Abstract

Agricultural risk management involves a portfolio of strategies that can, to different extents, prevent, reduce, and/or properly transfer the impact of a shock. Adaptation, mitigation and coping strategies provide a range of complementary approaches for managing risks resulting from adverse weather events. This paper discusses how the issue of adverse weather events is a challenge for agriculture, and offers an overview of climate risk management strategies and an in-depth examination of one of the most tested risk transfer tools—index-based insurance. It describes the development of the insurance market in Africa, and analyses the major challenges and contributions made by weather index-based insurance.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Although agriculture is Africa’s largest economic sector, it only generates 10% of its total agricultural output. Mainly rain-fed, agriculture remains highly dependent on weather and sensitive to extreme weather patterns such as erratic rainfall (AGRA 2014). Exposure and vulnerability to adverse events are key determinants for assessing the impacts of shocks that, in the majority of developing countries, still represent the main causes of losses. According to the data of the Centre for Research on the Epidemiology of Disasters-CRED (http://www.emdat.be), approximately 11 million people in developing countries were affected by natural hazards in 2013, 50% of whom were affected by weather-related events. Whilst floods were the most frequent type of natural disaster events, droughts were the most important events in terms of people affected and large economic damages caused (Carter et al. 2014).

The frequency of extreme climate events is generally increasing all over the world (IPCC 2012), but the devastating effects are mainly recorded in those areas where there are high rates of poverty and limited resources and capacity for disaster response. This is true for half of Sub-Saharan countries that are hit by at least one drought every 7.5 years, and by at least one flooding event every three years (Dilley et al. 2005).

In this context, prevention, adaptation and mitigation strategies provide a range of complementary approaches for managing risks that arise from adverse weather events. Effective risk management responses should involve a portfolio of strategies to reduce the impact of and properly transfer the residual part of the risks (the part not covered by other mechanisms). As a part of these mechanisms, a particular form of risk transfer, known as index-based insurance, has received increased attention from a number of academic researchers, international multilateral and non-governmental organisations, and national governments (Miranda and Farrin 2012). The interest shown in the use of this particular tool translated into a number of agricultural insurance pilots that, with the exception of a few cases outside Africa, still suffer from substantial limitations. Besides the numerous advantages of index-based insurance over conventional insurance products, a number of technical and socio-economic challenges have prevented its scalability at a commercial level. These unsatisfactory results are generated by both demand and supply. In this paper, we provide some insights into the reasons behind the difficulties in scaling-up agricultural insurance and, in particular, index-based insurance schemes.

By reviewing pilot projects in Africa and the current literature, this paper also aims to introduce the key concepts and definitions behind risk management; provide background information on the agricultural insurance market in Africa, discussing both its development as well as the different types of insurance products, particularly index-based insurance; and highlight the challenging factors that undermine product upscaling.

2 Agricultural Risk Management and Strategies

Agriculture is the largest economic sector of many African countries, employing 65% of the African labour force and accounting for about a third of its gross domestic product (World Bank 2008). Eighty percent of all farms in Sub-Saharan Africa (SSA) are smallholder farmers, who contribute up to 90% of the production in some SSA countries (AGRA 2014). However, production remains primarily at the subsistence farming level (70%), with only a residual part generally commercialised (McIntyre et al. 2009).

Because of its intrinsic nature, the agricultural output remains sensitive to climate variability (IPCC 2012). In addition, the increasing number of catastrophic events and other extreme natural resource challenges and constraints weaken the recovery process or worsen the long-term process of accumulating assets (Carter et al. 2007). These combined factors affect the livelihood of large parts of the population that are vulnerable to weather shocks (Gautam 2006), and whose level of preparedness and ability to properly respond to risks need to be improved.

Over time, individuals involved in the agricultural sector have developed a range of risk-management practices. Rural communities, financial institutions, traders, private insurers, relief agencies and governments all use a variety of both ex-ante and ex-post measures to reduce risk exposure and cope with losses. In some cases, and in the absence of formal mechanisms, rural households have developed individual or collective ex-ante actions for managing risks. In anticipating the negative effects of shocks, the most straightforward decision that a risk-averse farmer makes is to avoid profitable, but risky, activities (Elabed and Carter 2014; Hill 2011).

In the same vein, other informal arrangements, either in the form of ex-ante or ex-post strategies, though effective means for offsetting the negative impact of idiosyncratic shocks, have proven inadequate to protect people from destructive events that impact a large number of individuals simultaneously (Hazell 1992). For instance, Awel et al. (2014) highlight the ineffectiveness of informal risk sharing group arrangements, arguing that this mechanism cannot cope with spatial covariate shocks. Similarly, Dercon et al. (2014), showed that group risk-sharing mechanisms are very strong among households in Ethiopia, but tend to offer only a partial form of insurance, as they are characterised by limited commitment. This does not guarantee full insurance against covariate risks.

