural gas to extend electricity access to isolated communities. Tanzania currently has about 109 mini-grid systems in 21 regions operated by the national utility company, faith-based organizations, local communities, and private developers. Figure 1 shows the various types of mini-grid systems in Tanzania as of 2014. It highlights areas suitable for various mini-grid technologies based on the energy resources available in those areas. The black location indication on the map represents the specific area of interest for our study.

.

2.1 Regulatory Framework

After several years of operations, mini-grid developers in Tanzania still face some challenges, including a lack of regulatory framework and a specific tariff policy for mini-grid systems. The Electricity and Water Utilities Regulatory Authority (EWURA), which oversees Tanzania's power sector regulation, introduces a specific regulatory framework for small power producers (SPPs). The regulatory intervention saw the implementation of standardized power purchase agreements (SPPA) and standardized power purchase tariffs (SPPT), popularly known as feed-in-tariffs (FiT) for SPPs. However, the first generation of feed-in-tariffs EWURA introduced was technology-neutral, which means that the FiT favours some technologies. The regulator also quotes the FiTs in the local currency, which exposes developers to high currency risks.

In response to the above challenges, in 2008, the regulator developed attractive mini-grid policies and regulatory frameworks that address the power sector's challenges and encourage further investments in renewable energy-based mini-grid systems in the country (Org et al., 2016). EWURA revised the SPP regulatory policies to provide clear policy guidance for SPPs connected to the national grid and mini-grid systems that serve isolated communities. The regulations require developers of mini-grid systems with capacities of 1 MW and above to obtain a license from the regulator before commencing operations. Mini-grid systems between 1 MW and 100 kW are required to register with the regulator, whereas projects below 100 kW require neither a license nor the regulator's tariff approval. Additionally, EWURA implemented the technologic-specific and size-specific feed-in-tariffs for various mini-grid technologies. Feed-in-tariffs for mini-grid systems connected to the national grid were denominated in the US dollar to reduce the currency risks. Also, EWURA removed taxes and import duties on renewable energy technologies to make them more competitive. Additionally, the EWURA introduced a mini-grid information portal and geospatial portfolio planning tools, which provide comprehensive information on mini-grid developments in Tanzania and reduce pre-site preparation costs significantly.

2.2 Financing Mini-Grid Systems in Tanzania

Furthermore, from 2008 to 2014, the Tanzanian government, with support from the World Bank, established some financial support schemes to encourage local mini-grid developers to invest in the rural electrification program. The financial support scheme includes Smart Subsidies and Credit Line Facility. Under the Smart Subsidies, policymakers assist local developers with a matching grant of $100,000 for environmental impact assessment and business plan development. Also, as part of the Smart Subsidies, developers benefit from a performance grant of $500 for each household connected. However, renewable energy-based mini-grid systems require high initial capital investments that are often difficult for local developers to access from financial institutions due to doubts about mini-grid projects’ economic viability (Ahlborg & Hammar, 2012). Therefore, the government introduced the US $23 million credit line facility to provide commercial loans to small power producers. The loan facility is accessible through the Tanzania Investment Bank with 15 years payback period. Additionally, the World Bank has also made available $75 million under the Renewable Energy Rural Electrification Program to support the development of mini-grid projects between 2015 and 2019 (Org et al. 2016).

Despite the above regulatory interventions, there is still uncertainty among private developers about the fate of their investments in the arrival of the national grid. Up to date, there is no clear regulatory directive in that regard. However, the regulator envisages the following possible options. Firstly, the mini-grid operator can continue its operations as a small power producer and sell excess electricity to TANESCO. Secondly, in the event where the mini-grid operator is unable to compete with the national utility, the operator has the option to decommission its generation asset and buy electricity from TANESCO as a small power distributor. Lastly, the operator has the option to decommission its generation assets and sell-off its distribution assets to TANESCO.

