Abstract

In this study, we investigated around one million pieces of Japanese firm-size data, which are included in the database ORBIS, and confirmed that the age distribution of firms approximately obeys an exponential function. We estimated the decay rate of firms by comparing their activities in 2008 and 2013 and found that it does not depend on firm age and can be regarded to be constant. Here, decay rate of firms denotes the state transition probability of firm activities. These two observations are qualitatively consistent when the number of newly founded firms is nearly constant. This phenomenon is analogous to nuclear decay. We quantitatively confirmed this consistency by comparing the parameters of exponential age distribution with the decay rate of firm activities. At the same time, using this result, we estimated the number of firms founded annually and the decay rate of firm activities in Japan before World War II.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

1 Introduction

There are various subjects for econophysics research (see, e.g., [1–3]). One main argument, which has a deep relationship with macroeconomics, is power-law distribution that is confirmed in the large-scale range of various firm-size data [4–6]. Log-normal distribution is also frequently noted in mid-sized variables. These two laws, which are observed in firm-size variables at a point in time, are related to the short-term statistical laws observed in firm-size variables at two successive years [7–14]. The short-term laws denote (quasi-) inverse symmetry and (Non-) Gibrat’s law [15, 16]. To the best of our knowledge, however, long-term statistical laws by decade have not been sufficiently investigated.

Several studies reported that the age distribution of firms obeys an exponential function [17, 18]. Since some firms still exist that were founded over 100 years ago, the age distribution of firms, which is observed at a point in time, must be related to long-term statistical laws. In this study, we investigate the age distribution of firms by employing an exhaustive database of Japanese firms.

The rest of this paper is organized as follows. Section 17.2 describes our database. In Sect. 17.3, first we confirm that the age distribution of firms, observed in 2008, approximately follows an exponential function. Second, by classifying firms into age-rank bins, we compare the activities of firms in 2008 and 2013 and find that their decay rates do not depend on firm age. This observation is new to the best of our knowledge. In Sect. 17.4, we point out that the two laws observed in Sect. 17.3 are closely related to each other when the number of newly founded firms is nearly constant. This is analogous to nuclear decay [19]. We quantitatively verify this relation by comparing the parameters of exponential age distribution with the decay rate of firm activities. At the same time, using this result, we estimate the number of firms founded annually and the decay rate of firm activities in Japan before World War II. The last section concludes this paper.

2 Data

We employ the database ORBIS provided by Bureau van Dijk [20] that contains the activity data of 2,739,268 firms and the financial data of 984,502 firms in 2008 Japan. It also includes the activity data of 3,419,105 firms in 2013 Japan. Since the number of active firms in Japan is considered to be around several million [21], this database is exhaustive.

The activities of firms in the database ORBIS are largely categorized into the following three states:

-

Active

-

Active, Active (payment default), Active (insolvency proceedings), Active (dormant), Active (branch)

-

Inactive

-

In liquidation, Bankruptcy, Dissolved (merger or take-over), Dissolved (demerger), Dissolved (liquidation), Dissolved (bankruptcy), Dissolved, Inactive (branch), Inactive (no precision)

-

Unknown

We define the decay of firms as a transition from active to inactive or unknown (including Not Available). Note that in this definition, the decay of firms necessarily means bankruptcy. In the database ORBIS, the same vendor researched firm data both in 2008 and 2013 Japan and the response rate was sufficiently high; therefore, this definition is appropriate in Japan. In the database, 2,099,834 active firms existed in 2008, among which 1,888,294 firms remained active in 2013. 211,540 firms decayed in this 5-year period. Of the total, 1 firm was In liquidation, 14 firms were Bankruptcy, 58 Dissolved (merger or take-over), 1 Dissolved (liquidation), 6 Dissolved, 49 Inactive (branch), 207,553 Inactive (no precision), 3,645 Unknown, and 213 NA.