Another informal and ex-post strategy used by poor farmers and pastoralists is the depletion of productive assets to offset income shocks and stabilise consumption (Carter et al. 2011). This strategy, frequently used by farmers to cope with shocks (Janzen and Carter 2013), has been found to have pernicious effects on household welfare (Hill 2011) and lower households’ ability to escape poverty (Lunde 2009).

Whilst moving from informal to formal sharing arrangements appears in theory to be advantageous for rural community members, evidence from a rural village in the Borana area of Ethiopia shows that, due to the complementarity of the two forms of risk arrangement as well as the same selection and monitoring processes, “the formal credit service does not seem to outperform in terms of outreach the informal risk sharing arrangements” (Castellani 2010).

Whilst most ex-ante and ex-post mechanisms implemented as formal or informal mitigation/coping strategies (Fig. 16.1) are in place in many developing countries (albeit to different extents and in different combinations), a comprehensive framework that facilitates multidisciplinary risk evaluation and strategy implementation is commonly lacking.Footnote 1 The best way to efficiently combine a variety of instruments is also not yet completely clear. Jaffee et al. (2010) state that ‘all these instruments have different private and public costs and benefits, which might either increase or decrease the vulnerability of individual participants and the supply chain. When selecting a mix of risk responses, supply chain participants take account of the many inter-linkages among the different types of risk management strategies and instruments’.

Risk management strategies in agriculture (author elaboration based on World Bank 2005)

There is, however, only fragmented information for some countries as India (Venton and Venton 2004) or Nepal (Dixit et al. 2008), but there is as yet no national information system that can estimate the cost-benefit ratio of disaster management and preparedness programmes.

Hence, while the process for recognising the value of integrated and multi-layer strategies is still far from being widely implemented, countries have focused on the analysis of the potential benefits of specific tools designed to provide protection from one or more agricultural risks. One of these instruments is agricultural insurance.

3 Agricultural Insurance

Agricultural insurance has a long history in many countries, and has been largely successful in China and other developed countries (Sandmark et al. 2013). The first agricultural insurance product was developed in Germany in 1700 (Sandmark et al. 2013). It later emerged in the United States, Japan and Canada, and today different types of this product are common in most parts of Europe. Despite heavy government subsidies, insurance penetration remains low even in developed countries, where it never exceeds two percent (Mahul and Stutley 2010). The development of the market is even lower in developing countries, with market penetration in Africa generally being the lowest. A study carried out on a sample of 65 countries (including seven of the eleven countries offering insurance in Africa) by Mahul and Stutley (2010) concluded that agricultural insurance penetration was mostly low in large parts of the surveyed countries, particularly in low- and middle-income countries, where it was less than 0.3%.

Although the estimated global agricultural insurance premium volume almost doubled in the period 2004–2007, it remained low especially in African countries where it roughly reached 63.5 USD million, equivalent to an average of 0.13% of the 2007 agricultural GDP (Table 16.1). Despite the recent relative growth of the insurance industry in Africa, the premium volume generated by the agriculture sector remains marginal (Asseldonk 2013).

Additional insights come from further splitting crop insurance products into the two major groups: traditional indemnity-based productsFootnote 2 and index-based products (Table 16.2). These results depict a low level of development of the market, and particularly any relevant move of the unconventional products. Figures also suggest that the marginal growth of this sector remains predominantly anchored in traditional areas such as indemnity-based crops. This trend is also confirmed by other studies, which report that indemnity-based crops and livestock insurance account for almost 70% of all policies (McCord et al. 2013).

4 Penetration of Agricultural Insurance in Africa

The low expansion depicted above could be seen as a snapshot of past market development, which may not reflect current trends. However, the findings of other studies do not diverge significantly from these results. The study of the landscape of microfinance in Africa conducted by the MicroInsurance Centre (Matul et al. 2010) offers some valuable insights to help understand the dynamic of microinsurance markets.Footnote 3 In line with the previous findings, the study shows that while life insurance products dominate the insurance market, considerable regional differences remain in product outreach. Indeed, excluding Southern African countries (mainly South Africa), market development is quite unchanged, and agricultural microinsurance is almost inexistent (Fig. 16.2).

