Abstract

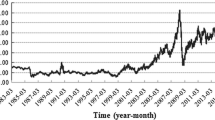

In this paper, we applied the method of asymmetric cointegration to analysis the non-symmetry impact of the international crude oil price volatility on the economic of China. The empirical results show that asymmetric cointegration relationship exists, even though there is no long-term cointegration between the international crude oil prices fluctuations and GDP in China. This shows that the rise in international crude oil price on China’s economic role played by the obstacles is greater than the price drop on the economy played a stimulating role, but the non-symmetry relationship is not obvious. This paper puts forward policy recommendation.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Bernanke BS, Gertler M, Watson M (1997) Systematic monetary policy and the effects of oil price shocks. Brookings Pap Econ Activity 1:91–157

Ferderer JP (1996) Oil price volatility and the macroeconomy: a solution to the asymmetry puzzle. J Macroecon 18:1–16

Hamilton JD (1983) Oil and the macro economy since World War II. J Polit Econ 91:228–248

Hamilton JD (1988) A neoclassical model of unemployment and the business cycle. J Polit Econ 96:593–617

Lardic S, Mignon V (2008) Oil price and economic activity: An asymmetric cointegration approach. Energy Econ 30:847–855

Lilien D (1982) Sectoral shifts and cyclical unemployment. J Polit Econ 90:777–793

Mory JF (1993) Oil prices and economic activity: is the relationship symmetric? Energy J 14:151–161

Acknowledgments

This research was supported by Scientific Research Foundation for the Dr. project of Northeast Dianli University of 2009, under Grant BSJM-200910.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2011 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Wu, X., Wang, Y., Pan, Y. (2011). The Asymmetrical Analysis of the International Crude Oil Price Fluctuation on Chinese Economy. In: Wu, D., Zhou, Y. (eds) Modeling Risk Management for Resources and Environment in China. Computational Risk Management. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-18387-4_51

Download citation

DOI: https://doi.org/10.1007/978-3-642-18387-4_51

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-18386-7

Online ISBN: 978-3-642-18387-4

eBook Packages: Business and EconomicsBusiness and Management (R0)