Abstract

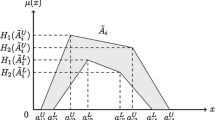

This paper discusses a fuzzy chance-constrained project portfolio selection problem based on credibility theory. Risk of project portfolio is measured using conditional value at risk (CVaR) approach. The proposed model maximizes the expected fuzzy net present value (FNPV) subject to credibilistic chance constraint (CCC) of CVaR. We transform the chance-constrained model into deterministic model when the investment cost and return are characterized by triangular and trapezoidal fuzzy numbers. An improved genetic algorithm (GA) is designed to solve this problem. Two numerical examples with different types of membership function are also given to illustrate the modeling idea of the paper and to demonstrate the effectiveness of the proposed algorithm.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Juite W, Hwang WL (2007) A fuzzy set approach for R&D portfolio selection using a real options valuation model. Omega Int J Manage Sci 35(3):247–257

Sherif M, McCowan AK (2001) Modelling project investment decisions under uncertainty using possibility theory. Int J Project Manage 19(4):231–241

Meng FM, Sun J, Goh M (2011) A smoothing sample average approximation method for stochastic optimization problems with CVaR risk measure. Comput Optim Appl 50(2):379–401

Szolgayová J, Fuss S, Khabarov N, Obersteiner M (2011) A dynamic CVaR-portfolio approach using real options: an application to energy investments. Eur Trans Electr Power 21(6):1825–1841

Wang MH, Xu CX, Xu FM, Xue HG (2012) A mixed 0–1 LP for index tracking problem with CVaR risk constraints. Ann Oper Res 196(1):591–609

Sun XL, Bai XD, Zheng XJ (2012) A survey on probabilistically constrained optimization problems. Oper Res Trans 16(3):65–74

Cheon MS, Ahmed S, Al-Khayyal F (2006) A branch-reduce-cut algorithm for the global optimization of probabilistically constrained linear programs. Math Program 108:617–634

Dentcheva D, Martinez G (2011) Augmented lagrangian method for probabilistic optimization. Ann Oper Res 200(1):109–130

Luedtke J, Ahmed S (2008) A sample approximation approach for optimization with probabilistic constraints. SIAM J Optim 19:674–699

Zadeh LA (2008) Is there a need for fuzzy logic? Inf Sci 178(13):2751–2779

Pedrycz W, Gomide F (2007) Fuzzy systems engineering: toward human-centric computing. IEEE press, Wiley, New York

Liu B, Liu YK (2002) Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans Fuzzy Syst 10(4):445–450

Huang X (2010) Portfolio analysis: from probabilistic to credibilistic and uncertain approaches. Studies in fuzziness and soft computing. Springer, Heidelberg

Acknowledgments

This work is partly supported by Natural Science Foundation of China under grant No. 71240015, Natural Science Foundation of Guangdong Province under grant No. S2011010001337, Foundation for Distinguished Young Talents in Higher Education of Guangdong under grant 2012WYM_0116, the MOE Youth Foundation Project of Humanities and Social Sciences at Universities in China under grant 13YJC630123 and the Fundamental Research Funds for the Central Universities under grant 2012ZM0031.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Li, L., Li, J., Qin, Q., Cheng, S. (2014). Fuzzy Chance-Constrained Project Portfolio Selection Model Based on Credibility Theory. In: Wen, Z., Li, T. (eds) Foundations of Intelligent Systems. Advances in Intelligent Systems and Computing, vol 277. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-54924-3_69

Download citation

DOI: https://doi.org/10.1007/978-3-642-54924-3_69

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-54923-6

Online ISBN: 978-3-642-54924-3

eBook Packages: EngineeringEngineering (R0)