Microinsurance penetration in SSA excluding South Africa (author’s elaboration based on www.microinsurancecentre.org/landscape-studies.html)

Compared to other developed and developing countries, African countries have very limited experience in the agricultural insurance sector. Information collected in 2008 on microinsurance in Africa identified fewer than 80,000 farmers benefiting from agricultural (crop and livestock) insurance (Matul et al. 2010). Agricultural coverage increased to approximately 220,000 people in 2011, although this growth was mainly concentrated in East Africa. In the same year, an average of 8000 policies were issued for each of the 30 different products identified in the region (McCord et al. 2013). In 2014, the number of total polices sold in Africa more than doubled, mainly as a result of the introduction of a significant number of parametric products that were still in a pilot stage. Although the insurance market in Africa has registered an increase in the past ten years, in terms of number of countries entering the market and number of policies sold, the overall outreach is still too small (Fig. 16.3).

Geographic distribution of total population covered by Agricultural microinsurance (figure for 2014) (www.microinsurancecentre.org/landscape-studies.html)

From 2011 to 2014, the average agricultural coverage ratio (defined as a percentage of the country’s total population covered by agricultural microinsurance) grew from 0.01 to 0.05. This increase was mainly driven by Algeria, Nigeria and Kenya, with an average agricultural coverage ratio of 0.33. Compared to the other two countries, Kenya experienced the higher increase in terms of policy numbers. From 23,523 policies in 2015, 150,370 people were subscribed in 2014. Compare this with Nigeria, which in 2014 entered the agricultural insurance market with more than 540,000 policies.

5 Index-Based Insurance Products

Whilst indemnity-based agricultural insurance continues to be the reference in the agricultural sector, over the past ten years, there has been a growing interest among researchers, international multilateral and non-governmental organisations, and national governments in exploring the possibility of using a particular form of microinsurance—insurance tailored to the needs of the poor—to cover the potential losses of smallholder farmers associated with weather shocks (Patt et al. 2008). This alternative form of insurance, known as index-based insurance, has been offered to stimulate rural development by allowing smallholder farmers to better adapt to climate change (Dercon et al. 2008), and remove some of the well-known structural problems associated with conventional agricultural insurance, including moral hazard, adverse selection, and systemic risk.

In contract to traditional crop insurance, index-based insurance product does not require a formal claim from the insured nor an individual check of the loss to process indemnification. Within this product, payouts are triggered by an independently monitored weather index that is based upon an objective event that causes loss (i.e. insufficient rainfall) and that is strongly correlated with the variable of interest (for example, crop yield). Based on the underlying data and information on which an index is based, we can distinguish three main types of products:

-

Area-yield index insurance: which was first developed in Sweden in the early 1950s and which has been implemented on a national scale in India since 1979 and in the United States since 1993. The average yield over a large area, e.g. a district, serves as index. Indemnities for farmers are determined as a function of the difference between the current season area yield and the longer-term average yield achieved in the same area. This requires that both, the current season yield level and the historical area yields be known.

-

Weather Index-based insurance: commercially underwritten since 2002, this type of insurance utilises a proxy (or index)—such as amount of rainfall or temperature—to trigger indemnity payouts to farmers. The operationalisation of this product requires intensive technical inputs and skills that are often not available in Africa. The concentration on rainfall indices and the need for high quality weather data and infrastructure, combined with the currently limited options for insurance products, present additional challenges to the adoption of this product.

-

Remotely-sensed index-based insurance: are insurance schemes based on indexes constructed using remote sensing data and are variants of either area-yield or weather index-based insurance schemes. These products were introduced to try resolve the problems of scarcity of weather stations in remote rural areas. However, the low correlation of the indices constructed from remote sensing data and the actual losses is not yet resolved. The calibration of the model linking the index to losses remains a challenge because of the lack of reference data. The inadequacy of ground-based data has prompted doubts on the use of these products (Rojas et al. 2011).

5.1 Pilot Projects in Africa

Index-based insurance has been sold as the most promising approach to minimising ex-post verification costs (IFAD 2011). Despite its multiple advantages (i.e. removal of asymmetric information, low administrative costs once the product structures have been standardised, timeliness in payment), the penetration of this product has not produced the expected results and, after more than a decade, is still largely in the pilot stage, with several projects operating around Africa. Different alternatives in terms of product design, delivery mechanisms, pricing, and target population have been tried, but no long-term solution has yet been reached.

Difficulties in achieving positive results (World Bank 2005) have not discouraged many from exploiting the market by promoting several pilot tests. While these initiatives have helped explore the possibility of creating a market for this product, they have not yet clarified the real set of benefits for consumers. Table 16.3 summarises some characteristics of a selected number of weather index-insurance projects reviewed in other publications (Bruke et al. 2010; Carter et al. 2014; Asseldonk 2013; Hess and Hazel 2009; Skees et al. 2007; World Bank 2005).