2.3 Tariff Regulatory Policy in Tanzania

Electricity regulators in SSA face the choice of applying the uniform national tariff or the cost-reflective tariffs for mini-grid systems operators.

The uniform national tariff is a fixed regulated rate that the regulator charges all customers irrespective of whether they are served by the national grid or by mini-grid systems. The idea behind this tariff scheme is to ensure equality and fairness across all consumer types. Mostly, utility regulators fix the electricity tariff for commercial mini-grid operators at the same rate as the state-owned utility service, which the government often subsides below the cost of supply (Reber et al., 2018). Usually, the main drivers of the tariff scheme are political and social considerations. Mini-grid systems operators struggle to be competitive under the national uniform tariff scheme as their production costs are often significantly higher than the uniform national tariffs.

Under the cost-reflective tariff scheme, the regulator deregulates the electricity rates, and operators are allowed to charge rates that will enable them to recover the power supply costs and earn favourable returns on their investments. With the cost-reflective tariff scheme, economic considerations are the main determinants of the electricity rates underpinned by ‘willing buyer – willing seller agreements’. Therefore, it is perceived as a more effective scheme for attracting private mini-grid developers and encouraging efficient electricity supply (Economic Consulting Associates Viewpoint Mini-Grids: Are Cost-Reflective Tariffs Necessary? What Are the Options? Economic Drivers of Tariff Policy, 2017). However, it does not consider the consumer ability to pay for power.

According to the Economic Consulting Associates (ECA), there is a mid-way approach that serves as a third option for regulators. Under the mid-way approach, operators are allowed to charge regulated cost-reflective tariffs. However, the regulator and the operator must agree on the rate of financial returns and the payback periods (Economic Consulting Associates Viewpoint Mini-Grids: Are Cost-Reflective Tariffs Necessary? What Are the Options? Economic Drivers of Tariff Policy, 2017). In the case of Tanzania, the regulator is more inclined towards the mid-way approach. EWURA sets the mini-grid tariffs relatively higher than the grid rate (TZS203.11/kWh or $0.08/kWh). However, EWURA determines the rate of financial returns and the payback periods for the mini-grid operators. EWURA uses the ‘avoided cost’ methodology to determine the electricity tariffs for small power producers in Tanzania. Moner-Girona et al. (2016) define avoided cost as “the price that the utility would have paid if it had to produce the power by itself or bought it.” In order words, it is the best-forgone alternative for a set of consumer groups at a particular location. Therefore, “the avoided cost, therefore, serves as the ‘floor’ price (a price specified in a market-price contract as the lowest purchase price of electricity, even if the market price falls below the specified floor price)” (Moner-Girona et al., 2016). Once the floor price is determined, a capacity band is applied to balance the tariff option for the various mini-grid technologies effectively. The approved standardized small power producers’ tariffs are then subject to review once every three years. Table 1 presents the recently updated approved tariffs for various mini-grid system operators in Tanzania.

3 Methods and Data

This section describes the methodology adopted by this study. We provide an overview of the selected community for the study, followed by the explanations on the LCOE and modeling approach. Later, we describe the data used for this project.

3.1 Description of Project Site – Mafinga Town

Our study's area comprises five villages in Mafinga Town, located in the Mufindi district of central Tanzania (Iringa Region). The villages are Ivambinungu, Mkombwe, Pipeline, Malingumu, and Mjimwema. According to the 2012 Tanzania national census, Mafinga Town has a total population of 51,902 and a total household number of 12,532 (The United Republic of Tanzania, 2013). We choose Mafinga Town for our study because both EWURA and the World Resource Institute (WRI) identify the Mufindi district as a preferred location for mini-grid enterprise investment. Both in terms of the rich solar energy resource potential and the economic buoyancy of the district. However, the district has one of the lowest electrification rates in the region. Out of the total households in Mafinga Town, 11,629 households with about 92.8% do not have access to electricity. Kerosene remains the primary energy source of light in the entire Mafinga Township to the extent that its usage has decreased by only 3.8% between 2012 and 2016 (The United Republic of Tanzania 2017). The five villages considered in this study have a total unconnected population of 18,140 people and 4424 unconnected households. Figure 2 shows a satellite image of Mafinga Town with the five villages earmarked for mini-grid electrification.