3 Data Analysis

3.1 Age Distribution of Firms

To calculate the age of firms T, we must identify a starting point in time for every firm. In this study, we regard a firm’s incorporation as its starting point. Since firms have financial statement from their year of foundation, we denote their age of foundation as T = 1. In our analyses, since we are interested in the number of firms as a function of firm age T to consider decay rate of firms, we call N(T) the age distribution of firms. The cumulative age distribution of firms is defined by

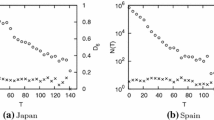

Figure 17.1 depicts cumulative age distribution N > (T) of firms whose year of foundation can be identified. The data in Fig. 17.1 are cumulated to smooth the dispersion. As shown in Fig. 17.1, the cumulative age distribution of firms approximately obeys an exponential function:

Here, \(\lambda\) is a constant parameter. Maximum age T in Fig. 17.1 is 150 years. This corresponds to the starting point of the modernization of Japan around the Meiji Restoration (1868) that marked the return of imperial power in Japan. In Fig. 17.1, the difference in the data around 60 years corresponds to World War II. If we apply Eq. (17.2) to the entire range in Fig. 17.1, the parameter is estimated as \(\lambda \sim 0.078\). This value is close to 0. 053 reported in [18], and is also close to around 0. 05 reported in [17].

3.2 Decay Rate of Firm Activities

We classify the firms into age-rank bins and compare their activities in 2008 and 2013. By classifying the active firms in 2008 into age-rank bins with 5-year width T, the number of firms N(T) and the decay rate in five years D 5 are depicted in Fig. 17.2. Interestingly, the decay rate in the five years of active firms in 2008 does not depend on firm age T and is constant. The average value is estimated by

In Fig. 17.2, there is a difference of N(T) around T = 60. This corresponds to the decay of many firms during World War II. The number of firms established before and after World War II decreased following an exponential function. However, the parameters of the two exponential functions are different.

The exponential decrease of N > (T) and N(T) is closely related to the constant decay rate of firm activities that does not depend on the age of firms. In the next section, we discuss this point.

4 Consistency of Laws

We clarify the relation between the two laws (17.2) and (17.3) observed in the previous section. One is the exponential decrease of the (cumulative) age distribution of firms. The other is their constant decay rate that does not depend on firm age. First, by analogy to nuclear decay, we analytically relate the two laws. After that, we quantitatively verify the relation by comparing parameter \(\lambda\), which is estimated by the exponential decrease of the number of firms, with the decay rate of firm activities in 5-year period D 5.

Using constant parameter N 0, the age distribution of firms is written as

Parameter N 0 is the number of firms newly founded at T = 0. Recently in Japan, since the number of newly founded firms has not changed drastically [22], the expression of Eq. (17.4) is acceptable as the number of firms at a point in time T. Equation (17.4) leads to a survival rate where firms are active in time T and in time T + 1 as follows:

From this survival rate, the decay rate of firm activities in year D 1 is expressed as

Since \(\lambda\) is a constant parameter, Eq. (17.6) denotes that the decay rate of firm activities does not depend on age of firms T and is constant. This is an analytical consequence from the exponential decrease of the number of firms. Since this equivalence is well known in nuclear decay [19], we call \(\lambda\) a decay constant, as in physics. When \(\lambda\) is sufficiently smaller than 1, Eq. (17.6) leads to a \(\lambda\) that nearly equals the decay rate of firm activities in year D 1: \(\lambda \sim D_{1}\).

Next, we quantitatively verify that D 1, which is estimated by the decay rate of firm activities, agrees with \(\lambda\), obtained as the parameter of the age distribution of firms. From Eqs. (17.3) and (17.9), D 1 is evaluated as

This means that 2 % firms annually decay at any age of the firms.

By applying the exponential function to the whole range of the cumulative age distribution of firms (Fig. 17.1), the decay constant is estimated as \(\lambda \sim 0.078\), which is different from D 1. This disagreement reflects that in Japan, \(\lambda\) and N 0 changed before and after World War II when many firms decayed. Because D 1 is measured between 2008 and 2013, we must estimate \(\lambda\) by measuring the recent age distribution of firms, which is not cumulated, and compare \(\lambda\) with D 1.

As shown in Fig. 17.2, by applying the exponential function to the range from T = 1 to 45 in which N 0 is relatively stable, the decay constant is estimated as

This value is close to D 1. From this agreement, we quantitatively confirmed the relation between the two laws concerning the decay of firms. This value is also close to around 0. 03 which is reported in [17] as a value with respect to a recent few decades.