Demand for index-based insurance is generally low. Supply and demand constraints have not yet been completely removed and results continue to be below expectations. Uptake among different products has been shown to be in the range of 20–30% (Giné 2009; Jensen et al. 2014a), with adopters usually hedging only a very small proportion of their agricultural income (McIntosh et al. 2013). Correspondingly, spontaneous uptake among the non-targeted population has never exceeded 10% (Oxfam 2013).

Though some experiences outside Africa seem satisfactory (Carter et al. 2014), several physical, economic and institutional constraints make it difficult to replicate these positive results in Africa. Bruke et al. (2010) identify several supply and demand constraints common to almost all pilots. On the supply side, the most common constraints are: lack of good quality data, start-up costs and related economic support by the government and difficulty in transferring covariate risk to the international reinsurance market. Other frequent supply constraints are related to inappropriate and/or costly delivery mechanisms (Sina 2012), lack of an enabling environmentFootnote 4 (Cole et al. 2009) and unfamiliarity with the insurance market Mahul and Stutley 2010).

Premium affordability (Carter 2012; Burke et al. 2010), farmers’ trust in insurance providers (Cole et al. 2009), financial illiteracy (Giné and Yang 2009), cognitive failure (Skees et al. 2008), and low willingness to pay (Chantarat et al. 2009) are usually pointed out as the major demand constraints that prevent product scalability. Similarly, empirical studies conducted in Malawi and Kenya strongly supported the hypothesis that ambiguity-averseFootnote 5 agents do not value any actuarially fair insurance contracts and have a lower willingness to pay for any specific contract (Bryan 2010).

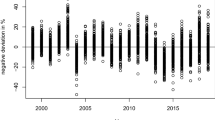

Data constraints remain the central problem for good index design. To work properly, an index must be highly correlated with losses. Studying this correlation is of particular interest because it allows insurance providers to understand the magnitude of error associated with poor information. Indeed, the higher the correlation, the lower the error of an index in predicting losses. This error (known as basis risk) is recognised as the main drawback of index insurance products (Carter et al. 2014). It basically consists in the mismatch between the payout triggered by the index and the real loss faced by the policy holders. Basis risk not only affects the insured but also the insurance company, which might be compelled to pay an indemnity even when no loss was incurred. To detect this correlation, long historical weather information and yield data are needed. It is generally assumed that a time series of at least 20 years’ data is enough to study this correlation. Additionally, for rainfall-based indices, it is also conventionally accepted that a 20-km radius data point can depict the rainfall pattern of all those living within this spatial area. This rule has, however, proved to be based on an overly optimistic assumption (Di Marcantonio et al. 2016), particularly in regions characterised by high levels of microclimatic variation (Gommes and Göbel 2013). This aspect, in combination with low density and uneven distribution of weather stations (Washington et al. 2006) and declining number of gauges (Maidment et al. 2014), lead us to rethink the suitability of current rainfall information as a good source for index insurance construction in many African countries. In addition to historical weather patterns, consistent and long-term weather time series are also essential for detecting correlations and to retrospectively estimate the frequency of extreme events, which influences the pricing of the product.Footnote 6

Past experiences showed that, while in some cases lack of such information discouraged suppliers from implementing further projects, in other cases it led to innovative alternatives. For instance, in the case of Malawi, one of the pioneer African countries experimenting with index insurance, the low density of automated rainfall stations prevent an additional 200,000 farmers from being included in the programme. On the contrary, insufficient weather data, low quality of historical weather data, and lack of dense weather stations did not prevent Syngenta Foundation (now operating through Agriculture and Climate Risk Enterprise Ltd. (ACRE)) from further expanding the project. The problem of low quality and scarce weather information was overcome by installing new automated weather stations.Footnote 7 Whilst this allows the insurance company to keep basis risk under check, it will not solve the problem of incomplete historical weather time series, at least in the short run. In addition, the installation and maintenance of additional weather stations is often not affordable for Meteorological Services in Africa, and can be very problematic in remote or conflict-affected areas.

For this reason, many pilots use alternative information, such as satellite-based measurements Besides the numerous advantages of applying remote sensing to the insurance market (de Leeuw et al. 2014), refining the set of missing information in an efficient and timing manner might be costly and even unfeasible (Vrieling et al. 2014).Footnote 8 However, the use of this information has brought new and as yet unresolved challenges. For instance in the case of IBLI, the performance of the first index was found to perform poorly in estimating drought-related mortality (Jensen et al. 2014b). The low quality of livestock mortality data led to study a new algorithm for the index (Woodard et al. 2016). The current index no longer explicitly predicts livestock mortality rates and product now “makes indemnity payments according to an index developed using only NDVI values” (Mills et al. 2015).