3.2 Solar Resource

The Iringa region is considered to have one of the highest solar energy resources in Tanzania, as presented in Fig. 3 (ESMAP, 2015). The Global Horizontal Irradiance (GHI) of the region located at latitude 7.67 south and longitude 35.75 east is estimated at 6.24 kWh/m2 (ESMAP, 2015). We use the HOMER software, linked to NASA’s Surface Meteorology and Solar Energy (SSE) dataset, to estimate the region's average daily radiations. The SSE has proved to be an accurate and reliable source for providing solar and meteorological data for regions with sparse or no surface measurement data (Pavlovi et al., 2013). Additionally, the SSE data set is explicitly formatted to support PV power system designs.

The graph in Fig. 4 illustrates the average daily variations in the solar resource data for the Iringa region downloaded from NASA’s SSE dataset.

3.3 Levelized Cost of Energy

The LCOE is the cost of producing a kilowatt unit of electricity. To compute the LCOE, we use the Hybrid Optimisation of Multiple Electric Renewables (HOMER), a computational software developed by the Alliance for Sustainable Energy System (ASES). For the proposed project, we consider three system design options: Thermal generation with a diesel generator, renewable energy generation with PV+Battery and a Hybrid System with a combination of thermal and renewable generation sources. The objective is to evaluate the economic and technical feasibility of these technology options. We use the HOMER software to model the project’s power system’s physical behaviour by performing energy balance calculations and simulating all feasible system configurations such as sizing system components (PV array, Battery, system converter and generator). The software calculates the energy flow to and from each component to determine the best system configurations required to meet the load demand and estimate the system’s minimum capital and operating and maintenance costs over the project's lifetime. HOMER uses a derivative-free optimization to search for the least costly system ranked by the LCOE, which is then compared with the approved mini-grid tariff to determine the mini-grid project's profitability. Figure 5 illustrates the system design.

.

3.4 Modelling the Energy Flow and the LCOE

We discuss the calculation of the energy flow and the simulation of the feasible system configuration components that feed into the financial model.

3.4.1 The PV+Battery system model

The PV+Battery system consists of a PV array, a battery storage system,Footnote 3 and a converterFootnote 4 as illustrated in Fig. 5. The model uses Eq. 2 to simulate the PV array power output from a series of parameters, including the solar irradiance of Mafinga Town, temperature, degradation factor, PV module installation and system component specifications. We present the PV module's system optimized capacity in the LCOE result summary in Table 4 and the total net present cost and the annualized cost of the PV module in Appendix A.

Equation 1: PV array power output

Where: \({Y}_{pv}\) is the predicted average power output of the PV array under standard test conditions in kW, \({f}_{pv}\) denotes the derating factor of the PV array, \({\overline{G} }_{T}\) is the solar radiation incident on the PV array in the current time step expressed in (kW/m2), \({\overline{G} }_{T, STC}\) represents the incident radiation at the standard test condition given as (1 kW/m2), \({\alpha }_{P}\) is the temperature coefficient of power expressed as (%/\({^\circ{\rm C} }\)), \({T}_{c}\) equals to the ambient temperature of PV cell, average throughout the test (\({^\circ{\rm C} }\)), and \({T}_{c,STC}\) equals to the PV cell temperature of 25 \({^\circ{\rm C} }\) under standard test condition.