Furthermore, Fig. 17.2 shows that parameter \(\lambda ^{B}\) of the exponential function, which is followed by firms founded before World War II, is larger than \(\lambda\) after World War II. In Fig. 17.2, \(\lambda ^{B}\) is evaluated by

The equivalence between \(\lambda\) and D 1 claims that decay rate \(\lambda ^{B}\) of the firms before World War II is approximately twice decay rate \(\lambda\) after World War II. Figure 17.2 also shows that in Japan, number of firms N 0 B annually founded before World War II approximately equals N 0 after World War II:

5 Conclusion

In this study, by employing an exhaustive database of firms in Japan, we showed that the number of firms exponentially decreases with respect to their age from their foundation. When the number of firms established annually is nearly constant, this exponential decrease means that their decay rate does not depend on the their age. We confirmed this feature and classified firms into age-rank bins and investigated the decay rate and showed that the parameter of the exponential age distribution of firms agrees with the decay rate, as we analytically expected. The decay rate of firm activities before World War II is estimated to be approximately twice that after World War II in Japan. This confirms that the social structure of Japan dynamically changed after World War II.

The study of bankruptcy prediction of firms has a long history and there are various articles and practical applications [23–29]. Most of the models do not include the firm age as a parameter explicitly. For instance in [23], the model includes five parameters; (Working Capital)∕(Total Assets), (Retained Earnings)∕(Total Assets), (Earnings before Interest and Taxes)∕(Total Assets), (Market Value of Equity)∕(Book Value of Total Liabilities), and (Sales)∕(Total Assets). Therefore, the main claim of this paper is consistent with them. However, parameters included in the models presumably depend on firm age and most of the models showed that the bankruptcy probability is smaller as the firm age is higher. This discrepancy probably comes from the data processing method that we consider not only bankruptcy but also dissolved (merger or take-over) as decay of firm activities.

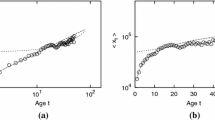

We investigated the age distribution of firms to understand the long-term statistical laws observed by firm-size data. We can also observe that firm age exponentially correlates with the logarithmic average of sales at that age, as shown in Fig. 17.3.

This relation significantly connects the age distribution of firms with the power-law distribution [4–6] of firm-size data. Furthermore, this exponential correlation can be interpreted as the average growth of sales. On the other hand, we found that the listed firms grow under power law by employing the database of listed firms both in the United States and Japan [30]. In the near future, we want to clarify these long-term statistical laws of firms, such as firm age distribution and firm growth, and confirm the relations among long- and short-term statistical laws, such as (quasi-) inverse symmetry and (Non-) Gibrat’s law.

References

Stanley HE (1971) Introduction to phase transitions and critical phenomena. Clarendon Press, Oxford

Saichev A, Malevergne Y, Sornette D (2009) Theory of Zipf’s law and beyond. Springer, Berlin

Pareto V (1897) Cours d’économie politique. Macmillan, London

Clauset A, Shalizi CR, Newman MEJ (2009) SIAM Rev 51:661

Fujiwara Y, Souma W, Aoyama H, Kaizoji T, Aoki M (2003) Phys A 321:598

Ishikawa A, Fujimoto S, Mizuno T (2011) Phys A 390:4273

Gibrat R (1932) Les inégalités économiques. Sirey, Paris

Sutton J (1997) J Econ Lit 35:40

Fujiwara Y (2004) Phys A 337:219

Miura W, Takayasu H, Takayasu M (2012) Phys Rev Lett 108:168701

Rutherford E, Soddy F (1903) Philos Mag 6:576

Bureau van Dijk, http://www.bvdinfo.com/Home.aspx

Statistics Bureau, Ministry of Internal Affairs and Communications, http://www.stat.go.jp/english/index.htm

Small and Medium Enterprise Agency, http://www.chusho.meti.go.jp/sme_english/index.html

Altman EI (1968) J Financ 23:589

Kouki M (2009) J Middle East Financ Econ 14:26

Ishikawa A, Fujimoto S, Mizuno T, Watanabe T, in preparation

Acknowledgements

This study was supported by JSPS KAKENHI Grant Number 24510212, 24710156.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This book is distributed under the terms of the Creative Commons Attribution Non-commercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Copyright information

© 2015 The Author(s)

About this paper

Cite this paper

Ishikawa, A., Fujimoto, S., Mizuno, T., Watanabe, T. (2015). Firm Age Distributions and the Decay Rate of Firm Activities. In: Takayasu, H., Ito, N., Noda, I., Takayasu, M. (eds) Proceedings of the International Conference on Social Modeling and Simulation, plus Econophysics Colloquium 2014. Springer Proceedings in Complexity. Springer, Cham. https://doi.org/10.1007/978-3-319-20591-5_17

Download citation

DOI: https://doi.org/10.1007/978-3-319-20591-5_17

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-20590-8

Online ISBN: 978-3-319-20591-5

eBook Packages: Physics and AstronomyPhysics and Astronomy (R0)