All these aspects highlight the reasons why index design is so complicated to implement and no pilots is currently scaled up in Africa to a commercially viable products at a fair price attractive to poor consumers. Additionally, while the level of uptake remains important for understanding the potential of scaling up the product, more emphasis should be given to other related aspects such as: (a) the market discovery effect (new purchaser compared to renewed insurance), (b) proportion of full cash compared non-cash purchaser (either those who pay with work or those who mainly use coupons or other form of subsidy), (c) quantity insured versus quantity owned.

6 Conclusion

The challenge of risk management in agriculture is to find the proper balance between taking on risk and preparing for it with ex-ante actions, and management of the consequences only after the event has occurred. Loss reduction and protection of livelihoods are the main goals of risk management actions. As there is no unique recipe to deal with shocks in agriculture, risk management strategies should pursue this goal by combining the capacity to prepare for risk with the ability to cope with the effects. The development of a comprehensive framework would help in this sense.

In the context of agricultural risk management, interest has moved recently towards risk transfer mechanisms in the form of crop and livestock insurance. A particular form of insurance, known as index-based insurance, has received growing attention, attracting substantial resources which have resulted in a large number of pilot programmes to test the effectiveness of this product to manage covariate risk in agriculture.

Although index-based insurance has been developed as an instrument to avoid consumption smoothing or depletion of valuable assets among other social welfare benefits, ambiguous results feed the debate on how much this product represents an opportunity for development, especially in a dynamic and changing environment.

The effectiveness of this instrument is still uncertain, but many lessons can be learned from past experience. Particularly, within the wide range of pilot experiences we revised, some key messages are clear and self-explanatory. In recent years the level of uptake has increased but is still insufficient to make the product commercially viable. On average, the uptake ranges from 30 to 40%, but in the majority of the cases this is mainly driven by the availability of subsidies to reduce the insurance premiums. Reasons behind the low uptake rates come from both the demand and supply sides. From the demand side, price affordability, cognitive failure and the economic behaviour of farmers have been found to be common factors that dampen the demand for the product. In many cases, these challenging aspects have called for government intervention, a solution that in the long term would not be sustainable. On the supply side, one of the major problems is the basis risk. This problem, which is intrinsic to the nature of the product, mainly steam from the inadequacy of the data and it represents a critical limitation to the upscaling of this product.

Whilst few analyses of the impact of basis risk on a product demand exist, statistical assessment of its magnitude is lacking. Understanding the “tolerable error” attached to this product would also clarify the effectiveness of the tool and confirm or reject the current trends. Similarly, considering that insurance is just one among a number of complementary instruments, it is important to understand to which extent and at what cost it is possible to design an affordable insurance scheme that responds to the real needs of the vulnerable farmers and pastoralists.

Notes

- 1.

The methodology for a Rapid agricultural supply chain risk assessment (RapAgRisk), developed by the Agricultural risk management team (ARMT) of the World Bank, provides a system-wide approach for identifying risks, risk exposure, the severity of potential losses, and options for risk management either by supply-chain participants (individually or collectively) or by third parties (e.g. the Government). It is designed to provide a first approximation of major risks, vulnerabilities, and areas that require priority attention for investment and capacity building (Jaffee et al. 2010).

- 2.

Indemnity-based insurance is generally divided into two categories: (1) named peril, and (2) multiple peril. Named peril crop insurance (NPCI) involves assessing losses based upon a specific risk or peril (hail insurance is the most common type of named peril insurance). Multiple peril crop insurance (MPCI) provides cover for more than one peril, but has never been successfully offered by the private sector on purely commercial terms (Sina 2012).

- 3.

- 4.

Public-sector interventions are important to ensure that conditions exist for private insurers to go beyond conducting pilot projects, and to start scaling up the business to reach larger numbers of smallholders (IFAD 2010).

- 5.

Ambiguity aversion is best understood by considering the Ellsberg paradox. Ellsberg (1961) argued that, faced with two gambling options, one with known odds and one with unknown odds, many people prefer to choose the option with known odds, even if they can choose which side of the gamble to take. Basically, he showed that individuals react much more cautiously when choosing among ambiguous lotteries (with unknown probabilities) than when they choose among lotteries with known probabilities.

- 6.