3.4.2 Battery Storage System

“The variability and intermittency of solar generation require a flexible storage system” (Hoarau & Perez, 2019). Therefore, to ensure the system’s higher reliability, we consider a battery storage system consisting of several Lithium-Ion (Li-ion) batteries. Li-ion batteries have higher round-trip efficiency (97.5%) and a higher life span than lead-acid batteries. The temperature at which a battery is kept has a strong bearing on the storage system’s life span. According to Smith et al. (2017), batteries exposed to higher temperature often have a shorter life-span. Therefore, we consider a battery maintenance system consisting of air conditioning, active air circulation, and direct evaporative cooling to control the batteries’ temperature and improve the storage system's useful life for the proposed project. Lockhart et al. (2019) referred to this maintenance system as the heating, ventilation, and air-conditioning (HVAC) configuration, which the Authors found to be very useful in prolonging a battery's life-span in SSA. However, it costs relatively more to implement the battery maintenance system's HVAC configuration; therefore, we consider $20 per kWh as the battery maintenance cost, consistent with Lockhart et al. (2019).

The battery storage system (BSS) model requires the following values to calculate the total cost of the BSS: The Battery initial and replacement cost ($/kW), maintenance cost ($/kW), the life-span of BSS (years) and BSS total capacity. HOMER uses a simulation optimization technique to determines the optimal BSS capacity. We present the storage systems’ capacity in the LCOE result summary in Table 4. Table 4 shows the BSS initial cost, and in Appendix A the replacement cost and maintenance cost are included.

The life-span of the BSS is determined using the following Equation.

Equation 2: Life-Span of the storage bank

Where \({R}_{\mathrm{batt}}\) is the BSS’ life (yr.), \({N}_{batt}\) is the number of batteries in the BSS, \({Q}_{\mathrm{lifetime}}\) is the lifetime throughput of a single battery (kWh), \({Q}_{\mathrm{thrpt }}\mathrm{and }{R}_{\mathrm{batt},f}\) represent the annual storage throughput (kWh/yr.) and storage float life (yr.) respectively.

3.4.3 Generator model

Following values are needed to model the LCOE for the diesel generator system design: the generator capacity, fuel consumption rate, generator efficiency rate, diesel cost ($/litre), generator life-span and operation and maintenance cost. The fuel cost is a significant cost parameter of the generator model, depending on the generator’s fuel consumption curve. The fuel consumption curve is defined as the amount of fuel the generator consumes to produce a kilowatt-hour of electricity; thus, it is linearly related to the electrical output as expressed in Eq. 3 and illustrated in Fig. 6.

Equation 3: Fuel consumption curve

Where F denotes the total fuel consumption for each timestep, \({F}_{0}\) represents the non-load fuel consumption per kW by the generator (fuel curve intercept coefficient expressed in (units /hr/kW)), and \({Y}_{\mathrm{gen}}\) represents the rated capacity of the diesel generator (kW). \({F}_{1}\) is the marginal fuel consumption per kW of the generator output in each timestep (the fuel curve slope also expressed in (units /hr/kW)), and \({P}_{\mathrm{gen}}\) represents the electrical output of the diesel generator. For our proposed project, we use the system optimized \({F}_{0}\) = 32.4 L/hr and \({F}_{1}\) = 0.236, which give the fuel consumption curve illustrated in Fig. 6.

The life-span of the generator represents the generator's actual operational life (\({R}_{\mathrm{gen}}\)), after which a replacement is required. It is defined in Eq. 4 as the lifetime hours of the generator (\({R}_{\mathrm{gen},\mathrm{ hr}}\)) divided by the number of hours the generator operates during the year (\({N}_{\mathrm{gen}}\)).

Equation 4: Operational life-span of the generator

The summation of the annualized fuel cost, generator initial and replacement costs, and OPEX divided by the total electrical load served gives the LCOE for the generator model. We present the individual cost components in Appendix A and the generator's auto-sized capacity in Table 4 (LCOE result summary).

3.4.4 Modelling the LCOE

The LCOE is the total annual cost of installing, operating and maintaining the mini-grid system divided by the total electricity served to consumers. We use Eq. 5 to calculate the LCOE,

Equation 5: Levelized Cost of Energy

where \({C}_{\mathrm{ann},\mathrm{tot}}\) is the total annualized system cost per year expressed in ($/yr). The \({E}_{\mathrm{served}}\) is the total electrical load served respectively.