The accuracy of these information, used to estimate the parameters of the probability distribution for the underlying weather risk, clearly determinates the pure risk of the insurance contract (Makaudze 2012).

- 7.

- 8.

Regarding the NDVI, for instance, retrieving long-term consistent time series from various sources based on different sensor characteristics and algorithms could be time and resource consuming (Miura et al. 2006). In addition to this and other technical constraints (i.e. corrections for effects such as sensor degradation, orbital drift, and atmospheric variability), Turvey and McLaurin (2012) state that three relationships need to exist for an NDVI to work as an insurance index: (i) weather parameters of interest (e.g. extreme heat and/or drought) are strongly related to the NDVI; (ii) the NDVI can explain the variability of crop yields in detail; and (iii) the NDVI measures must be correlated with losses.

References

AGRA-Alliance for a Green Revolution in Africa. 2014. Africa agriculture status report 2014: Climate change and smallholder agriculture in Sub-Saharan Africa. Nairobi, Kenya. Issue No. 2.

Asseldonk, M. Van. 2013. Market outlook for satellite-based RE index insurance in agribusiness. LEI memorandum 13-085.

Awel, Y.M., and T.T. Azomahou, T.T. 2014. Productivity and welfare effects of weather index insurance: Quasi-experimental evidence. Working Paper, UNU-MERIT and Maastricht University.

Bryan, G. 2010. Ambiguity and insurance. Yale working paper.

Burke, M., de Janvry, A., J. Quintero. 2010. Providing index based agricultural insurance to smallholders: Recent progress and future promise. Available at: http://siteresources.worldbank.org/EXTABCDE/Resources/7455676-1292528456380/7626791-1303141641402/7878676-1306270833789/Parallel-Session-5-Alain_de_Janvry.pdf.

Carter, M.R., A. de Janvry, E. Sadoulet, A. Sarris. 2014. Index-based weather insurance for developing countries: A review of evidence and a set of propositions for up-scaling. Working paper.

Carter, M.R., P.D. Little, T. Mogues, and W. Negatu. 2007. Poverty traps and natural disasters in Ethiopia and Honduras. World Development 35 (5): 835–856. doi:10.1016/j.worlddev.2006.09.010.

Carter, M.R. 2012. Designed for development: Next generation approaches to index insurance for smallholder farmers. ILO/MunichRe Microinsurance Compendium 2.

Carter, M.R., M. Ikegami, S.A. Janzen. 2011. Dynamic demand for index-based asset insurance in the presence of poverty traps. Working paper.

Castellani, D. 2010. Microfinance and risk sharing arrangements: Complements or substitutes? Theory and evidence from Ethiopia. Ph.D. thesis Catholic University of Milan.

Chantarat, S., A. Mude, C. Barrett. 2009. Willingness to pay for index based livestock insurance: Results from a field experiment in northern Kenya. Working paper.

Cole, SA, X. Gine, J. Tobacma, P. Topalova, R. Townsend, I.J. Vickery. 2009. Barriers to household risk management: Evidence from India. Working paper No. 09–116. Harvard Business School Finance; FRB of New York Staff Report No. 373.

de Leeuw, J.D., A. Vrieling, A. Shee, C. Atzberger, K.M. Hadgu, C. Biradar, H. Keah, and C. Turvey. 2014. The potential and uptake of remote sensing in support of insurance: A review. Remote Sensing 6 (11): 10888–10912. doi:10.3390/rs61110888.

Dercon, S., R.V. Hill, D. Clarke, I. Outes-Leon, and A.S. Taffesse. 2014. Offering rainfall insurance to informal insurance groups: Evidence from a field experiment in Ethiopia. Journal of Development Economics 106: 132–143. doi:10.1016/j.jdeveco.2013.09.006.

Dercon, S., M. Kirchberger, J. Gunning, J. Platteau. 2008. Literature review on microinsurance. Geneva: International Labour Organization. http://www.ilo.org/public/english/employment/mifacility/download/litreview.pdf. Accessed 28 Jan 2017.

Dilley, M., R.S. Chen, and U. Deichmann. 2005. Natural disaster hotspots: A global risk analysis. World Bank Publications.

Di Marcantonio, F., A. Leblois, W. Göbel, and H. Kerdiles 2016. Effectiveness of weather index insurance for smallholders in Ethiopia. Submitted to Applied Economic Perspectives and Policy.

Dixit, A., A. Pokhrel, and M. Moench. 2008. From risk to resilience: Costs and benefits of flood mitigation in the lower Bagmati basin: Case of Nepal Terai and North Bihar. Kathmandu, Nepal: ISET-Nepal and ProVention.