3.4.5 The Annualized Cost

As mentioned, the proposed mini-grid system has a life-cycle of 25 years, which implies that system components such as the battery storage system, converter and Genset will require replacements at particular times. Therefore, we assume a discount rate of 10% to translate all future cash flows of the project to present costs to estimate the proposed project's net present cost. This assumption is consistent with (Hittinger et al., 2015). The total NPC and annualized cost of each system components are presented in Appendices A and B.

Equation 6: Annualized Cost

Where \({C}_{\mathrm{ann},\mathrm{tot}}\) represents the total annualised cost, \({C}_{NPC,\mathrm{tot}}\) t is the total net present cost ($), CRF is the capital recovery factor (the present value of an annuity), and it is defined in Eq. 7 as:

Equation 7: Capital Recovery Factor

Where: i and N represent the real discount rate and the number of years, respectively.

3.5 Data and Load Estimation

We obtain the local economic and techno-economic data from the Tanzania 2012 National Population Census, Tanzania mini-grid portal, World Bank Group, and the National Renewable Energy Laboratory (NREL) publications. We obtain about two-thirds of the cost assumptions from the World Bank Group's publication on mini-grids market outlook (ESMAP, 2019). Table 2 shows the cost assumptions used in this study.

3.6 Electricity Demand Estimation

We rely on data from the following two sources to estimate the potential electricity demand from the five villages in Mafinga Town (Ghosh Banerjee et al., 2017); (Williams et al. 2017). Ghosh et al. (2017) include case-studies of two mini-grids systems in Tanzania, of which the Mwenga mini-grid project is of comparable size as the proposed project, in terms of similar household types, commercial, community and agricultural activities. Likewise, the study by Williams et al. (2017) is based on case-studies of mini-grid projects in four different Tanzania communities, which exhibit similar daily load consumption reported by the World Bank report. The Rural African load profile tool simulates the hourly electrical load profile for various households and commercial entities commonly found in rural Sub-Saharan Africa. Thus, based on the data obtained from the world bank publication and validated with (Williams et al., 2017), we used the Load profile tool to simulate the potential electricity demand for Mafinga Town. Table 3 presents the total estimated daily, yearly loads and the peak demand for the various consumer types in the five villages in Mafinga Town. The projected load profile for Mafinga Town is exhibited in Fig. 7.

4 Results

This section discusses the results of the HOMER model. Table 4 shows the possible system configuration, such as the system components’ capacity, the system cost summary, and the LCOE for the three system designs. Figure 8 demonstrates the breakdown of the LCOE by system cost components. Appendix A and Appendix B offer the detailed cost summaries for the Base Case and the Future Case.

The LCOE vary significantly from one technology option to another. The Hybrid System emerges as the most cost-effective solution with approximately 89% penetration of renewable energy generation (PV+Battery) throughout the year. Its optimal system configuration is expected to generate 16.75 MW of electricity per day, approximately 22% more than the estimated load demand of 12.55 MW per day. It has a total life-cycle cost (net present cost) of $18.20 million and requires an electricity tariff of 32 cents to breakeven. The PV+Battery System appears to be the second cost-effective solution and compared to the Hybrid System, it will cost consumers extra 14 cents per kWh of electricity consumed. The PV+Battery system generates almost twice the projected electricity demand (23.17 MWh per day) to ensure high system reliability, indicating that the feasible system configuration is over-sized to make-up for the PV's intermittent generation. The Diesel Genset option is the least cost-effective solution. Besides, it has a higher impact on the environment and produces about 4,067 tonnes of greenhouse gas emission per year. It also produces about 16% excess electricity to ensure high system reliability. The cost of fuel accounts for about half ($0.36/kWh) of the LCOE. However, under the PV+Battery and the Hybrid Systems, capital expenditure (CAPEX) accounts for more than half of the LCOE (see Fig. 8).