Elabed, G., and M. Carter. 2014. Ex-ante impacts of agricultural insurance: Evidence from a field experiment in Mali. Working paper University of California Davis Agricultural and resource economics. https://are.ucdavis.edu/people/faculty/michael-carter/working-papers.

Ellsberg, D. 1961. Risk, ambiguity and the savage axiorms. Quarterly Journal of Economics 75 (4): 643–669.

Gautam, M. 2006. Managing drought in Sub-Saharan Africa: Policy perspectives. Invited paper for an invited panel session on drought: Economic consequences and policies for mitigation, at the IAAE conference, Gold Coast, Queensland, Australia, August 12–18, 2006.

Giné, X. 2009. Experience with weather insurance in India and Malawi. In Innovations in insuring the poor. Washington DC: International Food Policy Research Institute.

Giné, X., and D. Yang. 2009. Insurance, credit, and technology adoption: Field experimental evidence from Malawi. Journal of Development Economics 89 (1): 1–11. doi:10.1016/j.jdeveco.2008.09.007.

Gommes, R, and W. Göbel. 2013. Beyond simple, one-station rainfall indices. In The challenges of index-based insurance for food security in developing countries. Publications Office of the European Union.

Hazell, P.B.R. 1992. The appropriate role of agricultural insurance in developing countries. Journal of International Development 4 (6): 567–581. doi:10.1002/jid.3380040602.

Hess, U., and P. Hazel. 2009. Innovations in insuring the poor. Focus 2020, Brief 14. Washington D.C.: International Food and Policy Research Institute (IFPRI).

Hill, R.V., J. Hoddinott, and N. Kumar. 2011. Adoption of weather index insurance: Learning from willingness to pay among a panel of households in rural Ethiopia. Discussion paper, 01088, International Food Policy Research Institute.

IFAD-International Fund for Agricultural Development. 2010. The potential for scale and sustainability in weather index insurance. Rome: International Fund for Agricultural Development.

IFAD-International Fund for Agricultural Development. 2011. Weather index-based insurance in agricultural development: A technical guide. Rome: World food program and IFAD.

IPCC. 2012. Managing the risks of extreme events and disasters to advance climate change adaptation. A special report of working groups I and II of the intergovernmental panel on climate change. In ed. Field, C.B., V. Barros, T.F. Stocker, D. Qin, D.J. Dokken, K.L. Ebi, M.D. Mastrandrea, K.J. Mach, G.-K. Plattner, S.K. Allen, M. Tignor, and P.M. Midgley. Cambridge, UK and New York, USA: Cambridge University Press.

Jaffee, S., P. Siegel, C. Andrews. 2010. Rapid agricultural supply chain risk assessment, a conceptual framework. Agriculture and Rural Development Discussion Paper 47, The World Bank.

Janzen, S.A., and M.R. Carter. 2013. The impact of microinsurance on consumption smoothing and asset protection: Evidence from a drought in Kenya. University of California at Davis.

Jensen, N., A. Mude, and C.B. Barrett. 2014a. How basis risk and spatiotemporal adverse selection influence demand for index insurance: Evidence from Northern Kenya. Working paper, Cornell University.

Jensen, N.D., C.B. Barret, and A.G. Mude. 2014b. Basis risk and the welfare gains from index insurance: Evidence from Northern Kenya, MPRA Paper No. 59153.

Lunde, T. 2009. Escaping poverty: Perceptions from twelve indigenous communities in Southern Mexico. Thesis (Ph.D.) Johns Hopkins University.

Maidment, R.I., D. Grimes, R.P. Allan, E. Tarnavsky, M. Stringer, T. Hewison, R. Roebeling, and E. Black. 2014. The 30 year TAMSAT African rainfall climatology and time series (TARCAT) data set. Journal of Geophysical Research: Atmospheres 119 (18): 10619–10644. doi:10.1002/2014JD021927.

Mahul, O., and C. Stutley. 2010. Government support to agricultural insurance: Challenges and options for developing countries. Washington DC: World Bank.

Makaudze, E. 2012. Weather index insurance for smallholder farmers in Africa. Leassons learnt and goals for the future. Stellenbosch: Sun Media.

Matul, M., M.J. McCord, C. Phily, and J. Harms. 2010. The landscape of microinsurance in Africa. ILO.

McCord, M.J., R. Steinmann, C. Tatin-Jaleran, M. Ingram, and M. Mateo. 2013. The landscape of microinsurnace in Africa 2012. GIZ-Program promoting financial sector dialogue in Africa and Microinsurance Centre Munich Re Foundation.

McIntosh, C., A. Sarris, and F. Papadopoulos. 2013. Productivity, credit, risk, and the demand for weather index insurance in smallholder agriculture in Ethiopia. Agricultural Economics 44: 399–417.

McIntyre, B.D., H.R. Herren, J. Wakhungu, and R.T. Watson. 2009. Agriculture at a crossroads. International assessment of agricultural knowledge, science and technology for development. Synthesis report. Whashington, DC: Island Press.

Mills, C., N. Jensen, C. Barrett, and A. Mude. 2015. Characterization for index based livestock insurance. Working Paper, Cornell University.

Miranda, M.J., and K. Farrin. 2012. Index insurance for developing countries. Applied Economic Perspectives and Policy 34 (3): 391–427. doi:10.1093/aepp/pps031.

Miura, T., A. Huete, and H. Yoshioka. 2006. An empirical investigation of cross-sensor relationships of NDVI and red/near-infrared reflectance using EO-1 Hyperion data. Remote Sensing of Environment 100: 223–236. doi:10.1016/j.res.2005.10.010.

Oxfam America. 2013. R4 rural resilience initiative quarterly report April-June 2013.

Patt, A., N. Peterson, M. Carter, M. Velez, U. Hess, A. Pfaff, and P. Suarez. 2008. Making index insurance attractive to farmers. Paper presented at a workshop on ‘Technical issues in index insurance’, held October 7–8, 2008 at IRI, Columbia University, New York.

Rojas, O., F. Rembold, J. Delincé, and O. Léo. 2011. Using the NDVI as auxiliary data for rapid quality assessment of rainfall estimates in Africa. International Journal of Remote Sensing 32 (12): 3249–3265. doi:10.1080/01431161003698260.

Sandmark, T., J-C. Debar, and C. Tatin-Jeleran. 2013. The emergence and development of agricultural microinsurance. Microinsurance Network Discussion paper. Luxembourg

Sina, J. 2012. Index-based weather insurance—international & Kenyan experiences. Adaptation to climate change and insurance (ACCI), Nairobi, Kenya.

Skees, J.R., A.G. Murphy, B. Collier, M.J. McCord, and J. Roth. 2007. Scaling up index insurance: What is needed for the next big leap forward? Weather insurance review prepared by the Microinsurance centre and global Agrisk for Kreditanstalt für Wiederaufbau (KfW).

Skees J.R., and B. Collier. 2008. The potential of weather index insurance for spurring a green revolution in Africa. Lexington, KY: The Watkins House, www.globalagrisk.com.

Turvey, C.G., M.K. Mclaurin. 2012. Applicability of the normalized difference vegetation index (NDVI) in index-based crop insurance design. Weather, Climate, and Society 4: 271–284. doi:10.1175/WCAS-D-11-00059.1.

Venton, C.C., and P. Venton. 2004. Disaster preparedness programmes in India: A cost benefit analysis. HPN Network Paper No. 49. London, UK: Overseas Development Institute.

Vrieling, A., M. Meroni, A. Shee, A.G. Mude, J. Woodard, C.A.J.M. Kees de Bie, and F. Rembold. 2014. Historical extension of operational NDVI products for livestock insurance in Kenya. International Journal of Applied Earth Observation and Geoinformation 28: 238–251. doi:10.1016/j.jag.2013.12.010.

Washington, R., G. Kay, M. Harrison, D. Conway, E. Black, A. Challinor, D. Grimes, R. Jones, A. Morse, and M. Todd. 2006. African climate change: Taking the shorter route. Bulletin of the American Meteorological Society 87: 1355–1366. doi:10.1175/BAMS-87-10-1355.

Woodard, J.D., A. Shee, and A. Mude. 2016. A spatial econometric approach to designing and rating scalable index insurance in the presence of missing data. Geneva Papers on Risk and Insurance Issues and Practice 41 (2): 259–279. doi:10.1057/gpp.2015.31.

World Bank. 2005. Managing agricultural production risk innovations in developing countries. Washington DC: World Bank.

World Bank. 2008. World development report 2008: Agriculture for development. Washington DC: World Bank.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Di Marcantonio, F., Kayitakire, F. (2017). Review of Pilot Projects on Index-Based Insurance in Africa: Insights and Lessons Learned. In: Tiepolo, M., Pezzoli, A., Tarchiani, V. (eds) Renewing Local Planning to Face Climate Change in the Tropics. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-59096-7_16

Download citation

DOI: https://doi.org/10.1007/978-3-319-59096-7_16

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-59095-0

Online ISBN: 978-3-319-59096-7

eBook Packages: EnergyEnergy (R0)