4.1 The Profitability of the Proposed Mini-Grid System

The approved tariff for the proposed mini-grid project is approximately 10 cents per kWh, below the LCOE of the most cost-effective solution for the proposed project – the Hybrid System. The Hybrid system requires a minimum of 32 cents per kWh to recover its cost of investments. Thus, selling electricity at the current rate of 10 cents per kWh for the proposed mini-grid system will result in a loss of 22 cents on every kWh of electricity produced, which amounts to a total gross loss of $998,145 per year. Besides, EWURA approves an 18.5% return on equity for SPPs. Therefore, for the proposed mini-grid project to be financially sustainable, it must retail its electricity at a minimum rate of 38 cents per kWh, which implies that the project will require a subsidy of approximately $1 million per year to be financially feasible.

However, most of the subsidies for mini-grid projects in Tanzania were implemented between 2008 and 2014 (Org et al., 2016). Even if we apply the subsidies that used to be in place (Marching Grant and Performance Grant), they will not be enough to make the project profitable. Therefore, we argue that under the current tariff scheme in Tanzania, mini-grid projects are not financially viable from an investment perspective.

4.2 Sensitivity Analysis

Although the Hybrid System emerges as the most cost-effective solution, the competitiveness of the PV+Battery system is highly influenced by parameters such as cost of capital, system reliability and capital investment cost. Therefore, given the rapidly declining cost of renewable energy technologies, we performed a sensitivity analysis on the LCOE for the three system designs using the 2030 cost estimates by ESMAP (2019), different discount rates from 3 to 15% and annual capacity shortages from 5 to 30%.

We assess the effect of all the variables on the LCOE and find that combining the three factors will deliver the lowest LCOE between 10 cents per kWh and 7 cents per kWh. However, this is an extreme case, which in the context of Tanzania, is neither feasible now nor by 2030. This is based on the assumption that given the high investment risks associated with mini-grid projects in SSA, most private investors prefer to discount their future cash flows at the interest rates they anticipate receiving over the life of their investments (Williams et al., 2018; Grant Thornton, 2018). Thus, it is less likely for solar mini-grid projects to be discounted at the rate of 3% in SSA from an investment perspective. Therefore, this reinforces our argument that private commercial mini-grid projects in Tanzania purposely for rural electrification are not profitable even by 2030. Figure 9 illustrates the sensitivity of the LCOE to all three variables.

5 Conclusion and Policy Implication

Our analysis shows that despite a well-structured mini-grid tariff system and subsidies initiatives in Tanzania, operating privately-owned mini-grid systems in rural communities is not financially feasible. Further, we describe some of the challenges with the effective deployment of mini-grid systems in Tanzania. Specifically, we highlight non-cost-reflective tariff for mini-grid projects and the commercial risk of mini-grid projects as significant challenges facing the commercial deployment of mini-grid systems in Tanzania. Therefore, the government may consider the following:

Firstly, EWURA may want to review its tariff scheme for mini-grid developers to reflect the electricity supply cost from an off-grid system to serve isolated rural communities. This is particularly important because it appears the current tariff scheme is based on mini-grids systems connected to the grid. Meanwhile, the grid-connected mini-grids enjoys significant trade-offs between buying unmet load from the grid and selling excess load to the grid and oversizing the system to ensure system reliability. This option is rarely available to off-grid developers except for the latter, which is considerably more expensive.

Secondly, given the Hybrid and PV+Battery systems’ high initial capital requirement, the government may consider expanding its loan facilities to enable private developers to access adequate funding for their projects at a considerably low rate.

Lastly, as pointed out earlier, with an annual capacity shortage of 15%, the PV+Battery system emerges as the most cost-effective solution for providing electricity at the rate of 28 cents per kWh (approximately 40 percent decrease in LCOE). In this regard, we recommend that private developers consider complementary solutions such as Solar Home Systems to make-up for the capacity shortage if necessary.

Notes

- 1.

Commercial risks refer to low customer ability to pay for power and or low demand for power due to inefficient power use.

- 2.

Derivative-free optimization: It is a search algorithm that the model employs to find the most efficient system configuration that delivers the lowest LOCE; however, since this is a non-derivative method of optimization, the optimality cannot be guaranteed.

- 3.

Battery Storage System (BSS) a group of batteries connected using a series or parallel wiring to store the excess power generated from the solar PV.

- 4.

Converter (Inverter): a device that converts the direct current (DC) from the PV array to alternating current (AC).

- 5.

Discount Factor: High DF = 15% and Low DF = 3%

- 6.

Capacity Shortage: 25% (about 18 h of power supply per day).

- 7.

Future cost: 2030 cost estimates.

References

Ahlborg, H., & Hammar, L. (2012). Drivers and barriers to rural electrification in Tanzania and Mozambique e grid-extension, off-grid, and renewable energy technologies. RENE, 61, 117–124. https://doi.org/10.1016/j.renene.2012.09.057.

Arowolo, W., Blechinger, P., Cader, C., & Perez, Y. (2019). Seeking workable solutions to the electrification challenge in Nigeria: Minigrid. Reverse Auctions and Institutional Adaptation’. https://doi.org/10.1016/j.esr.2018.12.007.

Azimoh, C. L., Klintenberg, P., Wallin, F., Karlsson, B., & Mbohwa, C. (2016). Electricity for development: Mini-grid solution for rural electrification in South Africa. Energy Conversion and Management, 110, 268–277. https://doi.org/10.1016/j.enconman.2015.12.015.

Eberhard, A., & Shkaratan, M. (2012). Powering Africa: Meeting the financing and reform challenges. Energy Policy, 42, 9-18. https://doi.org/10.1016/j.enpol.2011.10.033

Economic consulting associates viewpoint mini-grids: Are cost-reflective tariffs necessary? What are the options? Economic drivers of tariff policy, 2017.

ESMAP. (2015). Solar resource mapping in Tanzania. http://documents.worldbank.org/curated/en/651091467986286838/pdf/96827-ESM-P145287-PUBLIC-Box391467B-WBG-ESMAP-Tanzania-Solar-Modeling-Report-2015-02.pdf.

ESMAP. (2019). Mini grids for half a billion people Market outlook and handbook for decision makers.

EWURA. (2019a). Public notice on cap prices for petroleum products effective Wednesday.

EWURA. (2019b). Public notice on cap prices for petroleum products effective Wednesday. https://www.ewura.go.tz/wp-content/uploads/2019b/08/Cap-Prices-For-Petroleum-Products-07-August-2019-English.pdf.

Ghosh Banerjee, S., Malik, K., Tipping, A., Besnard, J., & Nash, J. (2017). Double dividend: Power and agriculture nexus in Sub-Saharan Africa.

Grant Thornton. (2018). Africa renewable energy discount rate survey – 2018, no. October.

Hittinger, E., Wiley, T., Kluza, J., & Whitacre, J. (2015). Evaluating the value of batteries in microgrid electricity systems using an improved energy systems model. Energy Conversion and Management, 89, 458–472. https://doi.org/10.1016/j.enconman.2014.10.011.

Hoarau, Q., & Perez, Y. (2019). Network tariff design with prosumers and electromobility: Who wins, who loses? Energy Economics, 83, 26–39. https://doi.org/10.1016/j.eneco.2019.05.009.

IEA. (2017a). WEO-2017a special report: Energy access outlook.

IEA. (2019). Africa_Energy_Outlook_2019.Pdf.

IEA; IRENA; UNSD; WB; WHO. (2019). Tracking SDG 7: The energy progress report 2019.

Lockhart, E., Li, X., Booth, S. S., Olis, D. R., Salasovich, J. A., Elsworth, J., & Lisell, L. (2019). Comparative study of techno-economics of lithium-ion and lead-acid batteries in micro-grids in Sub-Saharan Africa. https://doi.org/10.2172/1526204.

Moner-Girona, M., Ghanadan, R., Solano-Peralta, M., Kougias, I., Bódis, K., Huld, T., & Szabó, S. (2016). Adaptation of feed-in tariff for remote mini-grids: Tanzania as an illustrative case. Renewable and Sustainable Energy Reviews, 53(January), 306–318. https://doi.org/10.1016/j.rser.2015.08.055.

Org, W., Odarno, L., Sawe, E., Swai, M., Katyega, M. J. J., & Lee, A. (2016). Accelerating mini-grid deployment in Sub-Saharan Africa: Lessons from Tanzania.

Pavlovi, T. M., Milosavljevi, D. D., & Pirsl, D. S. (2013). Simulation of photovoltaic systems electricity generation using homer software in specific locations in Serbia. Thermal Science, 17(2), 333–347. https://doi.org/10.2298/TSCI120727004P.

Peters, J., Sievert, M., & Toman, Michael A. (2019). Rural electrification through mini-grids: Challenges ahead. Energy Policy, 132, 27–31. https://doi.org/10.1016/j.enpol.2019.05.016.

Reber, T., Booth, S., Cutler, D., Li, X., & Salasovich, J. (2018). Tariff considerations for micro-grids in Sub-Saharan Africa.

Smith, K., Saxon, A., Keyser, M., Lundstrom, B., Cao, Z., & Roc, A. (2017). Life prediction model for grid-connected Li-ion battery energy storage system. In 2017 American Control Conference (ACC) (pp. 4062-4068). IEEE. https://doi.org/10.23919/ACC.2017.7963578

The United Republic of Tanzania. (2013). The United Republic of Tanzania 2012 population and housing census. http://www.tzdpg.or.tz/fileadmin/documents/dpg_internal/dpg_working_groups_clusters/cluster_2/water/WSDP/Background_information/2012_Census_General_Report.pdf.

The United Republic of Tanzania. (2017). Energy access situation report, 2016 Tanzania Mainland’ 2 (February). https://doi.org/10.1016/S1052-3057(16)30617-6.

Williams, N. J., Jaramillo, P., Cornell, B., Lyons-Galante, I., & Wynn, E. (2017). Load characteristics of East African microgrids. In 2017 IEEE PES PowerAfrica, 236–41. IEEE. https://doi.org/10.1109/PowerAfrica.2017.7991230.

Williams, N. J., Jaramillo, P., & Taneja, J. (2018). An investment risk assessment of microgrid utilities for rural electrification using the stochastic techno-economic microgrid model: A case study in Rwanda. Energy for Sustainable Development, 42, 87–96. https://doi.org/10.1016/j.esd.2017.09.012.

Acknowledgements

The authors appreciate the support of the Climate Economics Chair. We thank HOMER Energy for granting us a temporal license to use the HOMER software for our analysis. The paper has also benefited from Quentin Hoarau, Come Billard, Olivier Rebenaque, Théotime Coudray and Wale Arowolo comments. All errors remain the responsibility of the Authors.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix A: Base Case Cost Summary

Appendix B: Future Case Cost Summary

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Zigah, E., Barry, M., Creti, A. (2023). Are Mini-Grid Projects in Tanzania Financially Sustainable?. In: Groh, S., Barner, L., Heinemann, G., von Hirschhausen, C. (eds) Electricity Access, Decarbonization, and Integration of Renewables. Energiepolitik und Klimaschutz. Energy Policy and Climate Protection. Springer VS, Wiesbaden. https://doi.org/10.1007/978-3-658-38215-5_10

Download citation

DOI: https://doi.org/10.1007/978-3-658-38215-5_10

Published:

Publisher Name: Springer VS, Wiesbaden

Print ISBN: 978-3-658-38214-8

Online ISBN: 978-3-658-38215-5

eBook Packages: EnergyEnergy (R0)